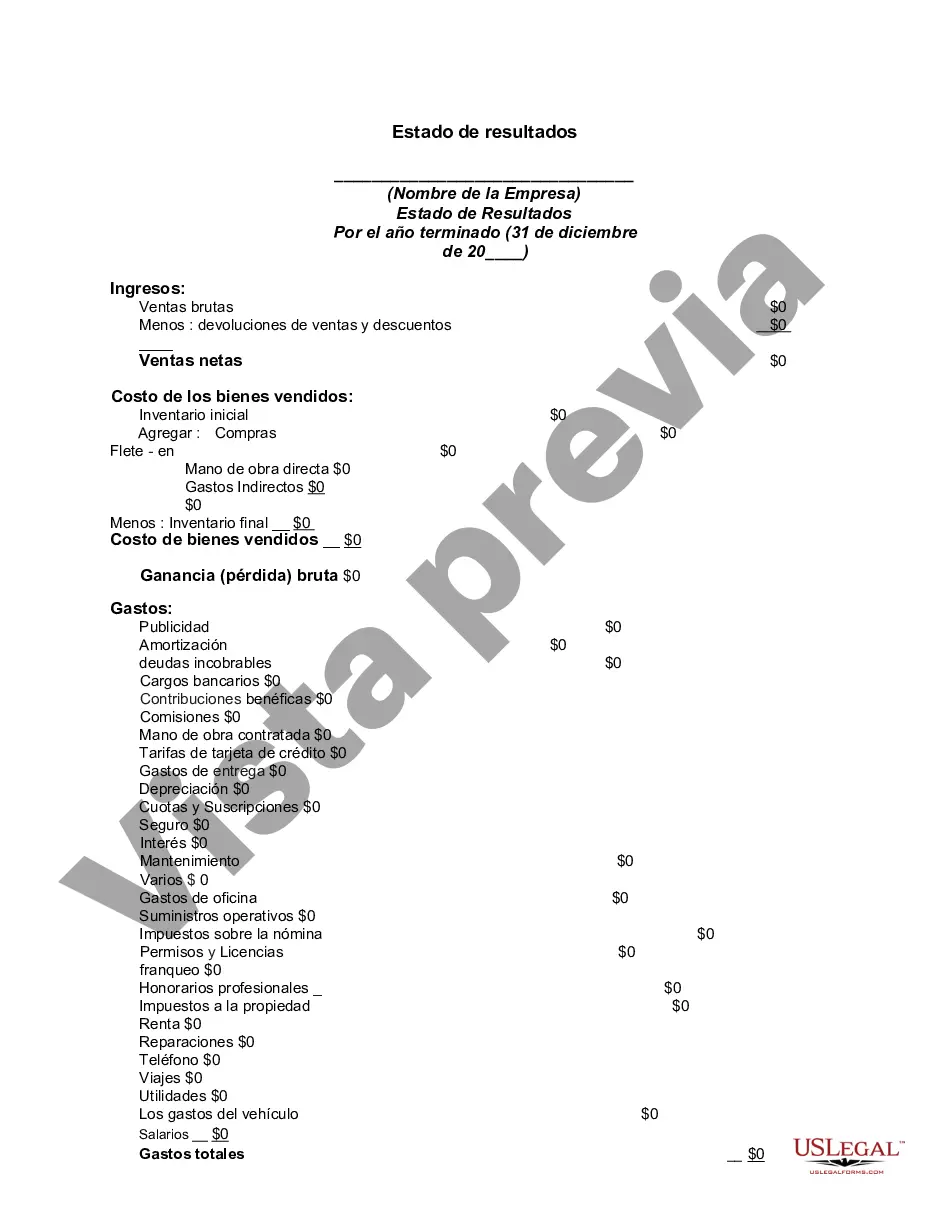

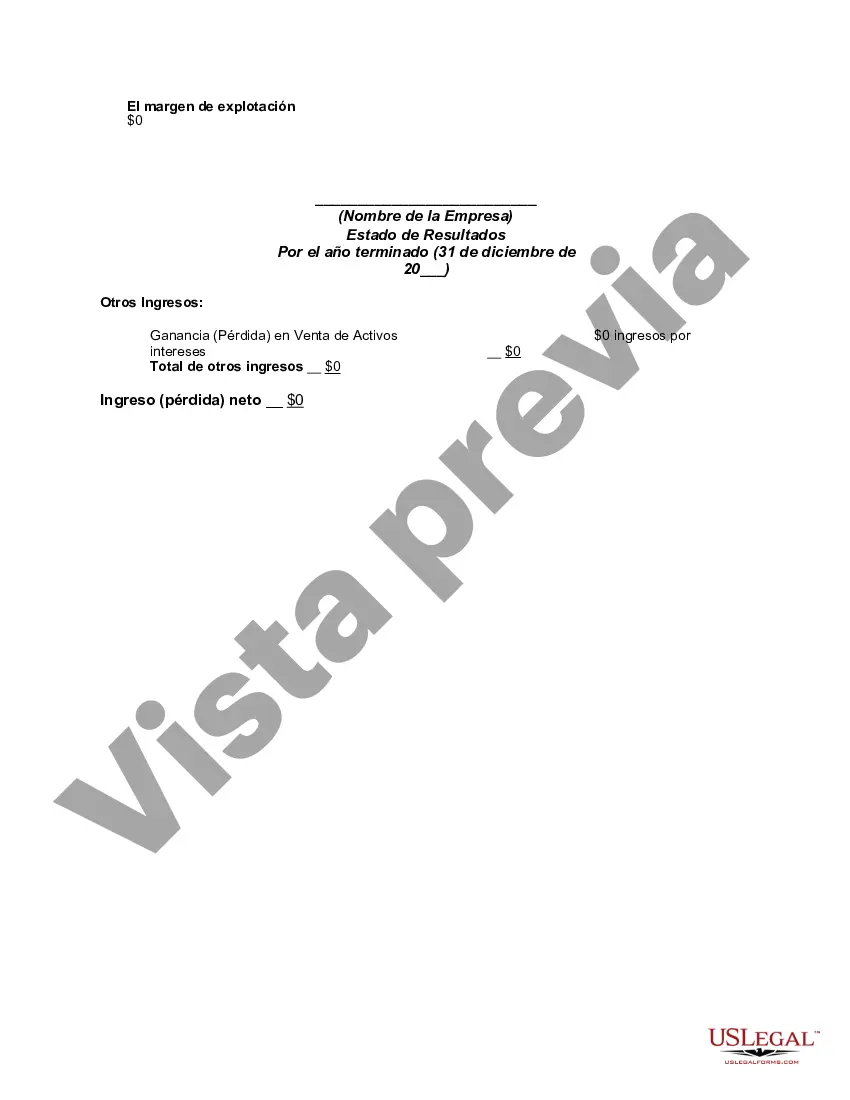

An income statement (sometimes called a profit and loss statement) lists your revenues and expenses, and tells you the profit or loss of your business for a given period of time. You can use this income statement form as a starting point to create one yourself.

The South Carolina Income Statement is a financial document that provides a detailed overview of an individual's or a business entity's financial performance over a specific period, usually on an annual basis. It is an essential part of financial reporting and analysis, helping individuals and organizations in South Carolina evaluate their profitability and make informed decisions. The South Carolina Income Statement presents revenues earned and expenses incurred during the specified period, ultimately calculating the net income or loss. Its structure typically includes several key components, such as revenue, cost of goods sold, operating expenses, non-operating income or expenses, and income tax expenses. The inclusion of these components varies depending on the type and complexity of the income statement. One common type of South Carolina Income Statement is the Single-Step Income Statement. This version presents all revenues and gains together and all expenses and losses together, resulting in a single calculation of net income or loss. It is suitable for simple businesses or individuals with relatively straightforward financial operations. Another type is the Multiple-Step Income Statement, which categorizes revenues and expenses into separate sections, providing more detailed insights into the financial performance. This type enables the calculation of gross profit, operating income, and net income, allowing businesses to grasp the profitability of their operations more comprehensively. Additionally, some South Carolina businesses may need to prepare specialized income statements tailored to their industry or specific reporting requirements. For instance, non-profit organizations may have to create a Statement of Activities, focusing on revenues and expenses related to their particular mission and operations. Overall, the South Carolina Income Statement is a crucial tool for assessing the financial health and identifying areas of improvement within an individual's or a business entity's operations. It helps stakeholders understand revenue streams, identify key expenses, and evaluate profitability, enabling informed decision-making and strategic planning.The South Carolina Income Statement is a financial document that provides a detailed overview of an individual's or a business entity's financial performance over a specific period, usually on an annual basis. It is an essential part of financial reporting and analysis, helping individuals and organizations in South Carolina evaluate their profitability and make informed decisions. The South Carolina Income Statement presents revenues earned and expenses incurred during the specified period, ultimately calculating the net income or loss. Its structure typically includes several key components, such as revenue, cost of goods sold, operating expenses, non-operating income or expenses, and income tax expenses. The inclusion of these components varies depending on the type and complexity of the income statement. One common type of South Carolina Income Statement is the Single-Step Income Statement. This version presents all revenues and gains together and all expenses and losses together, resulting in a single calculation of net income or loss. It is suitable for simple businesses or individuals with relatively straightforward financial operations. Another type is the Multiple-Step Income Statement, which categorizes revenues and expenses into separate sections, providing more detailed insights into the financial performance. This type enables the calculation of gross profit, operating income, and net income, allowing businesses to grasp the profitability of their operations more comprehensively. Additionally, some South Carolina businesses may need to prepare specialized income statements tailored to their industry or specific reporting requirements. For instance, non-profit organizations may have to create a Statement of Activities, focusing on revenues and expenses related to their particular mission and operations. Overall, the South Carolina Income Statement is a crucial tool for assessing the financial health and identifying areas of improvement within an individual's or a business entity's operations. It helps stakeholders understand revenue streams, identify key expenses, and evaluate profitability, enabling informed decision-making and strategic planning.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.