This form involves the sale or gift of a small business from one individual to another. The word memorandum is sometimes used when the agreement and transfer has already taken place, but has not yet been reduced to writing. If the transfer is a gift (e.g., on family member to another), the figure of $1.00 could be used or $0.00. Another alternative could be to write the word gift in the blank for the consideration.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

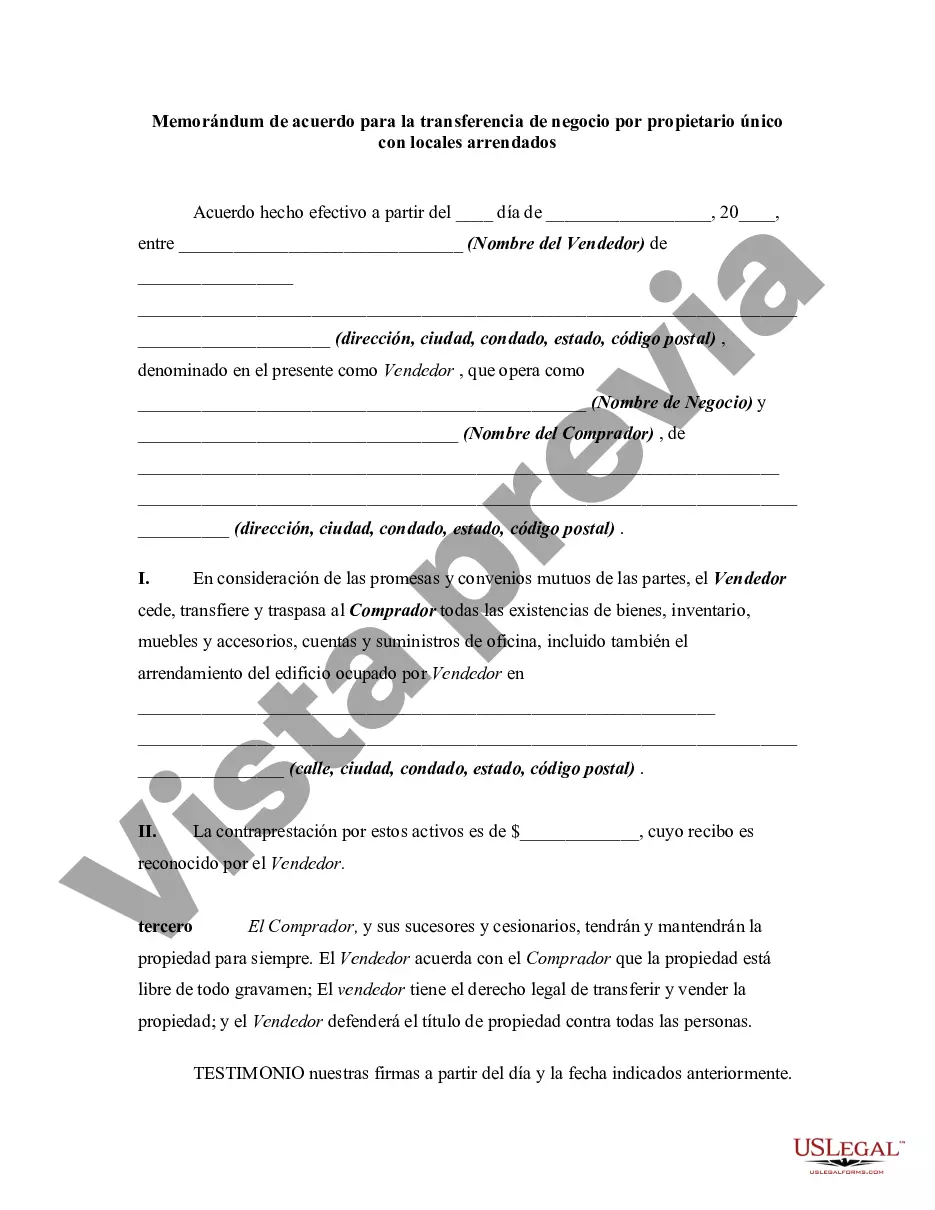

The South Dakota Memorandum of Agreement for Transfer of Business by Sole Proprietorship with Leased Premises is a legal document that outlines the terms and conditions for transferring ownership and operational control of a business from one sole proprietor to another. It is specifically designed for businesses that operate on leased premises within the state of South Dakota. This memorandum is essential for both parties involved in the transfer to have a clear understanding of their rights, obligations, and expectations. Keywords: South Dakota, Memorandum of Agreement, Transfer of Business, Sole Proprietorship, Leased Premises, legal document, ownership, operational control, rights, obligations, expectations. There may be different types of South Dakota Memorandum of Agreement for Transfer of Business by Sole Proprietorship with Leased Premises, such as: 1. Standard Agreement: This is a general template that covers the essential elements of transferring a sole proprietorship business with leased premises. It includes provisions for the transfer of assets, lease assignment, rights and responsibilities, purchase price, warranty, and more. 2. Partial Transfer Agreement: In some cases, a sole proprietor might want to transfer only a portion of their business to another individual or entity. This type of agreement specifies the specific assets or aspects being transferred, while leaving the existing sole proprietorship intact. 3. Lease Amendment Agreement: If the transfer of the business requires making changes to the existing lease agreement, a separate amendment agreement may be necessary. This document outlines the modifications to the lease terms, the responsibilities of the new owner, and any additional clauses required for a seamless transfer. 4. Financial Terms Addendum: In certain situations, the parties involved may choose to include an addendum that emphasizes the financial terms of the transfer. This could include details about payment schedules, financing arrangements, and any other financial considerations that are unique to the specific agreement. It's important to consult with a qualified attorney or legal professional specializing in business and contractual matters to determine which type of South Dakota Memorandum of Agreement for Transfer of Business by Sole Proprietorship with Leased Premises is most suitable for your specific circumstances.The South Dakota Memorandum of Agreement for Transfer of Business by Sole Proprietorship with Leased Premises is a legal document that outlines the terms and conditions for transferring ownership and operational control of a business from one sole proprietor to another. It is specifically designed for businesses that operate on leased premises within the state of South Dakota. This memorandum is essential for both parties involved in the transfer to have a clear understanding of their rights, obligations, and expectations. Keywords: South Dakota, Memorandum of Agreement, Transfer of Business, Sole Proprietorship, Leased Premises, legal document, ownership, operational control, rights, obligations, expectations. There may be different types of South Dakota Memorandum of Agreement for Transfer of Business by Sole Proprietorship with Leased Premises, such as: 1. Standard Agreement: This is a general template that covers the essential elements of transferring a sole proprietorship business with leased premises. It includes provisions for the transfer of assets, lease assignment, rights and responsibilities, purchase price, warranty, and more. 2. Partial Transfer Agreement: In some cases, a sole proprietor might want to transfer only a portion of their business to another individual or entity. This type of agreement specifies the specific assets or aspects being transferred, while leaving the existing sole proprietorship intact. 3. Lease Amendment Agreement: If the transfer of the business requires making changes to the existing lease agreement, a separate amendment agreement may be necessary. This document outlines the modifications to the lease terms, the responsibilities of the new owner, and any additional clauses required for a seamless transfer. 4. Financial Terms Addendum: In certain situations, the parties involved may choose to include an addendum that emphasizes the financial terms of the transfer. This could include details about payment schedules, financing arrangements, and any other financial considerations that are unique to the specific agreement. It's important to consult with a qualified attorney or legal professional specializing in business and contractual matters to determine which type of South Dakota Memorandum of Agreement for Transfer of Business by Sole Proprietorship with Leased Premises is most suitable for your specific circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.