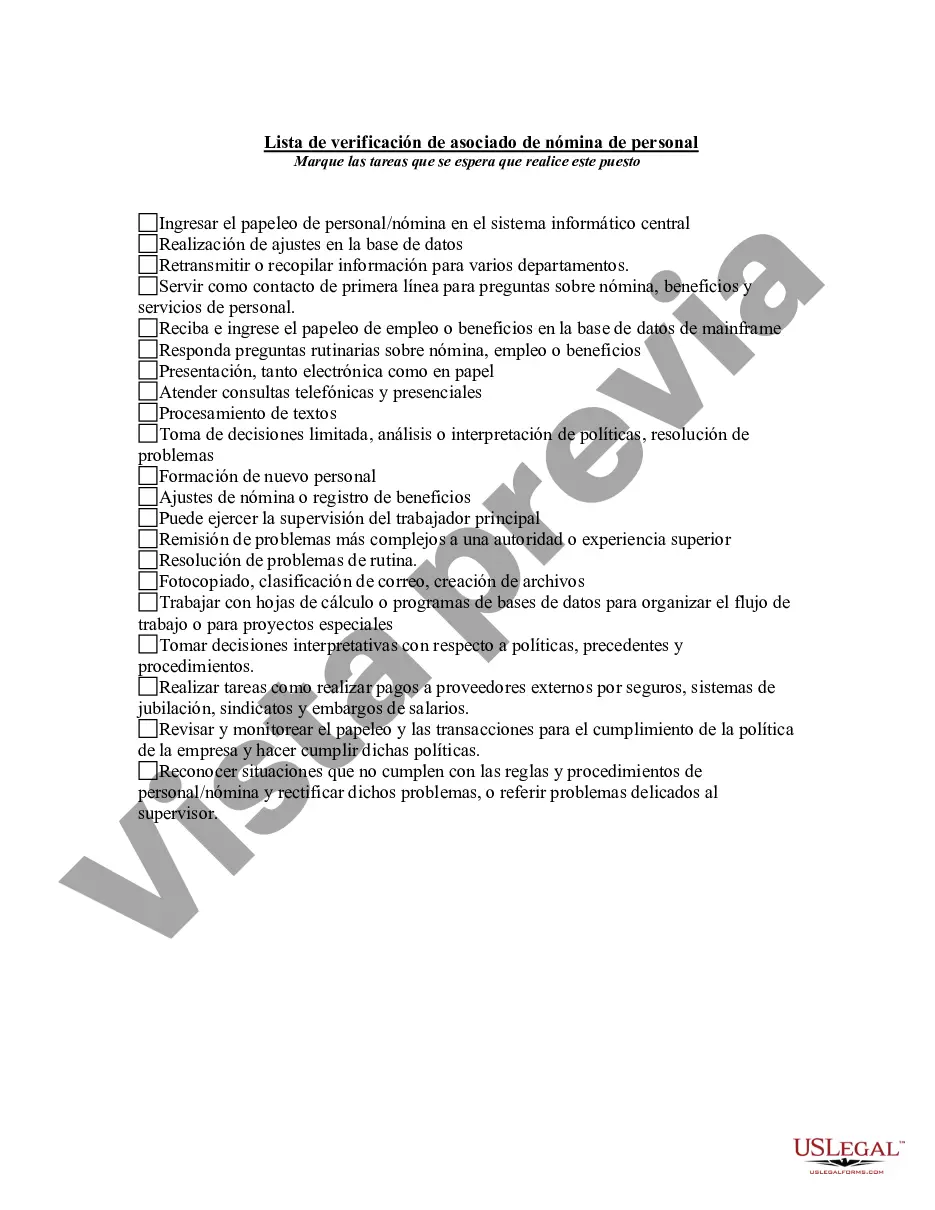

Description: Rhode Island Personnel Payroll Associate Checklist is a comprehensive tool used by human resources professionals and payroll associates to ensure accurate payroll processing and compliance with state regulations in Rhode Island. This checklist serves as a step-by-step guide to help streamline payroll procedures and minimize errors. Keywords: Rhode Island, personnel, payroll associate, checklist, human resources, payroll processing, compliance, state regulations, accurate, step-by-step guide, streamline, minimize errors. Different Types of Rhode Island Personnel Payroll Associate Checklists: 1. Rhode Island Payroll Compliance Checklist: This checklist specifically focuses on ensuring compliance with the state's payroll laws and regulations. It covers areas such as minimum wage requirements, overtime calculations, payroll tax withholding, and required employee documentation. 2. Rhode Island New Hire Onboarding Checklist: This checklist is designed to assist payroll associates when onboarding new employees in compliance with the state's regulations. It includes tasks such as collecting necessary forms, verifying eligibility to work, setting up payroll accounts, and explaining company policies and benefits. 3. Rhode Island Payroll Processing Checklist: This checklist outlines the essential steps for processing payroll accurately. It covers tasks such as verifying employee hours, calculating deductions, processing paychecks, and distributing pay stubs or direct deposits. The checklist ensures that all necessary payroll tasks are completed efficiently and without errors. 4. Rhode Island Payroll Tax Checklist: This checklist focuses on the state's specific payroll tax obligations. It includes tasks such as determining applicable tax rates, filing necessary tax forms, remitting payroll taxes, and staying updated with any changes in Rhode Island's tax laws. 5. Rhode Island Payroll Audit Checklist: This checklist aids in conducting periodic payroll audits to identify errors, inconsistencies, or potential compliance issues. It covers areas such as reviewing payroll records, verifying accuracy of calculations, reconciling payroll reports, and ensuring proper documentation and record-keeping. These different types of Rhode Island Personnel Payroll Associate Checklists cater to specific aspects of payroll processing and compliance within the state, providing a comprehensive resource for payroll associates to ensure accuracy and adherence to Rhode Island's regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Rhode Island Lista de verificación de asociado de nómina de personal - Personnel Payroll Associate Checklist

Description

How to fill out Rhode Island Lista De Verificación De Asociado De Nómina De Personal?

Are you in the situation the place you require paperwork for both organization or individual reasons virtually every day? There are a lot of authorized papers layouts accessible on the Internet, but locating versions you can trust is not effortless. US Legal Forms provides a huge number of type layouts, much like the Rhode Island Personnel Payroll Associate Checklist, that are written to fulfill federal and state specifications.

Should you be presently informed about US Legal Forms internet site and also have an account, merely log in. Following that, you are able to down load the Rhode Island Personnel Payroll Associate Checklist format.

If you do not have an accounts and would like to begin to use US Legal Forms, abide by these steps:

- Get the type you need and ensure it is for your appropriate town/county.

- Make use of the Review switch to review the shape.

- Look at the description to ensure that you have chosen the appropriate type.

- In case the type is not what you`re seeking, use the Lookup field to find the type that meets your requirements and specifications.

- When you get the appropriate type, click Get now.

- Opt for the pricing prepare you want, fill in the desired details to produce your money, and pay for the transaction making use of your PayPal or Visa or Mastercard.

- Select a convenient paper structure and down load your backup.

Discover every one of the papers layouts you may have purchased in the My Forms food list. You can get a extra backup of Rhode Island Personnel Payroll Associate Checklist whenever, if possible. Just select the required type to down load or print out the papers format.

Use US Legal Forms, the most considerable variety of authorized kinds, in order to save time as well as stay away from faults. The service provides appropriately produced authorized papers layouts which can be used for an array of reasons. Generate an account on US Legal Forms and commence producing your lifestyle easier.