This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The South Carolina General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a legal document that outlines the terms and conditions of a business sale between a sole proprietor and a buyer. This agreement is specific to South Carolina and is used when the sole proprietor of a business wants to sell its assets to a buyer. Keywords: South Carolina, General Form of Agreement, Sale of Business, Sole Proprietor, Asset Purchase Agreement. There are several types of South Carolina General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreements, including: 1. Basic Asset Purchase Agreement: This agreement covers the essential terms of the sale, such as the purchase price, payment terms, and a list of assets being sold. It also includes provisions for the transfer of ownership and any warranties or representations made by the seller. 2. Confidentiality Agreement: This type of agreement is used to protect the confidential information disclosed during the negotiation and due diligence process. It ensures that the buyer will keep all information confidential and not use it for any purpose other than evaluating the potential purchase. 3. Non-Compete Agreement: This agreement prohibits the seller (sole proprietor) from starting or running a similar business in a specific geographic area for a certain period of time after the sale. It protects the buyer from competition and ensures that the seller does not negatively impact the business's value. 4. Promissory Note: In some cases, the buyer may pay the purchase price in installments over a specified period. A promissory note is a legal document that outlines the terms of these payments, including the amount, interest rate, and repayment schedule. 5. Bill of Sale: This document is used to transfer the ownership of specific assets from the seller to the buyer. It includes a detailed description of the assets being sold, their condition, and any warranties or liabilities associated with them. These are just a few examples of the different types of South Carolina General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreements. The specific terms and clauses included in the agreement can vary depending on the nature of the business and the preferences of the parties involved. It is essential to consult with a qualified attorney to ensure that the agreement meets all legal requirements and adequately protects the interests of both the buyer and seller.The South Carolina General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a legal document that outlines the terms and conditions of a business sale between a sole proprietor and a buyer. This agreement is specific to South Carolina and is used when the sole proprietor of a business wants to sell its assets to a buyer. Keywords: South Carolina, General Form of Agreement, Sale of Business, Sole Proprietor, Asset Purchase Agreement. There are several types of South Carolina General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreements, including: 1. Basic Asset Purchase Agreement: This agreement covers the essential terms of the sale, such as the purchase price, payment terms, and a list of assets being sold. It also includes provisions for the transfer of ownership and any warranties or representations made by the seller. 2. Confidentiality Agreement: This type of agreement is used to protect the confidential information disclosed during the negotiation and due diligence process. It ensures that the buyer will keep all information confidential and not use it for any purpose other than evaluating the potential purchase. 3. Non-Compete Agreement: This agreement prohibits the seller (sole proprietor) from starting or running a similar business in a specific geographic area for a certain period of time after the sale. It protects the buyer from competition and ensures that the seller does not negatively impact the business's value. 4. Promissory Note: In some cases, the buyer may pay the purchase price in installments over a specified period. A promissory note is a legal document that outlines the terms of these payments, including the amount, interest rate, and repayment schedule. 5. Bill of Sale: This document is used to transfer the ownership of specific assets from the seller to the buyer. It includes a detailed description of the assets being sold, their condition, and any warranties or liabilities associated with them. These are just a few examples of the different types of South Carolina General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreements. The specific terms and clauses included in the agreement can vary depending on the nature of the business and the preferences of the parties involved. It is essential to consult with a qualified attorney to ensure that the agreement meets all legal requirements and adequately protects the interests of both the buyer and seller.

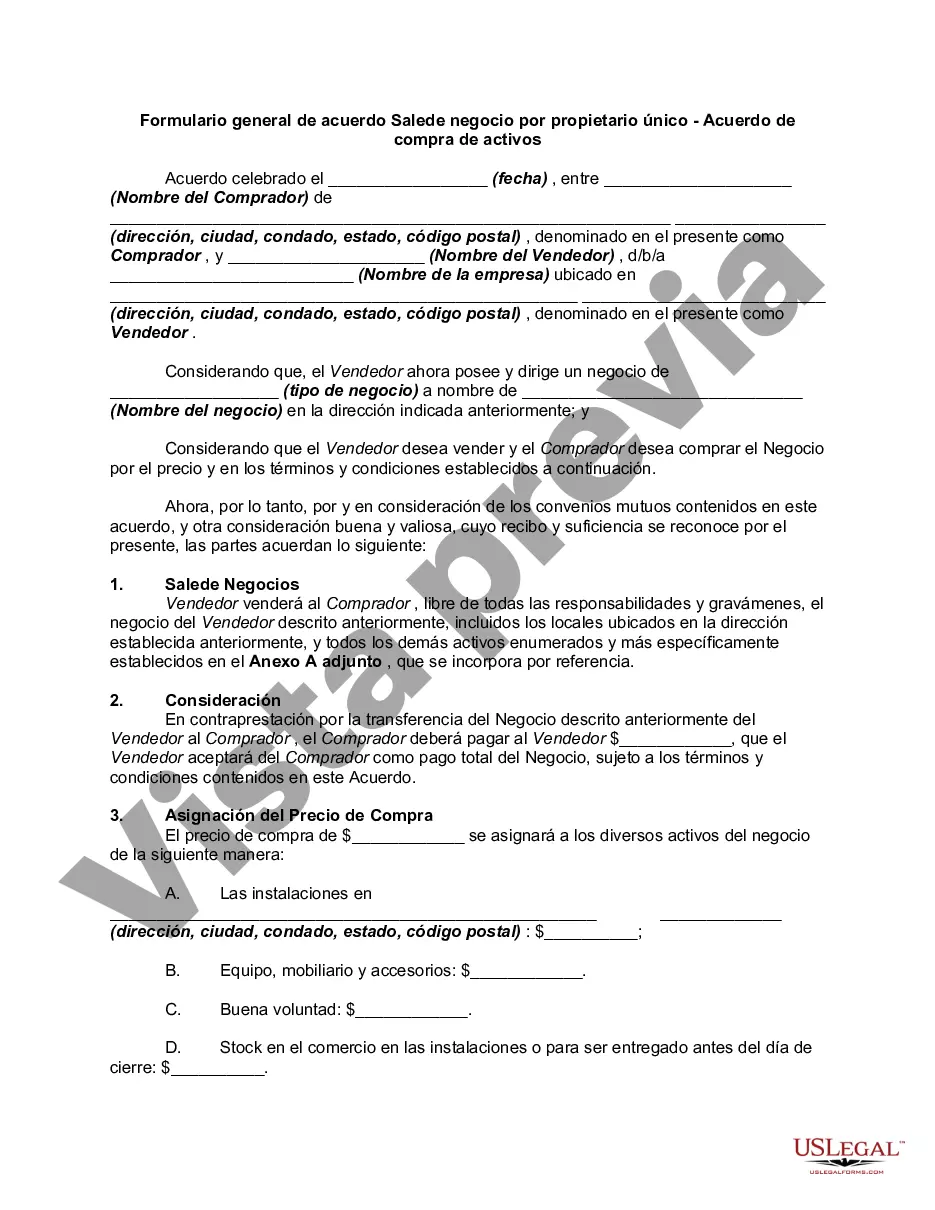

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.