South Carolina Agreement to Compromise Debt by Returning Secured Property is a legally binding document that outlines an agreement between a debtor and a creditor regarding the settlement of a debt. This agreement allows the debtor to return the secured property to the creditor as a means of satisfying the outstanding debt. In South Carolina, there are two common types of Agreement to Compromise Debt by Returning Secured Property: 1. Voluntary Agreement: This type of agreement is entered into willingly by both parties involved. The debtor voluntarily agrees to return the secured property in order to settle their debt, and the creditor accepts the property as full or partial satisfaction of the outstanding amount owed. 2. Court-Ordered Agreement: In certain circumstances, a court may intervene and order an Agreement to Compromise Debt by Returning Secured Property. This typically occurs when there is a dispute between the debtor and creditor, and the court deems it necessary to determine a fair resolution. The court may require the debtor to return the secured property to the creditor as a means of settling the debt based on the specific circumstances of the case. The South Carolina Agreement to Compromise Debt by Returning Secured Property includes several key elements. First, it identifies the parties involved, including the debtor and the creditor, along with their contact information and relevant legal entities. The agreement also outlines the details of the debt, including the amount owed, the date of the debt, and any interest or fees associated with it. Additionally, the agreement specifies the secured property or properties that will be returned by the debtor to the creditor. This may include items such as vehicles, real estate, or other valuable assets that were used as collateral for the debt. The condition of the property and any additional documents required for the transfer are also stated. Furthermore, the agreement clearly states the terms of the compromise, including the agreed-upon value of the secured property and how it will be applied towards the outstanding debt. It may specify whether the property will be accepted as full satisfaction or partial satisfaction of the debt. The agreement should also include provisions detailing the consequences if either party fails to comply with the terms, such as potential legal actions or additional penalties. Overall, the South Carolina Agreement to Compromise Debt by Returning Secured Property serves as a legally enforceable contract, ensuring that both the debtor and creditor understand and accept the terms of the settlement. It provides a means for resolving debts while allowing debtors to return secured property to satisfy their obligations and creditors to recoup their losses.

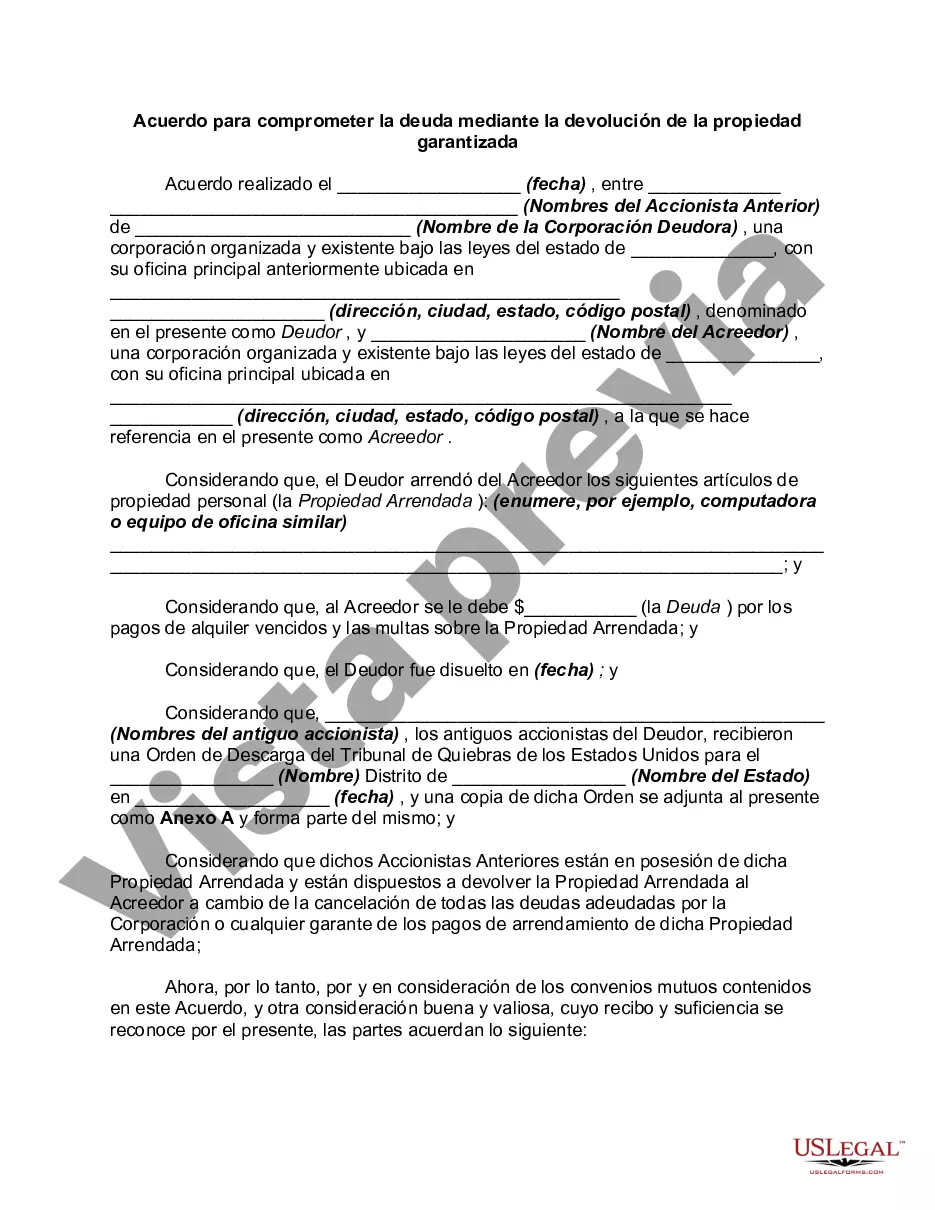

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.South Carolina Acuerdo para comprometer la deuda mediante la devolución de la propiedad garantizada - Agreement to Compromise Debt by Returning Secured Property

Description

How to fill out South Carolina Acuerdo Para Comprometer La Deuda Mediante La Devolución De La Propiedad Garantizada?

If you need to full, acquire, or print out lawful record themes, use US Legal Forms, the biggest collection of lawful kinds, which can be found on-line. Take advantage of the site`s simple and hassle-free look for to obtain the files you will need. Different themes for enterprise and personal uses are sorted by classes and says, or search phrases. Use US Legal Forms to obtain the South Carolina Agreement to Compromise Debt by Returning Secured Property within a few mouse clicks.

Should you be already a US Legal Forms customer, log in to your accounts and click the Acquire button to get the South Carolina Agreement to Compromise Debt by Returning Secured Property. You can even entry kinds you earlier saved in the My Forms tab of the accounts.

If you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the form for that right city/nation.

- Step 2. Take advantage of the Review solution to examine the form`s content. Do not forget about to see the outline.

- Step 3. Should you be not satisfied with the type, utilize the Research industry near the top of the screen to find other types of your lawful type format.

- Step 4. Upon having found the form you will need, click on the Purchase now button. Select the prices strategy you choose and add your references to sign up to have an accounts.

- Step 5. Method the purchase. You may use your credit card or PayPal accounts to accomplish the purchase.

- Step 6. Select the file format of your lawful type and acquire it on your product.

- Step 7. Total, edit and print out or sign the South Carolina Agreement to Compromise Debt by Returning Secured Property.

Every single lawful record format you purchase is yours permanently. You may have acces to every type you saved within your acccount. Select the My Forms section and choose a type to print out or acquire once more.

Remain competitive and acquire, and print out the South Carolina Agreement to Compromise Debt by Returning Secured Property with US Legal Forms. There are many expert and condition-particular kinds you can utilize for your personal enterprise or personal demands.

Form popularity

FAQ

In South Carolina, debt collectors can typically pursue old debts for up to three years after the last payment was made. After this period, the debt may be considered time-barred, meaning that collectors cannot take legal action to recover it. However, the South Carolina Agreement to Compromise Debt by Returning Secured Property can help you navigate this process effectively. Consulting experts on the uslegalforms platform can also provide further guidance on managing old debts.

When communicating with creditors, start by acknowledging the debt and your intent to settle it. Mention the South Carolina Agreement to Compromise Debt by Returning Secured Property as a potential resolution that may work for both parties. Make sure to express your willingness to negotiate and find a mutually beneficial solution. Clear and honest communication is key to reaching a settlement.

When attempting to settle debt, it's important to express your desire to resolve the matter amicably. Clearly explain your financial situation and mention the South Carolina Agreement to Compromise Debt by Returning Secured Property as a potential solution. Use respectful language and be open to negotiation. This approach can foster goodwill and increase the chance of reaching an agreement.

Typically, it is advisable to offer between 40% to 60% of the total debt for settlement. However, the right percentage can depend on your specific financial situation and the creditor's willingness to negotiate. When approaching the creditor, mentioning the South Carolina Agreement to Compromise Debt by Returning Secured Property can frame your offer positively. Be prepared to negotiate, as each case may differ.

When creating a debt settlement agreement, begin with the date and relevant parties involved. Clearly describe the terms of the agreement, including the specifics of the South Carolina Agreement to Compromise Debt by Returning Secured Property, if relevant. Incorporate payment terms and any agreed-upon deadlines. Having this document in writing ensures that both you and the creditor are on the same page and can prevent future disputes.

To write a settlement proposal, start by clearly stating your intention to resolve the debt. Outline the terms you are offering, specifically mentioning the South Carolina Agreement to Compromise Debt by Returning Secured Property if applicable. Make sure to include your contact information and express a willingness to discuss the terms further. A well-structured proposal can help facilitate negotiations with your creditor.

A levy on wages in South Carolina allows a creditor to take a portion of your paycheck to satisfy a debt. This process usually follows a court judgment and must comply with specific legal guidelines. If you are facing wage levies, exploring options like the South Carolina Agreement to Compromise Debt by Returning Secured Property could be beneficial to regain control of your financial situation.

In South Carolina, medical debt has a collection period of three years, similar to other unsecured debts. After this period, creditors can no longer pursue legal action to collect the debt. By using the South Carolina Agreement to Compromise Debt by Returning Secured Property, you could find a resolution that may ease your financial burden while protecting your rights regarding medical debt.

Creditors may be able to take your home in South Carolina if they obtain a judgment against you. They can enforce this judgment through a court order, potentially leading to foreclosure. It is critical to understand options such as the South Carolina Agreement to Compromise Debt by Returning Secured Property, which can help protect your assets and provide a way out of debt.

In South Carolina, a debt typically becomes uncollectible after three years due to the statute of limitations. However, this timeline can vary depending on the type of debt. If you face difficulties with debts, such as those covered by the South Carolina Agreement to Compromise Debt by Returning Secured Property, knowing your rights can help you manage your financial situation effectively.