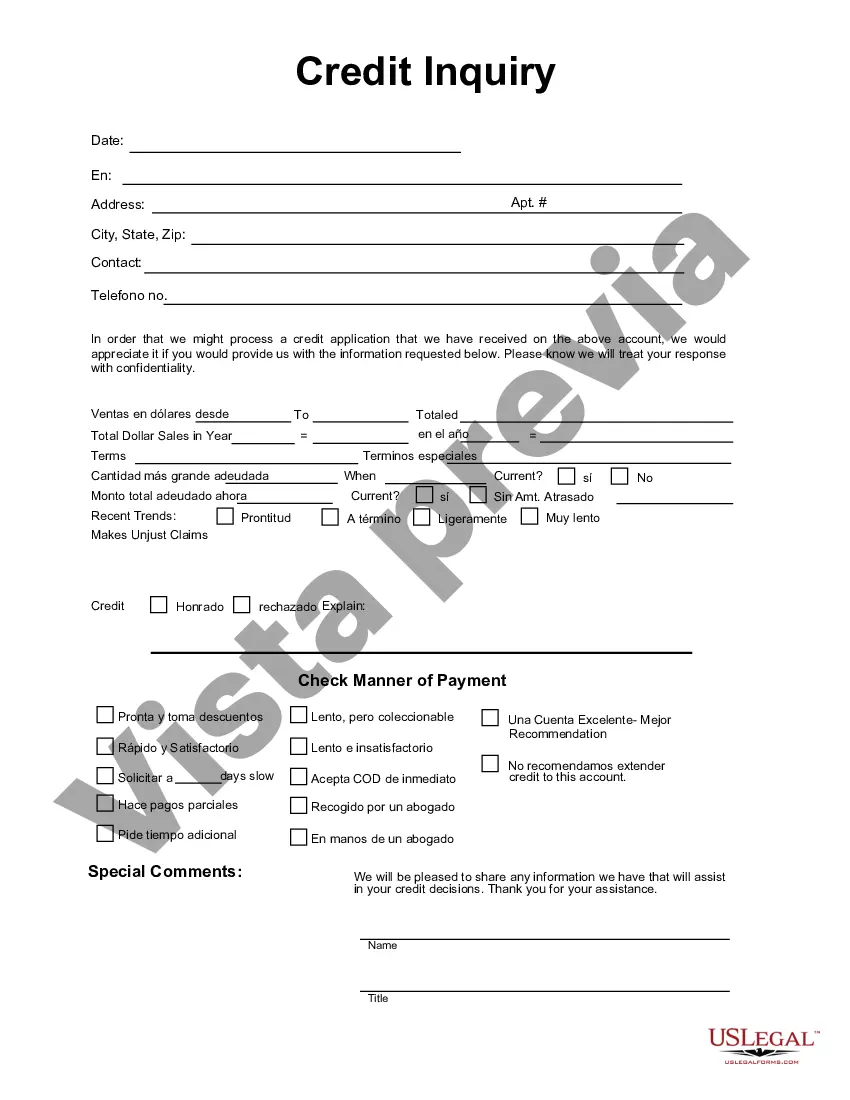

South Carolina Credit Inquiry: A Comprehensive Overview In the state of South Carolina, a credit inquiry refers to the process of assessing an individual's creditworthiness, which is typically carried out by financial institutions, lenders, and credit companies. By performing a credit inquiry, these entities aim to evaluate the credit history and financial health of an individual or business to determine their eligibility for loans, credit lines, or other financial services. There are primarily two types of credit inquiries that can take place in South Carolina: 1. Hard Inquiries: These inquiries occur when a potential lender or creditor reviews an individual's credit report in response to a credit application. Hard inquiries are typically conducted when a person applies for a new credit card, mortgage, auto loan, personal loan, or any other form of credit. Every hard inquiry is recorded on the credit report and may slightly impact the credit score of the individual. It is important to note that too many hard inquiries within a short span of time can negatively affect creditworthiness. 2. Soft Inquiries: Unlike hard inquiries, soft inquiries do not affect an individual's credit score. They occur when a person's credit report is accessed for non-lending purposes, such as pre-approval offers, background checks, or personal finance management. Soft inquiries can also be performed by individuals who want to review their own credit report regularly, helping them to monitor their financial situation and identify potential discrepancies. In South Carolina, credit inquiries play a vital role in determining various aspects of an individual's financial life. Lenders and creditors rely on credit inquiries to assess the level of risk involved in extending credit, offering competitive interest rates, and setting credit limits or terms. Moreover, employers, landlords, and insurance companies may also conduct credit inquiries to evaluate an applicant's financial responsibility and reliability. To maintain a good credit standing in South Carolina, it is essential to stay aware of any credit inquiries made in relation to your profile. Regularly reviewing your credit report and disputing any inaccuracies or unauthorized inquiries is crucial in preserving your financial reputation and ensuring fair credit assessment. In summary, credit inquiries are an integral part of financial transactions and decision-making in South Carolina. Whether they are hard or soft inquiries, understanding their implications, keeping track of them, and maintaining a healthy credit report can significantly impact an individual's ability to access financial services, secure loans, and enjoy favorable terms.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.South Carolina Consulta de crédito - Credit Inquiry

Description

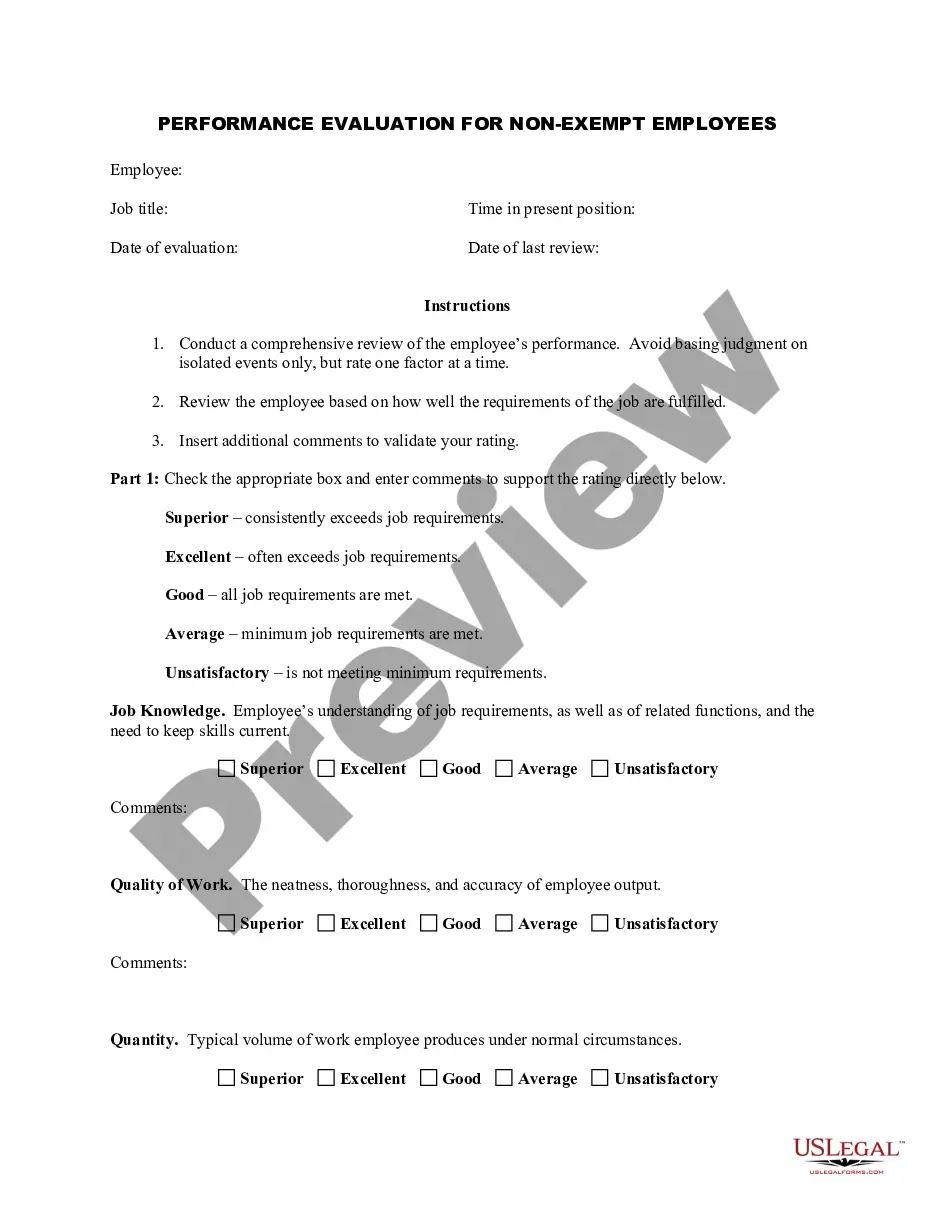

How to fill out South Carolina Consulta De Crédito?

You can spend hrs on the Internet looking for the legal document template that suits the federal and state demands you need. US Legal Forms offers thousands of legal varieties that happen to be reviewed by specialists. You can actually acquire or printing the South Carolina Credit Inquiry from the assistance.

If you already possess a US Legal Forms accounts, it is possible to log in and click on the Down load switch. After that, it is possible to complete, modify, printing, or sign the South Carolina Credit Inquiry. Each legal document template you acquire is your own property permanently. To have yet another duplicate for any bought develop, proceed to the My Forms tab and click on the related switch.

If you are using the US Legal Forms web site for the first time, keep to the simple instructions listed below:

- First, make certain you have chosen the correct document template for the state/area of your liking. Look at the develop outline to make sure you have picked out the proper develop. If offered, use the Review switch to look with the document template as well.

- If you would like find yet another model from the develop, use the Lookup area to find the template that fits your needs and demands.

- When you have found the template you want, click on Get now to continue.

- Choose the pricing program you want, enter your credentials, and register for a merchant account on US Legal Forms.

- Comprehensive the deal. You should use your charge card or PayPal accounts to pay for the legal develop.

- Choose the format from the document and acquire it for your gadget.

- Make adjustments for your document if necessary. You can complete, modify and sign and printing South Carolina Credit Inquiry.

Down load and printing thousands of document layouts while using US Legal Forms website, that provides the most important variety of legal varieties. Use professional and express-particular layouts to take on your company or personal demands.