This due diligence form is used to summarize data for each LLC associated with the company in business transactions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.South Carolina Resumen de datos de la compañía de responsabilidad limitada - Limited Liability Company Data Summary

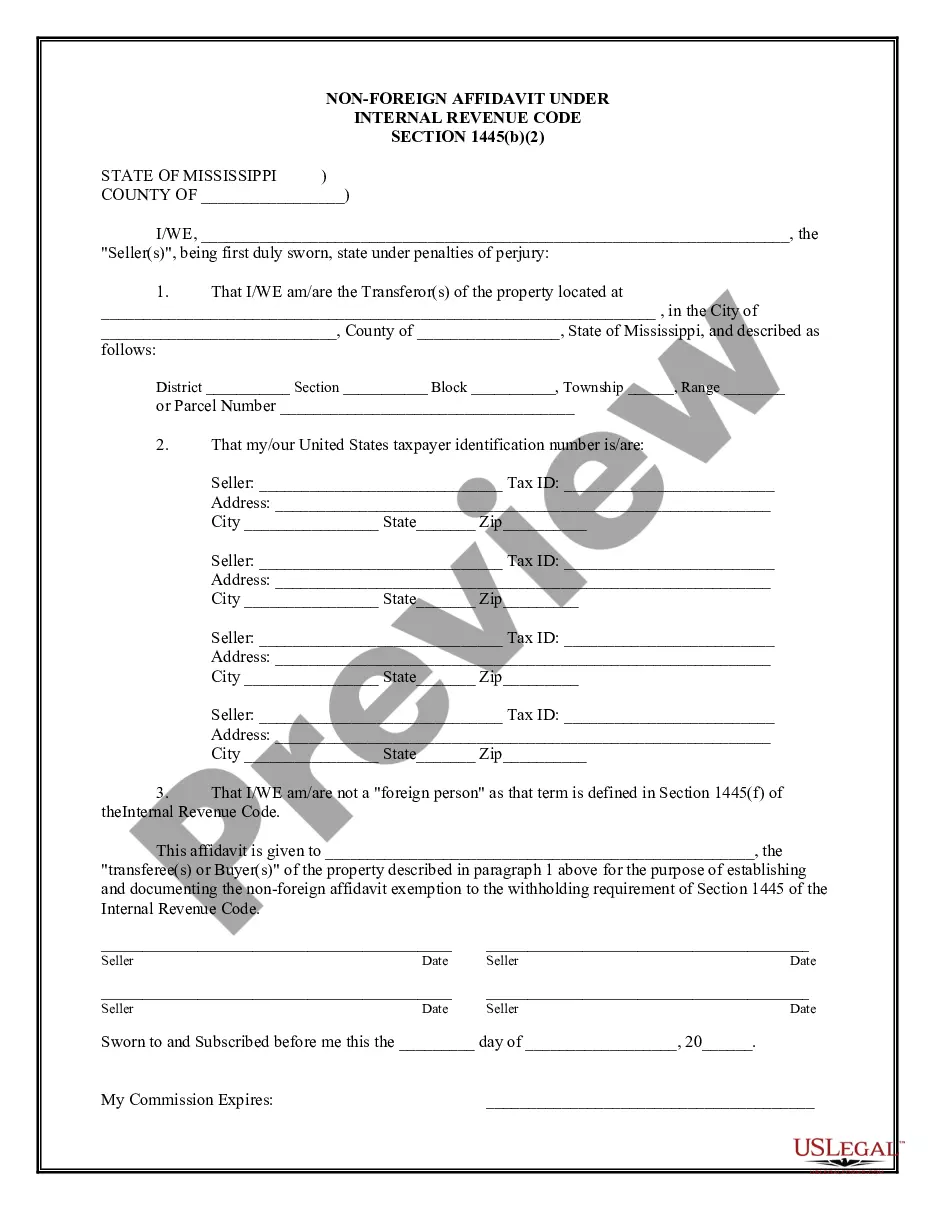

Description

How to fill out South Carolina Resumen De Datos De La Compañía De Responsabilidad Limitada?

Choosing the best legal document web template might be a have a problem. Naturally, there are tons of themes available online, but how can you get the legal develop you require? Use the US Legal Forms website. The service delivers 1000s of themes, such as the South Carolina Limited Liability Company Data Summary, which can be used for company and private requirements. Each of the varieties are checked out by pros and meet state and federal requirements.

In case you are previously authorized, log in in your bank account and click the Download key to find the South Carolina Limited Liability Company Data Summary. Utilize your bank account to appear through the legal varieties you have ordered in the past. Proceed to the My Forms tab of your own bank account and get one more copy in the document you require.

In case you are a brand new end user of US Legal Forms, allow me to share straightforward instructions that you can comply with:

- First, make certain you have selected the correct develop to your metropolis/region. You are able to examine the shape using the Review key and read the shape description to ensure this is the right one for you.

- In case the develop will not meet your needs, make use of the Seach field to find the right develop.

- When you are certain that the shape is acceptable, go through the Get now key to find the develop.

- Opt for the prices prepare you want and enter in the necessary details. Build your bank account and pay for the order utilizing your PayPal bank account or Visa or Mastercard.

- Select the file formatting and download the legal document web template in your gadget.

- Total, revise and produce and signal the attained South Carolina Limited Liability Company Data Summary.

US Legal Forms is the biggest collection of legal varieties that you can find various document themes. Use the company to download appropriately-manufactured paperwork that comply with status requirements.