South Carolina Acceptance of Claim by Collection Agency and Report of Experience with Debtor is a legal process that involves the submission and acknowledgement of a debt claim by a collection agency in the state of South Carolina. This procedure is crucial for both the agency and the debtor as it outlines their rights and responsibilities regarding the debt in question. Here are some essential aspects to consider when dealing with the South Carolina Acceptance of Claim by Collection Agency and Report of Experience with Debtor: 1. Definition and Purpose: The South Carolina Acceptance of Claim by Collection Agency is a formal document in which the collection agency asserts its right to pursue a debt owed by a debtor residing in South Carolina. This claim acceptance acts as a foundation for legal proceedings and aims to establish a clear record of debt ownership and subsequent collection activities. 2. Types of South Carolina Acceptance of Claim by Collection Agency and Report of Experience with Debtor: a. Initial Claim Acceptance: This occurs when the collection agency first takes up a debt for collection, typically after it has been assigned or sold by the original creditor. The agency submits a detailed claim to the South Carolina debtor, providing information about the debt, outstanding balance, original creditor, and any relevant supporting documents. b. Acknowledgement of Receipt: Once the debtor receives the claim, they must acknowledge its receipt within a specified timeframe. This step is crucial as it ensures that both parties are aware of the debt's existence and have initiated communication regarding its resolution. c. Disputing the Claim: If the debtor contests the validity of the claim or believes there are inaccuracies, they can file a dispute with the collection agency. The agency is then responsible for investigating these disputes and providing a satisfactory response. d. Acceptance of Claim by Debtor: If the debtor acknowledges the claim's validity and agrees to the outstanding debt, they must formally accept the claim by notifying the collection agency. This acceptance may include agreeing to a payment plan or negotiating a settlement. 3. Reporting of Experience with Debtor: Throughout the debt collection process, the collection agency maintains a comprehensive report of its interactions and experiences with the debtor. This report can include details of communication attempts, payment arrangements, settlement negotiations, or legal actions taken. The report serves as a record of the agency's efforts to collect the debt and may be crucial in legal proceedings or further actions. In conclusion, the South Carolina Acceptance of Claim by Collection Agency and Report of Experience with Debtor is an essential component of the debt collection process in the state. It outlines the obligations of both the collection agency and the debtor, ensuring transparency and providing a record of communication and actions taken.

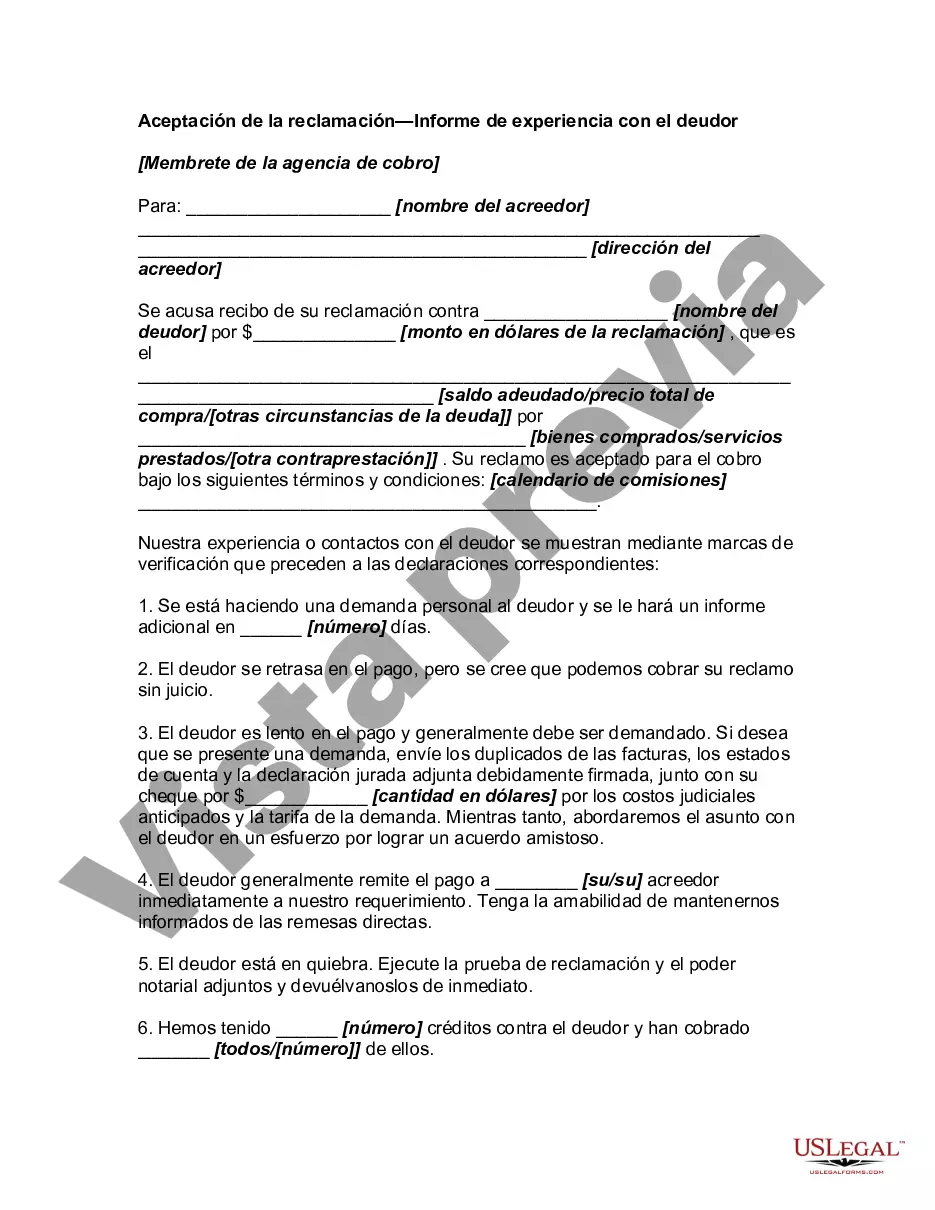

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.South Carolina Aceptación de Reclamo por Agencia de Cobranza e Informe de Experiencia con Deudor - Acceptance of Claim by Collection Agency and Report of Experience with Debtor

Description

How to fill out South Carolina Aceptación De Reclamo Por Agencia De Cobranza E Informe De Experiencia Con Deudor?

If you wish to total, acquire, or printing lawful file themes, use US Legal Forms, the largest selection of lawful forms, that can be found on the web. Make use of the site`s basic and convenient look for to discover the paperwork you will need. Various themes for enterprise and person reasons are sorted by categories and claims, or key phrases. Use US Legal Forms to discover the South Carolina Acceptance of Claim by Collection Agency and Report of Experience with Debtor with a few click throughs.

When you are previously a US Legal Forms consumer, log in to your profile and click the Acquire option to get the South Carolina Acceptance of Claim by Collection Agency and Report of Experience with Debtor. You can even accessibility forms you in the past acquired from the My Forms tab of your respective profile.

If you work with US Legal Forms the very first time, refer to the instructions under:

- Step 1. Ensure you have selected the shape for that proper metropolis/country.

- Step 2. Take advantage of the Review option to examine the form`s information. Never overlook to read through the description.

- Step 3. When you are not happy using the form, take advantage of the Research discipline near the top of the display to get other versions of the lawful form format.

- Step 4. When you have discovered the shape you will need, select the Acquire now option. Select the costs program you choose and include your references to sign up for an profile.

- Step 5. Approach the deal. You can use your bank card or PayPal profile to perform the deal.

- Step 6. Select the formatting of the lawful form and acquire it on the system.

- Step 7. Total, revise and printing or sign the South Carolina Acceptance of Claim by Collection Agency and Report of Experience with Debtor.

Each lawful file format you purchase is your own eternally. You possess acces to every single form you acquired inside your acccount. Select the My Forms area and select a form to printing or acquire once again.

Remain competitive and acquire, and printing the South Carolina Acceptance of Claim by Collection Agency and Report of Experience with Debtor with US Legal Forms. There are many specialist and condition-specific forms you may use for the enterprise or person demands.