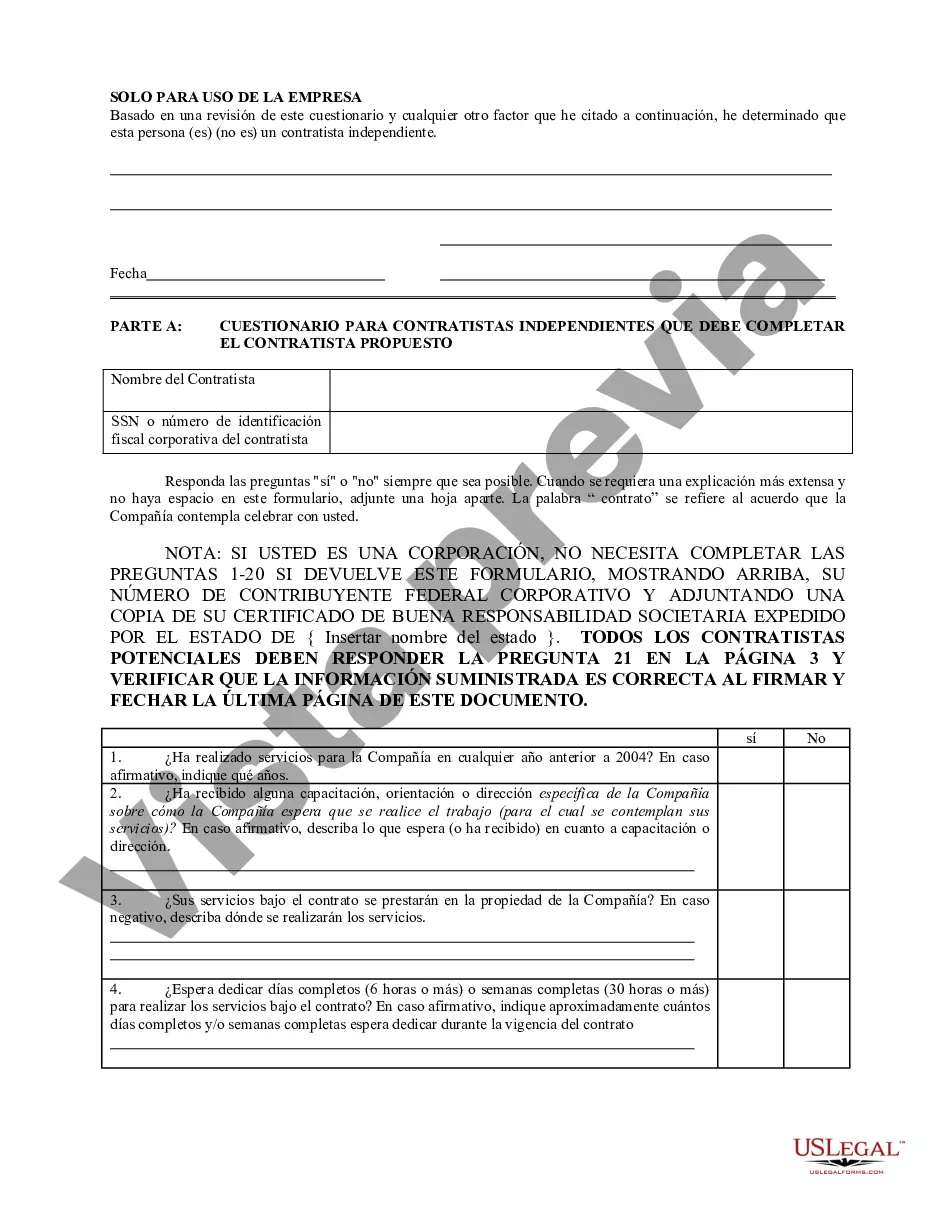

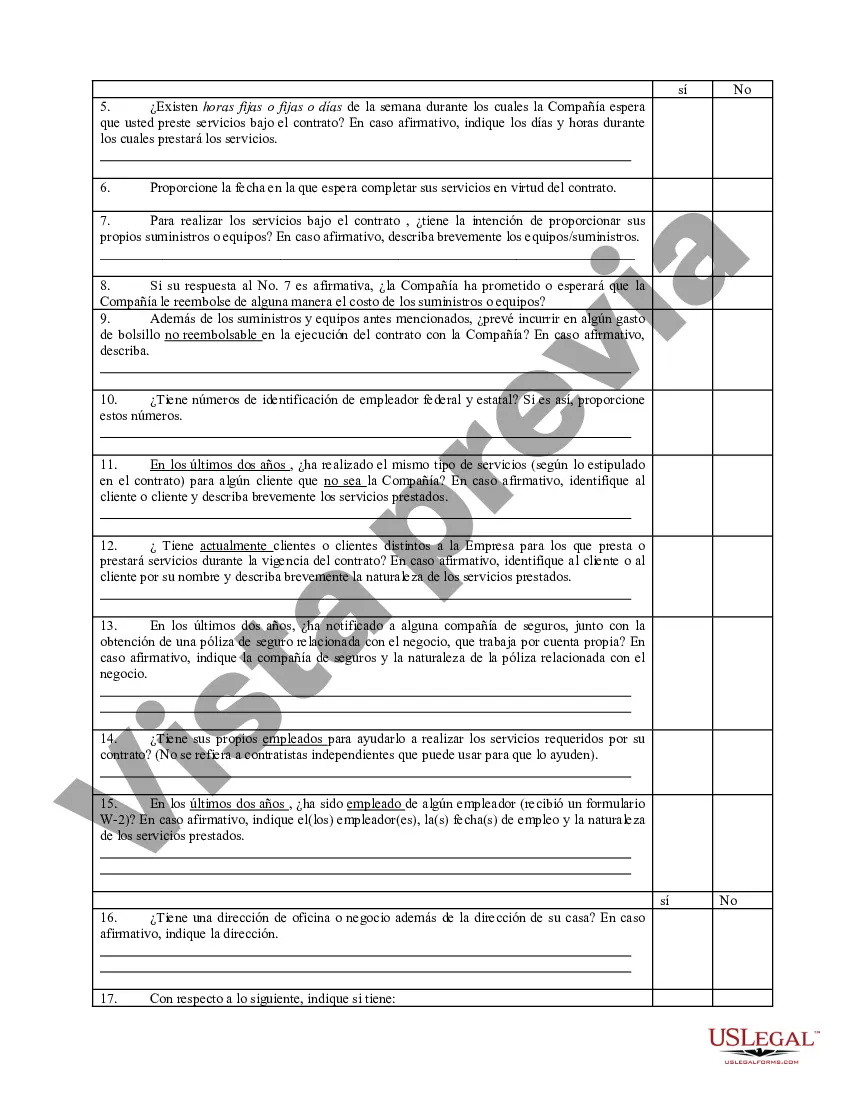

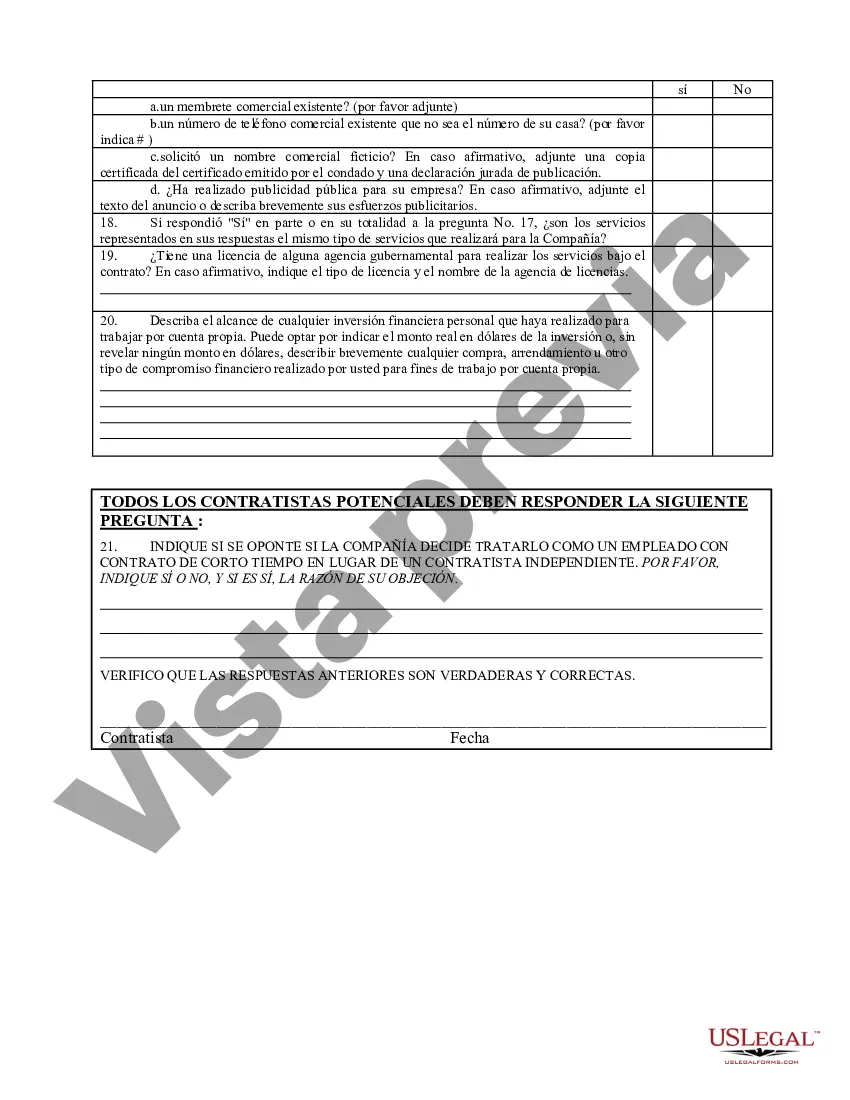

Rhode Island Self-Employed Independent Contractor Questionnaire: Understanding the Form, Requirements, and Types Rhode Island self-employed individuals and independent contractors are required to submit a detailed questionnaire known as the "Rhode Island Self-Employed Independent Contractor Questionnaire." This form is crucial for ensuring compliance with state tax laws and determining proper classification for tax purposes. The Rhode Island Self-Employed Independent Contractor Questionnaire gathers essential information from individuals engaged in self-employment or contracting work. It aims to verify their classification as independent contractors and understand the nature of their business relationships with clients or companies. The questionnaire typically contains the following sections: 1. Personal Information: This section collects the contractor's full name, contact details, social security number, and other identifying information. 2. Business Description: Here, contractors provide details about their business, including the nature of the services or work they offer, the industries they operate in, and the type of clients they serve. 3. Contractual Relationships: This section focuses on the contractor's agreements and relationships with clients or companies. Contractors are required to disclose the terms and conditions of their contracts, the duration of their engagements, and any existing written agreements. 4. Client Information: Contractors must provide the names and contact information of their clients or companies for whom they perform services or contract work. 5. Independent Contractor Status Determination: This part of the questionnaire delves into the specifics of the working relationship between the contractor and the client. It analyzes various factors outlined by Rhode Island law to assess the true nature of the engagement and determine whether it qualifies as an independent contractor relationship. Different types of Rhode Island Self-Employed Independent Contractor Questionnaires may exist based on variations in trade or industry. These specialized forms ensure that the questionnaire aligns with the specific requirements and regulations of particular sectors. Common variations include: — Construction Industry Contractor Questionnaire: Tailored for independent contractors and self-employed individuals engaged in the construction industry, this form may request additional information about project details, labor and material costs, licenses, and permits. — Healthcare Industry Contractor Questionnaire: Specifically designed for self-employed healthcare professionals, this version may focus on certifications, specialized training, medical licensure, and affiliation with healthcare institutions. — Professional Services Contractor Questionnaire: Suitable for contractors providing services such as legal advice, accounting, consulting, or creative work, this variant may require detailed information about professional qualifications, industry certifications, or memberships. The Rhode Island Self-Employed Independent Contractor Questionnaire plays a vital role in ensuring that self-employed individuals and independent contractors comply with state tax laws and regulations. It helps determine whether individuals meet the criteria for independent contractor status or if they should be classified as employees, thus impacting taxation, benefits, and legal obligations for both contractors and clients alike.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Rhode Island Cuestionario para contratistas independientes que trabajan por cuenta propia - Self-Employed Independent Contractor Questionnaire

Description

How to fill out Rhode Island Cuestionario Para Contratistas Independientes Que Trabajan Por Cuenta Propia?

Are you currently within a place the place you require papers for either company or personal uses almost every working day? There are a lot of authorized papers themes available on the Internet, but discovering kinds you can depend on is not easy. US Legal Forms gives a huge number of kind themes, such as the Rhode Island Self-Employed Independent Contractor Questionnaire, which are written to satisfy state and federal requirements.

In case you are currently informed about US Legal Forms internet site and also have a free account, merely log in. Afterward, it is possible to acquire the Rhode Island Self-Employed Independent Contractor Questionnaire template.

If you do not come with an bank account and would like to begin using US Legal Forms, abide by these steps:

- Obtain the kind you need and ensure it is for that correct metropolis/state.

- Utilize the Preview switch to analyze the shape.

- See the description to actually have selected the proper kind.

- In case the kind is not what you`re trying to find, use the Lookup area to obtain the kind that meets your requirements and requirements.

- If you obtain the correct kind, just click Purchase now.

- Opt for the rates prepare you would like, complete the necessary information to generate your money, and buy the transaction with your PayPal or Visa or Mastercard.

- Choose a handy document format and acquire your version.

Get all the papers themes you possess purchased in the My Forms food selection. You can aquire a more version of Rhode Island Self-Employed Independent Contractor Questionnaire any time, if needed. Just click on the needed kind to acquire or print the papers template.

Use US Legal Forms, one of the most comprehensive assortment of authorized types, to conserve time and avoid errors. The service gives appropriately created authorized papers themes which can be used for an array of uses. Make a free account on US Legal Forms and initiate creating your life a little easier.