The purpose of this form is to show creditors the dire financial situation that the debtor is in so as to induce the creditors to compromise or write off the debt due.

South Carolina Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due - Assets and Liabilities

Description

How to fill out Debtor's Affidavit Of Financial Status To Induce Creditor To Compromise Or Write Off The Debt Which Is Past Due - Assets And Liabilities?

Finding the correct legal document template can be a challenge.

Certainly, there are numerous templates available online, but how do you locate the legal form you require.

Utilize the US Legal Forms website. This service offers a multitude of templates, such as the South Carolina Debtor's Affidavit of Financial Status to Encourage Creditor to Settle or Write off the Overdue Debt - Assets and Liabilities, suitable for both business and personal purposes.

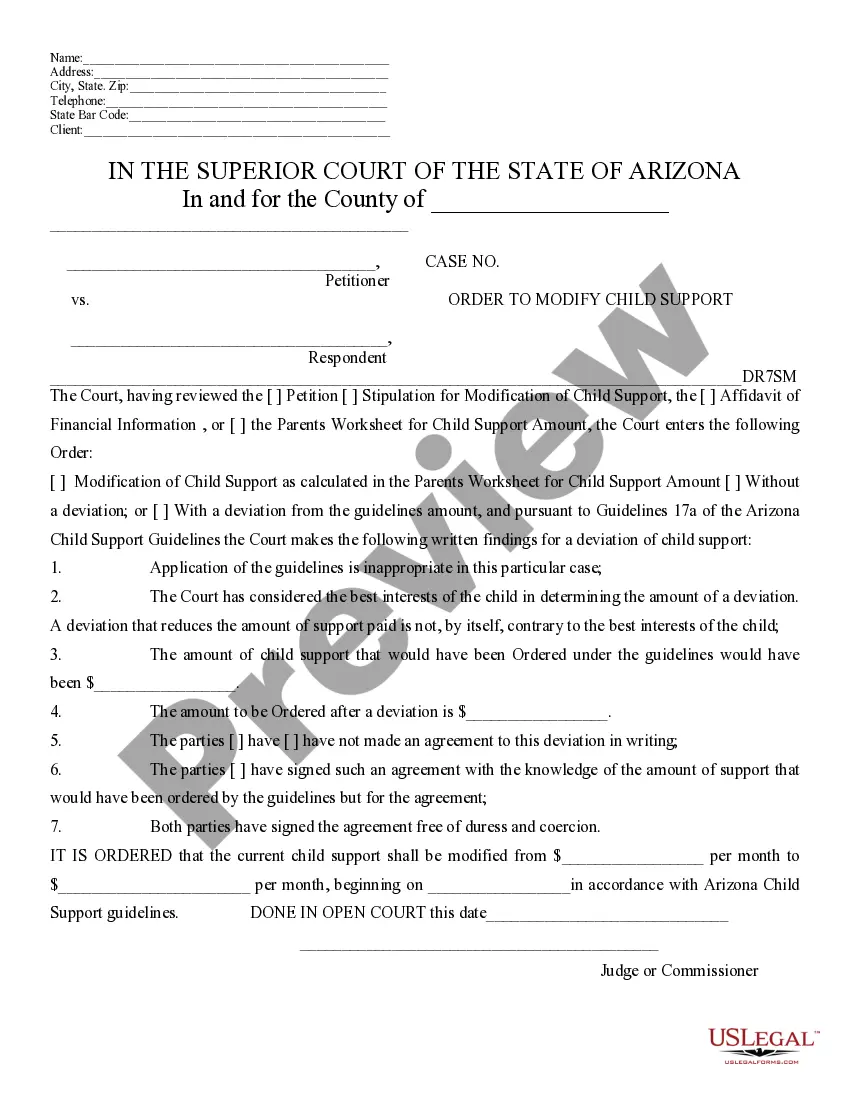

First, ensure you have selected the appropriate form for your city/area. You can preview the form using the Review button and read the form description to confirm this is indeed suitable for you.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, sign in to your account and click on the Download button to retrieve the South Carolina Debtor's Affidavit of Financial Status to Encourage Creditor to Settle or Write off the Overdue Debt - Assets and Liabilities.

- Use your account to search for the legal forms you may have previously ordered.

- Navigate to the My documents tab in your account and download another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

Form popularity

FAQ

Wages There is no wage garnishment in South Carolina for judgments on consumer debt. This means they cannot garnish your wages to pay a judgment on a consumer debt. Real Property (your house of land) If you have less than $59,100 in equity in your home then it is exempt from attachment, levy or sale.

If your debt isn't for your mortgage or another secured loan, your creditor can take legal action to stop you selling your home. This power is called inhibition and is used by a creditor to safeguard the value in your property.

A priority claim is debt that is entitled to special treatment in the bankruptcy process and will get paid ahead of non-priority claims. These might include bank lenders, employees, the government if any taxes are due, suppliers, and investors who have unsecured bonds.

Can the Judgment Creditor Take My Car? The short answer to the question, Can a judgment creditor take my car? is Maybe. Generally, creditors will only take a vehicle if your car has value. A car with value can be beneficial to a creditor, as they can sell it and use that money to pay off the debt you owe.

A judgment lien is created automatically on debtor property that's located in the South Carolina county where the judgment is entered. For debtor property in other South Carolina counties, the creditor files a transcript of the judgment with the clerk of the court of common pleas where the property is located.

What kind of property is subject to a judgment lien under South Carolina law? In every state, a judgment lien can be attached to the debtor's real estate -- meaning a house, condo, land, or similar kind of property interest.

The discharge releases the debtor from all debts provided for by the plan or disallowed (under section 502), with limited exceptions. Creditors provided for in full or in part under the chapter 13 plan may no longer initiate or continue any legal or other action against the debtor to collect the discharged obligations.

Wages There is no wage garnishment in South Carolina for judgments on consumer debt. This means they cannot garnish your wages to pay a judgment on a consumer debt. Real Property (your house of land) If you have less than $59,100 in equity in your home then it is exempt from attachment, levy or sale.

Wages There is no wage garnishment in South Carolina for judgments on consumer debt. This means they cannot garnish your wages to pay a judgment on a consumer debt. Real Property (your house of land) If you have less than $59,100 in equity in your home then it is exempt from attachment, levy or sale.