South Dakota Revocable Trust for Real Estate

Description

How to fill out Revocable Trust For Real Estate?

Have you ever found yourself in a situation where you require documentation for either business or individual reasons nearly every time.

There are numerous legal document templates accessible online, but locating reliable ones can be challenging.

US Legal Forms offers a vast array of form templates, such as the South Dakota Revocable Trust for Real Estate, which are designed to fulfill state and federal specifications.

Once you find the correct form, click Purchase now.

Select your desired pricing plan, fill in the required information to create your payment, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After logging in, you can download the South Dakota Revocable Trust for Real Estate template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it corresponds to the correct city/state.

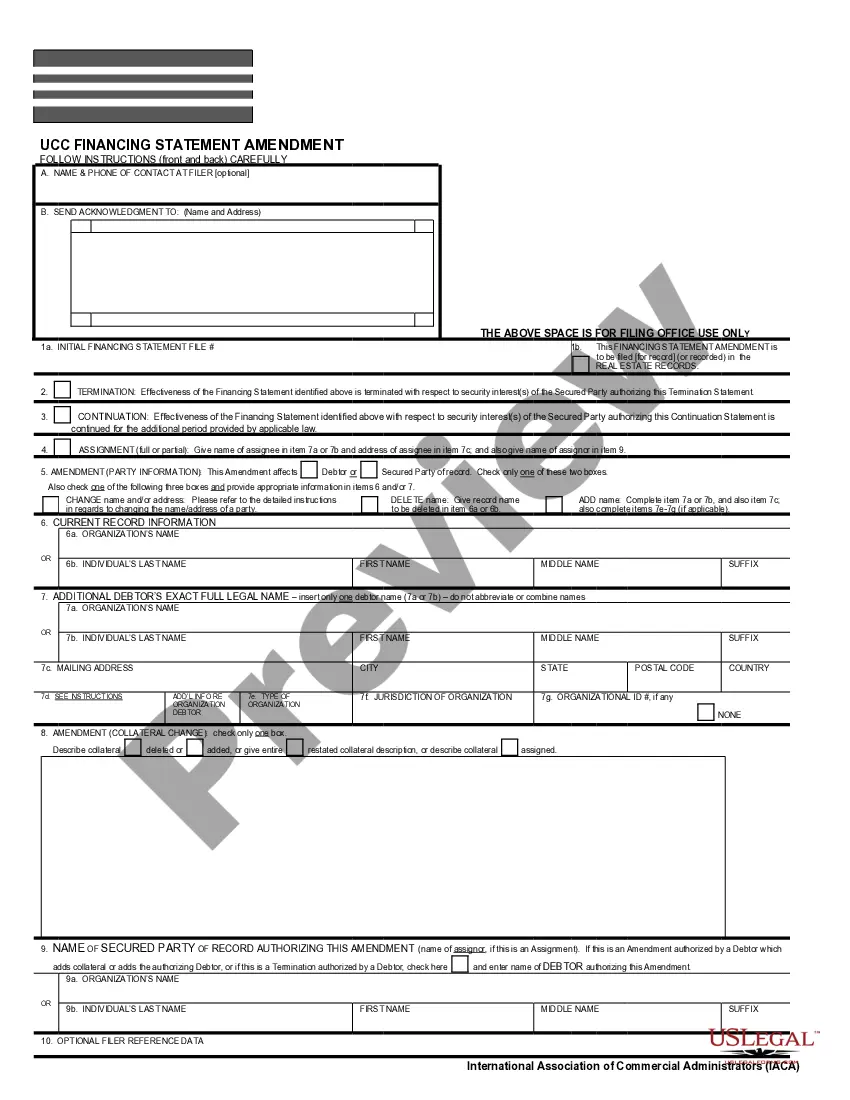

- Utilize the Review button to review the form.

- Read the details to confirm that you've selected the right form.

- If the form isn’t what you’re looking for, use the Lookup area to find the form that meets your needs.

Form popularity

FAQ

People choose to place a house in a South Dakota Revocable Trust for Real Estate to ensure a seamless transfer of ownership upon death. This approach helps avoid the lengthy probate process, which can tie up assets for months. Moreover, it provides peace of mind, knowing your wishes regarding property distribution are honored.

Placing your home in a South Dakota Revocable Trust for Real Estate can be a wise choice for many homeowners. It simplifies the transferring of assets upon your death and avoids probate, making the process smoother for your loved ones. Additionally, you maintain control over the assets during your lifetime, allowing flexibility if your needs change.

Using a South Dakota Revocable Trust for Real Estate has some drawbacks. First, you may face upfront costs associated with creating and funding the trust. Additionally, transferring your property can complicate your mortgage arrangements. Finally, some people worry that a trust may not provide the same level of asset protection as other estate planning options.

A South Dakota Revocable Trust for Real Estate must meet several legal requirements, such as having a clear purpose and identifiable beneficiaries. The trust should be in writing and signed by the grantor. Furthermore, the trust must include a trustee who is responsible for managing the trust assets in accordance with the trust document.

When creating a South Dakota Revocable Trust for Real Estate, avoid putting assets you rely on for day-to-day living, such as your primary residence if you lack a successor trustee. Additionally, certain retirement accounts like IRAs might not be suitable for a revocable trust. Always consult a professional to make informed decisions about asset placement.

To establish a South Dakota Revocable Trust for Real Estate, start by drafting a trust document that outlines your wishes. You may wish to consult with a legal expert to ensure all requirements are met. Then, transfer your property into the trust, ensuring that you follow South Dakota laws to make it enforceable.

Setting up a South Dakota Revocable Trust for Real Estate can be worth it for many individuals. This type of trust allows you to avoid probate, streamline asset distribution, and maintain privacy. For those with significant assets or specific estate planning goals, the benefits often outweigh the costs of setup and maintenance.

While a South Dakota Revocable Trust for Real Estate offers flexibility and control over your assets, some downsides exist. One common concern is that a revocable trust does not provide protection from creditors. Additionally, maintaining and funding the trust requires effort and attention, which may not be appealing to everyone.

Filing taxes for a South Dakota Revocable Trust for Real Estate involves including the trust's income on your personal return without separate forms for the trust. You should gather all pertinent documents that reflect the income generated from trust assets and ensure accuracy in reporting. Using platforms like USLegalForms can help streamline the process, offering resources and guidance tailored to your needs.

Yes, a South Dakota Revocable Trust for Real Estate is generally disregarded for tax purposes, meaning the trust's income is treated as yours for tax reporting. The IRS views it as a pass-through entity, and thus you report all income on your individual tax returns. This feature simplifies tax obligations and allows you to maintain control over your property while enjoying the benefits of the trust.