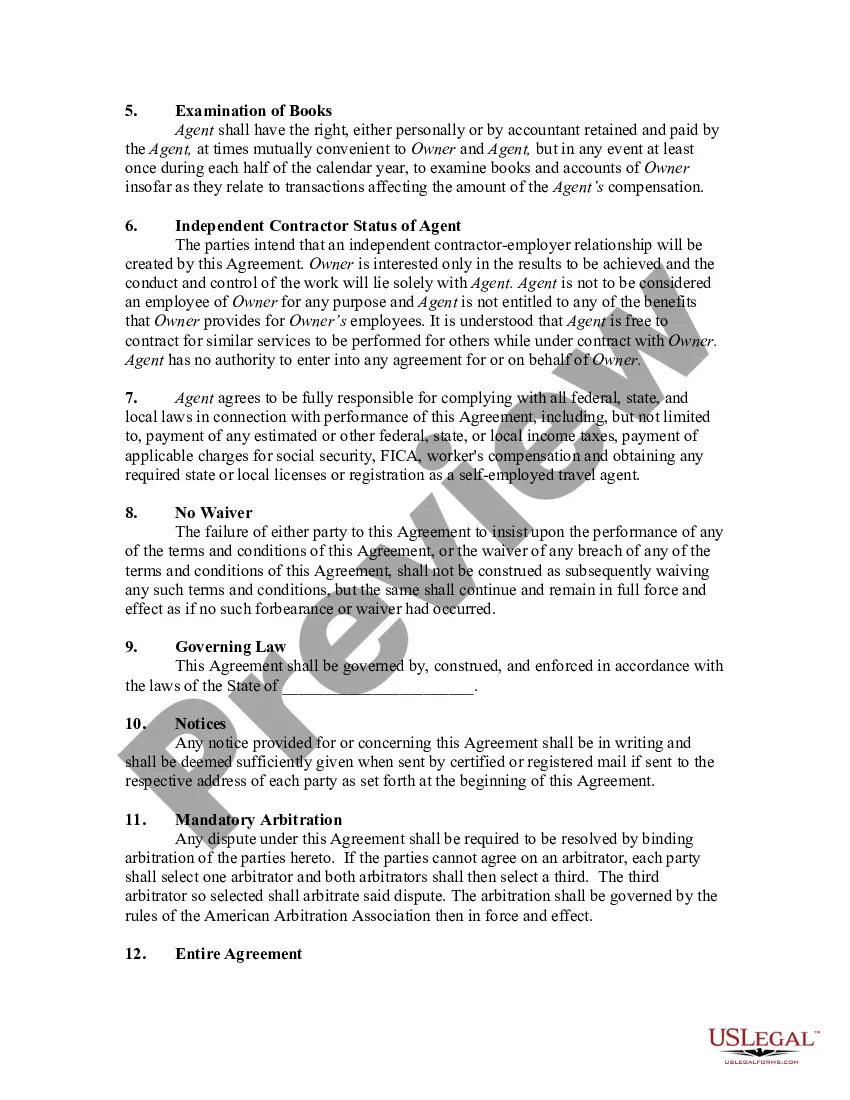

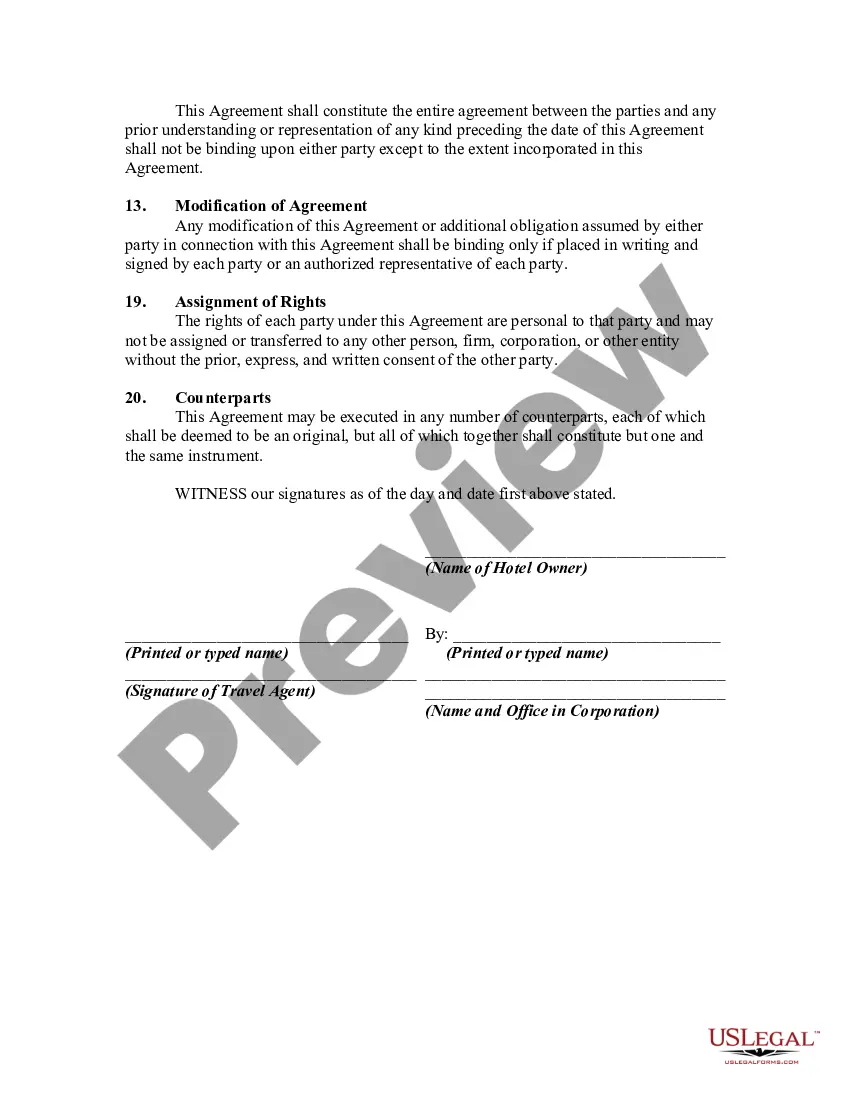

A travel agency is a business that sells travel related products and services, particularly package tours, to end-user customers on behalf of third party travel suppliers, such as airlines, hotels, tour companies, and cruise lines. This form agreement only deals with the sale of lodging to a particular hotel for a commission. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

South Carolina Agreement Between Travel Agent and Hotel Owner to Sell Lodging at Hotel in Return for a Commission

Description

How to fill out Agreement Between Travel Agent And Hotel Owner To Sell Lodging At Hotel In Return For A Commission?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal template documents that you can download or print.

By using the website, you will find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms, such as the South Carolina Agreement Between Travel Agent and Hotel Owner to Sell Accommodations at Hotel in Exchange for a Commission, in just seconds.

If you possess a subscription, Log In to access the South Carolina Agreement Between Travel Agent and Hotel Owner to Sell Accommodations at Hotel in Exchange for a Commission from the US Legal Forms library. The Download option will appear on every form you view. You have access to all previously downloaded forms within the My documents section of your account.

Proceed with the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded South Carolina Agreement Between Travel Agent and Hotel Owner to Sell Accommodations at Hotel in Exchange for a Commission. Each template you save in your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another version, just navigate to the My documents section and click on the form you need.

- Ensure you have selected the correct form for your region/area.

- Select the Preview option to review the form's content.

- Check the form details to confirm that you have chosen the right form.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you are happy with the form, confirm your choice by clicking on the Get Now button.

- Then, choose the payment plan you want and provide your credentials to register for an account.

Form popularity

FAQ

The hospitality tax in South Carolina can vary by locality, but it generally ranges from 1% to 3%. This tax is imposed on the sale of lodging and food and beverage services, supplementing the state's general tax revenue. For travel agents and hotel owners working together under a South Carolina Agreement Between Travel Agent and Hotel Owner to Sell Lodging at Hotel in Return for a Commission, understanding hospitality taxes will aid in setting competitive prices for services.

In South Carolina, certain items are tax-exempt, including most food purchased for home consumption and certain medical supplies. However, services related to hospitality, such as lodging, generally do not fall into this category. Knowing what is tax exempt is crucial for travel agents and hotel owners entering a South Carolina Agreement Between Travel Agent and Hotel Owner to Sell Lodging at Hotel in Return for a Commission.

The marketplace facilitator law in South Carolina requires online platforms to collect and remit sales tax on behalf of sellers using their services. This law enhances compliance and simplifies tax processes for businesses, including travel agents and hotel owners. When you create a South Carolina Agreement Between Travel Agent and Hotel Owner to Sell Lodging at Hotel in Return for a Commission, understanding this law can help both parties plan for tax responsibilities effectively.

In South Carolina, hotels do not become tax exempt after 30 days of operation. Instead, they are subject to sales tax, which applies to lodging services regardless of the duration. This is vital for travel agents and hotel owners entering a South Carolina Agreement Between Travel Agent and Hotel Owner to Sell Lodging at Hotel in Return for a Commission. It's essential to stay informed about local tax regulations to avoid unexpected liabilities.

As of now, New York is known for having the highest lodging tax in the United States. This high rate underscores the importance of thoroughly understanding travel agreements, such as the South Carolina Agreement Between Travel Agent and Hotel Owner to Sell Lodging at Hotel in Return for a Commission. If you're considering operating in various states, it's crucial to research local rates to prevent unexpected costs. This knowledge allows agents to provide accurate information to potential guests.

Calculating lodging tax involves applying the applicable tax rates to the total room rate before any additional fees. You can find specific rates in the South Carolina Agreement Between Travel Agent and Hotel Owner to Sell Lodging at Hotel in Return for a Commission. Typically, you multiply the room rate by the tax percentage. Ensure to include both state and local taxes to determine the final amount payable by guests.

Yes, travel agents can receive commissions or kickbacks from hotels for booking guests. These agreements often fall under a South Carolina Agreement Between Travel Agent and Hotel Owner to Sell Lodging at Hotel in Return for a Commission. Travel agents benefit financially while hotels gain more business through referrals. This reciprocity helps both parties thrive in the competitive travel industry.

Yes, travel agents often have access to exclusive deals on hotels due to their relationships with hotel owners. These deals may include discounted rates, complimentary upgrades, or added amenities that you may not find elsewhere. By utilizing the South Carolina Agreement Between Travel Agent and Hotel Owner to Sell Lodging at Hotel in Return for a Commission, agents can secure better offers for their clients. This means you can enjoy considerable savings and enhanced experiences during your travels.

The commission a travel agent takes can vary based on the South Carolina Agreement Between Travel Agent and Hotel Owner to Sell Lodging at Hotel in Return for a Commission. Typically, travel agents receive a percentage of the hotel stay, often ranging from 10% to 20%. This commission structure incentivizes agents to promote certain hotels, providing you with options that meet your travel needs. Always confirm the specific terms with your travel agent to understand the potential costs involved.