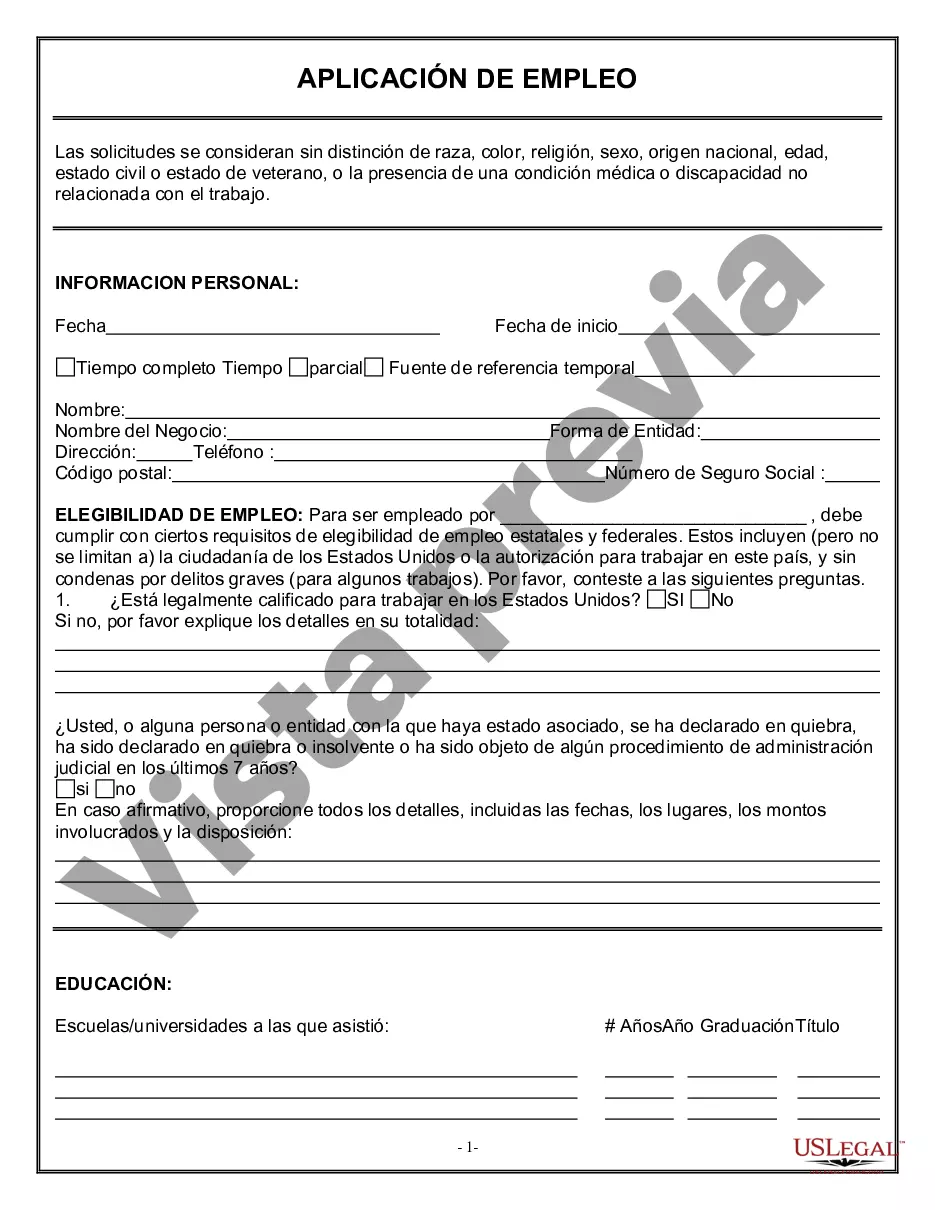

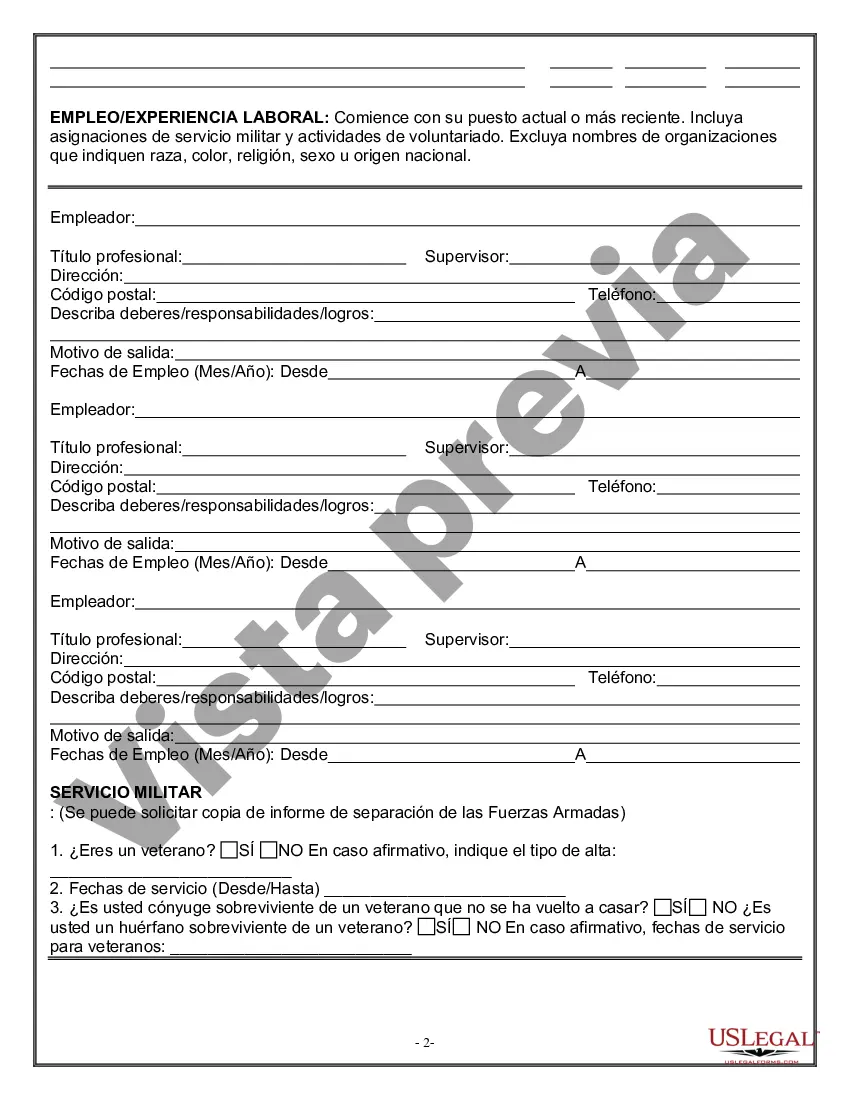

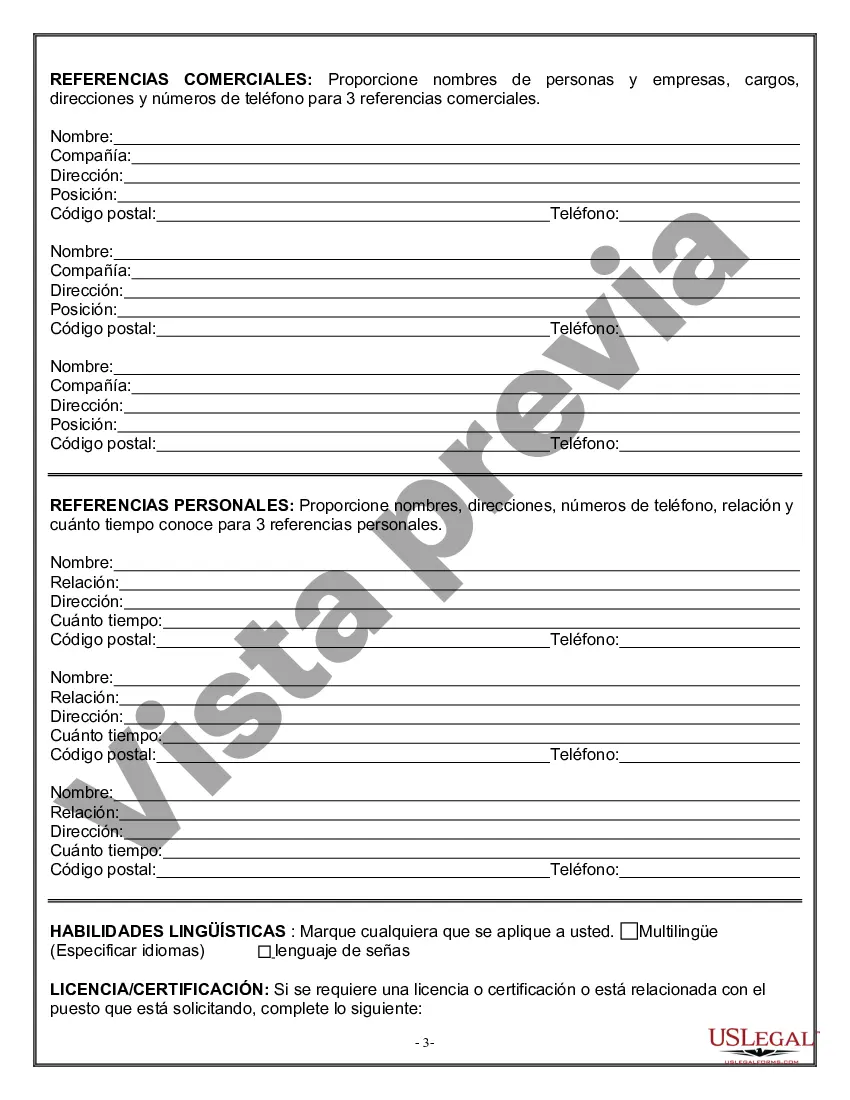

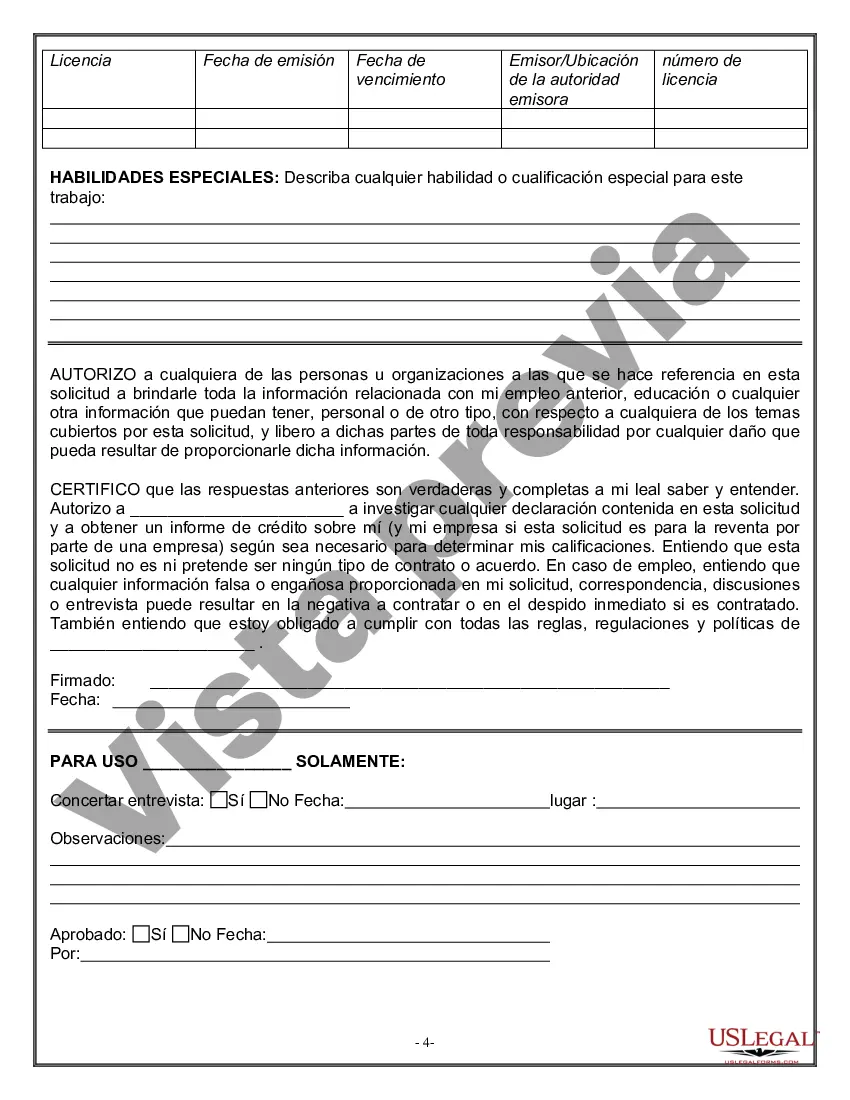

The South Dakota Employment Application for Accountant is a crucial document used by individuals interested in applying for accountant positions within the state of South Dakota. This application serves as the first step in the hiring process and provides employers with comprehensive information about the applicant's qualifications, skills, education, and experience in the field of accounting. The employment application typically starts with general information such as the applicant's full name, contact details (including address, phone number, and email), and social security number. It may also require the applicant to indicate their preferred job title or position, as well as their availability to work (part-time, full-time, or temporary). Next, the application delves into the applicant's educational background. Here, the applicant is expected to provide details about their highest level of education obtained (e.g., Bachelor's degree in Accounting) and the name and location of the educational institution attended. Additionally, the application may require the applicant to disclose any certifications or licenses they hold, such as Certified Public Accountant (CPA) or Chartered Accountant (CA). Moving on, the application asks the applicant to provide a detailed account of their previous work experience. This entails listing previous employers, job titles, dates of employment, and a description of job responsibilities and accomplishments in each role. Keywords to include here may be "financial analysis," "bookkeeping," "tax preparation," "audit," "budgeting," and "financial reporting." This section might also request the applicant to mention reasons for leaving previous positions and contact details of supervisors for references. The application may also ask about specific skills and knowledge relevant to accounting, including proficiency in accounting software such as QuickBooks, Excel, or SAP. It may inquire about the applicant's experience with financial analysis, general ledger maintenance, payroll, accounts payable/receivable, or tax compliance. Additionally, the applicant may be required to provide a brief narrative explaining their approach to problem-solving, auditing processes, or financial statement preparation. In terms of personal information, the application typically seeks disclosure regarding criminal records, driving records (if applicable to the position), and any professional disciplinary actions. The applicant may also be asked to answer questions related to their ability to meet the physical demands of the job, including lifting heavy objects or prolonged sitting. It is worth noting that there might not be different types of South Dakota Employment Applications specific to accountants. However, variations may exist in terms of the format or layout used by individual employers or government agencies. It is essential for applicants to carefully review the specific application requirements provided by the hiring entity to ensure they complete the correct form accurately. In conclusion, the South Dakota Employment Application for Accountant is a comprehensive document that enables employers to assess an applicant's qualifications and suitability for accounting positions within the state. By providing detailed information about educational background, work experience, skills, and personal information, applicants can present a compelling case for their suitability and increase their chances of being considered for employment.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.South Dakota Solicitud de Empleo para Contador - Employment Application for Accountant

Description

How to fill out South Dakota Solicitud De Empleo Para Contador?

You can devote hrs on the web looking for the lawful file design that meets the state and federal needs you need. US Legal Forms offers a large number of lawful varieties which can be reviewed by experts. It is possible to obtain or print out the South Dakota Employment Application for Accountant from your services.

If you currently have a US Legal Forms bank account, you may log in and then click the Down load option. After that, you may total, edit, print out, or indicator the South Dakota Employment Application for Accountant. Every lawful file design you get is yours forever. To acquire another backup of any bought type, go to the My Forms tab and then click the corresponding option.

Should you use the US Legal Forms internet site initially, stick to the simple recommendations under:

- First, make sure that you have chosen the proper file design for your county/area that you pick. See the type description to make sure you have picked out the correct type. If accessible, take advantage of the Preview option to search throughout the file design also.

- In order to get another model of your type, take advantage of the Look for industry to find the design that suits you and needs.

- Once you have discovered the design you would like, click on Get now to carry on.

- Select the pricing plan you would like, type in your accreditations, and register for a merchant account on US Legal Forms.

- Complete the financial transaction. You should use your charge card or PayPal bank account to purchase the lawful type.

- Select the formatting of your file and obtain it in your system.

- Make modifications in your file if needed. You can total, edit and indicator and print out South Dakota Employment Application for Accountant.

Down load and print out a large number of file templates utilizing the US Legal Forms web site, which provides the biggest selection of lawful varieties. Use specialist and condition-specific templates to take on your small business or individual requirements.