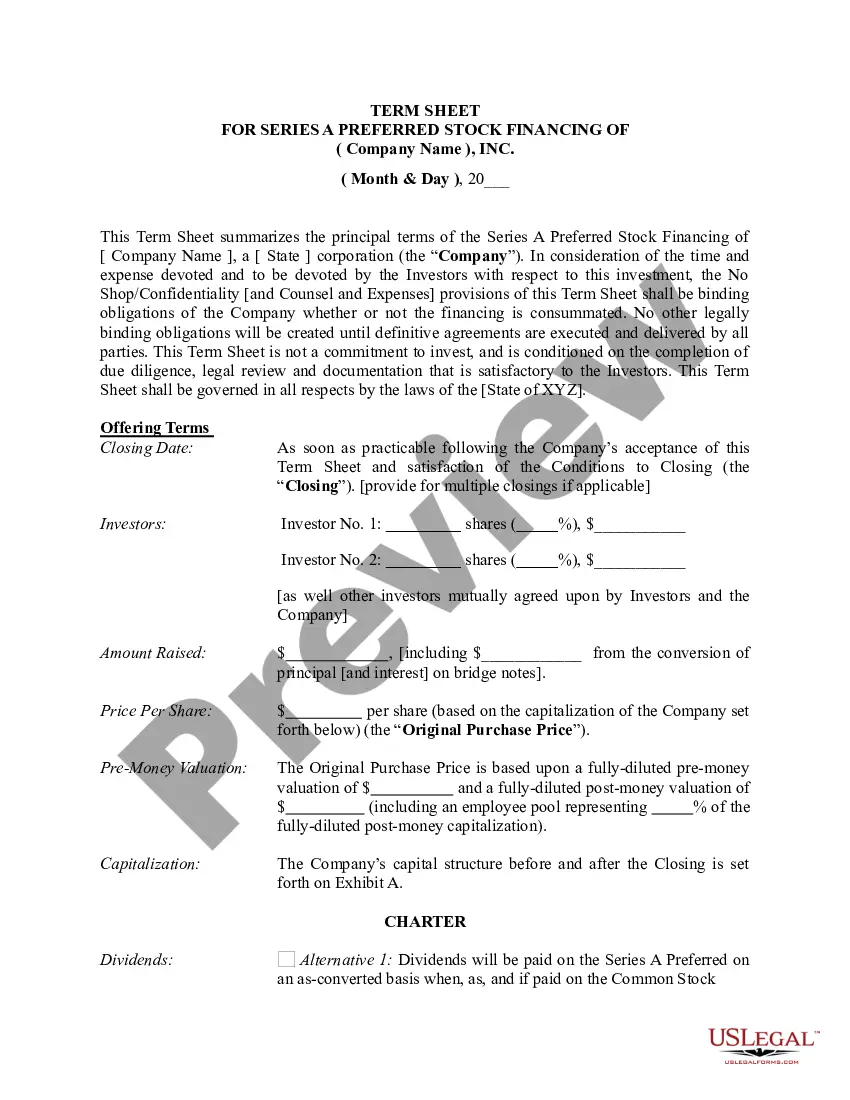

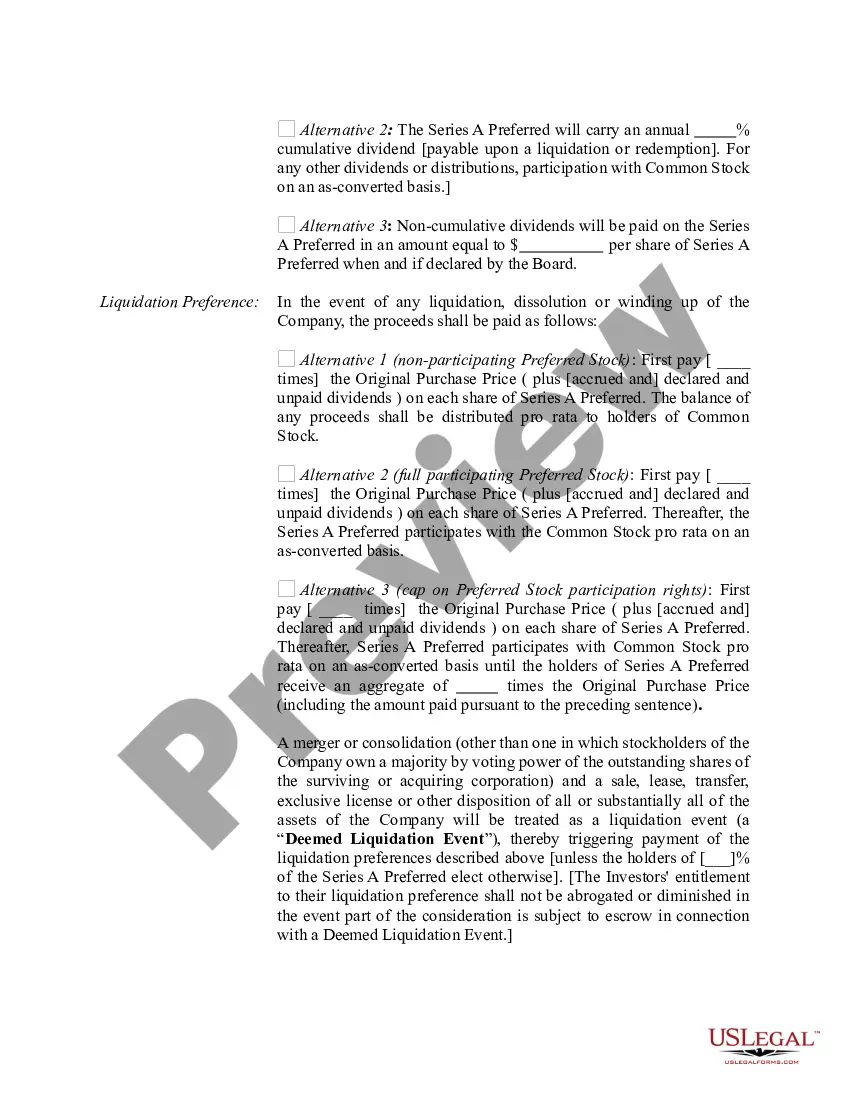

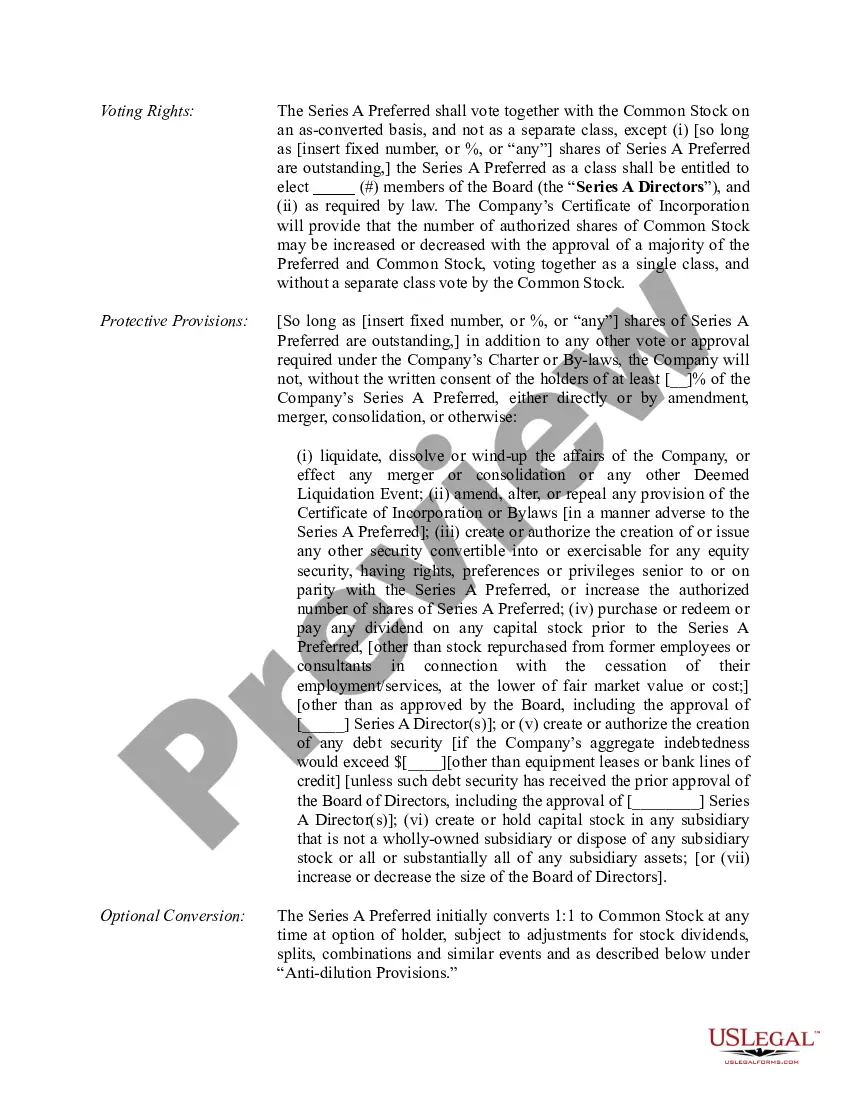

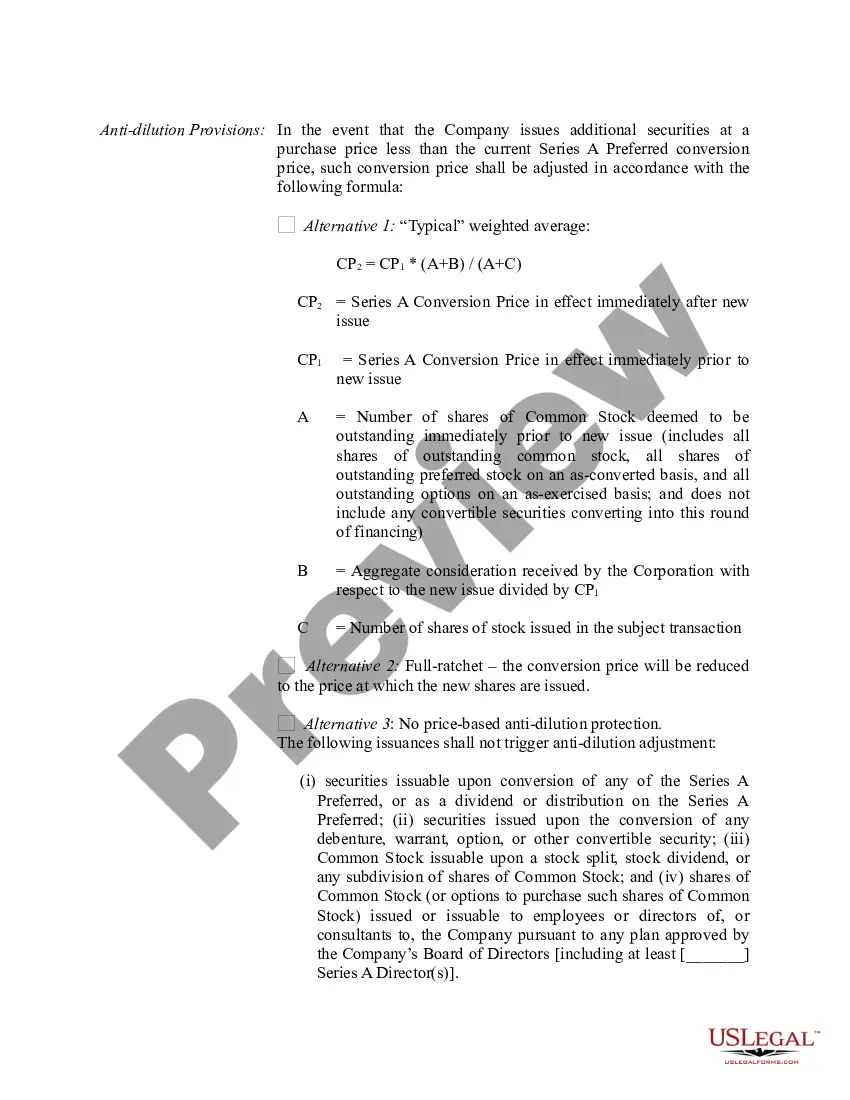

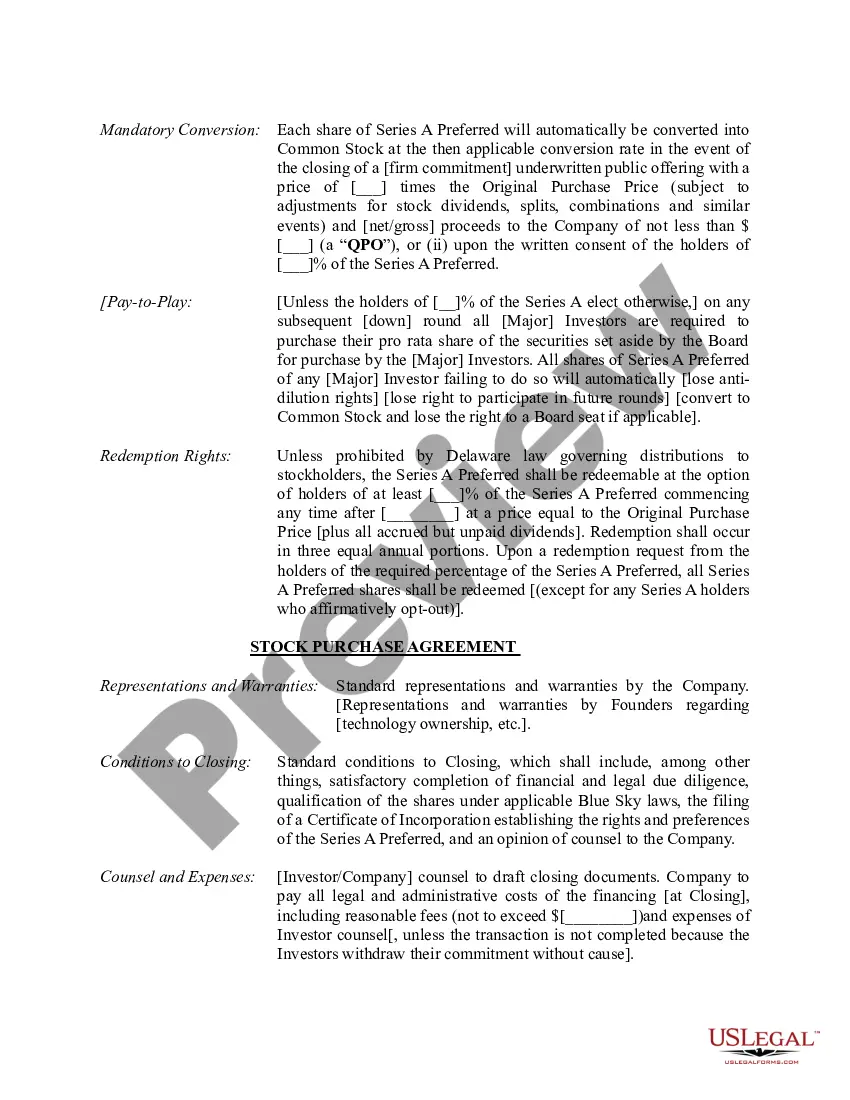

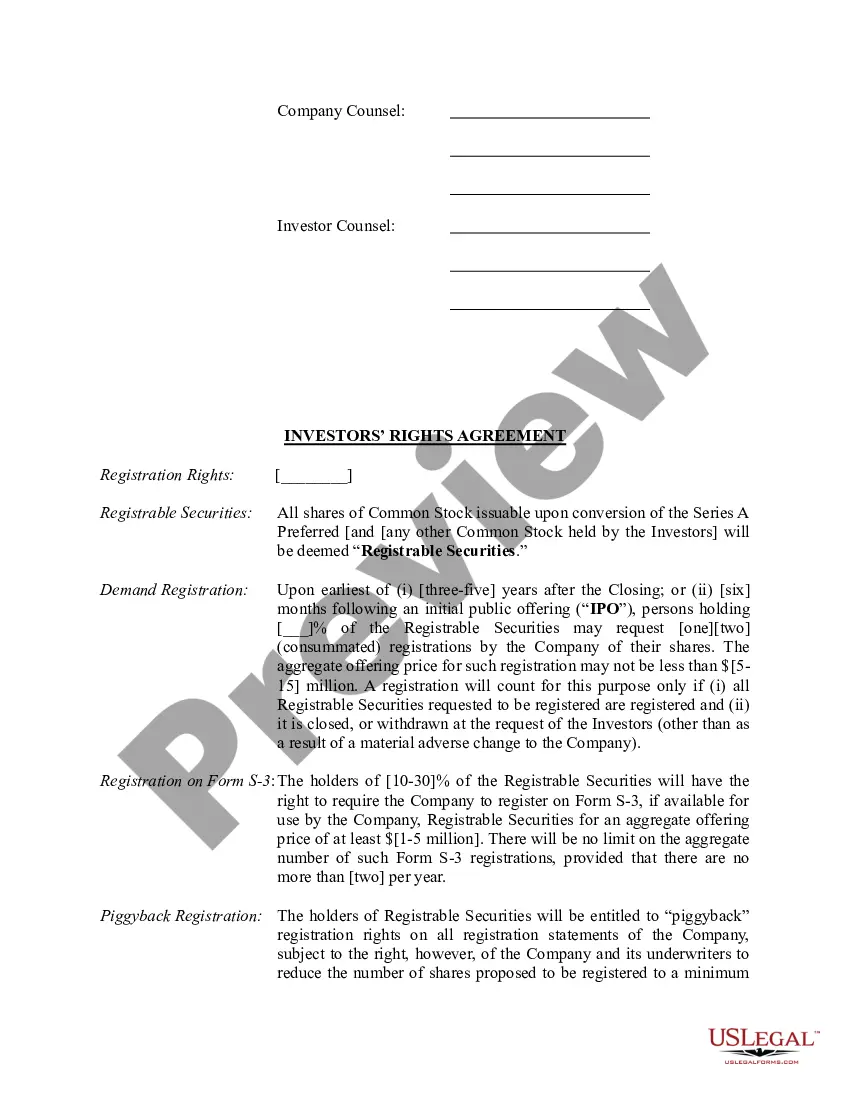

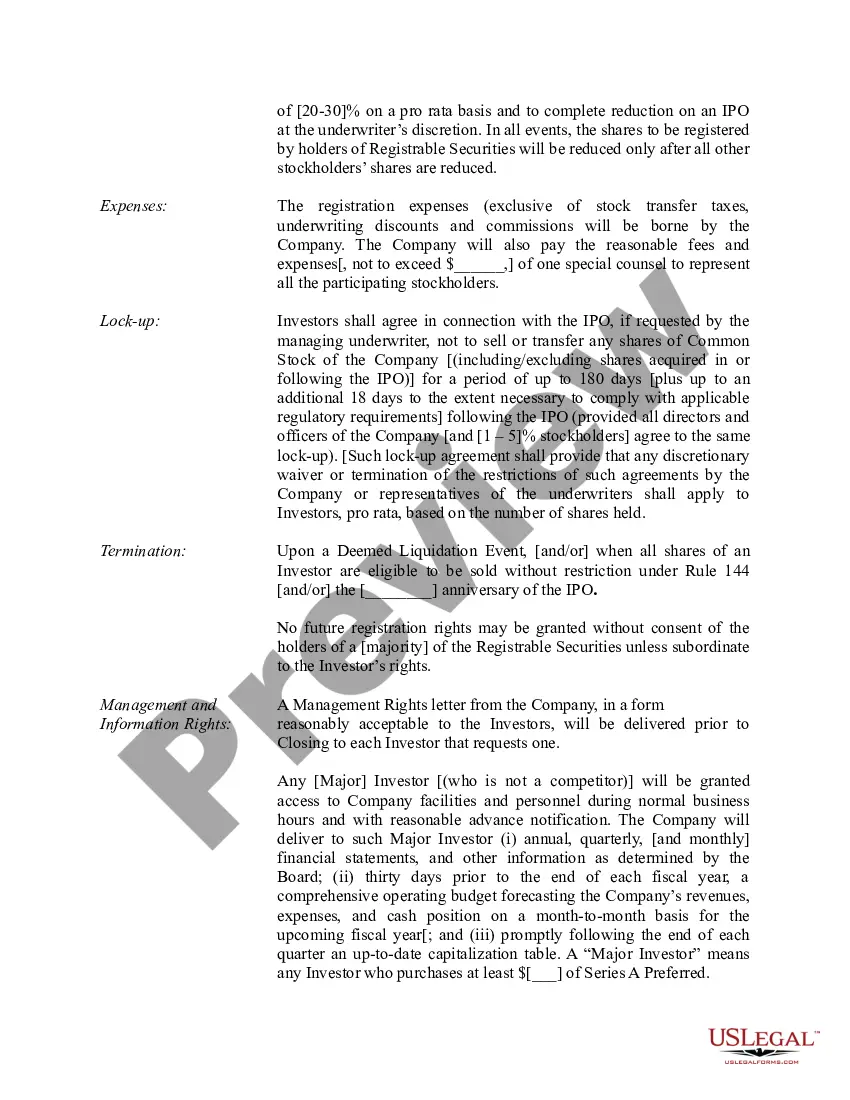

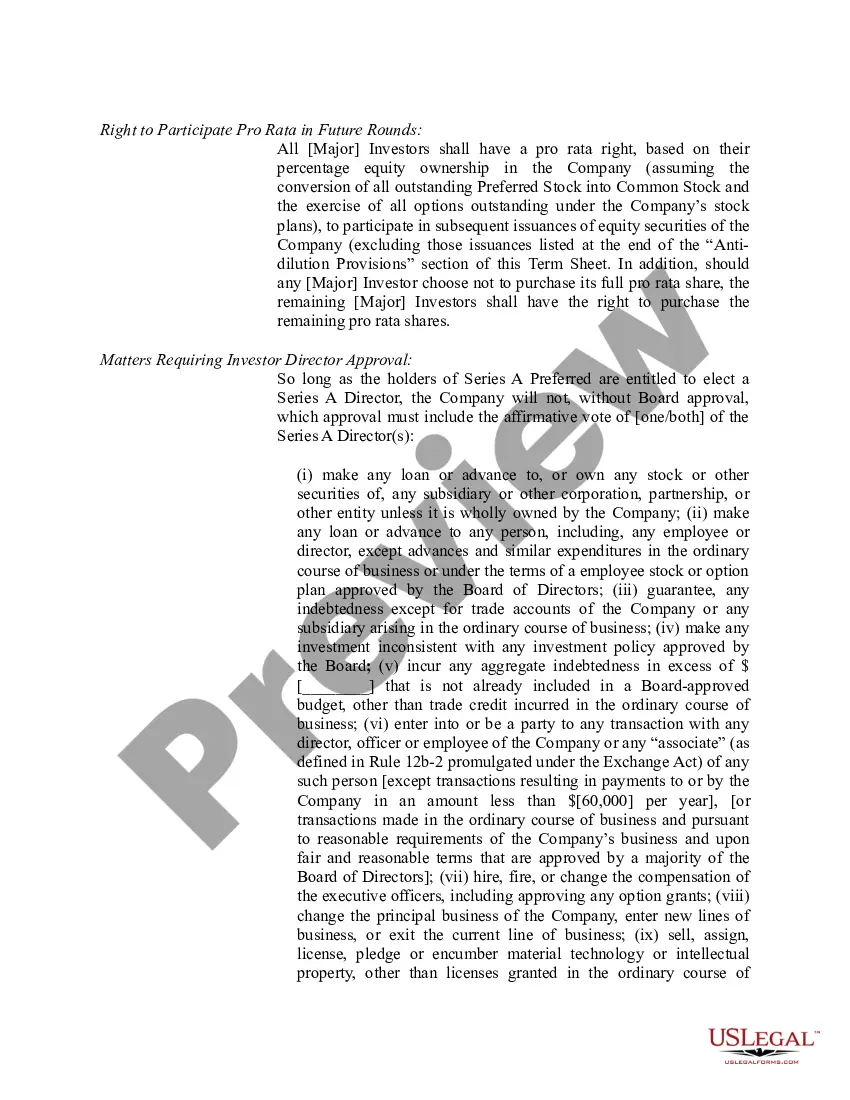

Rhode Island Term Sheet — Series A Preferred Stock Financing of a Company: A Detailed Description In the world of corporate finance, Rhode Island Term Sheet — Series A Preferred Stock Financing plays a pivotal role in providing necessary capital to companies for growth and expansion. This detailed description aims to shed light on the various aspects of this financing method, outlining its meaning, key features, and potential variations. Meaning and Purpose: The Rhode Island Term Sheet — Series A Preferred Stock Financing refers to an agreement between a company and investors for the issuance of preferred stock as a means of raising funds. This financing round typically occurs after the seed or angel investment stage, when the company shows promising potential for growth and market penetration. Series A Preferred Stock Financing serves as a crucial milestone for startups and early-stage companies, enabling them to secure capital from venture capitalists or institutional investors. Key Features: 1. Preferred Stock: Unlike common stockholders, investors purchasing Series A Preferred Stock holds a privileged position in terms of receiving dividends and recovering their investments in case of a company's liquidation or acquisition. Preferred stockholders are typically entitled to a fixed dividend rate and have a higher claim on company assets over common stockholders. 2. Valuation and Dilution: The term sheet specifies the pre-money valuation, which reflects the company's overall worth before considering the Series A Preferred Stock issuance. Additionally, it outlines the amount of preferred stock to be issued to investors, thereby indicating the percentage ownership they will hold. It is important to note that a Series A financing round often leads to dilution of existing common stockholders' ownership stakes. 3. Liquidation Preference: The term sheet outlines the liquidation preference of the series A preferred stockholders. This provision ensures that preferred stockholders are compensated first in case of a company's liquidation or acquisition. It may include a 1x or higher liquidation preference, ensuring that preferred stockholders receive at least their initial investment amount before common stockholders receive any proceeds. 4. Anti-Dilution Protection: The term sheet may include an anti-dilution provision, safeguarding the preferred stockholders' investment from any future issuance of stock at a lower price, thus mitigating the impact of dilution. Different Types of Series A Preferred Stock Financing: 1. Participating Preferred Stock: This type of financing provides additional benefits to series A preferred stockholders, enabling them to receive preferential dividends and participate in the distribution of remaining proceeds alongside common stockholders after the preferred liquidation preference is fulfilled. 2. Convertible Preferred Stock: In some cases, Series A Preferred Stock may be convertible into common stock on predetermined terms. This provision allows investors to convert their preferred shares into common shares, typically during an exit event or at their discretion. 3. Pay-to-Play Provision: Series A financings may include a pay-to-play provision, which encourages investors to participate in future financing rounds to maintain their investment percentage and avoid suffering certain penalties, such as a reduction of voting rights. 4. Redemption Rights: The term sheet may include redemption rights, allowing preferred stockholders to request the repurchase of their shares by the company after a specified period or under specific circumstances. In conclusion, Rhode Island Term Sheet — Series A Preferred Stock Financing plays a critical role in providing capital to companies at a crucial growth stage. This financing method offers various features, including preferred stock issuance, liquidation preference, anti-dilution protection, and different types such as participating preferred stock, convertible preferred stock, pay-to-play provision, and redemption rights. Companies pursuing Series A financing in Rhode Island should carefully consider the terms outlined in the term sheet, ensuring alignment between the company's growth objectives and the investor's expectations.

Rhode Island Term Sheet - Series A Preferred Stock Financing of a Company

Description

How to fill out Rhode Island Term Sheet - Series A Preferred Stock Financing Of A Company?

If you have to comprehensive, down load, or printing legal file templates, use US Legal Forms, the largest collection of legal forms, which can be found on the web. Make use of the site`s easy and handy research to find the papers you require. Different templates for enterprise and individual functions are categorized by groups and claims, or keywords. Use US Legal Forms to find the Rhode Island Term Sheet - Series A Preferred Stock Financing of a Company in a few click throughs.

Should you be already a US Legal Forms client, log in to the bank account and click on the Acquire switch to get the Rhode Island Term Sheet - Series A Preferred Stock Financing of a Company. You can also access forms you previously downloaded from the My Forms tab of your own bank account.

Should you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Be sure you have selected the form for that correct town/region.

- Step 2. Take advantage of the Review option to examine the form`s articles. Never overlook to read the outline.

- Step 3. Should you be not satisfied with all the kind, make use of the Look for discipline at the top of the screen to discover other models of the legal kind format.

- Step 4. After you have identified the form you require, select the Buy now switch. Opt for the prices program you favor and add your references to sign up to have an bank account.

- Step 5. Approach the transaction. You may use your Мisa or Ьastercard or PayPal bank account to complete the transaction.

- Step 6. Find the file format of the legal kind and down load it in your gadget.

- Step 7. Total, revise and printing or indication the Rhode Island Term Sheet - Series A Preferred Stock Financing of a Company.

Each legal file format you get is your own forever. You might have acces to every kind you downloaded in your acccount. Go through the My Forms portion and select a kind to printing or down load once more.

Contend and down load, and printing the Rhode Island Term Sheet - Series A Preferred Stock Financing of a Company with US Legal Forms. There are many specialist and condition-certain forms you can utilize for the enterprise or individual requires.