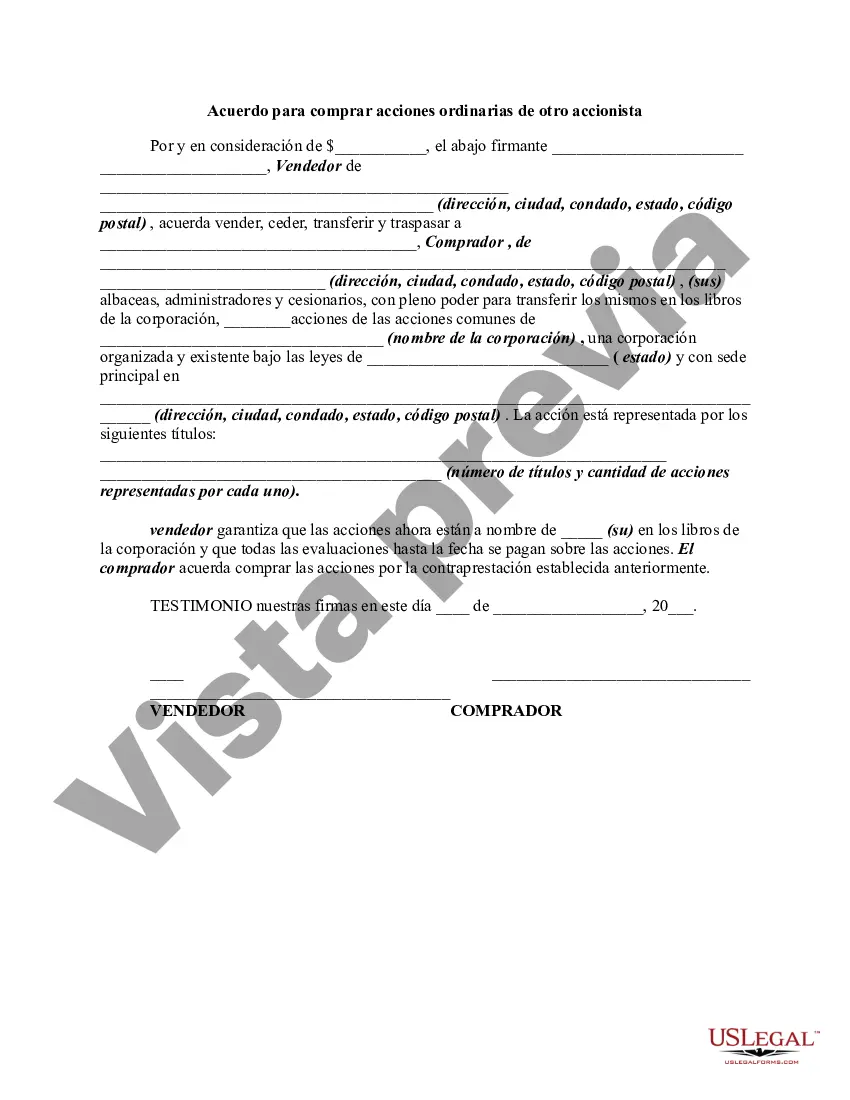

A corporation is owned by its shareholders. An ownership interest in a corporation is represented by a share or stock certificate. A certificate of stock or share certificate evidences the shareholder's ownership of stock. The ownership of shares may be transferred by delivery of the certificate of stock endorsed by its owner in blank or to a specified person. Ownership may also be transferred by the delivery of the certificate along with a separate assignment. This form is a sample of an agreement to purchase common stock from another stockholder.

Title: Understanding the South Dakota Agreement to Purchase Common Stock from another Stockholder Introduction: In the world of finance and stock markets, agreements to purchase common stock from another stockholder play a crucial role in facilitating transactions and shaping the ownership landscape. South Dakota, renowned for its business-friendly environment, also has its unique provisions and requirements for such agreements. This article aims to provide a detailed description of the South Dakota Agreement to Purchase Common Stock from another Stockholder, shedding light on its key aspects, types, and relevant keywords. Key Keywords: South Dakota, Agreement, Purchase, Common Stock, Stockholder I. Understanding the South Dakota Agreement to Purchase Common Stock: 1. Definition and Purpose: — A South Dakota Agreement to Purchase Common Stock is a binding contract between a buyer and a seller, facilitating the transfer of common stock ownership. — The purpose of this agreement is to document the terms and conditions, including the price, quantity, and timeframe, under which the stock purchase occurs. 2. Key Elements: a. Parties: The agreement must include the names and details of both the buyer and the seller, ensuring legal clarity and identification. b. Purchase Price: The agreed amount at which the common stock will be transferred from the seller to the buyer. c. Quantity: The number of common stock shares being purchased. d. Closing Date: The date when the transaction should be completed and ownership transferred. e. Representations and Warranties: Accurate information about the stock, its ownership, and related corporate documents, ensuring transparency and mitigating risks. f. Conditions Precedent: Any specific conditions or requirements that need to be met before the transaction is finalized. g. Indemnification: Provisions for indemnifying either party against any losses or damage resulting from the agreement's breach. h. Governing Law: Specifies that the agreement will be governed by and interpreted under the laws of South Dakota. i. Confidentiality: The confidentiality obligations of both parties regarding any non-public information shared during the transaction process. II. Types of South Dakota Agreements to Purchase Common Stock: 1. Stock Purchase Agreement: — This type of agreement represents a standard transaction involving the transfer of common stock from one stockholder to another. — It encompasses all the key elements mentioned earlier and serves as the foundation for stock transactions. 2. Restricted Stock Purchase Agreement: — This agreement is specifically designed for the purchase of restricted stock, subject to certain limitations or conditions imposed by the issuer. — It may include provisions regarding sale restrictions, holding periods, and potential forfeiture of shares. 3. Stock Option Purchase Agreement: — This agreement focuses on the purchase of stock options, allowing the buyer to acquire a fixed number of shares at a predetermined price within a specified period. — It outlines the terms for exercising the option and may involve unique considerations such as vesting schedules and expiration dates. Conclusion: The South Dakota Agreement to Purchase Common Stock from another Stockholder is an essential legal document governing stock transactions within South Dakota. By understanding its elements and types such as Stock Purchase, Restricted Stock Purchase, and Stock Option Purchase agreements, individuals can ensure legality, transparency, and a successful transfer of ownership. Properly crafted agreements build trust, safeguard investments, and underpin a flourishing business environment in South Dakota.Title: Understanding the South Dakota Agreement to Purchase Common Stock from another Stockholder Introduction: In the world of finance and stock markets, agreements to purchase common stock from another stockholder play a crucial role in facilitating transactions and shaping the ownership landscape. South Dakota, renowned for its business-friendly environment, also has its unique provisions and requirements for such agreements. This article aims to provide a detailed description of the South Dakota Agreement to Purchase Common Stock from another Stockholder, shedding light on its key aspects, types, and relevant keywords. Key Keywords: South Dakota, Agreement, Purchase, Common Stock, Stockholder I. Understanding the South Dakota Agreement to Purchase Common Stock: 1. Definition and Purpose: — A South Dakota Agreement to Purchase Common Stock is a binding contract between a buyer and a seller, facilitating the transfer of common stock ownership. — The purpose of this agreement is to document the terms and conditions, including the price, quantity, and timeframe, under which the stock purchase occurs. 2. Key Elements: a. Parties: The agreement must include the names and details of both the buyer and the seller, ensuring legal clarity and identification. b. Purchase Price: The agreed amount at which the common stock will be transferred from the seller to the buyer. c. Quantity: The number of common stock shares being purchased. d. Closing Date: The date when the transaction should be completed and ownership transferred. e. Representations and Warranties: Accurate information about the stock, its ownership, and related corporate documents, ensuring transparency and mitigating risks. f. Conditions Precedent: Any specific conditions or requirements that need to be met before the transaction is finalized. g. Indemnification: Provisions for indemnifying either party against any losses or damage resulting from the agreement's breach. h. Governing Law: Specifies that the agreement will be governed by and interpreted under the laws of South Dakota. i. Confidentiality: The confidentiality obligations of both parties regarding any non-public information shared during the transaction process. II. Types of South Dakota Agreements to Purchase Common Stock: 1. Stock Purchase Agreement: — This type of agreement represents a standard transaction involving the transfer of common stock from one stockholder to another. — It encompasses all the key elements mentioned earlier and serves as the foundation for stock transactions. 2. Restricted Stock Purchase Agreement: — This agreement is specifically designed for the purchase of restricted stock, subject to certain limitations or conditions imposed by the issuer. — It may include provisions regarding sale restrictions, holding periods, and potential forfeiture of shares. 3. Stock Option Purchase Agreement: — This agreement focuses on the purchase of stock options, allowing the buyer to acquire a fixed number of shares at a predetermined price within a specified period. — It outlines the terms for exercising the option and may involve unique considerations such as vesting schedules and expiration dates. Conclusion: The South Dakota Agreement to Purchase Common Stock from another Stockholder is an essential legal document governing stock transactions within South Dakota. By understanding its elements and types such as Stock Purchase, Restricted Stock Purchase, and Stock Option Purchase agreements, individuals can ensure legality, transparency, and a successful transfer of ownership. Properly crafted agreements build trust, safeguard investments, and underpin a flourishing business environment in South Dakota.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.