Rhode Island Anti-Dilution Adjustments are a legal provision designed to protect minority shareholders or investors against the potential dilution of their ownership interests in a company. It ensures that their ownership percentage remains unchanged in the event of subsequent stock issuance or conversions. Anti-dilution adjustments in Rhode Island are typically incorporated into stock purchase agreements or shareholder's agreements. These agreements may outline different types of anti-dilution provisions, including: 1. Full Ratchet Anti-Dilution: This type of adjustment provides the most significant protection to investors as it reduces the conversion price of preferred stock to the price at which new stock is issued. This means that existing shareholders are fully compensated for the dilution they may experience. 2. Weighted Average Anti-Dilution: Under this method, the conversion price is adjusted based on a weighted average of the old and new stock issuance prices. The adjustment takes into account the number of shares issued and the respective prices. 3. Broad-Based Weighted Average Anti-Dilution: This type of anti-dilution provision considers not only the dilution caused by new stock issuance, but also the dilution caused by other factors, such as stock splits, stock dividends, or reclassification. It provides a more comprehensive adjustment mechanism. 4. Narrow-Based Weighted Average Anti-Dilution: Unlike the broad-based method, this provision excludes certain events such as stock splits or stock dividends from triggering an adjustment. It only focuses on new equity issuance. Rhode Island Anti-Dilution Adjustments aim to safeguard the investments of shareholders and ensure fair treatment during subsequent financing rounds or corporate actions. By utilizing these provisions, investors can protect their ownership percentage and prevent unjustified dilution that could impact their financial stake in the company. It is essential for both companies and investors to carefully consider and negotiate the terms of these adjustments to ensure a fair and transparent mechanism is in place.

Rhode Island Anti-Dilution Adjustments

Description

How to fill out Rhode Island Anti-Dilution Adjustments?

You may invest hrs on the Internet trying to find the legal document web template that suits the state and federal demands you require. US Legal Forms supplies a huge number of legal types which are examined by experts. It is possible to obtain or printing the Rhode Island Anti-Dilution Adjustments from my support.

If you have a US Legal Forms bank account, you are able to log in and click the Down load button. Afterward, you are able to full, modify, printing, or indicator the Rhode Island Anti-Dilution Adjustments. Each and every legal document web template you buy is yours permanently. To acquire another backup of any acquired form, proceed to the My Forms tab and click the corresponding button.

If you are using the US Legal Forms website the first time, stick to the simple directions listed below:

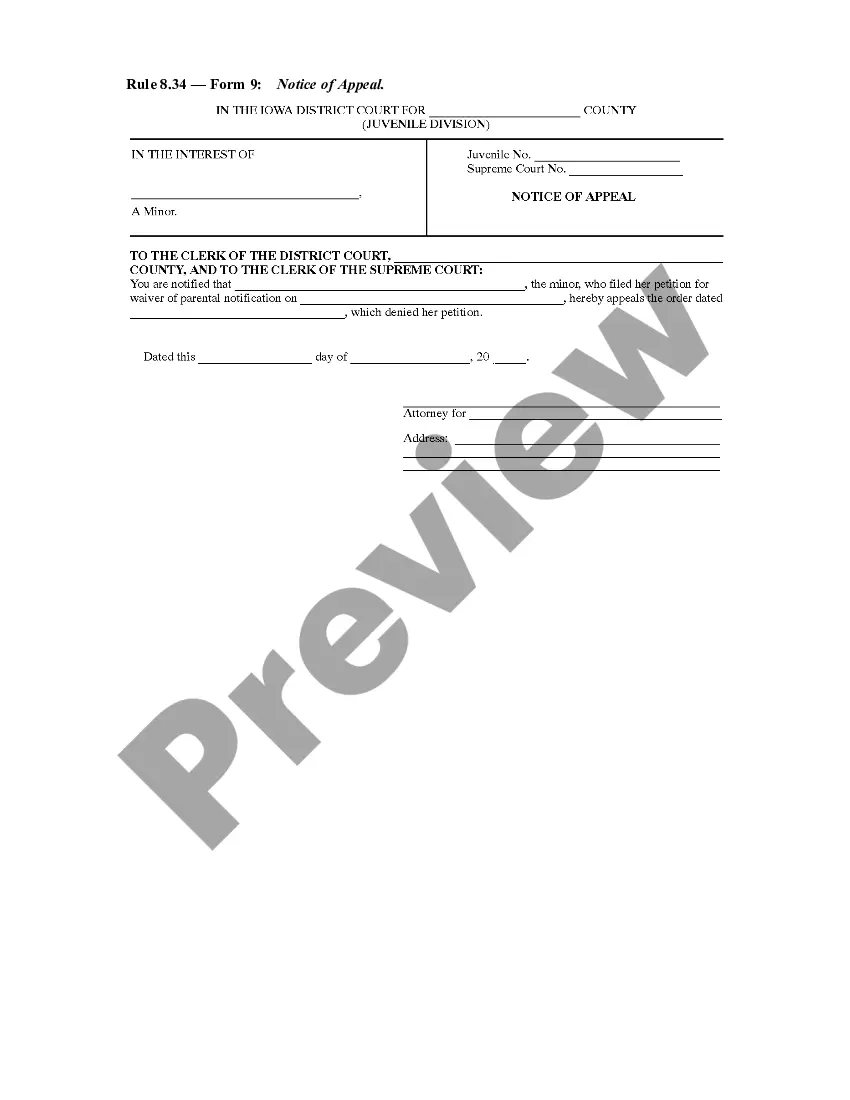

- Initially, make certain you have chosen the proper document web template for your region/city that you pick. Browse the form description to make sure you have chosen the correct form. If accessible, take advantage of the Review button to check through the document web template at the same time.

- In order to locate another variation in the form, take advantage of the Search industry to obtain the web template that fits your needs and demands.

- When you have found the web template you need, click on Purchase now to carry on.

- Select the pricing strategy you need, type your references, and sign up for a free account on US Legal Forms.

- Full the purchase. You should use your charge card or PayPal bank account to pay for the legal form.

- Select the file format in the document and obtain it for your device.

- Make alterations for your document if needed. You may full, modify and indicator and printing Rhode Island Anti-Dilution Adjustments.

Down load and printing a huge number of document layouts while using US Legal Forms Internet site, that provides the largest variety of legal types. Use skilled and status-distinct layouts to deal with your company or individual demands.