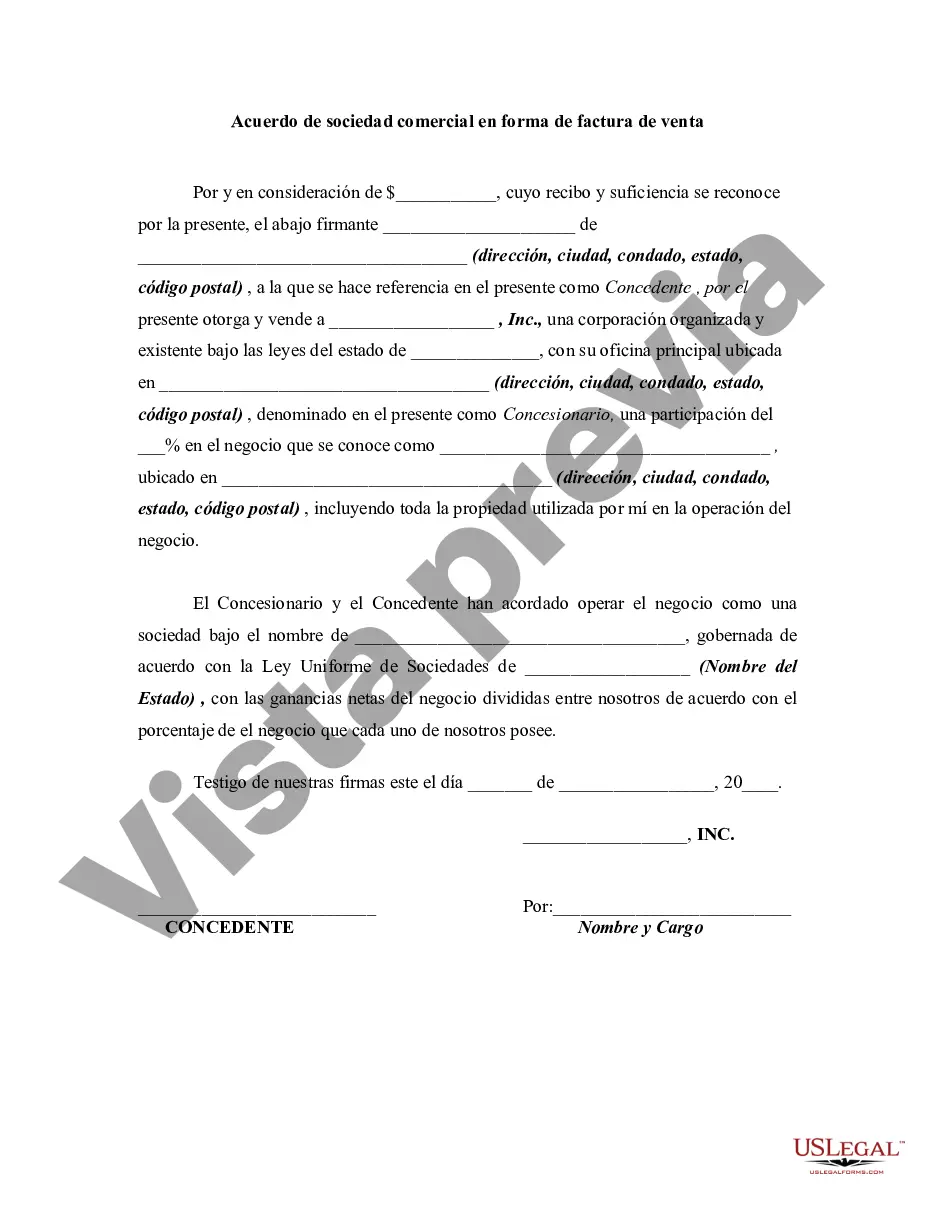

South Carolina Commercial Partnership Agreement in the Form of a Bill of Sale is a legally-binding document that outlines the terms and conditions agreed upon between two or more parties entering into a partnership with commercial interests in the state of South Carolina. This agreement serves as proof of the transfer of ownership and assets related to a business, and it helps in establishing the rights, responsibilities, and obligations of each partner involved in the partnership. The South Carolina Commercial Partnership Agreement in the Form of a Bill of Sale can include various types, depending on the nature and purpose of the partnership. Some commonly seen types include: 1. General Partnership Agreement: This agreement is commonly used when two or more individuals or entities come together to start a business and mutually share its profits, losses, and liabilities. All partners have equal rights and decision-making authority, and they are collectively responsible for the debts and obligations of the partnership. 2. Limited Partnership Agreement: In this type of agreement, there are both general partners and limited partners. General partners have unlimited liability and are actively involved in the day-to-day management of the business, while limited partners have limited liability and are usually passive investors. Limited partners enjoy some liability protection while sharing in the profits and losses of the partnership. 3. Limited Liability Partnership Agreement: This agreement is typically formed by professionals like lawyers, accountants, or doctors. It offers limited liability protection to partners, meaning their personal assets are shielded from the partnership's debts and obligations. Each partner is liable only for their own actions and not for the actions of other partners. 4. Joint Venture Agreement: This type of agreement is entered into by two or more parties to collaborate on a specific business project or undertaking. The partners agree to pool their resources, expertise, and efforts for a defined period or until the completion of the venture. Each partner contributes capital, shares profits or losses, and maintains some level of control over the project. 5. Franchise Partnership Agreement: This agreement establishes a relationship between a franchisor and a franchisee. The franchisor grants the franchisee the rights to operate a business under an established brand name, providing them with necessary support, training, and marketing assistance. The franchisee agrees to follow the franchisor's systems, processes, and requirements. In all these types of South Carolina Commercial Partnership Agreements in the Form of a Bill of Sale, it is important to include key provisions such as the description of the business, capital contributions, profit and loss sharing, management roles and responsibilities, dispute resolution mechanisms, duration of the partnership, and provisions for termination or dissolution of the partnership. It is crucial for all parties involved to seek legal advice and understand their rights and obligations before entering into any partnership agreement in the state of South Carolina.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.South Carolina Acuerdo de sociedad comercial en forma de factura de venta - Commercial Partnership Agreement in the Form of a Bill of Sale

Description

How to fill out South Carolina Acuerdo De Sociedad Comercial En Forma De Factura De Venta?

Choosing the right legitimate file web template can be a have a problem. Naturally, there are a variety of themes available online, but how can you find the legitimate develop you require? Take advantage of the US Legal Forms site. The support gives thousands of themes, such as the South Carolina Commercial Partnership Agreement in the Form of a Bill of Sale, which you can use for business and private needs. All of the types are checked by specialists and satisfy federal and state specifications.

Should you be already signed up, log in to your bank account and click the Down load button to get the South Carolina Commercial Partnership Agreement in the Form of a Bill of Sale. Make use of your bank account to appear with the legitimate types you may have acquired formerly. Check out the My Forms tab of your bank account and acquire an additional version in the file you require.

Should you be a fresh consumer of US Legal Forms, here are easy recommendations that you should follow:

- Initially, make sure you have selected the correct develop for your personal area/region. You are able to look through the shape using the Preview button and read the shape outline to guarantee it is the best for you.

- In case the develop is not going to satisfy your expectations, use the Seach area to get the right develop.

- When you are positive that the shape would work, select the Get now button to get the develop.

- Pick the costs program you need and type in the required info. Make your bank account and pay for the transaction using your PayPal bank account or Visa or Mastercard.

- Select the document file format and acquire the legitimate file web template to your product.

- Total, modify and print out and sign the obtained South Carolina Commercial Partnership Agreement in the Form of a Bill of Sale.

US Legal Forms may be the greatest local library of legitimate types where you can see numerous file themes. Take advantage of the service to acquire appropriately-manufactured paperwork that follow condition specifications.