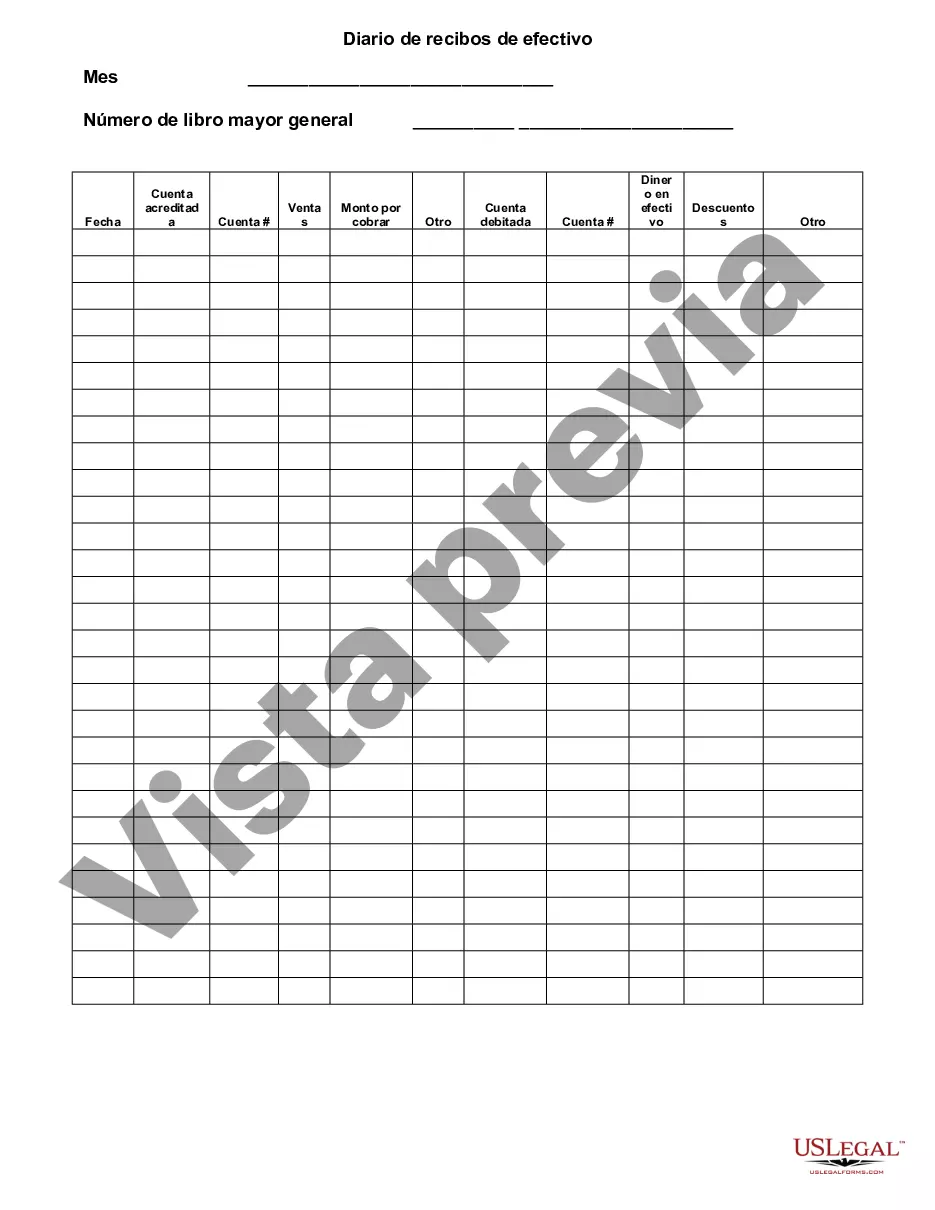

South Carolina Cash Receipts Journal is a financial record-keeping tool used by businesses and organizations in the state of South Carolina to track and document all incoming cash transactions. It serves as a vital component of their accounting systems, allowing them to accurately record and reconcile their cash inflows. The South Carolina Cash Receipts Journal is typically divided into various sections, depending on the nature of the receipts and the organization's specific needs. Some common types of South Carolina Cash Receipts Journals may include: 1. Sales Receipts: This section captures the cash received from sales of products, services, or goods. It records the date of the transaction, the customer's name or account number, the amount received, and any relevant details. 2. Rental Payments: In case of rental properties, this section records the cash received as rental payments from tenants. Information such as the tenant's name, rental period, property address, amount received, and any associated fees or charges would be included. 3. Miscellaneous Receipts: This section encompasses all other types of cash receipts that do not fall under sales or rental payments. It could include items like interest earned, refunds, reimbursements, or any other income sources. 4. Accounts Receivable: If an organization extends credit to customers, this section tracks cash received against outstanding accounts receivable balances. It records payments made by customers, the corresponding invoice number or reference, and the amount applied towards the outstanding balance. 5. Donations: For nonprofit organizations or charities, this section records any cash donations received. It typically includes the donor's name, donation date, donation amount, and any specific purpose or restrictions associated with the donation. Each of these sections within the South Carolina Cash Receipts Journal allows businesses and organizations to easily distinguish and categorize their incoming cash transactions. It promotes accuracy and efficiency in financial record-keeping and provides a comprehensive view of all cash inflows. By utilizing a South Carolina Cash Receipts Journal, businesses and organizations can effectively manage their finances, ensure proper allocation of funds, and maintain transparency in their financial reporting. It serves as a crucial tool for tracking and reconciling cash receipts and plays a significant role in financial decision-making processes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.South Carolina Diario de recibos de efectivo - Cash Receipts Journal

Description

How to fill out South Carolina Diario De Recibos De Efectivo?

It is possible to devote time online searching for the legal document template that suits the state and federal specifications you need. US Legal Forms supplies thousands of legal forms that happen to be analyzed by specialists. It is possible to obtain or print the South Carolina Cash Receipts Journal from our assistance.

If you currently have a US Legal Forms profile, you are able to log in and then click the Acquire key. Next, you are able to complete, revise, print, or signal the South Carolina Cash Receipts Journal. Every single legal document template you get is your own property eternally. To obtain another duplicate of any acquired kind, proceed to the My Forms tab and then click the related key.

If you use the US Legal Forms internet site the very first time, keep to the easy directions beneath:

- First, make sure that you have selected the proper document template for that county/city that you pick. Look at the kind outline to make sure you have chosen the correct kind. If offered, utilize the Preview key to check from the document template at the same time.

- If you would like locate another model from the kind, utilize the Search field to obtain the template that meets your needs and specifications.

- After you have located the template you would like, click Buy now to continue.

- Select the costs plan you would like, enter your credentials, and register for an account on US Legal Forms.

- Total the deal. You can use your charge card or PayPal profile to cover the legal kind.

- Select the structure from the document and obtain it to the device.

- Make adjustments to the document if possible. It is possible to complete, revise and signal and print South Carolina Cash Receipts Journal.

Acquire and print thousands of document templates making use of the US Legal Forms web site, that provides the greatest collection of legal forms. Use specialist and condition-specific templates to tackle your business or personal requirements.