A South Carolina Simple Promissory Note for Tuition Fee is a legally binding document outlining the terms and conditions agreed upon by both parties involved in a tuition fee loan transaction. This promissory note provides a detailed description of the borrower's obligation to repay the borrowed amount to the lender, along with any applicable interest and fees. The South Carolina Simple Promissory Note for Tuition Fee starts with the identification of the borrower and lender, including their names and contact information. It also mentions the loan amount and specifies the purpose of the loan, which in this case, is specifically for tuition fees. The note further outlines the repayment terms, including the principal amount borrowed, the interest rate (if any), the repayment schedule, and any late fees or penalties for non-payment. It is essential to mention the due date for the first payment as well as subsequent installment dates. Additionally, the South Carolina Simple Promissory Note for Tuition Fee may include provisions regarding the use of loan proceeds exclusively for tuition fees. This ensures that the borrowed amount is used solely for educational purposes. Different types or variations of South Carolina Simple Promissory Notes for Tuition Fee may include: 1. Fixed Interest Rate Promissory Note: This type of promissory note specifies a fixed interest rate that remains consistent throughout the loan term. The borrower knows the exact amount of interest they will need to pay over the repayment period. 2. Variable Interest Rate Promissory Note: In this scenario, the interest rate is subject to fluctuations based on market conditions or a specified index. The borrower's repayment amount may vary depending on the changes in the interest rate. 3. Secured Promissory Note: This type of promissory note includes collateral to secure the loan. If the borrower fails to repay the loan, the lender has the right to claim the collateral as repayment. 4. Unsecured Promissory Note: An unsecured promissory note is not backed by any collateral. The loan is solely based on the borrower's promise to repay, and if they fail to do so, the lender may need to pursue legal actions for repayment. 5. Acceleration Clause Promissory Note: This type of note includes a provision that allows the lender to accelerate the entire loan balance if the borrower fails to make timely payments or breaches the terms of the note. 6. Installment Promissory Note: This note outlines a fixed repayment plan where the borrower agrees to repay the loan in a series of installment payments over a specified period. 7. Balloon Promissory Note: A balloon note includes smaller regular payments for a certain period, but a large final payment (balloon payment) due at the end of the term. When utilizing a South Carolina Simple Promissory Note for Tuition Fee, it is highly recommended seeking legal advice to ensure compliance with applicable state laws and regulations.

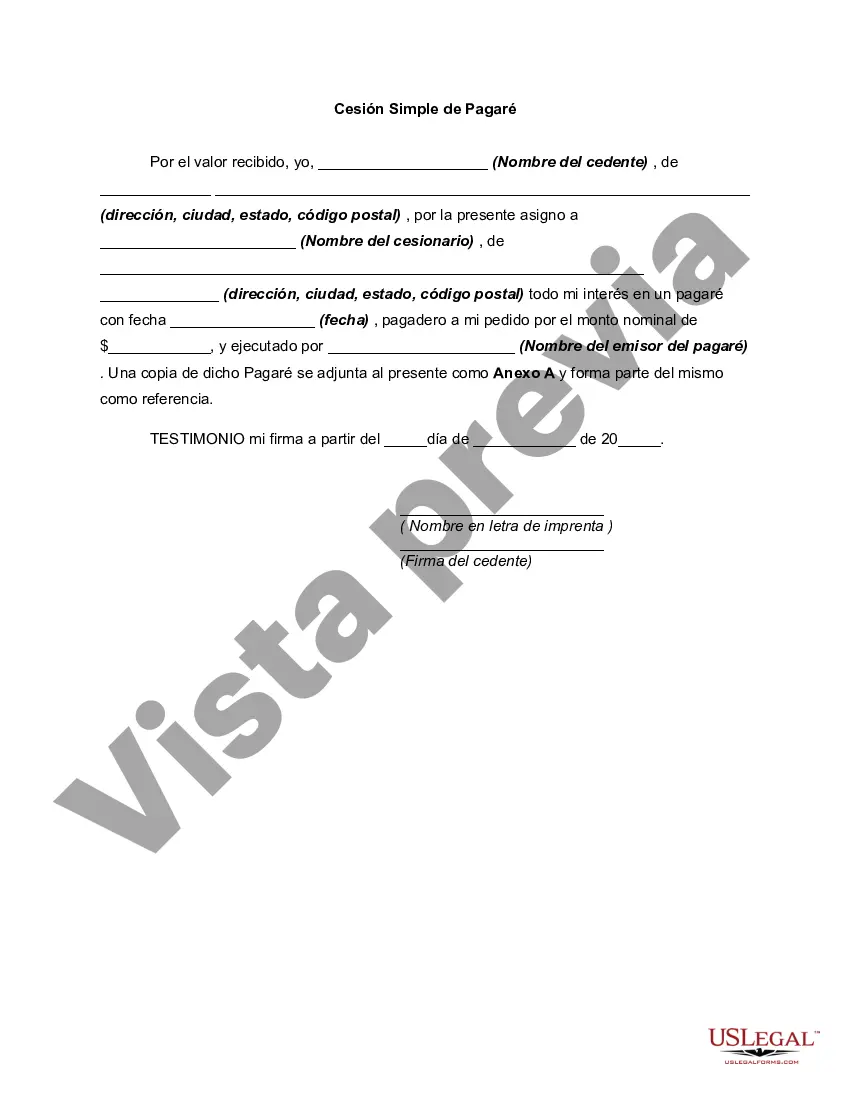

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.South Carolina Pagaré simple de matrícula - Simple Promissory Note for Tutition Fee

Description

How to fill out South Carolina Pagaré Simple De Matrícula?

Have you been in a placement that you require paperwork for both business or personal reasons virtually every day time? There are a variety of legal document themes available on the Internet, but discovering versions you can rely isn`t easy. US Legal Forms provides a huge number of develop themes, just like the South Carolina Simple Promissory Note for Tutition Fee, which can be created to meet state and federal specifications.

When you are presently informed about US Legal Forms website and get an account, merely log in. Following that, you may acquire the South Carolina Simple Promissory Note for Tutition Fee web template.

Unless you offer an profile and want to begin using US Legal Forms, follow these steps:

- Discover the develop you want and make sure it is for your proper area/county.

- Utilize the Preview key to examine the shape.

- Look at the outline to ensure that you have chosen the appropriate develop.

- When the develop isn`t what you`re seeking, take advantage of the Research field to discover the develop that suits you and specifications.

- When you obtain the proper develop, simply click Get now.

- Pick the pricing plan you need, fill in the necessary info to produce your bank account, and pay for the transaction making use of your PayPal or Visa or Mastercard.

- Choose a practical data file formatting and acquire your duplicate.

Find all of the document themes you might have bought in the My Forms menu. You can get a further duplicate of South Carolina Simple Promissory Note for Tutition Fee whenever, if possible. Just go through the essential develop to acquire or printing the document web template.

Use US Legal Forms, by far the most considerable assortment of legal kinds, to conserve time and stay away from mistakes. The services provides professionally made legal document themes that you can use for a variety of reasons. Create an account on US Legal Forms and initiate creating your life a little easier.