South Carolina Acknowledgment Form for Consultants or Self-Employed Independent Contractors

Description

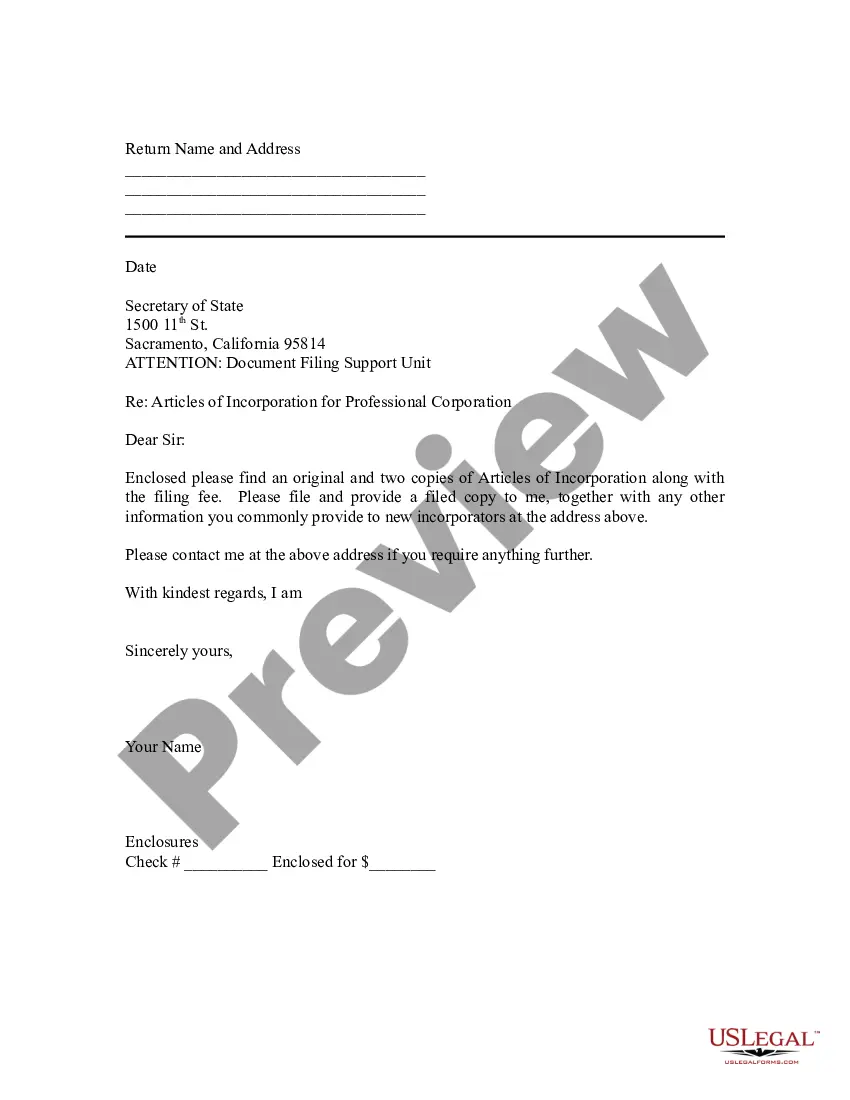

How to fill out Acknowledgment Form For Consultants Or Self-Employed Independent Contractors?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a variety of legal template files that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, sorted by categories, states, or keywords.

You can quickly obtain the latest versions of forms such as the South Carolina Acknowledgment Form for Consultants or Self-Employed Independent Contractors.

Read the form description to confirm you have chosen the right form.

If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you already have a subscription, Log In and download the South Carolina Acknowledgment Form for Consultants or Self-Employed Independent Contractors from the US Legal Forms library.

- The Download button will appear on each form you view.

- You can access all previously acquired forms from the My documents section of your account.

- To use US Legal Forms for the first time, here are straightforward instructions to get started.

- Ensure you have selected the correct form for your city/county.

- Click the Review button to examine the form's content.

Form popularity

FAQ

Yes, you can notarize a document without an acknowledgment, but it may not be the best approach for all reports. The South Carolina Acknowledgment Form for Consultants or Self-Employed Independent Contractors specifically requires acknowledgment to clarify the intent of the signer. Using an acknowledgment form strengthens the document’s enforceability and is often the preferred method to ensure everything is above board and properly executed.

CALIFORNIA ALL-PURPOSE ACKNOWLEDGEMENT. CALIFORNIA ALL-PURPOSE ACKNOWLEDGEMENT. A Notary Public or other officer completing this certificate verifies only the identity of the individual who signed the document to which this certificate is attached, and not the truthfulness, accuracy, or validity of that document.

South Carolina Notaries must have an official seal of office, which may be in the form of an ink stamp or embosser. The seal must contain the following information: Your name as it appears on your commission. The words "Notary Public"

Notaries cannot notarize any documents in which they are a party to or stand to benefit from. The law does not automatically restrict performing services for family members but notaries should exercise caution.

Create a signature line in Word or ExcelIn the document or worksheet, place your pointer where you want to create a signature line.On the Insert tab, in the Text group, click the Signature Line list, and then click Microsoft Office Signature Line.More items...

In short, you cannot notarize your own documents. Despite having the technical understanding, it's against notary laws to certify your own paperwork. This is because being a notary means that you can demonstrate the ability to remain impartial or disinterested in a transaction.

The purpose of an acknowledgment is for a signer, whose identity has been verified, to declare to a Notary or notarial officer that he or she has willingly signed a document.

This is a form that shows that a notary public has established the identity of the signer(s) and witnessed the signature of a document. It only demonstrates that the document has been signed and does not make any claims about the information in the document.

The application must be signed with pen and ink and the signature of the applicant must be acknowledged by a person authorized to administer oaths (§26-1-40). The date of your signature and the date of the notarization must match. You cannot notarize your own signature on the application or at any other time.

South Carolina Governor Henry McMaster recently signed Senate Bill 631 which provides for the electronic notarization of documents. The law went into effect .