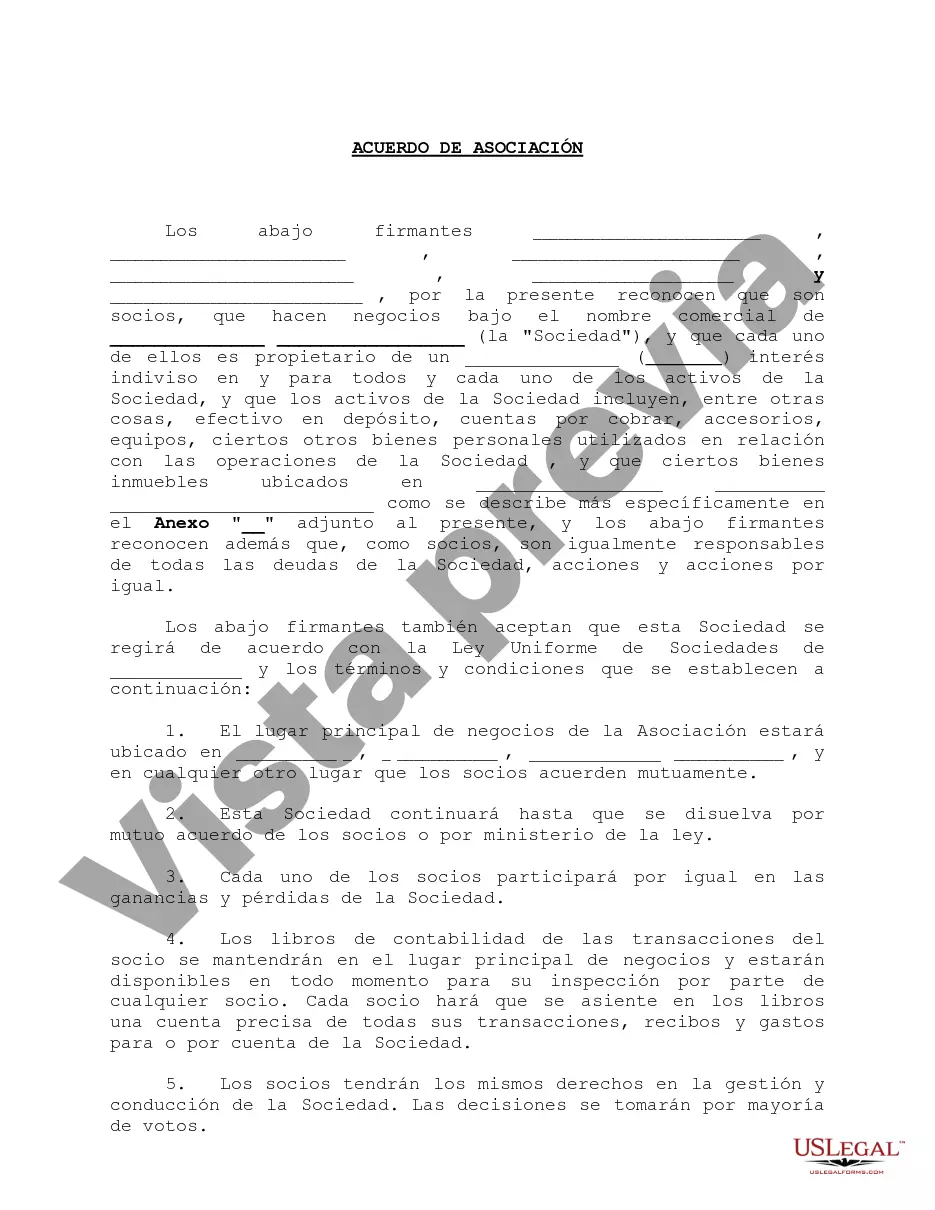

South Carolina Partnership Agreement for LLP: A Comprehensive Guide The South Carolina Partnership Agreement for Limited Liability Partnerships (Laps) is a legal document that outlines the rights, duties, and responsibilities of partners in a business entity operating as an LLP in the state of South Carolina. This agreement governs the internal affairs of the LLP and establishes the framework for decision-making, profit sharing, liability protection, and dissolution. The South Carolina Partnership Agreement for LLP is designed to provide flexibility and protection for partners by combining elements of general partnerships and limited liability entities. By creating an LLP, partners can enjoy limited personal liability, similar to that of a corporation or limited liability company (LLC), while maintaining the benefits of a partnership structure, such as pass-through taxation. When drafting a South Carolina Partnership Agreement for LLP, the following key aspects are typically addressed: 1. Formation: This section details the process of establishing the LLP, including the name of the partnership, the principal place of business, and the duration of the partnership. It may also outline the admission or withdrawal of partners. 2. Management: The agreement outlines the management structure of the LLP, whether it is a designated managing partner or a management committee. It specifies decision-making processes, voting rights, and the authority of partners. 3. Capital Contributions: This section addresses the initial capital contributions made by partners to fund the LLP. It may outline how additional capital contributions are made and whether partners can borrow from the LLP. 4. Profits and Losses: The agreement describes how profits and losses are allocated among partners. This includes provisions on the distribution of profits, the treatment of losses, and any preferential distributions that certain partners may be entitled to. 5. Liability Protection: The South Carolina Partnership Agreement for LLP offers partners limited personal liability protection. It clarifies the extent to which partners are liable for the LLP's debts, obligations, and legal actions. 6. Dissolution: This section outlines the process of dissolving the LLP, including triggering events, notice requirements, and the distribution of remaining assets. It may also establish procedures for the continuation of the partnership in the event of a partner's death or withdrawal. South Carolina does not currently differentiate between different types of Partnership Agreements for Laps. Instead, businesses can customize their agreements based on their specific needs and requirements. However, it is crucial to consult with an attorney experienced in South Carolina partnership law to ensure compliance with state regulations and to tailor the LLP agreement to the unique circumstances of the partnership. In conclusion, the South Carolina Partnership Agreement for LLP provides a comprehensive framework for partners to establish and operate a limited liability partnership in South Carolina. By addressing important aspects such as formation, management, capital contributions, profit sharing, liability protection, and dissolution, partners can define their roles and responsibilities and protect their interests while conducting business in the state.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.South Carolina Acuerdo de asociación para LLP - Partnership Agreement for LLP

Description

How to fill out South Carolina Acuerdo De Asociación Para LLP?

US Legal Forms - one of several biggest libraries of legitimate types in the States - gives a wide array of legitimate record web templates it is possible to download or produce. Using the site, you can find thousands of types for enterprise and person uses, sorted by categories, says, or keywords.You can get the latest versions of types much like the South Carolina Partnership Agreement for LLP within minutes.

If you already have a membership, log in and download South Carolina Partnership Agreement for LLP in the US Legal Forms library. The Down load key can look on each and every kind you view. You have accessibility to all previously downloaded types in the My Forms tab of your respective account.

If you would like use US Legal Forms the first time, allow me to share basic directions to help you get started out:

- Be sure you have chosen the right kind for your personal town/county. Click the Preview key to examine the form`s articles. Read the kind explanation to ensure that you have chosen the proper kind.

- When the kind doesn`t suit your needs, take advantage of the Research industry near the top of the monitor to obtain the one which does.

- Should you be content with the form, affirm your decision by simply clicking the Buy now key. Then, choose the costs program you prefer and give your references to sign up for the account.

- Process the purchase. Make use of charge card or PayPal account to accomplish the purchase.

- Choose the structure and download the form on your own system.

- Make alterations. Load, edit and produce and sign the downloaded South Carolina Partnership Agreement for LLP.

Each and every template you included in your account does not have an expiry time and is your own property permanently. So, in order to download or produce one more version, just proceed to the My Forms area and click on around the kind you need.

Gain access to the South Carolina Partnership Agreement for LLP with US Legal Forms, probably the most considerable library of legitimate record web templates. Use thousands of specialist and express-certain web templates that satisfy your small business or person requirements and needs.