South Carolina Flexible Work Hours Audit

Description

How to fill out Flexible Work Hours Audit?

Have you ever found yourself in a location where you require documentation for possibly business or personal reasons almost every day.

There is a wide range of legitimate document templates accessible online, but locating ones you can trust isn't straightforward.

US Legal Forms provides thousands of form templates, such as the South Carolina Flexible Work Hours Audit, designed to comply with state and federal regulations.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the South Carolina Flexible Work Hours Audit template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/area.

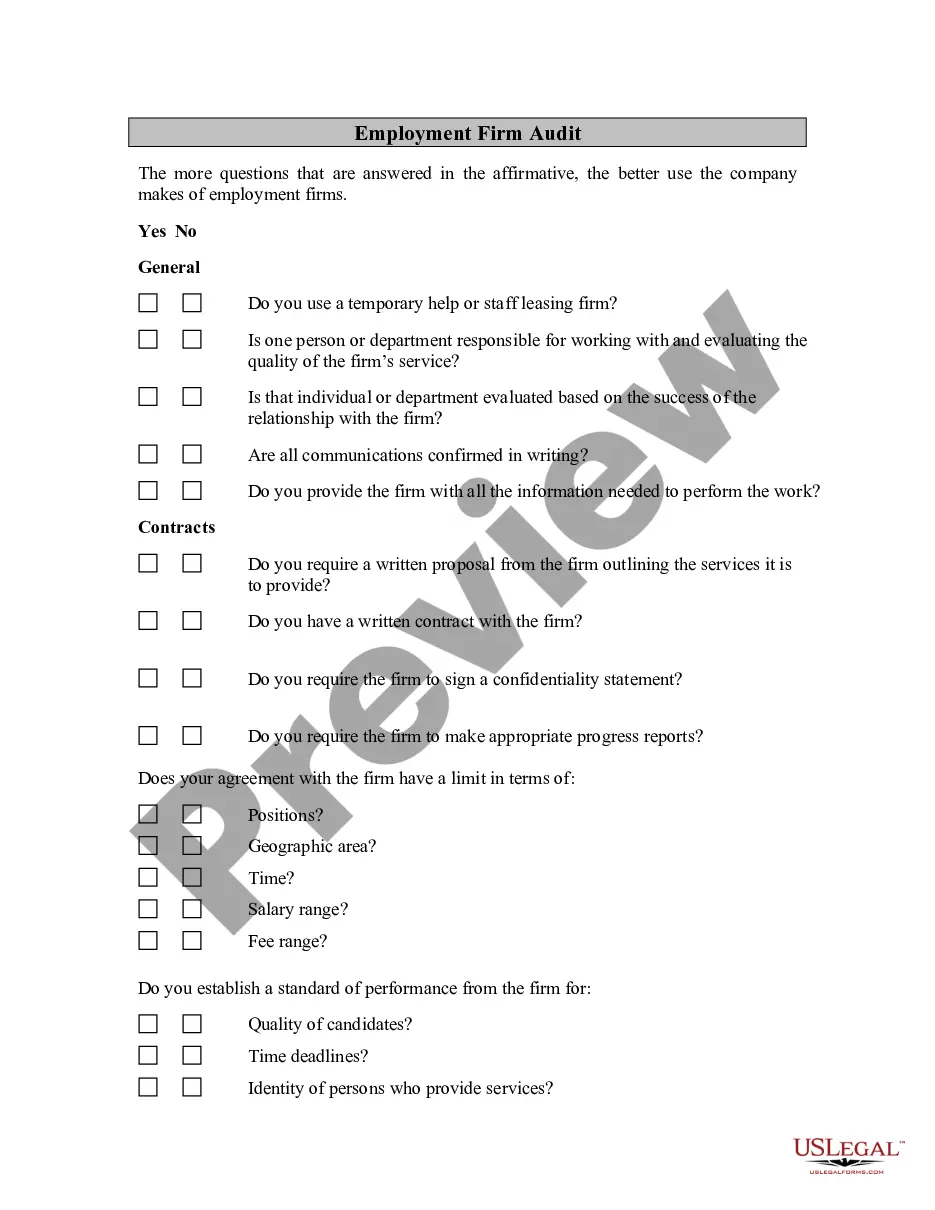

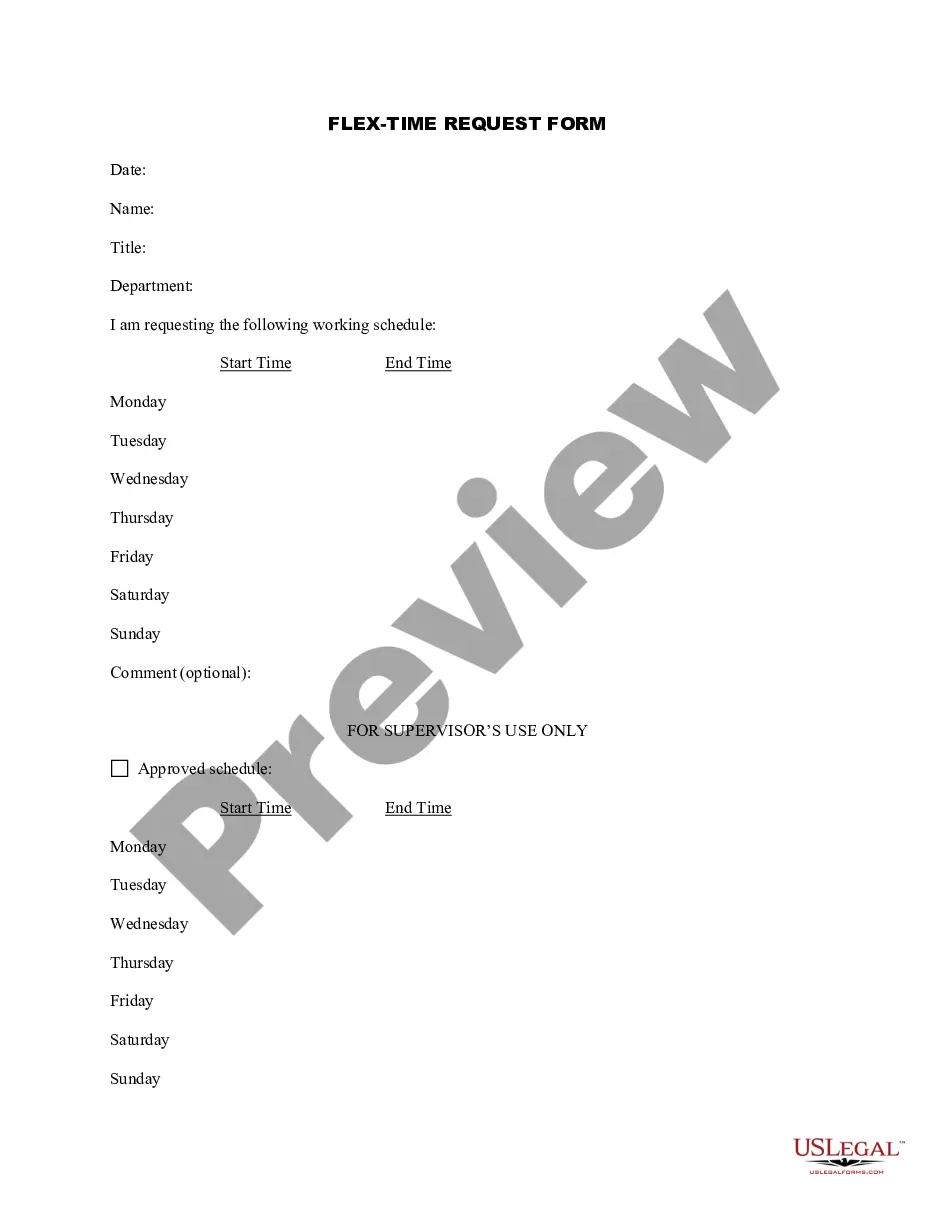

- Utilize the Preview option to review the document.

- Verify the details to ensure you have selected the correct form.

- If the form isn't what you are looking for, use the Lookup field to find the form that fits your needs and specifications.

- Once you find the right form, click on Acquire now.

- Select the pricing plan you wish, fill out the required information to create your account, and complete the purchase using your PayPal or credit card.

- Choose a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the South Carolina Flexible Work Hours Audit whenever necessary; just follow the suitable link to download or print the document template.

- Utilize US Legal Forms, the most extensive collection of legal forms, to save time and prevent errors.

- The service offers professionally crafted legal document templates that can be utilized for a variety of purposes.

- Create an account on US Legal Forms and start making your life a bit easier.

Form popularity

FAQ

Welcome to our Auditor remote jobs!The opportunities can vary from full-time, part-time, freelance, and contract work; and often include job titles such as Senior Technology Auditor, Regulatory Compliance Auditor, and IT Auditor.

For freelancers who aren't as tidy, an audit could turn out to be a much more frightening experience. Freelancers are more likely some say three times more likely to be audited than a big corporation, mostly because there is a larger likelihood of mistakes on tax returns.

Auditing is mostly a desk job In reality, the opposite is true. Because auditors attend frequent client meetings, they often travel to company sites all over the country (and sometimes the world). And because some auditing work can be done autonomously, auditors are also able to work remotely.

Accountants and bookkeepers don't need to sink big bucks into infrastructure anymore. The overheads can be as little as a laptop and business insurance. And because businesses that use cloud accounting software are far more growth-focused, a freelance accountant or bookkeeper can get set up and take off quickly.

When conducting an audit, Department of Labor wage and hour auditors typically inspect employer payroll records for the past two years, reviewing records of both current and former employees.

With the help of technology, most auditors are finding that they're able to effectively work from home but what is still emerging is the degree to which auditors will elect to continue working remotely if given the choice to return to the office.

Internal Auditor SrFlexible schedule including some opportunity to work from home. Within scope of job, requires critical thinking skills, decisive judgement and the ability to work with minimal supervision.

However, public companies must produce audited statements by lawhence the name Certified Public Accountant. So, while you do not need your CPA to get a job, you can do more if you do have your certification. CPAs and private accountants work hand-in-hand.

Employers can reduce the risk of legal and financial exposure by auditing their practices to ensure they comply with federal, state, and local wage and hour law, including the core requirements of: Paying minimum wage and overtime compensation, including understanding: what time is compensable; and.