South Carolina Inquiry of Credit Cardholder Concerning Billing Error is a legal process that allows credit cardholders in South Carolina to address and resolve billing errors on their credit card statements. This inquiry is essential in protecting the rights of consumers and ensuring fair transactions. The inquiry can be initiated by any South Carolina credit cardholder who believes there is an error in their billing statement that needs to be corrected. Keywords: South Carolina, Inquiry, Credit Cardholder, Billing Error, Legal Process, Credit Card Statements, Consumers, Fair Transactions, Corrected. There are two primary types of South Carolina Inquiry of Credit Cardholder Concerning Billing Error: 1. Formal Inquiry: In this type of inquiry, the credit cardholder formally communicates with the credit card company, either through written correspondence or online channels, notifying them of the billing error. The credit cardholder is required to provide detailed information about the error, including the amount, date, and description. The credit card company must acknowledge receipt of the inquiry within 30 days and investigate the error promptly. 2. Informal Inquiry: This type of inquiry involves an informal discussion between the credit cardholder and the credit card company's customer service representative. The credit cardholder can contact the customer service department via phone or email, explaining the billing error and requesting a resolution. The representative will investigate the matter and provide a response to the credit cardholder. If the issue is resolved, no formal documentation is required. The purpose of both types of inquiries is to rectify billing errors, such as unauthorized charges, inaccurate amounts, duplicate charges, or charges for undelivered goods or services. It is crucial for credit cardholders to review their statements regularly and identify any potential errors promptly. Upon receiving a South Carolina Inquiry of Credit Cardholder Concerning Billing Error, the credit card company must investigate the claim within a reasonable timeframe. They should rectify the error by adjusting the billing statement, issuing a credit, or providing a written explanation for denying the claim. It is important for credit cardholders to keep copies of all correspondence and supporting documentation related to the inquiry for future reference. In certain cases where the credit card company fails to provide a satisfactory resolution, the credit cardholder can escalate the matter to appropriate authorities, such as the South Carolina Department of Consumer Affairs or seek legal advice to protect their rights. Overall, the South Carolina Inquiry of Credit Cardholder Concerning Billing Error serves as a vital tool for credit cardholders, ensuring fair and accurate billing practices. It empowers consumers to dispute errors and seek remedies, ultimately promoting transparency and accountability in credit card transactions. Keywords: South Carolina, Inquiry, Credit Cardholder, Billing Error, Formal Inquiry, Informal Inquiry, Legal Process, Credit Card Statements, Consumers, Fair Transactions, Rectify, Unauthorized Charges, Inaccurate Amounts, Duplicate Charges, Undelivered Goods or Services, Prompt Resolution, Documentation, South Carolina Department of Consumer Affairs, Legal Advice, Transparency, Accountability.

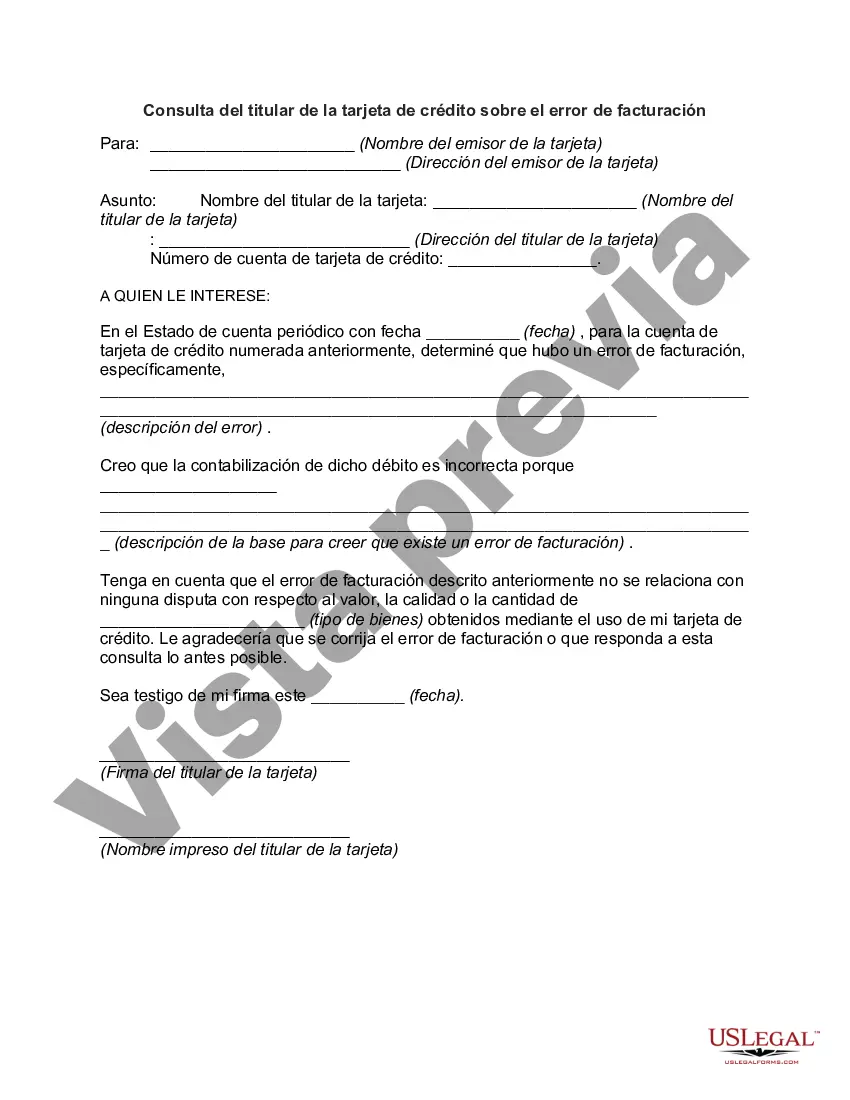

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.South Carolina Consulta del titular de la tarjeta de crédito sobre un error de facturación - Inquiry of Credit Cardholder Concerning Billing Error

Description

How to fill out South Carolina Consulta Del Titular De La Tarjeta De Crédito Sobre Un Error De Facturación?

Choosing the right legitimate record design can be quite a have a problem. Naturally, there are a variety of themes available on the Internet, but how can you obtain the legitimate type you require? Use the US Legal Forms website. The support gives thousands of themes, for example the South Carolina Inquiry of Credit Cardholder Concerning Billing Error, that you can use for organization and private requires. Each of the types are inspected by specialists and meet up with federal and state demands.

In case you are already authorized, log in to the account and click the Acquire switch to get the South Carolina Inquiry of Credit Cardholder Concerning Billing Error. Utilize your account to look from the legitimate types you may have acquired previously. Proceed to the My Forms tab of your account and have an additional version from the record you require.

In case you are a brand new customer of US Legal Forms, allow me to share straightforward recommendations for you to comply with:

- Initially, ensure you have selected the right type for your personal city/area. You may look over the form making use of the Preview switch and study the form description to make certain it is the right one for you.

- In the event the type is not going to meet up with your preferences, utilize the Seach area to discover the correct type.

- Once you are sure that the form would work, click on the Get now switch to get the type.

- Select the costs plan you desire and enter the essential details. Build your account and purchase the order with your PayPal account or charge card.

- Choose the document file format and acquire the legitimate record design to the system.

- Full, modify and produce and indication the received South Carolina Inquiry of Credit Cardholder Concerning Billing Error.

US Legal Forms will be the biggest local library of legitimate types for which you will find different record themes. Use the service to acquire expertly-created documents that comply with condition demands.