Title: Rhode Island Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank Introduction: In Rhode Island, LCS may require additional capital to support their growth ambitions or meet specific financial needs. When LLC members decide to seek external funding through loans from a designated bank, they typically go through a formal process of adopting a resolution. This resolution outlines the essential details regarding the borrowing arrangements and the execution of financial obligations. It is crucial to understand the various types and elements involved in a Rhode Island Resolution of Meeting for an LLC to Borrow Capital from a Designated Bank. 1. General Rhode Island Resolution of Meeting of LLC Members to Borrow Capital: This type of resolution refers to the standard or generic form used by LCS seeking a loan from a designated bank. It encompasses the essential components such as the purpose of borrowing, the desired loan amount, terms of repayment, interest rates, collateral requirements, and any necessary approvals from members or managers. LCS can customize this resolution to suit their specific borrowing requirements. 2. Resolution to Approve Borrowing of Capital for Expansion Purposes: This type of resolution specifically addresses LLC members' intention to borrow capital from a designated bank for expansion or business growth. Here, the resolution may include details about the areas or activities the borrowed capital will support, such as acquiring new assets, expanding market presence, researching new markets, or investing in innovative technologies. 3. Resolution to Approve Borrowing of Capital for Working Capital Needs: Some LCS may need to borrow capital to fulfill their working capital needs, such as managing day-to-day operations, covering short-term expenses, or supporting seasonal fluctuations. The resolution adopted for this purpose will focus on outlining the reasons for the working capital loan, the estimated amount required, and how it will be utilized to ensure the smooth functioning of the business. 4. Resolution to Approve Borrowing of Capital for Specific Projects: When an LLC has defined projects requiring financial resources, it may adopt a resolution specifying the borrowing of capital for those specific endeavors. This resolution explains the nature of the projects, their expected outcomes, timelines, and the associated financial requirements. It may also outline any additional approvals needed for undertaking the projects. 5. Resolution to Approve Borrowing of Capital with Member Consent: In certain scenarios, an LLC may require a resolution that explicitly mentions acquiring member consent for borrowing capital from a designated bank. This type of resolution ensures that all members are aware of and actively support the loan transaction. It may also provide an opportunity for members to voice any concerns or suggest modifications to the borrowing terms. Conclusion: In Rhode Island, an LLC's decision to borrow capital from a designated bank involves adopting a detailed resolution during a meeting of LLC members. By understanding the various types of resolutions available, LCS can tailor their borrowing strategy to meet their business needs, whether it is for general purposes, expansion, working capital, specific projects, or gaining member consent. It is crucial to consult legal professionals specialized in corporate law to draft and finalize these resolutions to ensure compliance with Rhode Island's regulations and safeguard the LLC's interests.

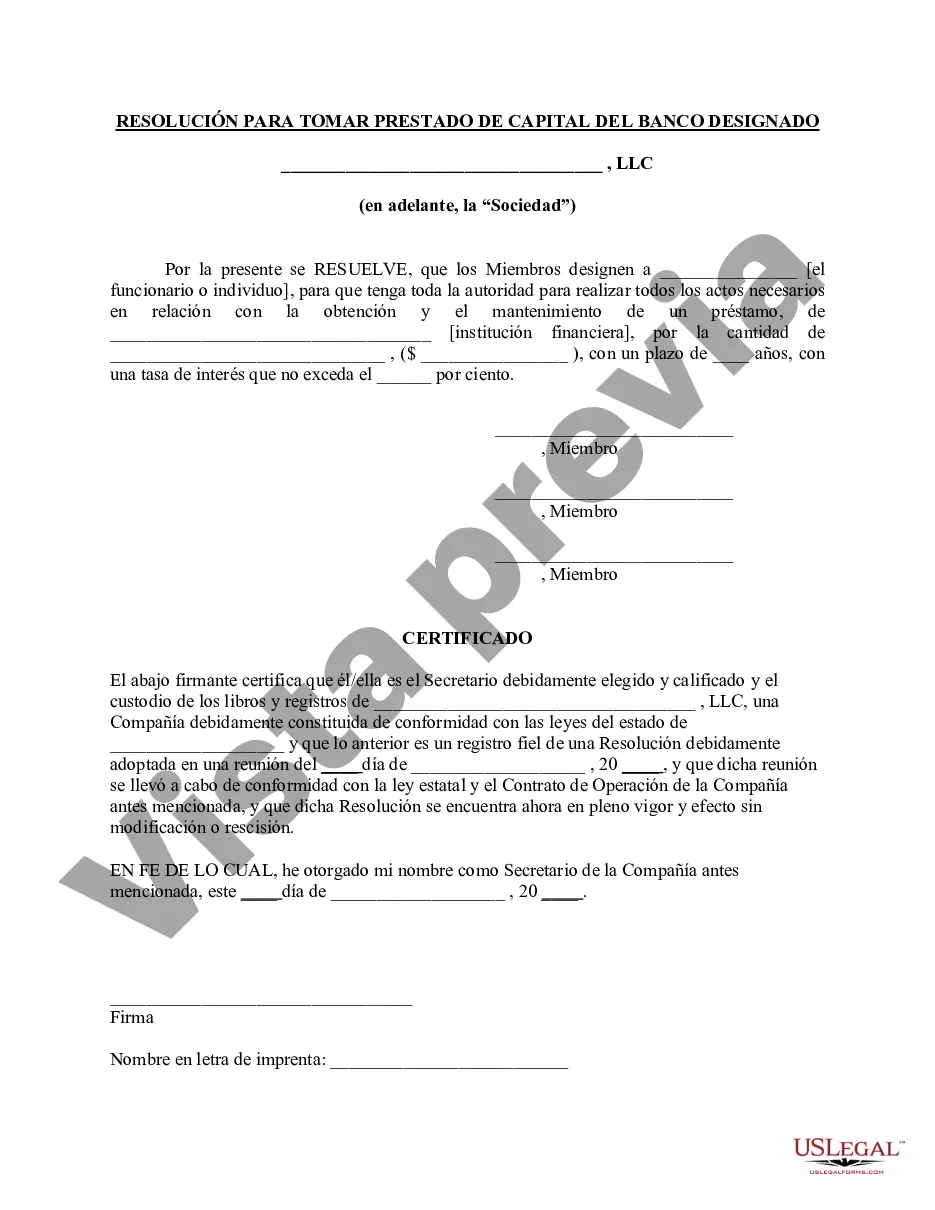

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Rhode Island Resolución de la reunión de miembros de la LLC para pedir prestado capital del banco designado - Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank

Description

How to fill out Rhode Island Resolución De La Reunión De Miembros De La LLC Para Pedir Prestado Capital Del Banco Designado?

If you have to complete, down load, or print lawful file web templates, use US Legal Forms, the largest selection of lawful varieties, that can be found on-line. Take advantage of the site`s simple and easy handy lookup to discover the papers you require. Different web templates for company and specific purposes are sorted by classes and says, or keywords. Use US Legal Forms to discover the Rhode Island Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank with a number of mouse clicks.

Should you be currently a US Legal Forms consumer, log in for your account and click the Obtain option to obtain the Rhode Island Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank. You can even accessibility varieties you previously delivered electronically within the My Forms tab of the account.

If you use US Legal Forms initially, refer to the instructions below:

- Step 1. Make sure you have selected the shape for the proper town/region.

- Step 2. Use the Review option to look through the form`s content material. Do not forget to learn the outline.

- Step 3. Should you be not satisfied with all the type, utilize the Look for industry on top of the screen to discover other models from the lawful type template.

- Step 4. When you have located the shape you require, select the Acquire now option. Choose the rates strategy you favor and include your accreditations to register for an account.

- Step 5. Method the financial transaction. You may use your credit card or PayPal account to accomplish the financial transaction.

- Step 6. Choose the format from the lawful type and down load it in your system.

- Step 7. Total, revise and print or sign the Rhode Island Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank.

Each lawful file template you get is the one you have for a long time. You have acces to every single type you delivered electronically with your acccount. Click the My Forms section and decide on a type to print or down load once more.

Compete and down load, and print the Rhode Island Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank with US Legal Forms. There are millions of professional and status-certain varieties you may use to your company or specific requirements.