Title: South Carolina Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transaction: Understanding Different Types and Their Importance Introduction: The South Carolina Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transaction is a crucial legal document that facilitates the transfer of personal assets during the sale of a business in South Carolina. This detailed description aims to shed light on the significance of this document and highlight its various types. 1. General Overview: A South Carolina Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transaction is a legal contract that serves as concrete evidence of the transfer of ownership of personal assets from the seller to the buyer. The document includes comprehensive details about the assets being sold, the agreed purchase price, terms and conditions of the sale, representations and warranties, and any other relevant clauses. 2. Types of South Carolina Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transaction: a) Equipment and Machinery Bill of Sale: This type of bill of sale is used when a business is selling its equipment and machinery as part of the asset purchase transaction. It includes details such as serial numbers, descriptions, condition, and the agreed-upon purchase price for each item. b) Intellectual Property Bill of Sale: This bill of sale applies when the sale includes the transfer of intellectual property such as trademarks, patents, copyrights, or trade secrets. It outlines the specific rights being transferred and any associated agreements or warranties. c) Inventory Bill of Sale: In cases where the sale involves transferring the existing inventory of the business, this bill of sale provides detailed records of the inventory being sold, including types, quantities, quality, and any conditions or warranties regarding the inventory. d) Real Estate Bill of Sale: If the sale includes the transfer of any real estate property, this bill of sale captures all relevant details of the property, including legal descriptions, boundaries, encumbrances, and conditions of sale. 3. Importance of South Carolina Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transaction: a) Legal Protection: The bill of sale ensures that both the buyer and the seller are protected from any potential disputes or claims regarding the assets being sold. It serves as an official record and evidence in the event of any future legal issues. b) Clarity and Transparency: The bill of sale provides a clear and comprehensive understanding of the assets being transferred and the terms and conditions of the transaction. This minimizes misunderstandings or misinterpretations between the parties involved. c) Smooth Transition: Having a legal document that outlines the sale of personal assets ensures a seamless transition for both parties. It helps facilitate a smooth transfer of ownership, preventing any potential disruptions or uncertainties during the process. Conclusion: The South Carolina Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transaction is a vital legal instrument that safeguards the interests of both the buyer and the seller during the sale of a business. With diverse types catering to equipment, machinery, intellectual property, inventory, and real estate, businesses can conduct their transactions with confidence and ensure a fair and legally binding transfer of assets.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.South Carolina Venta de negocio - Factura de venta de bienes personales - Transacción de compra de bienes - Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction

Description

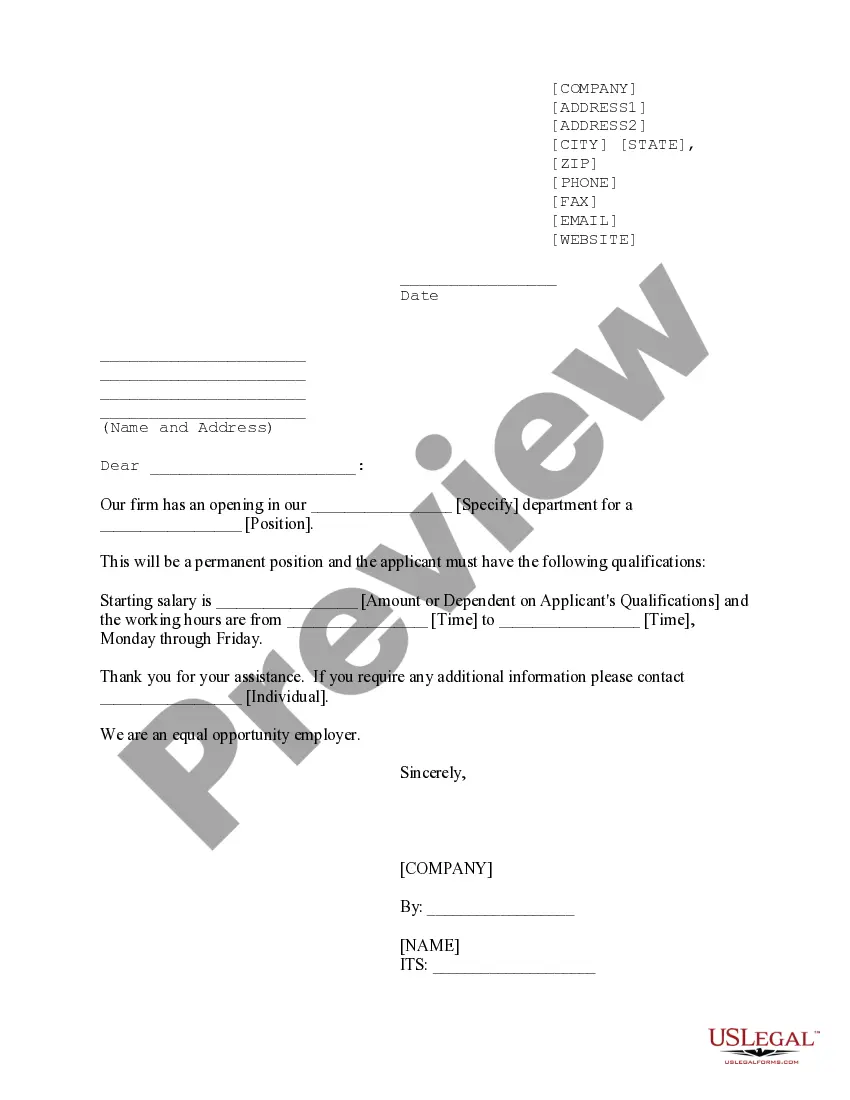

How to fill out South Carolina Venta De Negocio - Factura De Venta De Bienes Personales - Transacción De Compra De Bienes?

If you wish to comprehensive, acquire, or print legal record web templates, use US Legal Forms, the greatest variety of legal types, which can be found on the Internet. Utilize the site`s basic and handy look for to discover the paperwork you want. Different web templates for organization and personal uses are sorted by groups and claims, or key phrases. Use US Legal Forms to discover the South Carolina Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction within a handful of clicks.

When you are previously a US Legal Forms buyer, log in in your account and click on the Download key to obtain the South Carolina Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction. Also you can access types you in the past acquired from the My Forms tab of your account.

If you use US Legal Forms the very first time, refer to the instructions under:

- Step 1. Be sure you have selected the form to the appropriate town/country.

- Step 2. Make use of the Review method to examine the form`s content material. Don`t forget about to read through the outline.

- Step 3. When you are not happy with all the kind, utilize the Look for field at the top of the display screen to get other types in the legal kind web template.

- Step 4. Upon having discovered the form you want, select the Purchase now key. Opt for the costs prepare you prefer and include your accreditations to sign up for an account.

- Step 5. Method the transaction. You should use your bank card or PayPal account to perform the transaction.

- Step 6. Choose the formatting in the legal kind and acquire it on your own system.

- Step 7. Total, change and print or sign the South Carolina Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction.

Every legal record web template you buy is the one you have eternally. You possess acces to each and every kind you acquired in your acccount. Click on the My Forms section and decide on a kind to print or acquire again.

Remain competitive and acquire, and print the South Carolina Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction with US Legal Forms. There are many skilled and state-particular types you can use for your organization or personal requirements.