South Dakota Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements

Description

How to fill out Farm Lease Or Rental With Right To Make Improvements And Receive Reimbursements?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a range of legal form types that you can download or print.

While utilizing the website, you will access a vast selection of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest forms like the South Dakota Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements within minutes.

If you already hold a monthly subscription, Log In and download the South Dakota Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements from the US Legal Forms library. The Download button will appear on each form you review. You can access all previously acquired forms in the My documents section of your account.

Process the payment. Utilize your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded South Dakota Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements. Every template you add to your account has no expiration date and is yours permanently. Thus, if you wish to download or print another copy, simply visit the My documents section and click on the form you desire. Access the South Dakota Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements with US Legal Forms, the most comprehensive library of legal document templates. Utilize a multitude of professional and state-specific templates that fulfill your business or personal requirements.

- Make sure you have selected the appropriate form for your city/state.

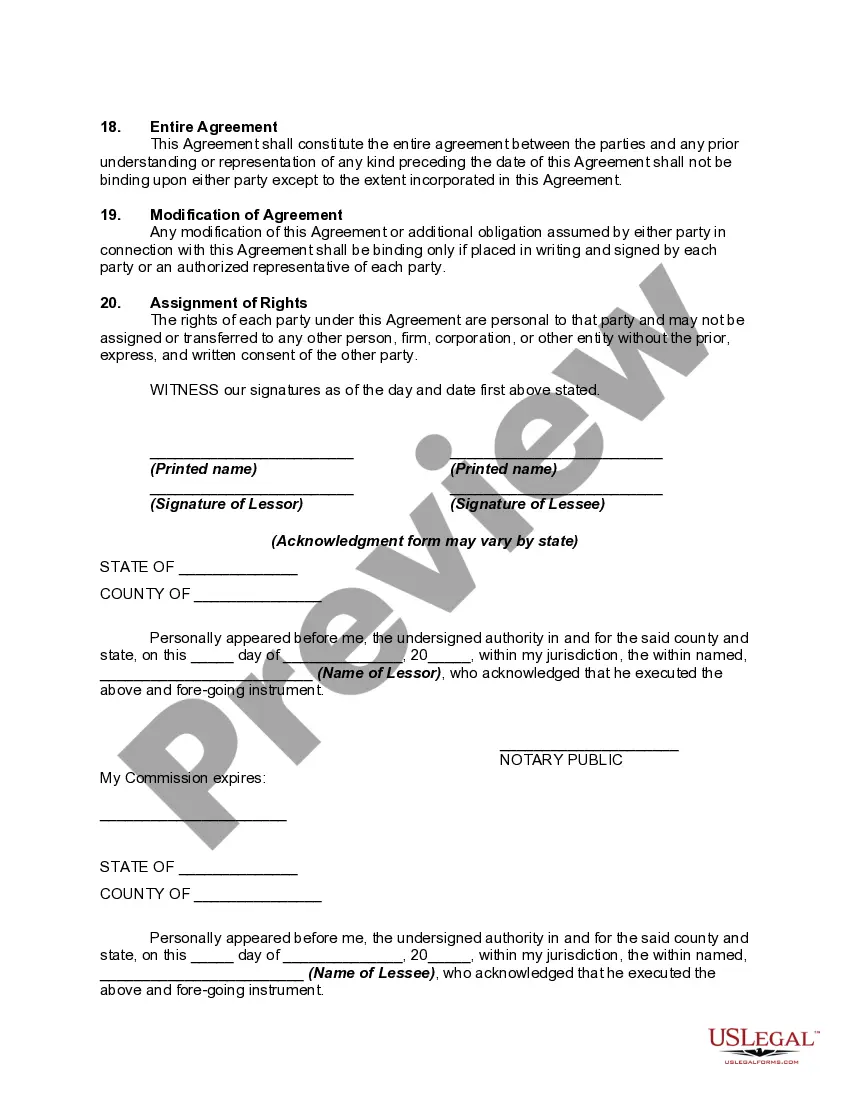

- Click the Preview button to view the content of the form.

- Review the form summary to confirm that you have selected the correct one.

- If the form does not meet your requirements, use the Search field at the top of the page to find a suitable one.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, choose the payment plan you prefer and provide your details to create an account.

Form popularity

FAQ

In South Dakota, landlords can raise rent based on the terms outlined in the rental agreement. Typically, the increase must be communicated to the renter ahead of time, often aligned with lease renewal periods. If you are involved in a South Dakota Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, reviewing your agreement is crucial for understanding any rent adjustment conditions.

In general, property owners possess specific rights, but these do not entirely supersede renters' rights. For instance, owners can set terms for a South Dakota Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements but must also respect renters' legal rights to privacy and proper conditions. Both parties should understand their rights and responsibilities to foster a positive rental relationship.

To report farmland rental income, you will typically use Schedule F of your tax return. It is vital to keep accurate records of your rental payments and expenses related to your South Dakota Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements. Consulting a tax professional can aid in ensuring that you comply with all reporting requirements while maximizing your potential deductions.

As a renter in South Dakota, you have several rights, including the right to a safe and habitable living environment. You also have the right to access the property without unnecessary interference from the landlord, especially in a South Dakota Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements. Understanding these rights helps you advocate for yourself while enjoying your rental arrangement.

Yes, as a property owner in South Dakota, you have the right to deny renters under certain circumstances. This may include factors such as financial history, lack of references, or failure to meet your specific criteria for a South Dakota Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements. It is essential to have clear criteria and document your decisions to avoid potential disputes.

For tax purposes, the IRS does not define a specific number of acres that constitute a farm. Generally, farms can start as small as a few acres, depending on the revenue generated and type of agricultural activity. When renting land through a South Dakota Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, keep in mind that the scale of your operation can influence tax obligations and reporting requirements.

Yes, you can create your own lease agreement for your South Dakota Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements. However, it is essential to ensure that the lease complies with state laws and regulations. Utilizing templates from platforms like uslegalforms can simplify the process and help you draft a comprehensive agreement that meets your needs.

To report farm rental income, complete Schedule E on your tax return, which covers supplemental income and losses. Include the income derived from your South Dakota Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements. By accurately reporting this income, you ensure compliance with tax regulations while potentially benefiting from allowable expenses.

Farm income is reported to the IRS using Form 1040 along with Schedule F. This form captures all varieties of farm income, including profits from a South Dakota Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements. It allows you to report both income and expenses, which can help reduce your overall taxable income.

You should report farmland rental income on Schedule F of your IRS Form 1040. This schedule is specifically designed for farmers and ranchers to report their income and expenses. When managing a South Dakota Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, consider consulting a tax professional for accurate reporting to optimize your tax benefits.