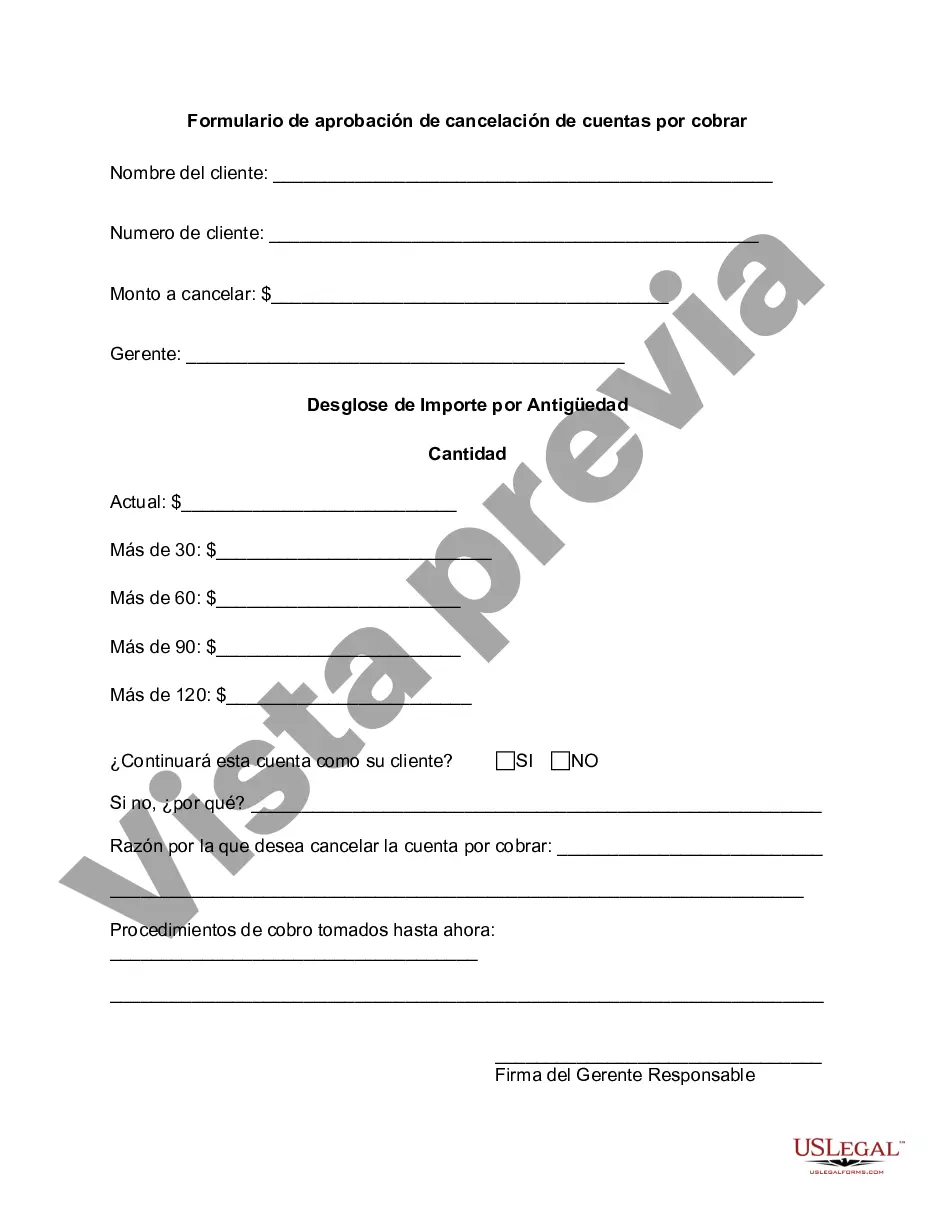

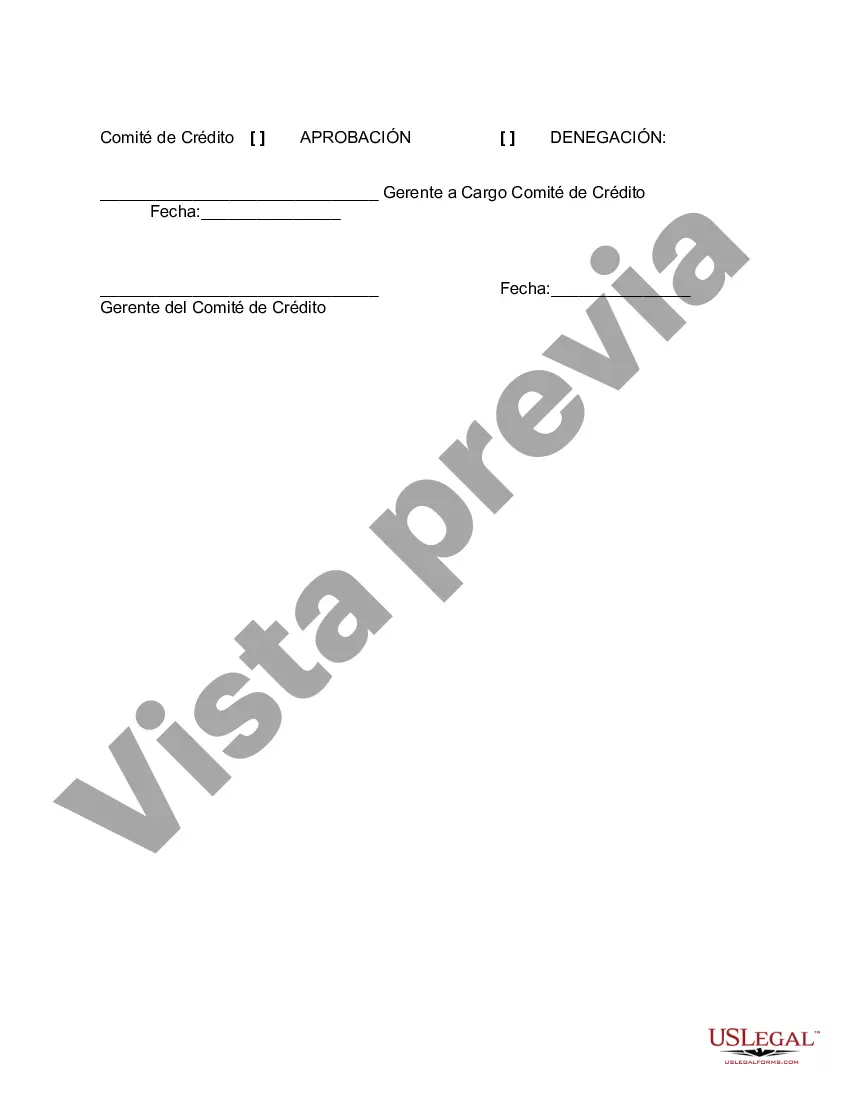

South Carolina Accounts Receivable Write-Off Approval Form is a document used to authorize the write-off of outstanding accounts receivable in South Carolina. This form ensures that proper procedures are followed and approvals are obtained before the write-off is processed. It plays a vital role in maintaining accurate financial records and managing the accounts receivable process effectively. Keywords: South Carolina Accounts Receivable, Write-Off Approval Form, outstanding accounts receivable, proper procedures, approvals, accurate financial records, managing accounts receivable, effective process. There are two types of South Carolina Accounts Receivable Write-Off Approval Forms: 1. Individual Account Write-Off Approval Form: This form is used when writing off a specific customer's outstanding account receivable. It requires specific details such as the customer's name, account number, amount to be written off, reason for write-off, and applicable supporting documentation. This form ensures that each write-off is carefully reviewed and approved for accuracy and validity. Keywords: Individual Account, customer's name, account number, amount to be written off, reason for write-off, supporting documentation, review, approved for accuracy, validity. 2. Batch Write-Off Approval Form: This form is used when there are multiple accounts receivable that need to be written off as a batch. It allows for efficient write-off processing by consolidating multiple write-offs into one form. The form includes details such as the total amount to be written off, reason for the write-off, and any necessary supporting documentation. This form streamlines the approval process for multiple write-offs, promoting efficiency and accuracy. Keywords: Batch Write-Off, multiple accounts receivable, efficient processing, consolidate, total amount, reason for write-off, supporting documentation, approval process, efficiency, accuracy. In conclusion, the South Carolina Accounts Receivable Write-Off Approval Form is an essential tool for managing outstanding accounts receivable effectively. Whether it's an individual account or a batch of accounts, this form ensures proper procedures are followed, approvals are obtained, and accurate financial records are maintained.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.South Carolina Formulario de aprobación de cancelación de cuentas por cobrar - Accounts Receivable Write-Off Approval Form

Description

How to fill out South Carolina Formulario De Aprobación De Cancelación De Cuentas Por Cobrar?

US Legal Forms - one of several biggest libraries of lawful kinds in America - gives an array of lawful file themes it is possible to obtain or printing. Making use of the internet site, you will get a large number of kinds for organization and person functions, sorted by groups, claims, or keywords and phrases.You can get the most up-to-date models of kinds such as the South Carolina Accounts Receivable Write-Off Approval Form within minutes.

If you currently have a membership, log in and obtain South Carolina Accounts Receivable Write-Off Approval Form from your US Legal Forms library. The Acquire switch can look on each develop you view. You have access to all previously saved kinds from the My Forms tab of the account.

If you want to use US Legal Forms the very first time, allow me to share straightforward guidelines to help you started out:

- Be sure you have picked out the best develop for your metropolis/county. Click on the Review switch to review the form`s content. Read the develop outline to actually have chosen the correct develop.

- If the develop doesn`t satisfy your demands, make use of the Research area on top of the screen to get the one who does.

- In case you are content with the shape, affirm your option by visiting the Get now switch. Then, pick the rates strategy you want and supply your credentials to register for an account.

- Method the deal. Utilize your credit card or PayPal account to perform the deal.

- Select the formatting and obtain the shape in your gadget.

- Make changes. Fill up, edit and printing and sign the saved South Carolina Accounts Receivable Write-Off Approval Form.

Each format you put into your money does not have an expiry time which is yours permanently. So, in order to obtain or printing an additional copy, just visit the My Forms section and click around the develop you will need.

Get access to the South Carolina Accounts Receivable Write-Off Approval Form with US Legal Forms, probably the most considerable library of lawful file themes. Use a large number of professional and express-specific themes that satisfy your organization or person requires and demands.