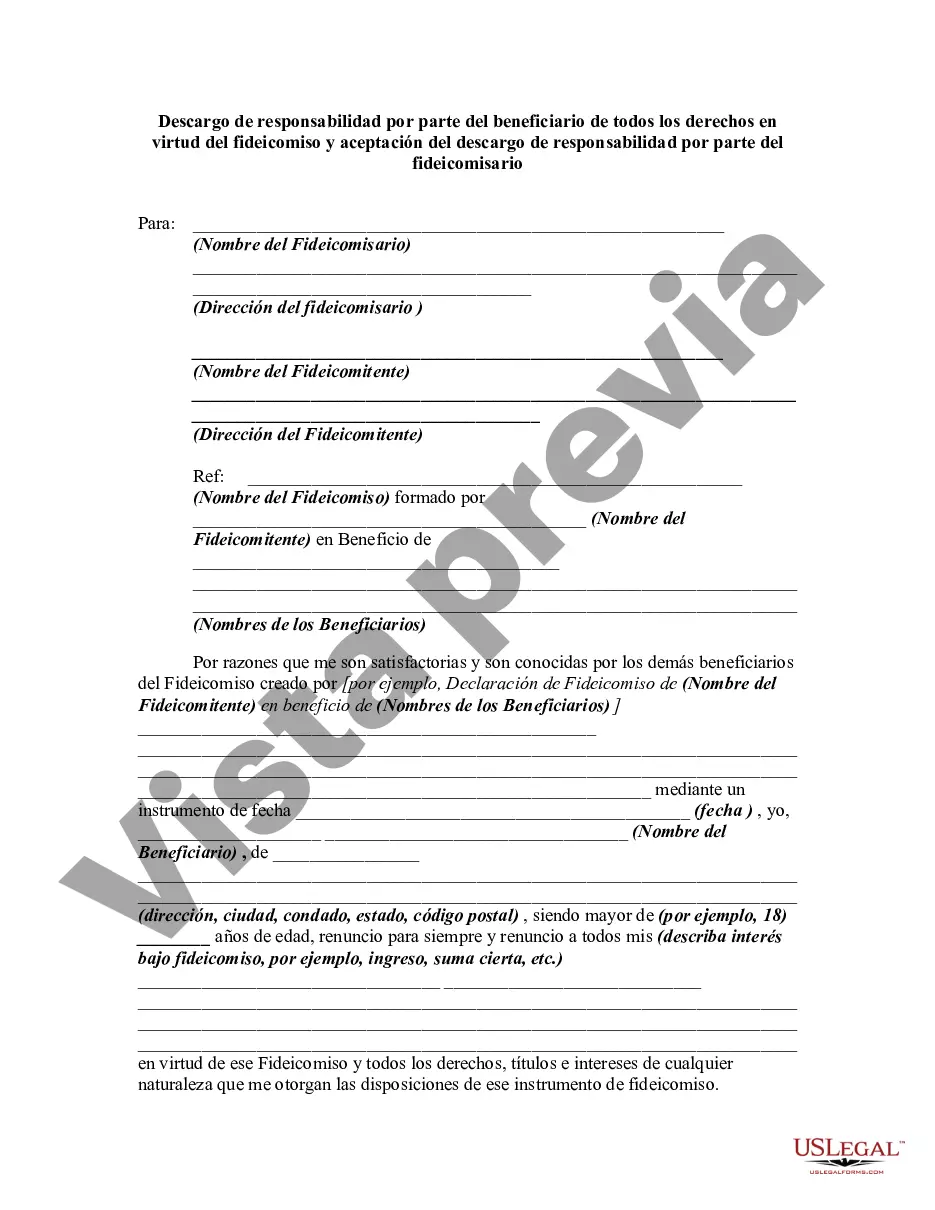

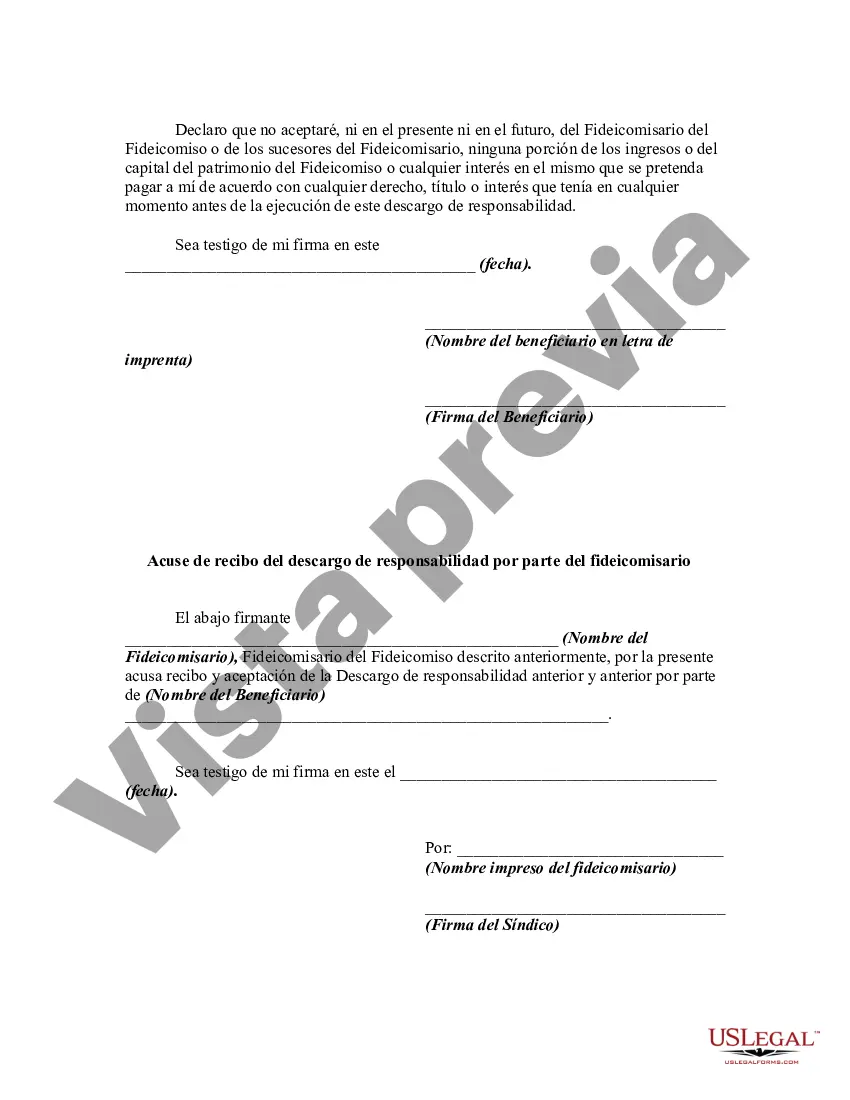

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept an estate which has been conveyed to him. In this instrument, the beneficiary of a trust is disclaiming any rights he has in the trust.

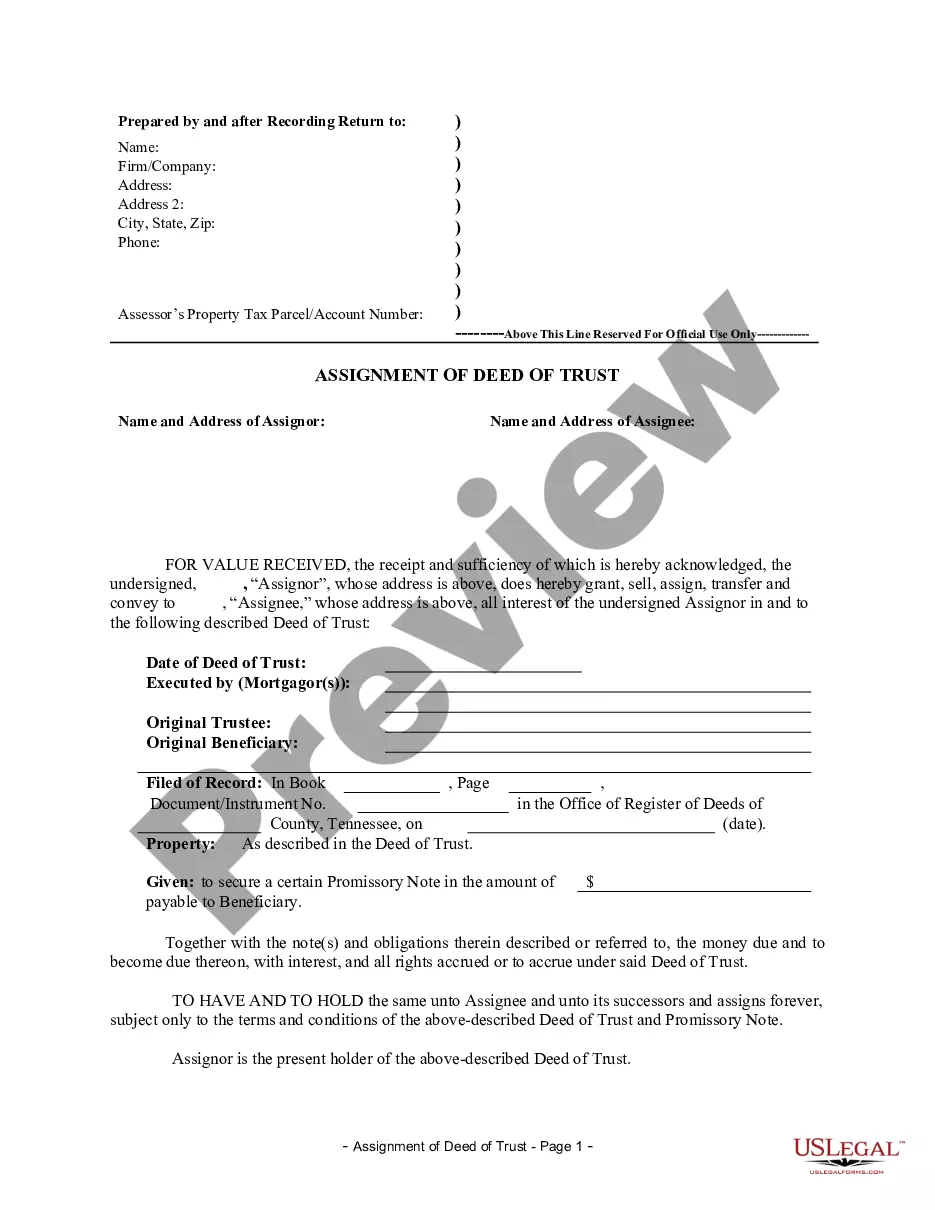

South Carolina Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee refers to a legally binding document in South Carolina where a beneficiary of a trust disclaims or renounces their rights and interests in the assets held by the trust. This disclaimer is accepted by the trustee, who is responsible for managing and distributing the trust's assets. Keywords: South Carolina, Disclaimer by Beneficiary, Trust, Rights, Acceptance, Trustee. There are several types of South Carolina Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee: 1. South Carolina Partial Disclaimer by Beneficiary: In this type of disclaimer, the beneficiary disclaims a portion of their rights or interests in the trust assets. This allows the beneficiary to refuse the inheritance of specific assets or a share of the overall trust. 2. South Carolina Full Disclaimer by Beneficiary: In this type of disclaimer, the beneficiary completely disclaims all their rights and interests in the trust assets. The beneficiary does not receive any portion of the trust and effectively rejects the inheritance. 3. South Carolina Qualified Disclaimer by Beneficiary: This type of disclaimer is made with certain conditions or restrictions. It often requires the beneficiary to disclaim the assets within a specific timeframe or meet particular legal requirements. Regardless of the type of disclaimer, the acceptance of the disclaimer by the trustee is crucial. The trustee must acknowledge and accept the beneficiary's disclaimer, ensuring proper administration of the trust and distribution of assets to other beneficiaries. It's important to note that the process of disclaiming rights under a trust in South Carolina should comply with state laws, including the South Carolina Uniform Disclaimer of Property Interests Act. Seek legal advice or consult an attorney specializing in trust and estate matters to ensure compliance and accurate implementation of the disclaimer.South Carolina Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee refers to a legally binding document in South Carolina where a beneficiary of a trust disclaims or renounces their rights and interests in the assets held by the trust. This disclaimer is accepted by the trustee, who is responsible for managing and distributing the trust's assets. Keywords: South Carolina, Disclaimer by Beneficiary, Trust, Rights, Acceptance, Trustee. There are several types of South Carolina Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee: 1. South Carolina Partial Disclaimer by Beneficiary: In this type of disclaimer, the beneficiary disclaims a portion of their rights or interests in the trust assets. This allows the beneficiary to refuse the inheritance of specific assets or a share of the overall trust. 2. South Carolina Full Disclaimer by Beneficiary: In this type of disclaimer, the beneficiary completely disclaims all their rights and interests in the trust assets. The beneficiary does not receive any portion of the trust and effectively rejects the inheritance. 3. South Carolina Qualified Disclaimer by Beneficiary: This type of disclaimer is made with certain conditions or restrictions. It often requires the beneficiary to disclaim the assets within a specific timeframe or meet particular legal requirements. Regardless of the type of disclaimer, the acceptance of the disclaimer by the trustee is crucial. The trustee must acknowledge and accept the beneficiary's disclaimer, ensuring proper administration of the trust and distribution of assets to other beneficiaries. It's important to note that the process of disclaiming rights under a trust in South Carolina should comply with state laws, including the South Carolina Uniform Disclaimer of Property Interests Act. Seek legal advice or consult an attorney specializing in trust and estate matters to ensure compliance and accurate implementation of the disclaimer.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.