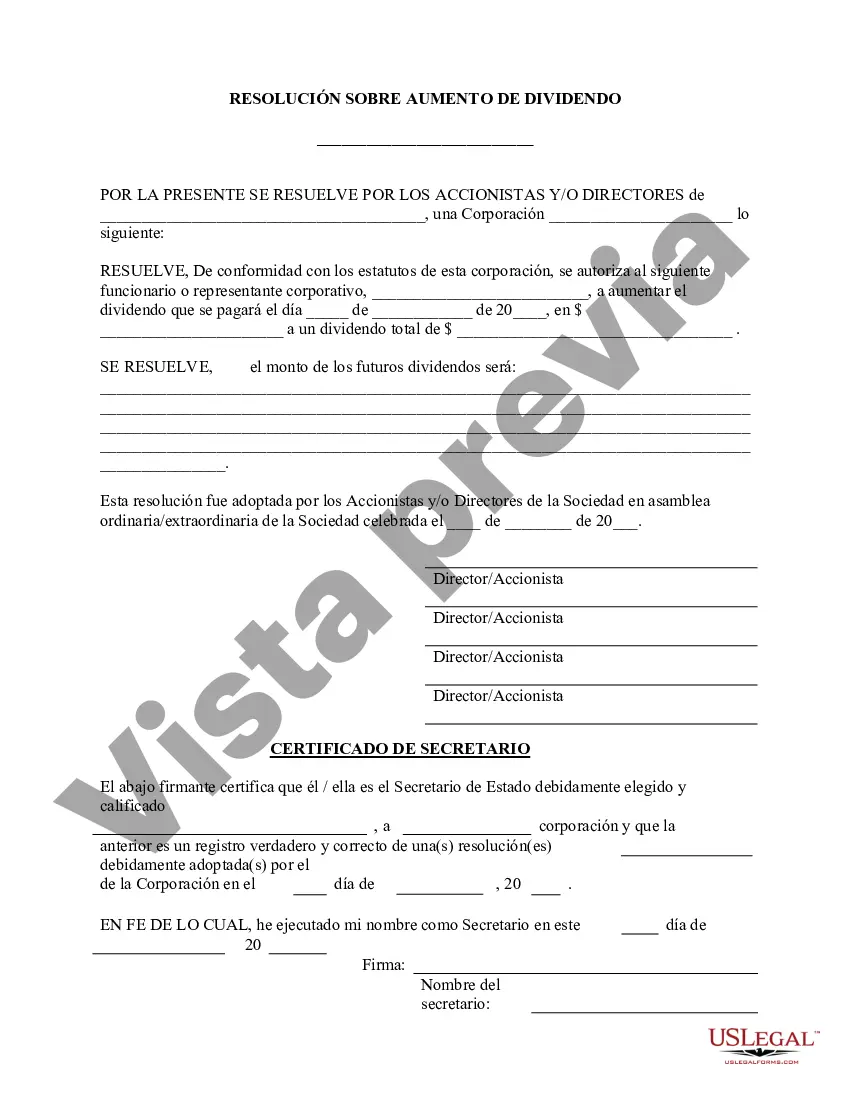

South Carolina Increase Dividend — Resolution For— - Corporate Resolutions: A Comprehensive Overview In South Carolina, the Increase Dividend — Resolution Form is a crucial document used in corporate resolutions to authorize a dividend increase for a company. This resolution allows shareholders and board members to formalize and approve the decision to raise the dividend payouts to the shareholders. Keywords: South Carolina, Increase Dividend, Resolution Form, Corporate Resolutions There are different types of South Carolina Increase Dividend — Resolution Forms that cater to the unique needs of various corporations. Let's explore the commonly used types: 1. Standard Increase Dividend — Resolution Form: This is the most common type used by companies in South Carolina to declare a dividend increase. It outlines the necessary details such as the current dividend rate, proposed increase percentage, effective date of the new dividend rate, and shareholder approval. 2. Special Dividend Increase — Resolution Form: This specific form is utilized when a company wishes to issue a one-time special dividend increase rather than a recurring dividend raise. It involves additional considerations such as the source of funds for the special dividend and the reasons for the extraordinary payout. 3. Preferred Share Dividend Increase — Resolution Form: Some companies issue different classes of shares, including preferred shares. This form focuses on authorizing an increase in dividend payouts specifically for preferred shareholders. It entails specifying the distinct dividend rate applicable to preferred shares, while mentioning any changes in relation to the common shareholders' dividends. When utilizing a South Carolina Increase Dividend — Resolution Form, it is essential to include all the necessary information. Typically, the document starts with a resolution statement affirming the intention to increase dividends. This is followed by sections covering shareholders' voting rights, date of implementation, and any amendments made to existing bylaws or articles of incorporation. Moreover, it is crucial to ensure compliance with South Carolina corporate laws, including the approval threshold for dividend increase resolutions as mandated by the state statutes. It might also be necessary to engage legal counsel or seek expert advice to navigate any complexities associated with dividend increases under specific circumstances. Overall, South Carolina Increase Dividend — Resolution For— - Corporate Resolutions empower companies and their stakeholders to make informed decisions about dividend policy changes. By following the appropriate procedures and using the right form tailored to their needs, businesses can effectively communicate their dividend increase plans while adhering to legal requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.South Carolina Incrementar Dividendo - Formulario de Resoluciones - Resoluciones Corporativas - Increase Dividend - Resolution Form - Corporate Resolutions

Description

How to fill out South Carolina Incrementar Dividendo - Formulario De Resoluciones - Resoluciones Corporativas?

If you want to full, down load, or print out legitimate record web templates, use US Legal Forms, the most important selection of legitimate varieties, that can be found on-line. Utilize the site`s easy and practical look for to get the files you want. Various web templates for business and personal uses are categorized by groups and claims, or search phrases. Use US Legal Forms to get the South Carolina Increase Dividend - Resolution Form - Corporate Resolutions in just a few mouse clicks.

If you are currently a US Legal Forms consumer, log in for your profile and then click the Acquire key to have the South Carolina Increase Dividend - Resolution Form - Corporate Resolutions. You may also accessibility varieties you previously saved within the My Forms tab of your respective profile.

Should you use US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have selected the shape for that appropriate town/country.

- Step 2. Utilize the Review method to look through the form`s articles. Never neglect to see the explanation.

- Step 3. If you are unhappy using the type, take advantage of the Lookup industry towards the top of the display to discover other models of the legitimate type web template.

- Step 4. Once you have located the shape you want, go through the Purchase now key. Select the costs plan you favor and include your accreditations to sign up for an profile.

- Step 5. Process the transaction. You can utilize your bank card or PayPal profile to perform the transaction.

- Step 6. Pick the file format of the legitimate type and down load it on your own system.

- Step 7. Full, change and print out or signal the South Carolina Increase Dividend - Resolution Form - Corporate Resolutions.

Each legitimate record web template you buy is the one you have permanently. You might have acces to each and every type you saved within your acccount. Click on the My Forms portion and select a type to print out or down load once more.

Remain competitive and down load, and print out the South Carolina Increase Dividend - Resolution Form - Corporate Resolutions with US Legal Forms. There are thousands of specialist and express-specific varieties you can utilize to your business or personal needs.