A South Dakota Revocable Trust for Real Estate is a legal agreement that allows a property owner to transfer their real estate assets into a trust, providing them with added control, flexibility, and potential tax benefits. This type of trust is revocable, meaning it can be altered, modified, or terminated by the granter (the individual creating the trust) during their lifetime. One type of South Dakota Revocable Trust for Real Estate is the South Dakota Irrevocable Trust. Unlike a revocable trust, an irrevocable trust cannot be modified or terminated without the consent of the beneficiaries. This type of trust often offers additional asset protection benefits and may be used for estate planning or philanthropic purposes. Another type is the South Dakota Testamentary Trust. This trust is created within a last will and testament and comes into effect upon the death of the granter. It allows the granter to specify how their real estate assets should be managed and distributed to beneficiaries after their passing. South Dakota Dynasty Trusts are also relevant in the context of real estate. These trusts are designed to provide long-term asset management for multiple generations and offer significant tax advantages. Property held within a dynasty trust can be passed down from one generation to another without incurring estate taxes. South Dakota Qualified Personnel Residence Trust (PRT) is yet another type of trust used in real estate planning. With a PRT, an individual can transfer their primary residence or vacation home into the trust while retaining the right to use the property for a specific period. This allows the granter to reduce gift and estate taxes while still enjoying the benefits of owning the property. Overall, South Dakota Revocable Trusts for Real Estate provide property owners with various options to protect and manage their assets in a manner that aligns with their estate planning goals. Whether it's the irrevocable trust, testamentary trust, dynasty trust, or PRT, each trust type offers unique advantages to suit different circumstances and objectives. It is crucial to consult with a knowledgeable attorney or estate planner to maximize the benefits of establishing such trusts in South Dakota.

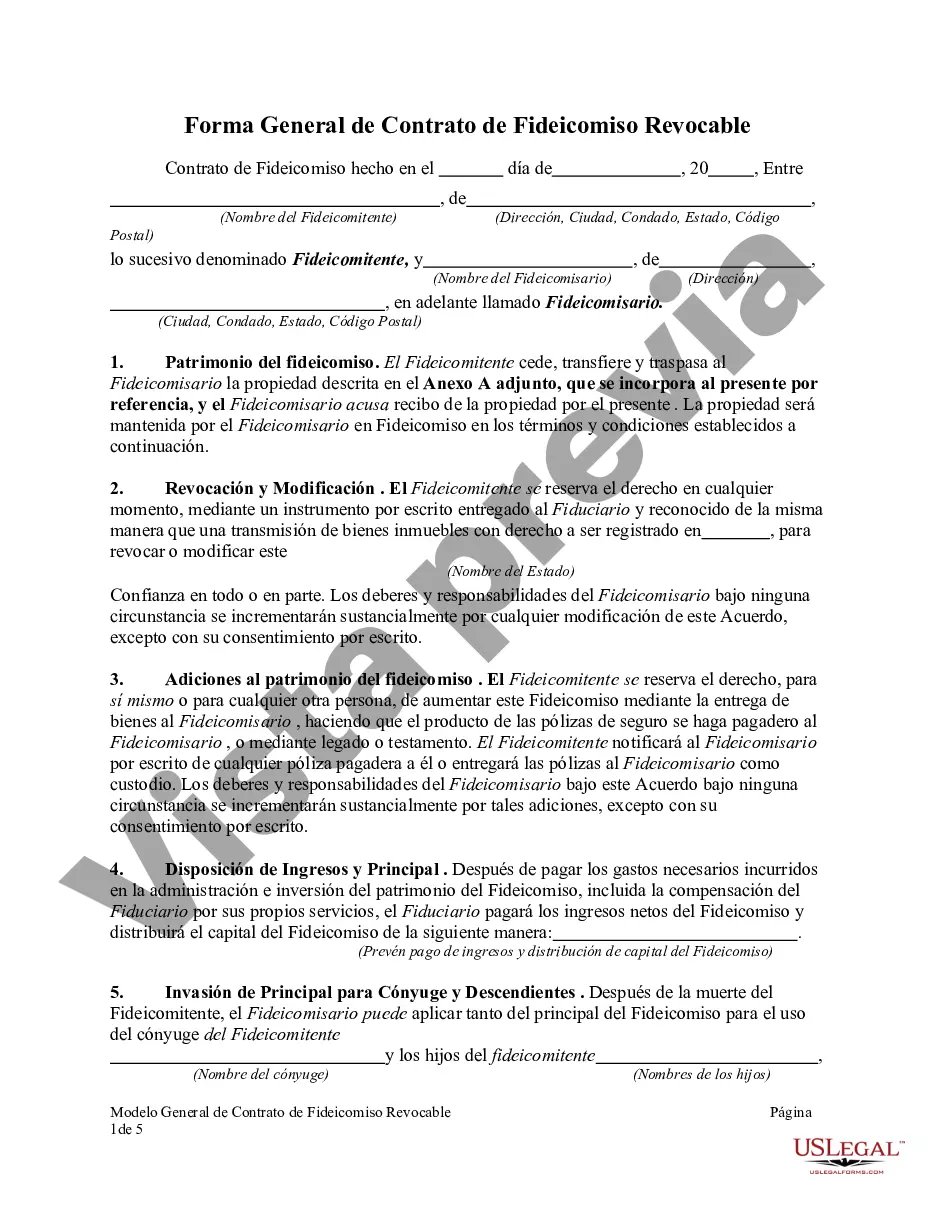

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.South Dakota Fideicomiso Revocable para Bienes Raíces - Revocable Trust for Real Estate

Description

How to fill out South Dakota Fideicomiso Revocable Para Bienes Raíces?

Have you been in a placement where you will need paperwork for either company or person purposes just about every time? There are tons of legal record templates available on the net, but discovering types you can depend on isn`t effortless. US Legal Forms gives thousands of form templates, just like the South Dakota Revocable Trust for Real Estate, that happen to be published in order to meet state and federal demands.

If you are already informed about US Legal Forms web site and get a merchant account, simply log in. Next, you may acquire the South Dakota Revocable Trust for Real Estate web template.

Should you not offer an account and wish to start using US Legal Forms, abide by these steps:

- Find the form you need and make sure it is to the correct town/region.

- Take advantage of the Review key to examine the form.

- Read the information to ensure that you have selected the appropriate form.

- When the form isn`t what you`re trying to find, utilize the Lookup area to discover the form that fits your needs and demands.

- Once you get the correct form, click Purchase now.

- Pick the pricing prepare you want, submit the desired details to produce your money, and pay for the order using your PayPal or bank card.

- Choose a handy data file format and acquire your version.

Get each of the record templates you might have bought in the My Forms food selection. You can aquire a further version of South Dakota Revocable Trust for Real Estate whenever, if possible. Just go through the needed form to acquire or print the record web template.

Use US Legal Forms, by far the most considerable selection of legal types, in order to save some time and avoid mistakes. The service gives skillfully made legal record templates which can be used for a range of purposes. Make a merchant account on US Legal Forms and start producing your daily life a little easier.