South Carolina Promissory Note with Payments Amortized for a Certain Number of Years

Description

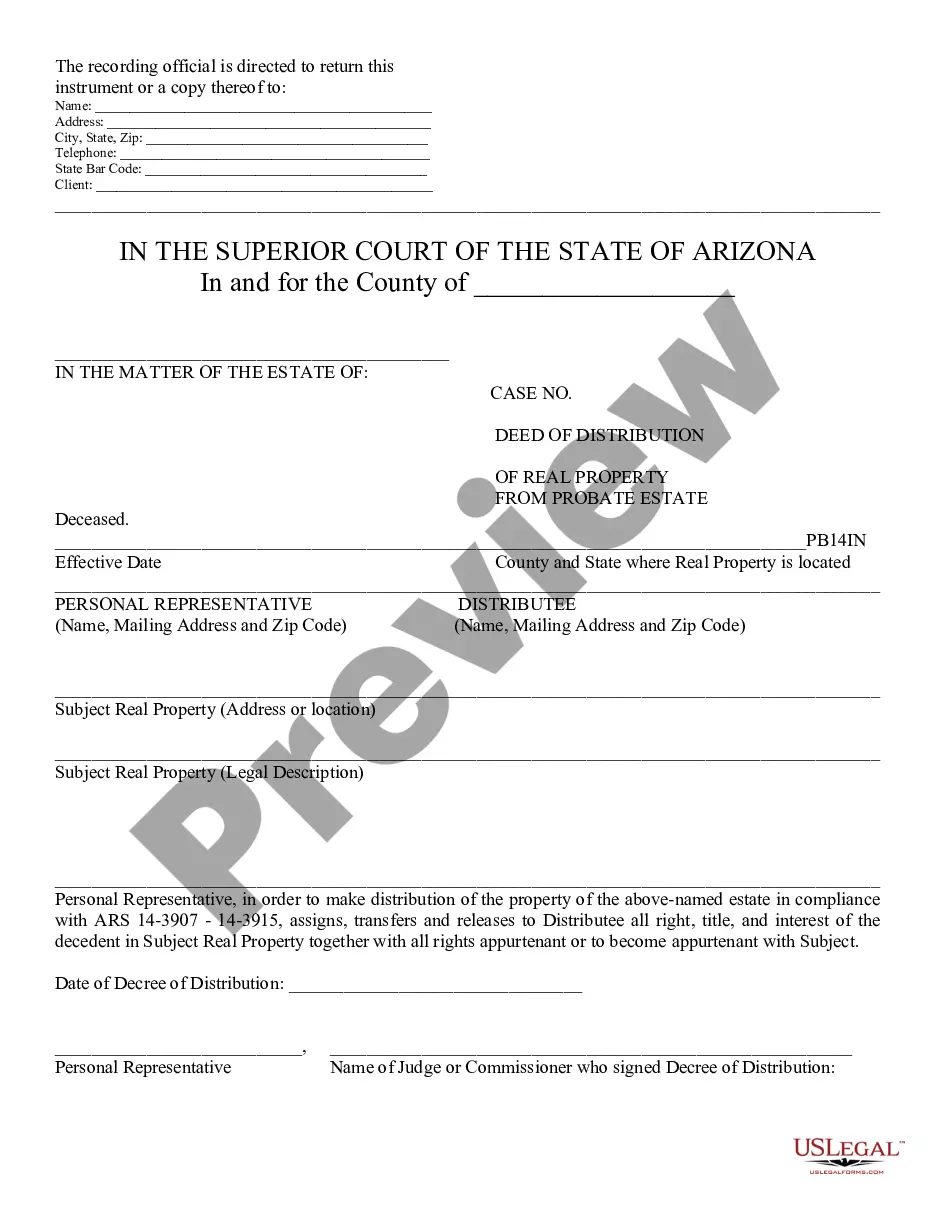

How to fill out Promissory Note With Payments Amortized For A Certain Number Of Years?

If you seek exhaustive options, download, or printing sanctioned document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Leverage the website's straightforward and convenient search feature to locate the documents you need.

A range of templates for business and personal purposes is categorized by type and jurisdiction, or keywords.

Step 4. After identifying the form you need, click the Get now button. Choose the pricing plan you prefer and enter your information to register for an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Employ US Legal Forms to acquire the South Carolina Promissory Note with Payments Amortized for a Specific Number of Years in just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click the Download button to receive the South Carolina Promissory Note with Payments Amortized for a Specific Number of Years.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for your correct area/state.

- Step 2. Utilize the Preview option to review the form's contents. Remember to read the instructions.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form format.

Form popularity

FAQ

Filling out a promissory note requires basic information such as the borrower’s and lender's names, the principal amount, interest rate, and repayment terms. For a South Carolina Promissory Note with Payments Amortized for a Certain Number of Years, include the monthly payment schedule and any specific conditions. Ensure you read the sample note thoroughly to understand required fields.

The duration a South Carolina promissory note with payments amortized for a certain number of years remains valid largely depends on the terms outlined within the document. Depending on the payment schedule and agreement reached, a promissory note can span several years, often three to ten. Once the terms are met, the note is considered fulfilled. For clarity on your specific situation, using our services at uslegalforms can assist in customizing your note effectively.

A promissory note with payments amortized for a certain number of years in South Carolina does not have a fixed expiration but is subject to the statute of limitations. If the borrower does not fulfill their payment obligations, the lender must file a claim within three years to enforce the note. After this period, the lender may lose the right to collect on the debt. Staying informed and proactive is essential, and uslegalforms can help you navigate these timelines.

Several factors can render a South Carolina promissory note with payments amortized for a certain number of years invalid. If the note lacks necessary elements like signatures, mutual agreement, or clarity of terms, it may not hold up in court. Additionally, if it is created under duress or fraud, this can also lead to invalidity. It's crucial to carefully draft your note, and our platform can guide you in ensuring all legal requirements are met.

The validity period of a South Carolina promissory note with payments amortized for a certain number of years depends on the terms agreed upon by both parties. Generally, notes remain valid as long as the borrower meets their obligations and payments are made as agreed. If a borrower fails to make payments, the lender may need to act within the statute of limitations to collect the debt. Utilizing uslegalforms can help you draft clear terms to avoid confusion.

In South Carolina, the statute of limitations for a promissory note with payments amortized for a certain number of years is typically three years. This means you have three years to enforce the note and collect on it after a payment is missed. It's essential to keep track of this timeframe to ensure your rights are preserved. Consulting platforms like uslegalforms can help you create a legally binding note and ensure you understand your rights.

Promissory notes can be either short-term or long-term, depending on the agreement you establish. A South Carolina Promissory Note with Payments Amortized for a Certain Number of Years is typically designed for a longer duration, allowing you to spread out payments comfortably. However, short-term notes may also suit specific situations. Ultimately, the terms should fit both parties' financial needs and goals.

Yes, there are time limits concerning how long you have to enforce a promissory note. In South Carolina, you generally have six years to take action if a payment is missed. This time limitation emphasizes the importance of creating a clear South Carolina Promissory Note with Payments Amortized for a Certain Number of Years to ensure both parties are aware of their obligations. Keep this timeline in mind when drafting your document.

The length of a promissory note can vary significantly based on the agreement. In South Carolina, you can specify a term that suits your needs when drafting a South Carolina Promissory Note with Payments Amortized for a Certain Number of Years. Usually, these notes can range from a few months to several years. Just ensure that both parties agree on the duration to avoid misunderstandings.

Yes, a notarized promissory note is considered legally binding. When you create a South Carolina Promissory Note with Payments Amortized for a Certain Number of Years, notarization adds an extra layer of validity. Notarization ensures that all parties involved are who they say they are and that they willingly signed the document. This helps protect your rights and clearly establishes the terms of repayment.