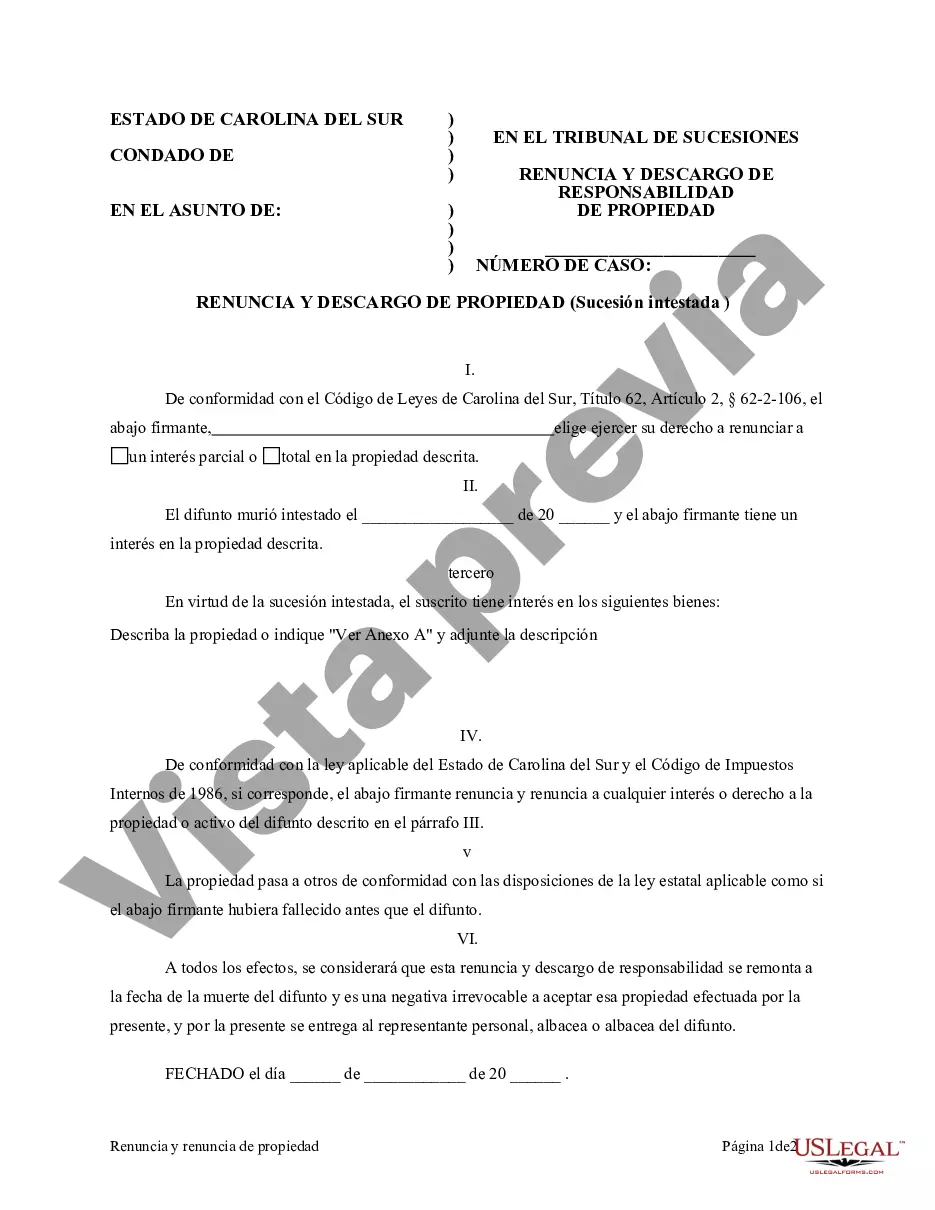

Renuncia y Deslinde de Bienes recibidos por Sucesión Intestada

Disclaimer of Property Interest-South Carolina

SOUTH CAROLINA CODE OF LAWS

Title 62 - Probate

ARTICLE 2. INTESTATE SUCCESSION AND WILLS

PART 1. INTESTATE SUCCESSION

Representation; disclaimer by intestate beneficiary.

If representation is called for by this Code,

the estate is divided into as many equal shares as there are surviving

heirs in the nearest degree of kinship and deceased persons in the same

degree who left issue who survive the decedent, each surviving heir in

the nearest degree receiving one share and the share of each deceased person

in the same degree being divided among his issue in the same manner. If

an interest created by intestate succession is disclaimed, the beneficiary

is not treated as having predeceased the decedent for purposes of determining

the generation at which the division of the estate is to be made.

Title 62, Art. 2, Part 1, §62-2-106.

PART 8. GENERAL PROVISIONS

Disclaimer.

(a) In addition to any methods available under existing

law, statutory or otherwise, if a person (or his executor, administrator,

successor, personal representative, special administrator, guardian, attorney-in-fact,

trustee, committee, conservator, or his other fiduciary or agent who performs

substantially similar functions under the law governing his status, acting

with or without the approval of a specific court order and with or without

the receipt of consideration for the act), as a disclaimant, makes a disclaimer

as defined in Section 12-16-1910 of the 1976 Code, with respect to any

transferor's transfer (including transfers by any means whatsoever, lifetime

and testamentary, voluntary and by operation of law, initial and successive,

by grant, gift, trust, contract, intestacy, wrongful death, elective share,

forced share, homestead allowance, exempt property allowance, devise,

bequest, beneficiary designation, survivorship provision, exercise and

nonexercise of a power, and otherwise) to him of any interest in, including

any power with respect to, property, or any undivided portion thereof,

the interest, or such portion, is considered never to have been transferred

to the disclaimant.

(b) The right to disclaim exists notwithstanding any limitation

on the disclaimant's interest in the nature of a spendthrift provision

or similar restriction.

(c) The right to disclaim is barred by the disclaimant's written

waiver of the right.

(d) Unless the transferor has provided otherwise in the event of

a disclaimer, the disclaimed interest shall be transferred (or fail to

be transferred, as the case may be) as if the disclaimant had predeceased

the date of effectiveness of the transfer of the interest; the disclaimer

shall relate back to that date of effectiveness for all purposes; and any

future interest which is provided to take effect in possession or enjoyment

after the termination of the disclaimed interest shall take effect as if

the disclaimant had predeceased the date on which he or she as the taker

of the disclaimed interest became finally ascertained and the disclaimed

interest became indefeasibly vested; provided, that an interest disclaimed

by a disclaimant who is the spouse of a decedent, the transferor of the

interest, may pass by any further process of transfer to such spouse, notwithstanding

the treatment of the transfer of the disclaimed interest as if the disclaimant

had predeceased.

(e) The date of effectiveness of the transfer of the disclaimed

interest is (1) as to transfers by intestacy, wrongful death, elective

share, forced share, homestead allowance, exempt property allowance, devise

and bequest, the date of death of the decedent transferor of, or that of

the donee of a testamentary power of appointment (whether exercised or

not exercised) with respect to, the interest, as the case may be, and (2)

as to all other transfers, the date of effectiveness of the instrument,

contract, or act of transfer.

(f) It is the intent of the legislature of the State of South Carolina

by this provision to clarify the laws of this State with respect to the

subject matter hereof in order to ensure the ability of persons to disclaim

interests in property without the imposition of federal and state estate,

inheritance, gift, and transfer taxes. This provision is to be interpreted

and construed in accordance with, and in furtherance of, that intent.

(g) With the court's approval, a personal representative, trustee,

or similar fiduciary may disclaim any one or more of the powers granted

to the personal representative, trustee, or similar fiduciary. Any disclaimer

must be made by written instrument in the manner provided in subsection

(a) and has the same effect as in subsection (d). The disclaimer of a power

may be made binding on any successor fiduciary, if the disclaiming fiduciary

so declares when making the disclaimer.

Title 62, Art. 2, Part 8, §62-2-801.