South Carolina Breakdown of Savings for Budget and Emergency Fund

Description

How to fill out Breakdown Of Savings For Budget And Emergency Fund?

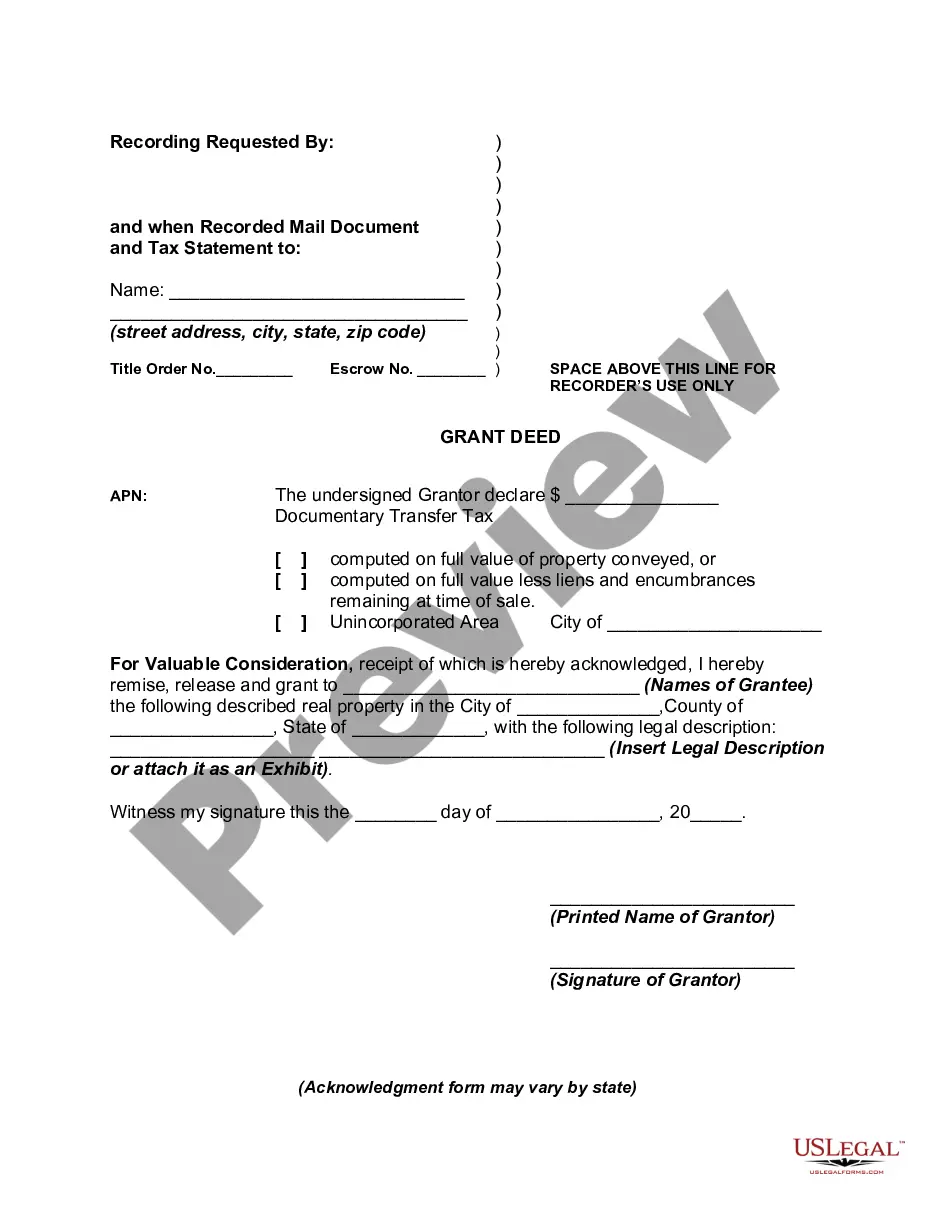

US Legal Forms - one of the most substantial repositories of legal documents in the country - offers a broad selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of forms like the South Carolina Breakdown of Savings for Budget and Emergency Fund within minutes.

If you already have a subscription, Log In and retrieve the South Carolina Breakdown of Savings for Budget and Emergency Fund from your US Legal Forms library. The Acquire button will be present on every document you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use a credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the retrieved South Carolina Breakdown of Savings for Budget and Emergency Fund. Every template you save to your account does not have an expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you require. Access the South Carolina Breakdown of Savings for Budget and Emergency Fund through US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and specifications.

- Ensure you have selected the correct form for your city/county.

- Click the Preview button to check the form's content.

- Read the form description to confirm you have chosen the right form.

- If the form does not meet your needs, use the Search field at the top of the page to locate one that does.

- If you are satisfied with the form, confirm your selection by clicking the Get now button.

- Then, choose the payment plan you prefer and provide your information to sign up for the account.

Form popularity

FAQ

Catastrophe savings accounts allow South Carolina residents to prepare for the financial impact of a catastrophic storm and save on South Carolina income taxes. Catastrophe savings accounts can be established at a state or federally chartered bank. The money can only be held in an interest bearing account.

What is a "Catastrophe Savings Account"? A "Catastrophe Savings Account" is a tax advantaged regular savings account or money market account established after January 1, 2015 by a Mississippi income taxpayer, to assist with post catastrophe losses, or to self insure all or a portion of one's home.

Savings are counted as any money you can get hold of relatively easily, or financial products that can be sold on. These include: cash and money in bank or building society accounts, including current accounts that don't pay interest. National Savings & Investments savings accounts, and Premium Bonds.

Savings is the amount of money left over after spending and other obligations are deducted from earnings. Savings represent money that is otherwise idle and not being put at risk with investments or spent on consumption.

It's our simple guideline for saving and spending: Aim to allocate no more than 50% of take-home pay to essential expenses, save 15% of pretax income for retirement savings, and keep 5% of take-home pay for short-term savings.

Every U.S. state other than Vermont has some form of balanced budget provision that applies to its operating budget. The precise form of this provision varies from state to state. Indiana has a state debt prohibition with an exception for "temporary and casual deficits," but no balanced budget requirement.

It's our simple guideline for saving and spending: Aim to allocate no more than 50% of take-home pay to essential expenses, save 15% of pretax income for retirement savings, and keep 5% of take-home pay for short-term savings. (Your situation may be different, but you can use our framework as a starting point.)

South Carolina's manufacturing activities historically have been typified by low-wage production of fabrics and other nondurable goods, but with shifts in the state's economy since the late 20th century, transportation equipment and other durable goods have become more significant.

Fortunately, unlike the federal government, the state is constitutionally mandated to maintain a balanced budget, so even though the state has racked up an enormous debt load in recent years, the preponderance of the state budget isn't borrowed money.

Among the states, Alaska had the highest per capita state and local spending in 2019 at $17,596, followed by New York ($15,667) and Wyoming ($15,107).