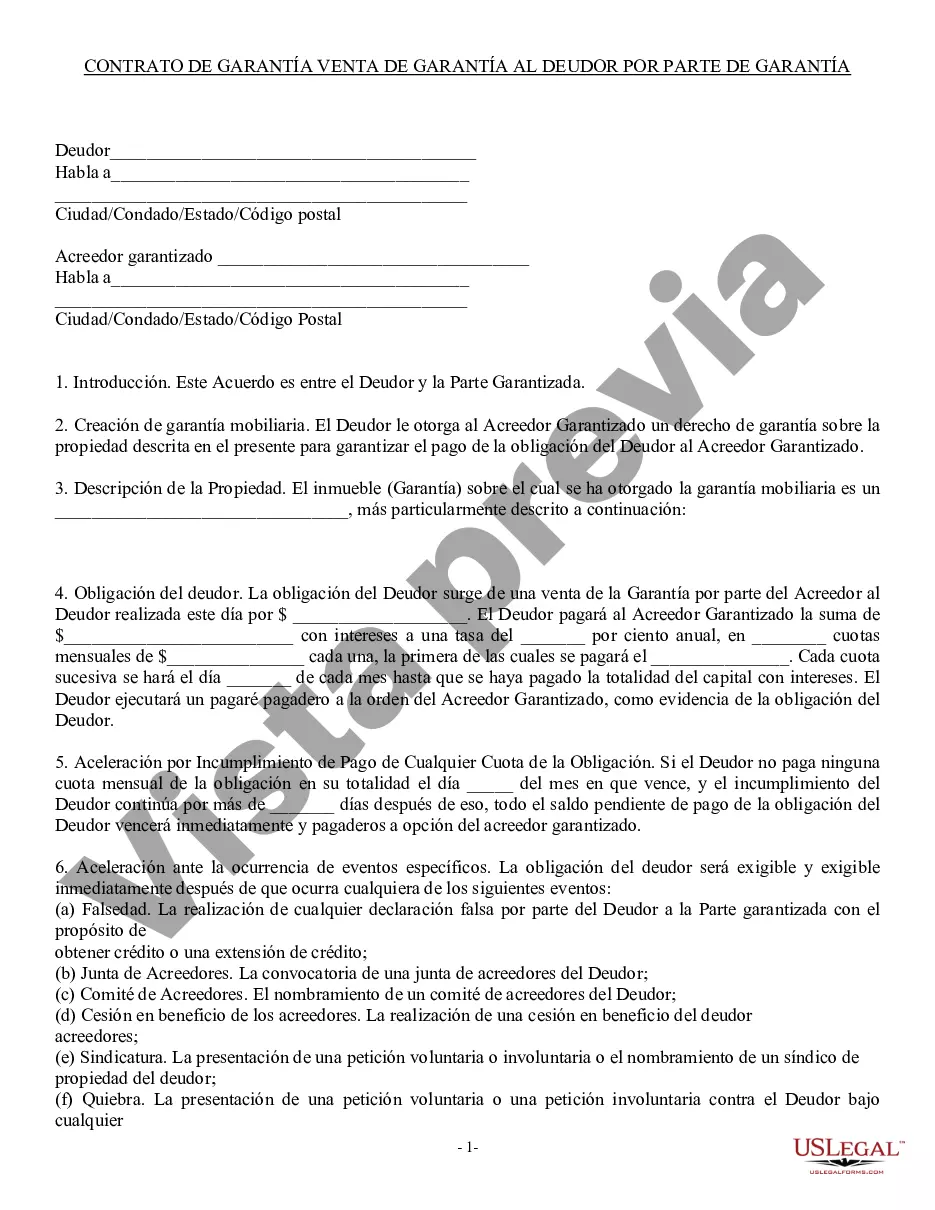

South Dakota Security Agreement involving Sale of Collateral by Debtor is a legally binding agreement between a debtor and a secured party, typically a lender or a creditor, that establishes a security interest in the debtor's collateral. The agreement provides protection for the secured party in case of default or non-payment by the debtor. Keywords: South Dakota, security agreement, sale of collateral, debtor, secured party, collateral, lender, creditor, default, non-payment. There are two main types of South Dakota Security Agreement involving the Sale of Collateral by Debtor: 1. South Dakota Security Agreement for Personal Property: This type of security agreement covers personal property or movable assets that can be used as collateral, such as vehicles, inventory, equipment, accounts receivable, and intellectual property. The debtor grants the secured party a security interest in the collateral, which allows the secured party to sell the collateral in case of default to recover their owed debt. This agreement is governed by the Uniform Commercial Code (UCC) Article 9 in South Dakota. 2. South Dakota Real Estate Security Agreement: This type of security agreement involves real estate properties as collateral. The debtor, typically a property owner, grants a security interest in the real estate to the secured party. In case of default, the secured party can foreclose on the property and sell it to recover the debt owed. This agreement is subject to specific laws and regulations governing real estate transactions in South Dakota. When drafting a South Dakota Security Agreement involving the Sale of Collateral by Debtor, the following elements should be included: 1. Identification of the parties: The agreement should clearly identify the debtor and the secured party, including their legal names, addresses, and contact information. 2. Description of collateral: The agreement must specify the collateral being used to secure the debt. It should provide a detailed description of the collateral, including serial numbers, make and model, location, quantity, or any other identifying information. 3. Grant of security interest: The debtor grants the secured party a security interest in the collateral to secure the repayment of the debt. This grant should be explicitly stated in the agreement. 4. Use of collateral: The agreement may specify any restrictions on the debtor's use of the collateral while the security interest is in effect. This can include limitations on selling, transferring, or encumbering the collateral without the secured party's consent. 5. Default and remedies: The agreement should outline the circumstances that constitute a default by the debtor, such as non-payment, breach of terms, or insolvency. It should also include the remedies available to the secured party in case of default, including the right to sell the collateral and apply the proceeds towards the outstanding debt. 6. Governing law: The agreement should state that it is governed by the laws of the State of South Dakota, specifically referencing the relevant provisions of the Uniform Commercial Code (UCC) Article 9 for personal property security agreements. 7. Signatures: The agreement should be signed by both the debtor and the secured party to indicate their acceptance and consent to the terms and conditions. It is crucial for both parties to carefully review and understand the South Dakota Security Agreement involving Sale of Collateral by Debtor before signing it. In case of any doubts or concerns, it is advisable to seek legal counsel to ensure compliance with South Dakota laws and protect both parties' interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.South Dakota Acuerdo de garantía que involucra la venta de garantía por parte del deudor - Security Agreement involving Sale of Collateral by Debtor

Description

How to fill out South Dakota Acuerdo De Garantía Que Involucra La Venta De Garantía Por Parte Del Deudor?

Are you in the placement that you will need files for either company or individual purposes almost every day time? There are plenty of legitimate document templates available on the net, but finding kinds you can rely on isn`t simple. US Legal Forms delivers a large number of develop templates, much like the South Dakota Security Agreement involving Sale of Collateral by Debtor, that happen to be created in order to meet federal and state specifications.

Should you be presently acquainted with US Legal Forms website and get a merchant account, simply log in. Next, you may obtain the South Dakota Security Agreement involving Sale of Collateral by Debtor web template.

Should you not come with an bank account and would like to start using US Legal Forms, adopt these measures:

- Discover the develop you require and make sure it is to the appropriate city/area.

- Make use of the Review option to examine the form.

- Browse the description to ensure that you have chosen the appropriate develop.

- In case the develop isn`t what you`re seeking, take advantage of the Lookup discipline to obtain the develop that suits you and specifications.

- Whenever you obtain the appropriate develop, simply click Purchase now.

- Select the costs program you desire, submit the desired details to make your money, and pay for the order utilizing your PayPal or charge card.

- Decide on a convenient file formatting and obtain your duplicate.

Locate all of the document templates you might have bought in the My Forms menus. You can get a extra duplicate of South Dakota Security Agreement involving Sale of Collateral by Debtor any time, if required. Just go through the necessary develop to obtain or print the document web template.

Use US Legal Forms, by far the most extensive variety of legitimate types, to save lots of some time and steer clear of mistakes. The assistance delivers skillfully manufactured legitimate document templates that you can use for a range of purposes. Create a merchant account on US Legal Forms and start producing your lifestyle easier.