South Carolina Notice of Default on Promissory Note Installment

Description

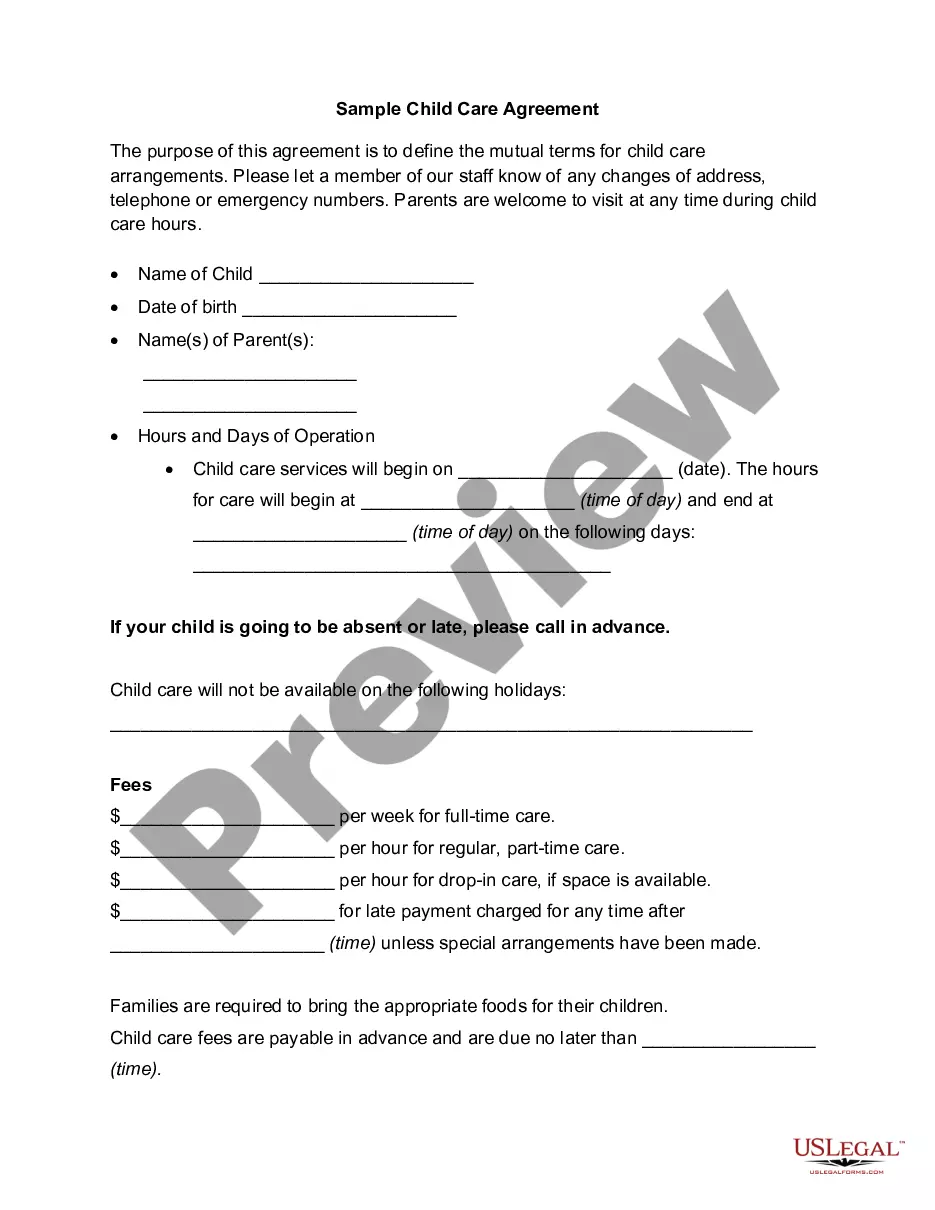

How to fill out Notice Of Default On Promissory Note Installment?

If you desire to complete, acquire, or print official document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Employ the site's straightforward and user-friendly search to find the documents you seek.

A range of templates for commercial and personal uses are organized by categories and states, or keywords.

Step 4. Once you have found the form you require, click the Purchase now button. Select your preferred pricing plan and enter your credentials to register for an account.

Step 5. Complete the purchase. You may utilize your Visa, Mastercard, or PayPal account to finalize the transaction.

- Utilize US Legal Forms to retrieve the South Carolina Notice of Default on Promissory Note Installment with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and select the Download option to access the South Carolina Notice of Default on Promissory Note Installment.

- You can also access forms you previously downloaded from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Preview option to review the form's content. Remember to read through the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to locate alternative versions of the legal form template.

Form popularity

FAQ

To write a South Carolina Notice of Default on Promissory Note Installment, begin by clearly stating the reason for the notice, including the amount due and the specific terms of the promissory note. Ensure you include the date on which the payment was initially due, as well as any applicable grace periods. It's important to specify that this notice serves as an official warning of default, and outline the next steps for resolution. Utilizing a platform like uslegalforms can simplify this process by providing templates and guidance tailored for your needs.

To issue a default notice, draft a letter that includes essential information such as the borrower's name, details of the promissory note, and the nature of the default. Ensure you use clear and professional language, outlining what the borrower needs to do next. For South Carolina Notice of Default on Promissory Note Installment, you may want to utilize templates from resources like uslegalforms that can streamline this process and ensure compliance with local laws.

To legally enforce a promissory note, you must first provide necessary notices of default to the borrower, which can include a South Carolina Notice of Default on Promissory Note Installment. If the borrower fails to comply, you may proceed to file a lawsuit to recover the owed amount. It’s often beneficial to follow legal advice during this process to ensure all steps are correctly managed.

If someone defaults on a promissory note, the first step is to communicate directly with the borrower to understand their situation. It’s also important to issue a South Carolina Notice of Default on Promissory Note Installment, outlining the specifics of the default and the necessary steps to resolve it. This process often helps both parties avoid litigation and may lead to a repayment agreement.

To write a default notice, start with clear identification of the borrower and the promissory note involved. Clearly state the details of the default, including the amount owed and the dates of missed payments. It is crucial to include a call to action, providing the borrower clear instructions on how to make the payment or remedy the default. When handling a South Carolina Notice of Default on Promissory Note Installment, clarity and precision are key.

A default notice is a formal communication typically sent to a borrower when they fail to make required payments on a promissory note. For instance, if a borrower misses an installment payment, the lender can issue a South Carolina Notice of Default on Promissory Note Installment, outlining the amount due and the actions the borrower should take to remedy the situation. This notice serves to inform the borrower of their default and provides an opportunity to correct it.

When a borrower defaults on a promissory note, the first step is to review the terms of the agreement. Familiarize yourself with the South Carolina Notice of Default on Promissory Note Installment, as it outlines your rights and options. You may want to reach out to the borrower to discuss the situation and explore possible solutions. If necessary, consider using legal resources, such as US Legal Forms, to draft the required notices and take appropriate legal action.

Defaulting on a promissory note means you have failed to meet the payment terms agreed upon. Typically, the lender will send you a South Carolina Notice of Default on Promissory Note Installment, outlining the delinquent payments and potential legal actions. It is important to communicate with your lender to discuss possible solutions, such as restructuring your payment plan. Platforms like uslegalforms can help you understand your options and guide you through the necessary processes.

If someone defaults on a promissory note, the lender may initiate collection processes, which can include legal action. This often means that the lender will send a South Carolina Notice of Default on Promissory Note Installment, informing the borrower of their overdue payment status and the next steps. It’s essential to respond to this notice to avoid further penalties or repercussions. Actively engaging will help you manage your financial situation more effectively.

Generally, not paying a promissory note does not lead to jail time. Financial obligations like these are civil matters, not criminal offenses. However, ignoring a South Carolina Notice of Default on Promissory Note Installment could lead to legal actions, which may include garnishments or liens against your assets. It is crucial to address these issues promptly to avoid further complications.