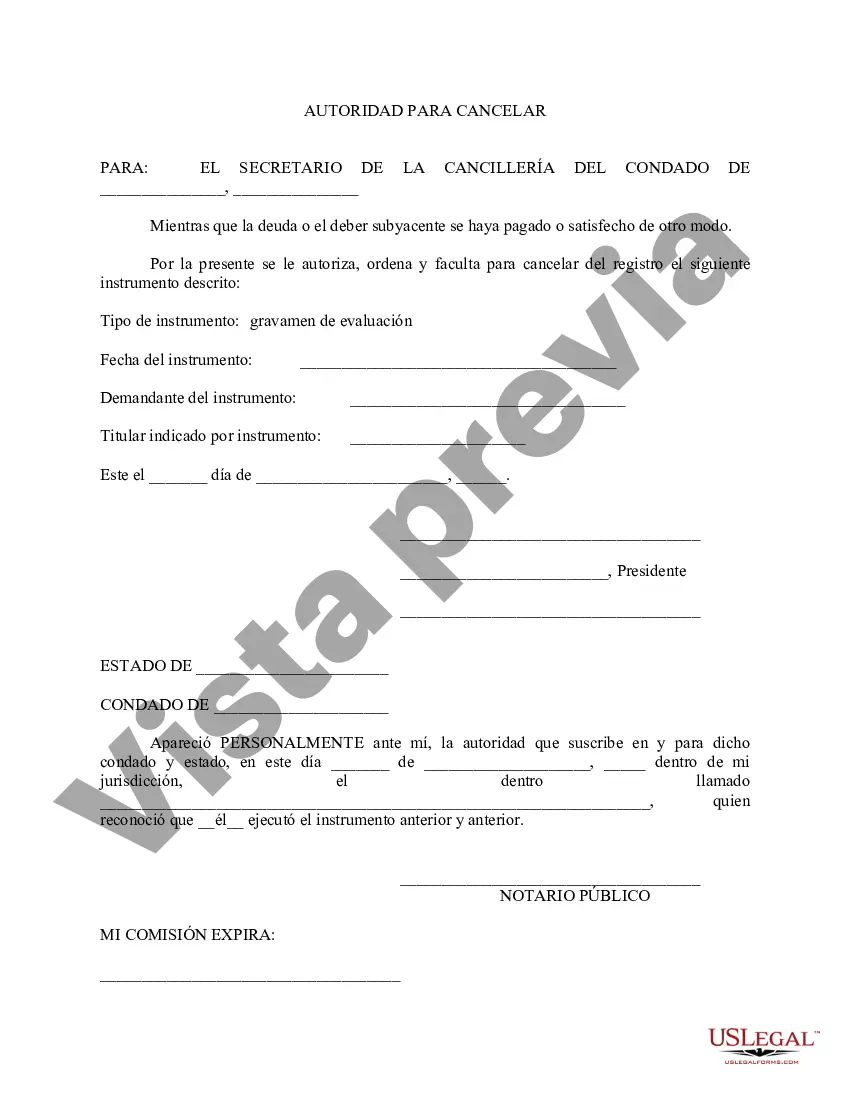

This form is a model Authority to Cancell Lien. Lienholder files with court certifying that indebtedness has been satisfied and lien should be cancelled. Adapt to fit your specific facts and circumstances.

South Dakota Authority to Cancel, also known as the South Dakota Cancellation of Authority, is a legal process by which a business entity registered in South Dakota can terminate its existence or withdraw from operating and conducting business in the state. This process is carried out by filing the necessary documents with the South Dakota Secretary of State. The Authority to Cancel is applicable to different types of business entities, including corporations, limited liability companies (LCS), limited partnerships, limited liability partnerships (Laps), and nonprofit corporations. Each entity type may have its own specific requirements and procedures for cancellation. For corporations, the South Dakota Authority to Cancel is typically initiated by the board of directors or the registered agent of the corporation. The entity must file the appropriate document, such as a Certificate of Termination or Certificate of Dissolution, with the Secretary of State. This document formally notifies the state that the corporation has decided to terminate its existence. For LCS, the process may involve a vote or resolution by the members or managers to dissolve the LLC. The LLC then files a Certificate of Cancellation with the Secretary of State, which includes information such as the name of the LLC, its registered agent, and its effective date of cancellation. Limited partnerships in South Dakota must also follow a similar procedure to cancel their authority. The general partner or a majority of the limited partners may adopt a resolution to dissolve the partnership and proceed with filing a Certificate of Cancellation. Laps, which are typically formed by professionals such as lawyers or accountants, must file a Statement of Cancellation to terminate their authority in South Dakota. This document includes the LLP's name, the date of filing, and the reason for cancellation. Nonprofit corporations, on the other hand, need to follow the specific regulations set forth by the South Dakota Nonprofit Corporation Act to cancel their authority. This may involve obtaining the required approvals from the corporation's board of directors and members, as well as filing a Certificate of Dissolution with the Secretary of State. In summary, South Dakota Authority to Cancel refers to the legal process by which a business entity officially terminates its existence or withdraws from conducting business in the state. The specific requirements and documents vary depending on the entity type, such as corporations, LCS, limited partnerships, Laps, and nonprofit corporations.South Dakota Authority to Cancel, also known as the South Dakota Cancellation of Authority, is a legal process by which a business entity registered in South Dakota can terminate its existence or withdraw from operating and conducting business in the state. This process is carried out by filing the necessary documents with the South Dakota Secretary of State. The Authority to Cancel is applicable to different types of business entities, including corporations, limited liability companies (LCS), limited partnerships, limited liability partnerships (Laps), and nonprofit corporations. Each entity type may have its own specific requirements and procedures for cancellation. For corporations, the South Dakota Authority to Cancel is typically initiated by the board of directors or the registered agent of the corporation. The entity must file the appropriate document, such as a Certificate of Termination or Certificate of Dissolution, with the Secretary of State. This document formally notifies the state that the corporation has decided to terminate its existence. For LCS, the process may involve a vote or resolution by the members or managers to dissolve the LLC. The LLC then files a Certificate of Cancellation with the Secretary of State, which includes information such as the name of the LLC, its registered agent, and its effective date of cancellation. Limited partnerships in South Dakota must also follow a similar procedure to cancel their authority. The general partner or a majority of the limited partners may adopt a resolution to dissolve the partnership and proceed with filing a Certificate of Cancellation. Laps, which are typically formed by professionals such as lawyers or accountants, must file a Statement of Cancellation to terminate their authority in South Dakota. This document includes the LLP's name, the date of filing, and the reason for cancellation. Nonprofit corporations, on the other hand, need to follow the specific regulations set forth by the South Dakota Nonprofit Corporation Act to cancel their authority. This may involve obtaining the required approvals from the corporation's board of directors and members, as well as filing a Certificate of Dissolution with the Secretary of State. In summary, South Dakota Authority to Cancel refers to the legal process by which a business entity officially terminates its existence or withdraws from conducting business in the state. The specific requirements and documents vary depending on the entity type, such as corporations, LCS, limited partnerships, Laps, and nonprofit corporations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.