South Carolina Sample Letter for Tax Deeds

Description

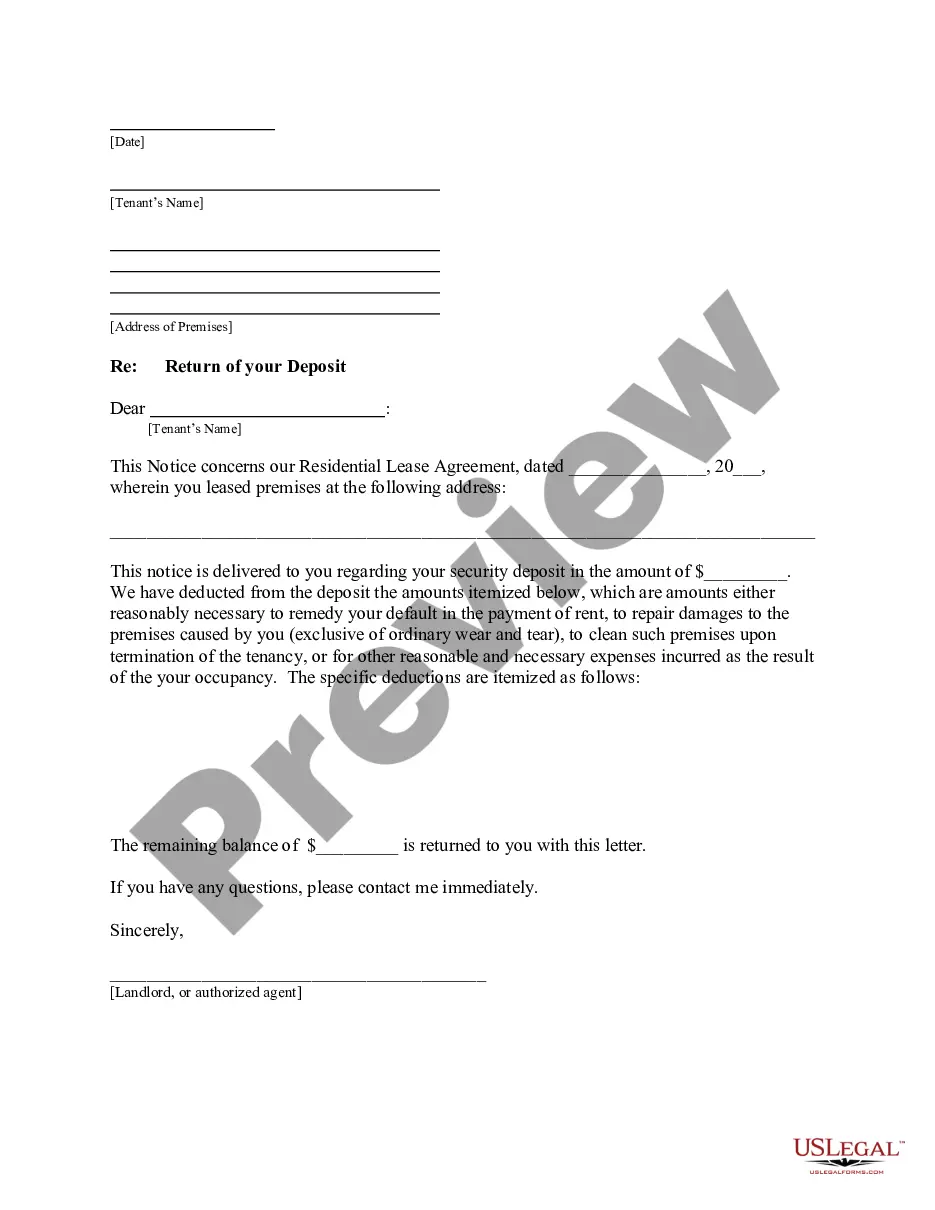

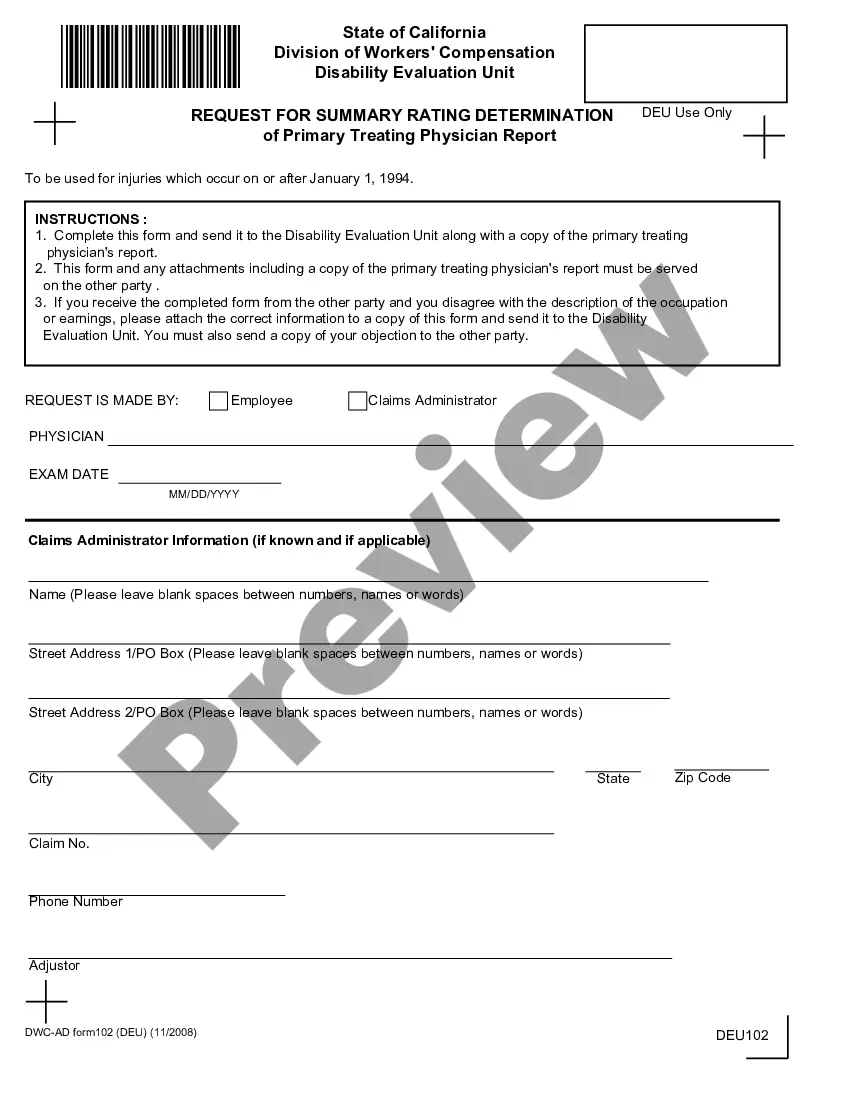

How to fill out Sample Letter For Tax Deeds?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a variety of legal document templates that you can obtain or print. By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the South Carolina Sample Letter for Tax Deeds in moments.

If you already have an account, Log In and retrieve the South Carolina Sample Letter for Tax Deeds from the US Legal Forms library. The Get button will be visible on every form you encounter. You can access all previously saved forms from the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple instructions to help you get started: Make sure you have selected the correct form for your city/state. Click the Review button to view the form’s content. Read the form description to confirm that you have chosen the right form. If the form does not meet your requirements, use the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your choice by clicking the Get now button. Next, choose the pricing plan you prefer and provide your details to create an account. Process the transaction. Use your credit card or PayPal account to complete the transaction. Select the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded South Carolina Sample Letter for Tax Deeds. Every template you added to your account has no expiration date and is yours permanently. So, if you want to download or print another copy, just navigate to the My documents section and click on the form you need.

- Access the South Carolina Sample Letter for Tax Deeds through US Legal Forms, one of the most extensive collections of legal document templates.

- Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

Form popularity

FAQ

Q: If I pay someone else's delinquent tax bill, does the property become mine? A: No, anyone can pay a tax bill unless it was sold in the tax sale. However, payment of someone else's tax bill does not give one claim to the property.

Unlike North Carolina, which is a tax deed state, South Carolina has enacted legislation requiring the counties to sell tax liens. South Carolina is a tax lien state. So to answer the question: is South Carolina a tax deed state? The answer is no.

We hope you enjoyed Ted's lesson, ?Is North Carolina a Tax Lien or Tax Deed State?? North Carolina is a tax deed state. The state confiscates property for unpaid property taxes and sells it to the highest bidder at a tax defaulted auction.

Redemption Period The defaulting taxpayer, any grantee from the owner, or any mortgage or judgment creditor may redeem each item of real estate within twelve months from the date of the delinquent tax sale.

As South Carolina is not a tax lien state, buyers purchase an interest in land, rather than a lien. Investors usually receive anywhere from 3% - 12% back in interest or receive the deed outright on the property.

How do I become a bidder in the Tax Sale? You must register as a bidder and pay your $10 registration fee in person or online beginning Monday, October 9, 2023. Registration will end on Monday, November 27, 2023. The sale is conducted in an open auction format.

Once a tax bill is delinquent, and execution notice is issued upon the property for which the tax bill is assessed. If the tax bill remains unpaid thirty days after the execution notice is mailed, a Notice of Seizure is issued upon the property.

Are state tax liens available for the public to view? Yes. Tax liens are a public notice of debt. Information about any state tax lien issued by the SCDOR is available to the public at any time at dor.sc.gov/LienRegistry.