The South Carolina Settlement Agreement Regarding Property Damages due to an Automobile Accident is a legal document that outlines the terms and conditions of resolving property damages resulting from a car crash in the state of South Carolina. This agreement is designed to protect the rights and interests of all parties involved and ensure fair compensation for any property damage sustained. Keywords: South Carolina, settlement agreement, property damages, automobile accident, legal document, terms and conditions, resolving, car crash, rights, interests, fair compensation, sustained. There may be different types of South Carolina Settlement Agreements Regarding Property Damages due to an Automobile Accident, depending on the specific circumstances and factors involved. These types can include: 1. Liability agreement: This settlement agreement determines the responsibility for the property damages resulting from the accident and outlines the compensation amount to be paid by the at-fault party. 2. Uninsured/under insured motorist agreement: In cases where the at-fault party is uninsured or does not have sufficient insurance coverage, this type of agreement ensures that the injured party receives compensation for the property damages through their own insurance policy. 3. Property damage only agreement: Sometimes, automobile accidents result only in property damage without any bodily injuries. This type of agreement focuses solely on addressing and resolving the property damage aspect of the case. 4. Total loss agreement: When a vehicle involved in an accident is deemed a total loss due to extensive damages, this agreement determines the value of the vehicle and the compensation the owner should receive. 5. Subrogation agreement: If an insurance company pays for property damages on behalf of their insured client after an accident caused by another party's negligence, this agreement enables the insurer to seek reimbursement from the at-fault party through legal means. Each type of South Carolina Settlement Agreement Regarding Property Damages due to an Automobile Accident serves a unique purpose and aims to provide the necessary resolution for the parties involved. It is essential to understand the specific terms and conditions outlined in the agreement before signing to ensure fair and just compensation for the property damages sustained.

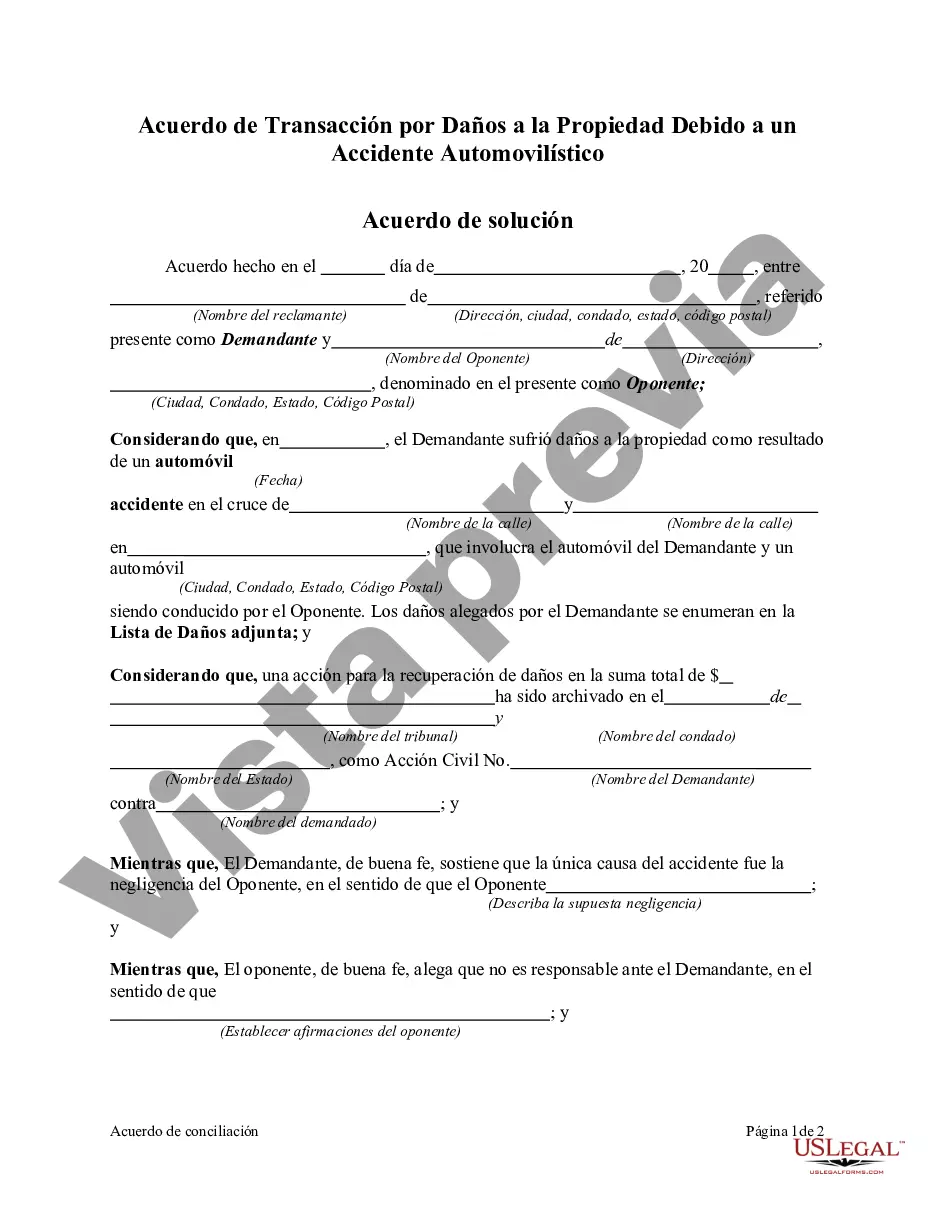

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.South Carolina Acuerdo de conciliación sobre daños a la propiedad debido a un accidente automovilístico - Settlement Agreement Regarding Property Damages due to an Automobile Accident

Description

How to fill out South Carolina Acuerdo De Conciliación Sobre Daños A La Propiedad Debido A Un Accidente Automovilístico?

It is possible to commit several hours on the web looking for the legal papers template which fits the state and federal needs you need. US Legal Forms provides 1000s of legal varieties that happen to be reviewed by professionals. It is possible to acquire or produce the South Carolina Settlement Agreement Regarding Property Damages due to an Automobile Accident from our support.

If you already possess a US Legal Forms profile, you are able to log in and click the Down load switch. Following that, you are able to full, modify, produce, or indication the South Carolina Settlement Agreement Regarding Property Damages due to an Automobile Accident. Each and every legal papers template you buy is your own property forever. To obtain an additional copy associated with a purchased type, go to the My Forms tab and click the corresponding switch.

If you work with the US Legal Forms site initially, adhere to the simple recommendations listed below:

- Very first, make sure that you have chosen the proper papers template to the area/city of your choice. Look at the type explanation to make sure you have chosen the correct type. If readily available, take advantage of the Preview switch to appear throughout the papers template also.

- If you would like get an additional version of the type, take advantage of the Search industry to obtain the template that fits your needs and needs.

- Upon having found the template you would like, click on Get now to carry on.

- Choose the pricing strategy you would like, type in your references, and register for a free account on US Legal Forms.

- Full the transaction. You may use your credit card or PayPal profile to purchase the legal type.

- Choose the format of the papers and acquire it to the product.

- Make modifications to the papers if necessary. It is possible to full, modify and indication and produce South Carolina Settlement Agreement Regarding Property Damages due to an Automobile Accident.

Down load and produce 1000s of papers themes making use of the US Legal Forms site, that provides the greatest collection of legal varieties. Use skilled and condition-particular themes to deal with your company or individual demands.