The sale of any ongoing business, even a sole proprietorship, can be a complicated transaction. Depending on the nature of the business sold, statutes and regulations concerning the issuance and transfer of permits, licenses, and/or franchises should be consulted. If a license or franchise is important to the business, the buyer generally would want to make the sales agreement contingent on such approval. Sometimes, the buyer will assume certain debts, liabilities, or obligations of the seller. In such a sale, it is vital that the buyer know exactly what debts he/she is assuming.

A sale of a business is considered for tax purposes to be a sale of the various assets involved. Therefore it is important that the contract allocate parts of the total payment among the items being sold. For example, the sale may require the transfer of the place of business, including the real property on which the building(s) of the business are located. The sale might involve the assignment of a lease, the transfer of good will, equipment, furniture, fixtures, merchandise, and inventory. The sale may also include the transfer of the business name, patents, trademarks, copyrights, licenses, permits, insurance policies, notes, accounts receivables, contracts, cash on hand and on deposit, and other tangible or intangible properties. It is best to include a broad transfer provision to insure that the entire business is being transferred to the buyer, with an itemization of at least the more important assets to be transferred.

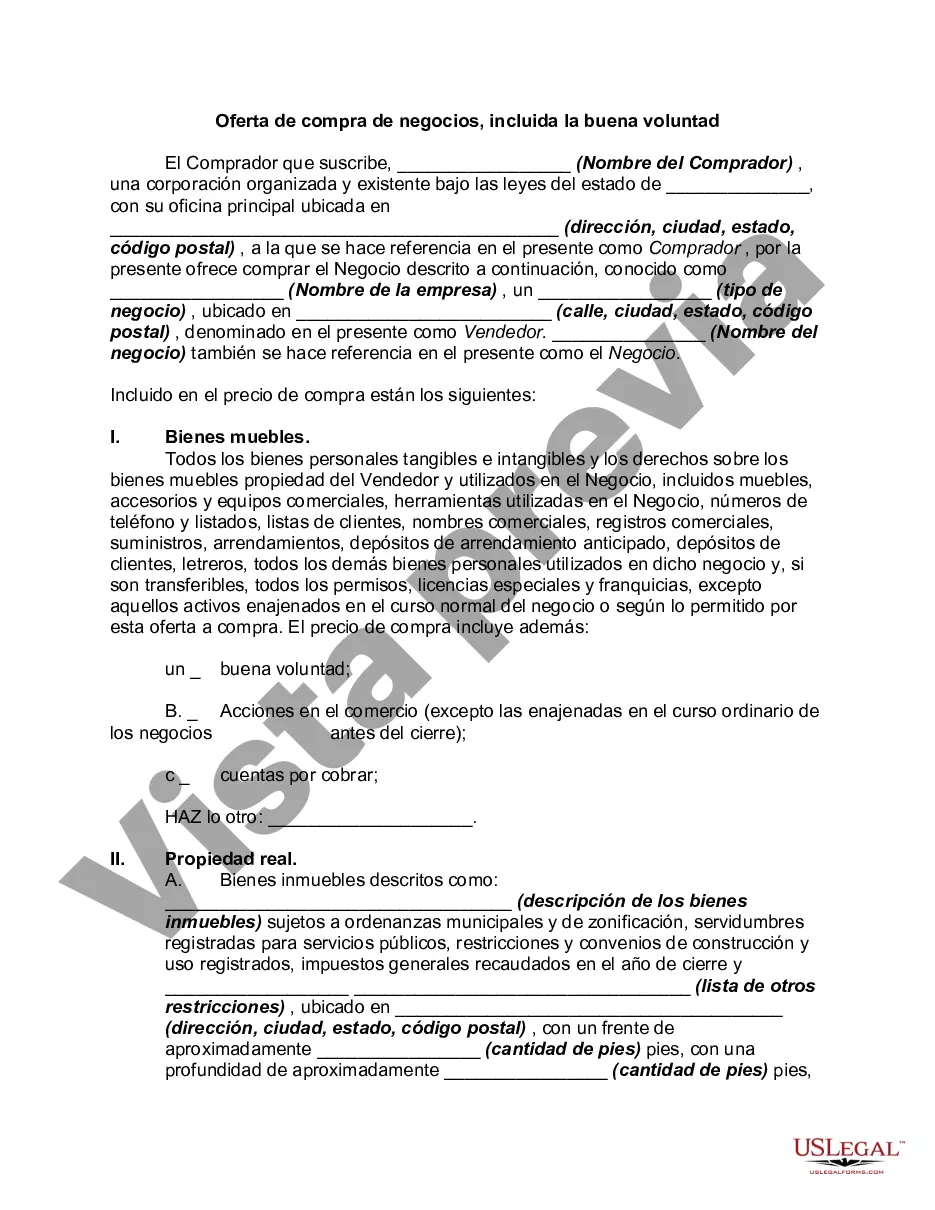

A South Carolina Offer to Purchase Business, Including Good Will, is a legal document that outlines the terms and conditions under which a buyer agrees to purchase a business, along with its tangible and intangible assets, such as goodwill. It serves as a binding agreement between the buyer and the seller, ensuring a smooth and transparent transaction. The South Carolina Offer to Purchase Business, Including Good Will, typically includes the following key components: 1. Identification of the Parties: The document starts by clearly identifying the buyer and the seller. It includes their legal names, contact information, and any relevant entity details if the business is operated as a corporation or partnership. 2. Description of Business: A comprehensive description of the business being sold is provided, including its name, location, nature of operations, and any licenses or permits required for its operation. 3. Purchase Price and Payment Terms: The offer states the total purchase price offered by the buyer and the proposed payment terms, such as a lump sum payment, installments, or financing arrangements. 4. Assets Included: The document specifies the assets included in the sale. These may encompass physical assets (equipment, inventory, real estate) as well as intangible assets (goodwill, intellectual property, customer database, trademarks). 5. Allocation of Purchase Price: If there are several assets being sold, the document may outline how the purchase price will be allocated among them for tax or accounting purposes. 6. Due Diligence: The offer may include a clause that allows the buyer a period of time to conduct due diligence, examining the business’s financial records, contracts, leases, and any other relevant documents to ensure it meets their requirements. 7. Conditions and Contingencies: The offer may state any specific conditions or contingencies that need to be met for the sale to proceed. This can include obtaining financing, landlord's consent, regulatory approvals, or other legal requirements. 8. Closing Details: The document outlines the proposed closing date, the location where the transaction will take place, and any conditions relating to the transfer of assets, contracts, or employees. 9. Confidentiality and Non-Compete: To protect the seller's interest, the offer may contain clauses regarding confidentiality of the transaction details and non-compete agreements, preventing the seller from starting a similar business in the geographical area for a specified period. Different types of South Carolina Offer to Purchase Business, Including Good Will, can vary based on factors such as the size of the business, industry, and specific deal terms. Some variations include: 1. Asset Purchase Agreement: In this type of offer, the buyer mainly acquires specific assets of the business, such as equipment, inventory, and goodwill, rather than buying the entire company. 2. Stock Purchase Agreement: This offer involves purchasing the seller's shares or ownership interests in the company, including all its assets, liabilities, and contractual obligations. 3. Merger Agreement: In situations where two companies want to combine forces, a merger agreement outlines how the transaction will occur, including the transfer of assets, liabilities, and goodwill. In summary, a South Carolina Offer to Purchase Business, Including Good Will, is a crucial legal document that enables a buyer to acquire a business while protecting the interests of both parties. It covers key aspects of the transaction, including the purchase price, asset allocation, due diligence, conditions, and closing details. Various types of purchase agreements exist, each tailored to specific circumstances and goals of the buyer and seller.A South Carolina Offer to Purchase Business, Including Good Will, is a legal document that outlines the terms and conditions under which a buyer agrees to purchase a business, along with its tangible and intangible assets, such as goodwill. It serves as a binding agreement between the buyer and the seller, ensuring a smooth and transparent transaction. The South Carolina Offer to Purchase Business, Including Good Will, typically includes the following key components: 1. Identification of the Parties: The document starts by clearly identifying the buyer and the seller. It includes their legal names, contact information, and any relevant entity details if the business is operated as a corporation or partnership. 2. Description of Business: A comprehensive description of the business being sold is provided, including its name, location, nature of operations, and any licenses or permits required for its operation. 3. Purchase Price and Payment Terms: The offer states the total purchase price offered by the buyer and the proposed payment terms, such as a lump sum payment, installments, or financing arrangements. 4. Assets Included: The document specifies the assets included in the sale. These may encompass physical assets (equipment, inventory, real estate) as well as intangible assets (goodwill, intellectual property, customer database, trademarks). 5. Allocation of Purchase Price: If there are several assets being sold, the document may outline how the purchase price will be allocated among them for tax or accounting purposes. 6. Due Diligence: The offer may include a clause that allows the buyer a period of time to conduct due diligence, examining the business’s financial records, contracts, leases, and any other relevant documents to ensure it meets their requirements. 7. Conditions and Contingencies: The offer may state any specific conditions or contingencies that need to be met for the sale to proceed. This can include obtaining financing, landlord's consent, regulatory approvals, or other legal requirements. 8. Closing Details: The document outlines the proposed closing date, the location where the transaction will take place, and any conditions relating to the transfer of assets, contracts, or employees. 9. Confidentiality and Non-Compete: To protect the seller's interest, the offer may contain clauses regarding confidentiality of the transaction details and non-compete agreements, preventing the seller from starting a similar business in the geographical area for a specified period. Different types of South Carolina Offer to Purchase Business, Including Good Will, can vary based on factors such as the size of the business, industry, and specific deal terms. Some variations include: 1. Asset Purchase Agreement: In this type of offer, the buyer mainly acquires specific assets of the business, such as equipment, inventory, and goodwill, rather than buying the entire company. 2. Stock Purchase Agreement: This offer involves purchasing the seller's shares or ownership interests in the company, including all its assets, liabilities, and contractual obligations. 3. Merger Agreement: In situations where two companies want to combine forces, a merger agreement outlines how the transaction will occur, including the transfer of assets, liabilities, and goodwill. In summary, a South Carolina Offer to Purchase Business, Including Good Will, is a crucial legal document that enables a buyer to acquire a business while protecting the interests of both parties. It covers key aspects of the transaction, including the purchase price, asset allocation, due diligence, conditions, and closing details. Various types of purchase agreements exist, each tailored to specific circumstances and goals of the buyer and seller.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.