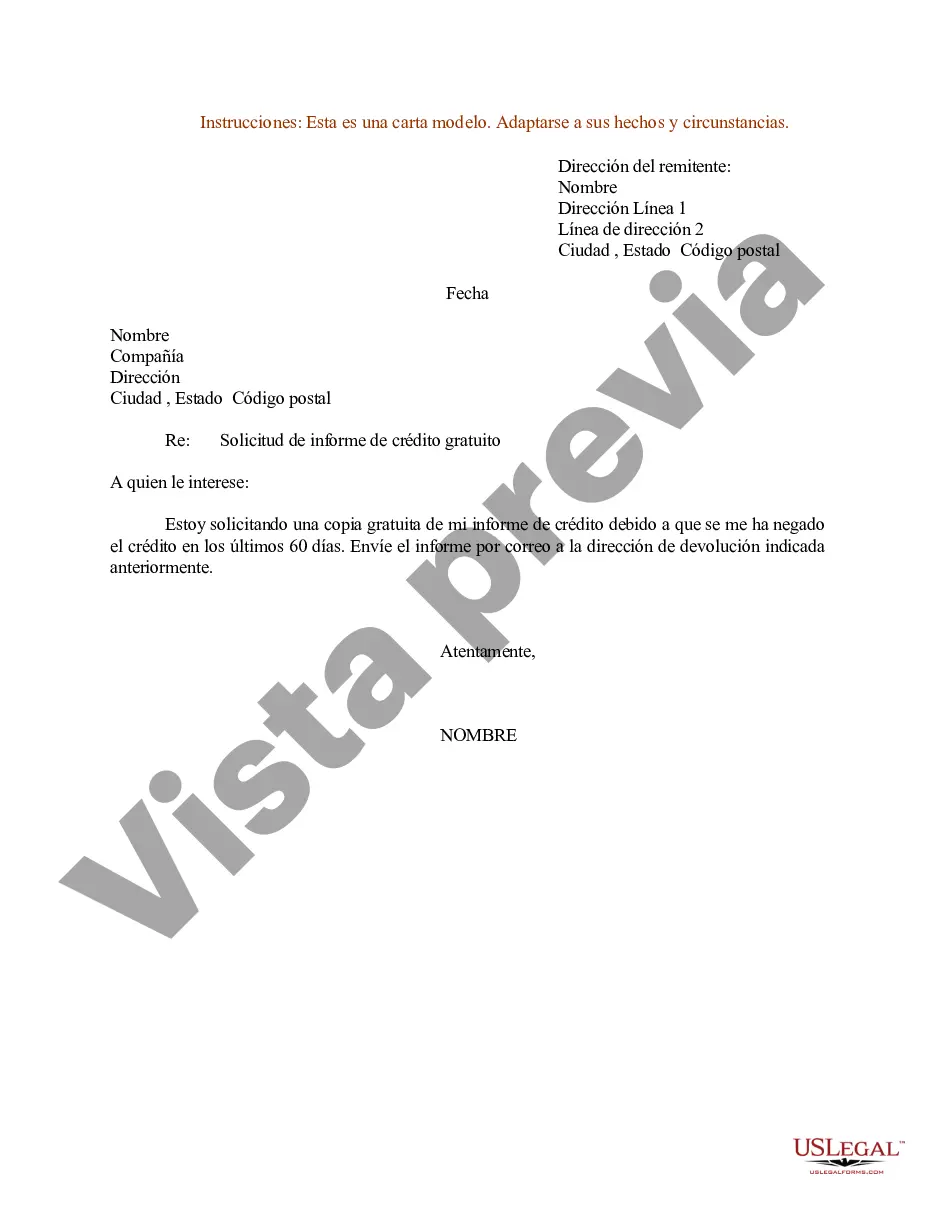

A South Carolina Sample Letter for Requesting a Free Credit Report Based on Denial of Credit is a formal document that individuals can use to exercise their right to access and review their credit report free of charge. This type of letter is specifically used when someone has been denied credit and wants to understand the underlying reasons for the denial. It is essential to mention relevant keywords and mention different types if they exist. Here is a detailed description of South Carolina Sample Letter for Request for Free Credit Report Based on Denial of Credit: 1. Heading: The letter should start with the sender's name, address, and contact information, aligned to the left side of the page. Then, the recipient's name, title, and address should follow, aligned on the left side as well. The date of writing the letter should be placed below the recipient's information. 2. Subject: It is beneficial to include a subject line that clearly states the purpose of the letter, such as "Request for Free Credit Report Based on Denial of Credit." 3. Salutation: Begin the letter with a formal salutation addressing the recipient, such as "Dear [Recipient's Name]". 4. Introduction: a. Start with a concise introduction, providing necessary information about the sender, including their full name and the date of the denial of credit. b. State the purpose of the letter — to request a free copy of the credit report. 5. Body: a. Explain your entitlement under the Fair Credit Reporting Act (FCRA) to receive a free credit report within 60 days of a credit denial. b. Clearly mention that you were denied credit and specify the reason provided by the creditor. c. If possible, include the details of the credit application, such as the date, the creditor's name, and any reference number provided. d. Emphasize that you are seeking a free copy of your credit report to review the information that led to the denial. 6. Request: a. Explicitly request a free copy of your credit report from one or all of the three major credit reporting agencies — Equifax, Experian, and TransUnion. b. Specify if you would like to receive a copy of the report from each agency or if you only want it from a specific one. c. Provide accurate personal information, including your full name, address, social security number, and date of birth. d. Mention that you would prefer to receive the credit report through email or physical mail, depending on your preference. 7. Closing: a. Express appreciation for the recipient's attention to your request. b. Provide your contact information again, such as your phone number and email address. c. Close the letter with a professional closing, for example, "Sincerely," followed by your full name. 8. Enclosures: Optionally, mention any documents being enclosed to support your request, such as a copy of the credit denial letter. Different types of South Carolina Sample Letters for Request for Free Credit Report Based on Denial of Credit may exist to cater to specific situations or personal preferences. These variations can include customized templates for different credit bureaus, alternate methods of requesting the report, or additional information required by certain institutions. It is always advisable to tailor the letter according to individual circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.South Carolina Modelo de carta de solicitud de informe de crédito gratuito basado en la denegación de crédito - Sample Letter for Request for Free Credit Report Based on Denial of Credit

Instant download

Description

Carta solicitando reporte de crédito gratis.

A South Carolina Sample Letter for Requesting a Free Credit Report Based on Denial of Credit is a formal document that individuals can use to exercise their right to access and review their credit report free of charge. This type of letter is specifically used when someone has been denied credit and wants to understand the underlying reasons for the denial. It is essential to mention relevant keywords and mention different types if they exist. Here is a detailed description of South Carolina Sample Letter for Request for Free Credit Report Based on Denial of Credit: 1. Heading: The letter should start with the sender's name, address, and contact information, aligned to the left side of the page. Then, the recipient's name, title, and address should follow, aligned on the left side as well. The date of writing the letter should be placed below the recipient's information. 2. Subject: It is beneficial to include a subject line that clearly states the purpose of the letter, such as "Request for Free Credit Report Based on Denial of Credit." 3. Salutation: Begin the letter with a formal salutation addressing the recipient, such as "Dear [Recipient's Name]". 4. Introduction: a. Start with a concise introduction, providing necessary information about the sender, including their full name and the date of the denial of credit. b. State the purpose of the letter — to request a free copy of the credit report. 5. Body: a. Explain your entitlement under the Fair Credit Reporting Act (FCRA) to receive a free credit report within 60 days of a credit denial. b. Clearly mention that you were denied credit and specify the reason provided by the creditor. c. If possible, include the details of the credit application, such as the date, the creditor's name, and any reference number provided. d. Emphasize that you are seeking a free copy of your credit report to review the information that led to the denial. 6. Request: a. Explicitly request a free copy of your credit report from one or all of the three major credit reporting agencies — Equifax, Experian, and TransUnion. b. Specify if you would like to receive a copy of the report from each agency or if you only want it from a specific one. c. Provide accurate personal information, including your full name, address, social security number, and date of birth. d. Mention that you would prefer to receive the credit report through email or physical mail, depending on your preference. 7. Closing: a. Express appreciation for the recipient's attention to your request. b. Provide your contact information again, such as your phone number and email address. c. Close the letter with a professional closing, for example, "Sincerely," followed by your full name. 8. Enclosures: Optionally, mention any documents being enclosed to support your request, such as a copy of the credit denial letter. Different types of South Carolina Sample Letters for Request for Free Credit Report Based on Denial of Credit may exist to cater to specific situations or personal preferences. These variations can include customized templates for different credit bureaus, alternate methods of requesting the report, or additional information required by certain institutions. It is always advisable to tailor the letter according to individual circumstances.

How to fill out South Carolina Modelo De Carta De Solicitud De Informe De Crédito Gratuito Basado En La Denegación De Crédito?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a broad assortment of legal form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest forms like the South Carolina Sample Letter for Requesting a Free Credit Report Due to Credit Denial in just a few seconds.

If the form does not meet your needs, use the Search feature at the top of the page to find the one that fits.

Once you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, select the pricing plan you prefer and provide your details to create an account.

- If you already hold a subscription, Log In/">Log In to obtain the South Carolina Sample Letter for Requesting a Free Credit Report Due to Credit Denial from the US Legal Forms database.

- The Download button appears on every form you view.

- You can access all previously downloaded forms from the My documents section of your account.

- If you are a new user of US Legal Forms, here are simple steps to get started.

- Ensure that you have selected the correct form for your city/region.

- Click the Review button to examine the form’s details.