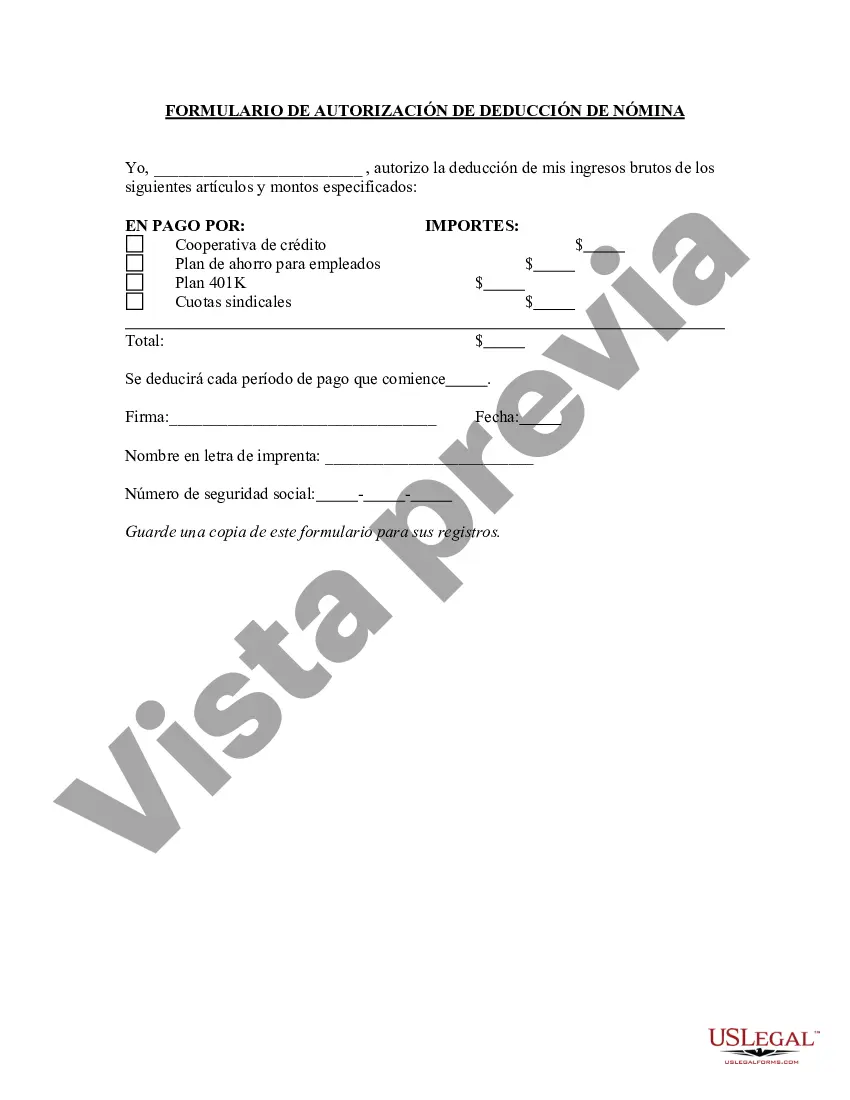

South Carolina Payroll Deduction Authorization Form is a crucial document used by employers in the state of South Carolina to gain consent from their employees regarding specific payroll deductions. This form is an agreement between the employer and the employee that details the various deductions that will be made from the employee's wages. Keywords: South Carolina, payroll deduction, authorization form, employees, consent, employer, deductions, wages. The South Carolina Payroll Deduction Authorization Form is aimed at ensuring a smooth and transparent process for deducting specific amounts from an employee's salary. This form allows for clear communication between employers and employees, as well as legal protection for both parties involved. Some different types of South Carolina Payroll Deduction Authorization Forms may include: 1. Health Insurance Deduction Form: This form allows employees to authorize deductions from their wages to cover the cost of health insurance premiums offered by their employer. It ensures that employees have access to healthcare benefits and that the premiums are paid on time. 2. Retirement Fund Contributions Form: This type of form permits employees to specify the amount that they want to invest in their retirement fund. By authorizing a payroll deduction, employees can contribute a specific percentage or fixed dollar amount from their wages towards their retirement savings. 3. Union Dues Deduction Form: For employees who are part of a union, this form enables them to authorize their employer to deduct union dues from their wages. This ensures that the employees can maintain their union membership and access the benefits provided by the union. 4. Charitable Donation Authorization Form: This form allows employees to make voluntary contributions to charitable organizations directly from their wages. By completing this form, employees can select the amount they wish to donate each pay period, thereby supporting causes they care about. 5. Wage Garnishment Authorization Form: This form is used when a court order or legal procedure requires an employer to withhold a portion of an employee's wages for debt repayment or child support obligations. By completing this form, employees acknowledge and authorize the employer to make the required deductions from their wages. In conclusion, the South Carolina Payroll Deduction Authorization Form is a vital document that outlines the agreement between employers and employees regarding specific payroll deductions. Employers use various types of these forms to deduct amounts for health insurance, retirement contributions, union dues, charitable donations, and wage garnishments. By adhering to the state's laws and obtaining employee consent, this form ensures transparency and compliance in the deduction process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.South Carolina Formulario de Autorización de Deducción de Nómina - Payroll Deduction Authorization Form

Description

How to fill out South Carolina Formulario De Autorización De Deducción De Nómina?

If you wish to full, download, or printing legal record layouts, use US Legal Forms, the biggest assortment of legal forms, which can be found on the Internet. Make use of the site`s basic and handy look for to find the papers you want. Different layouts for organization and person uses are sorted by classes and claims, or key phrases. Use US Legal Forms to find the South Carolina Payroll Deduction Authorization Form in just a few mouse clicks.

When you are currently a US Legal Forms consumer, log in to your accounts and click on the Acquire button to find the South Carolina Payroll Deduction Authorization Form. You may also accessibility forms you in the past delivered electronically in the My Forms tab of your own accounts.

Should you use US Legal Forms for the first time, follow the instructions below:

- Step 1. Be sure you have selected the form to the right city/land.

- Step 2. Take advantage of the Review solution to look through the form`s content. Do not overlook to learn the description.

- Step 3. When you are unsatisfied with the type, use the Lookup field on top of the display screen to discover other models in the legal type template.

- Step 4. Upon having found the form you want, go through the Purchase now button. Opt for the costs program you prefer and add your qualifications to register for the accounts.

- Step 5. Method the purchase. You should use your bank card or PayPal accounts to finish the purchase.

- Step 6. Find the formatting in the legal type and download it on the device.

- Step 7. Comprehensive, modify and printing or indicator the South Carolina Payroll Deduction Authorization Form.

Every single legal record template you buy is your own eternally. You possess acces to each and every type you delivered electronically in your acccount. Select the My Forms segment and decide on a type to printing or download again.

Compete and download, and printing the South Carolina Payroll Deduction Authorization Form with US Legal Forms. There are millions of skilled and condition-specific forms you can utilize for your personal organization or person needs.