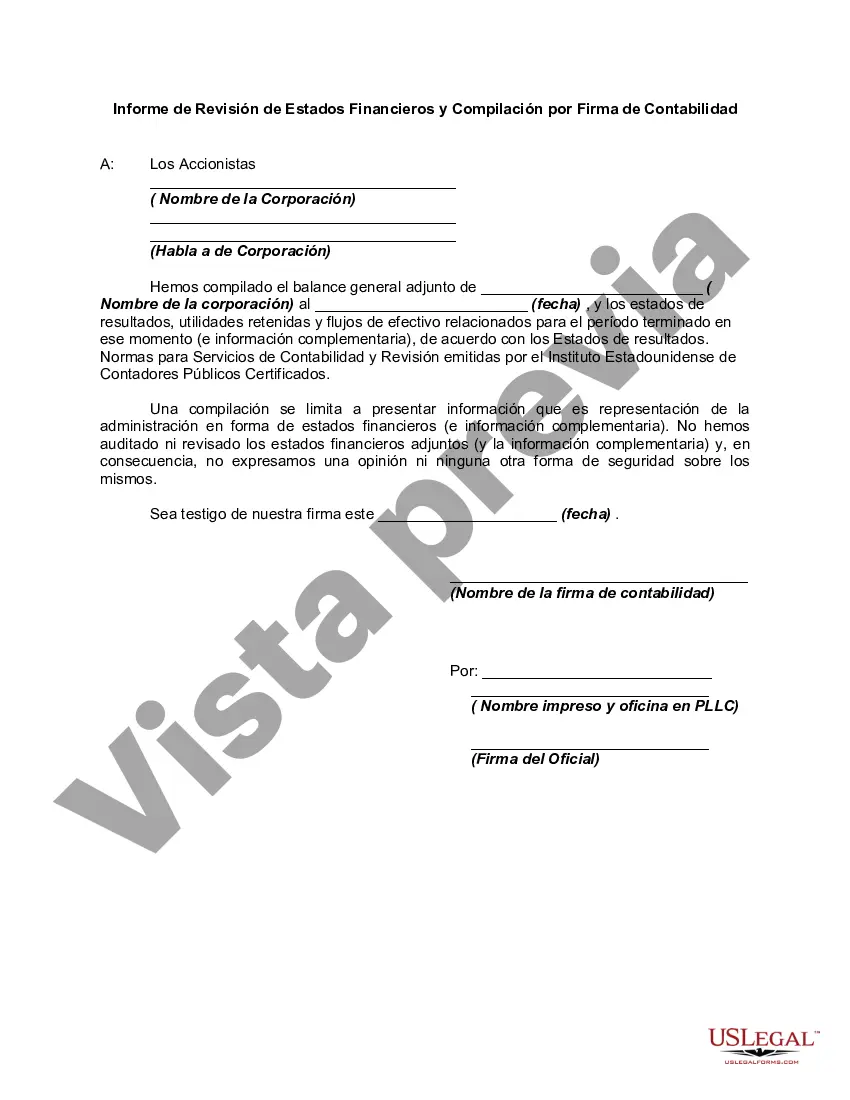

In a compilation engagement, the accountant presents in the form of financial statements information that is the representation of management (owners) without undertaking to express any assurance on the statements. In other words, using management's records, the accountant creates financial statements without gathering evidence or opining about the validity of those underlying records. Because compiled financial statements provide the reader no assurance regarding the statements, they represent the lowest level of financial statement service accountants can provide to their clients. Accordingly, standards governing compilation engagements require that financial statements presented by the accountant to the client or third parties must at least be compiled.

Title: A Comprehensive Overview of South Carolina Reports from Review of Financial Statements and Compilation by Accounting Firm Introduction: In the state of South Carolina, reports from the review of financial statements and compilation by accounting firms play a crucial role in providing accurate and reliable information about the financial performance and position of businesses, organizations, and government entities. These reports, prepared by certified public accountants (CPA's), assist stakeholders in making informed decisions, assessing the credibility of financial data, and ensuring compliance with relevant regulations. This article aims to shed light on different types of South Carolina reports from a review of financial statements and compilation by accounting firms, highlighting their key features, benefits, and how they contribute to overall financial transparency. 1. South Carolina Review Report: The South Carolina Review Report is a type of report generated by accounting firms after conducting a detailed analysis of a company's financial statements. This report primarily focuses on assessing financial information for accuracy and consistency. It evaluates the conformity of these statements with Generally Accepted Accounting Principles (GAAP) or other applicable reporting standards. The South Carolina Review Report provides limited assurance to stakeholders about the accuracy and reliability of financial statements, deepening their confidence in the reported financial data. 2. South Carolina Compilation Report: In addition to the review report, accounting firms in South Carolina also generate Compilation Reports. These reports involve the preparation of financial statements by the accounting firm based on information provided by management, without performing verification or analysis of the data's accuracy. While no assurance is provided on the accuracy of the compiled financial statements, it is crucial in facilitating presentation of financial information in an appropriate format that conforms to GAAP or other applicable reporting frameworks. 3. Differences between Review and Compilation Reports: It is important to distinguish between the South Carolina Review Report and Compilation Report. The key difference lies in the level of assurance provided by the accounting firm. Review Reports offer limited assurance, indicating the statements are plausible, without any material misstatements, while Compilation Reports provide no assurance. Both reports have their distinct purposes, serving different needs of stakeholders. 4. Importance and Benefits of South Carolina Reports: South Carolina reports from review of financial statements and compilation by accounting firms hold several key benefits, including: a. Enhancing credibility: These reports instill trust and credibility in the reported financial data, providing external validation of accuracy and adherence to standard accounting principles. b. Facilitating decision-making: Investors, lenders, and other stakeholders rely on these reports to make well-informed decisions regarding investments, loans, or partnerships, as the reports help assess financial stability and performance. c. Ensuring compliance: The reports aid in ensuring compliance with state and federal regulatory requirements by highlighting any discrepancies or potential issues found during the review or compilation process. d. Detecting fraud or errors: By scrutinizing financial statements, accountants can identify irregularities, misstatements, or potential fraudulent activities, thus reducing the risk of financial misrepresentation. Conclusion: South Carolina reports from the review of financial statements and compilation by accounting firms are crucial tools in fostering financial transparency, credibility, and compliance. These reports provide stakeholders with a thorough understanding of an entity's financial position, aid in decision-making, and contribute to the overall stability and integrity of South Carolina's financial ecosystem.Title: A Comprehensive Overview of South Carolina Reports from Review of Financial Statements and Compilation by Accounting Firm Introduction: In the state of South Carolina, reports from the review of financial statements and compilation by accounting firms play a crucial role in providing accurate and reliable information about the financial performance and position of businesses, organizations, and government entities. These reports, prepared by certified public accountants (CPA's), assist stakeholders in making informed decisions, assessing the credibility of financial data, and ensuring compliance with relevant regulations. This article aims to shed light on different types of South Carolina reports from a review of financial statements and compilation by accounting firms, highlighting their key features, benefits, and how they contribute to overall financial transparency. 1. South Carolina Review Report: The South Carolina Review Report is a type of report generated by accounting firms after conducting a detailed analysis of a company's financial statements. This report primarily focuses on assessing financial information for accuracy and consistency. It evaluates the conformity of these statements with Generally Accepted Accounting Principles (GAAP) or other applicable reporting standards. The South Carolina Review Report provides limited assurance to stakeholders about the accuracy and reliability of financial statements, deepening their confidence in the reported financial data. 2. South Carolina Compilation Report: In addition to the review report, accounting firms in South Carolina also generate Compilation Reports. These reports involve the preparation of financial statements by the accounting firm based on information provided by management, without performing verification or analysis of the data's accuracy. While no assurance is provided on the accuracy of the compiled financial statements, it is crucial in facilitating presentation of financial information in an appropriate format that conforms to GAAP or other applicable reporting frameworks. 3. Differences between Review and Compilation Reports: It is important to distinguish between the South Carolina Review Report and Compilation Report. The key difference lies in the level of assurance provided by the accounting firm. Review Reports offer limited assurance, indicating the statements are plausible, without any material misstatements, while Compilation Reports provide no assurance. Both reports have their distinct purposes, serving different needs of stakeholders. 4. Importance and Benefits of South Carolina Reports: South Carolina reports from review of financial statements and compilation by accounting firms hold several key benefits, including: a. Enhancing credibility: These reports instill trust and credibility in the reported financial data, providing external validation of accuracy and adherence to standard accounting principles. b. Facilitating decision-making: Investors, lenders, and other stakeholders rely on these reports to make well-informed decisions regarding investments, loans, or partnerships, as the reports help assess financial stability and performance. c. Ensuring compliance: The reports aid in ensuring compliance with state and federal regulatory requirements by highlighting any discrepancies or potential issues found during the review or compilation process. d. Detecting fraud or errors: By scrutinizing financial statements, accountants can identify irregularities, misstatements, or potential fraudulent activities, thus reducing the risk of financial misrepresentation. Conclusion: South Carolina reports from the review of financial statements and compilation by accounting firms are crucial tools in fostering financial transparency, credibility, and compliance. These reports provide stakeholders with a thorough understanding of an entity's financial position, aid in decision-making, and contribute to the overall stability and integrity of South Carolina's financial ecosystem.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.