South Dakota Promissory Note in Connection with Sale of Motor Vehicle

Description

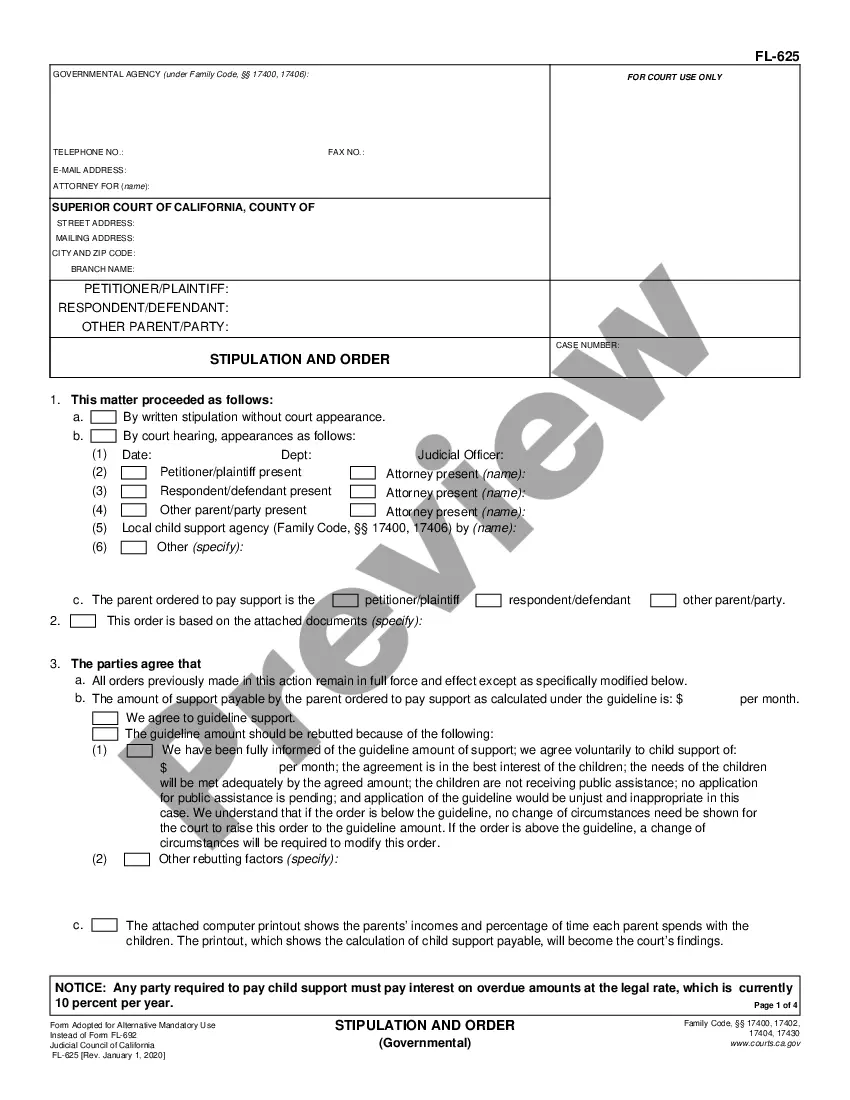

A promissory note should have several essential elements, including the amount of the loan, the date by which it is to be paid back, the interest rate, and a record of any collateral that is being used to secure the loan. Default terms (what happens if a payment is missed or the loan is not paid off by its due date) should also be spelled out in the promissory note.

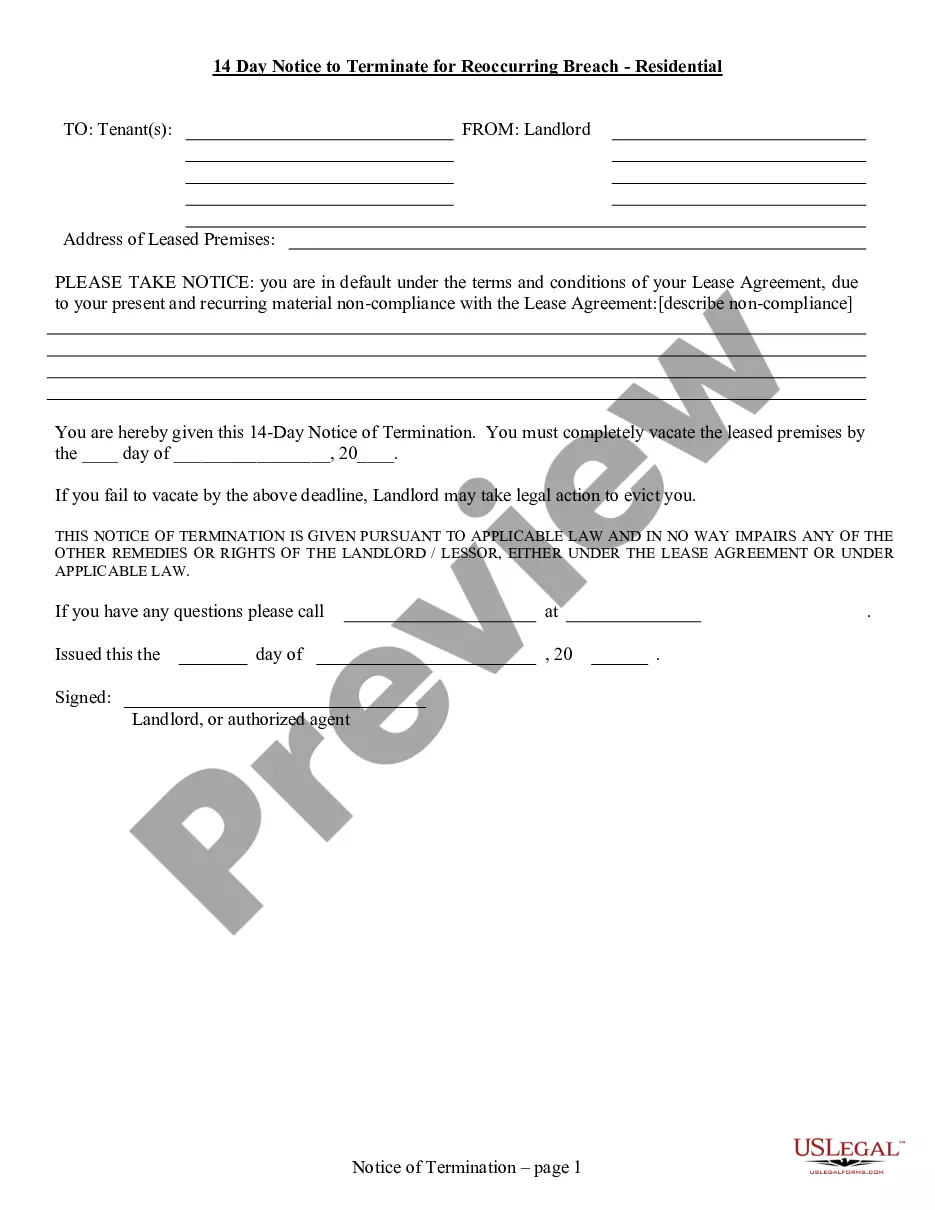

How to fill out Promissory Note In Connection With Sale Of Motor Vehicle?

You might spend multiple hours online searching for the legal documents template that meets the state and federal requirements you need.

US Legal Forms offers a vast array of legal forms that are reviewed by experts.

You can easily download or print the South Dakota Promissory Note related to the Sale of Motor Vehicle from my services.

To find another version of the form, use the Lookup field to search for the template that fulfills your needs and specifications.

- If you have a US Legal Forms account, you can Log In and select the Obtain option.

- After that, you can complete, modify, print, or sign the South Dakota Promissory Note regarding the Sale of Motor Vehicle.

- Every legal document template you obtain is yours permanently.

- To acquire another copy of the purchased form, visit the My documents tab and click the corresponding option.

- If you are using the US Legal Forms site for the first time, follow the simple steps below.

- First, ensure that you have chosen the correct document template for the area/city of your choice.

- Review the form description to confirm you have selected the right form.

Form popularity

FAQ

To obtain a copy of your promissory note, you should contact the lender or seller who issued the note. They are typically responsible for keeping records and providing copies when needed. If you need assistance with drafting or retrieving a South Dakota Promissory Note in Connection with Sale of Motor Vehicle, you can utilize platforms like uslegalforms, which offer templates and legal guidance.

A promissory note for the sale of a motor vehicle is a contract in which the buyer promises to repay the seller for the vehicle over a specified time period. This note includes important details like the total amount due, interest rates, and the due dates for payments. This document is vital for both parties as it formalizes the financial arrangement and ensures accountability.

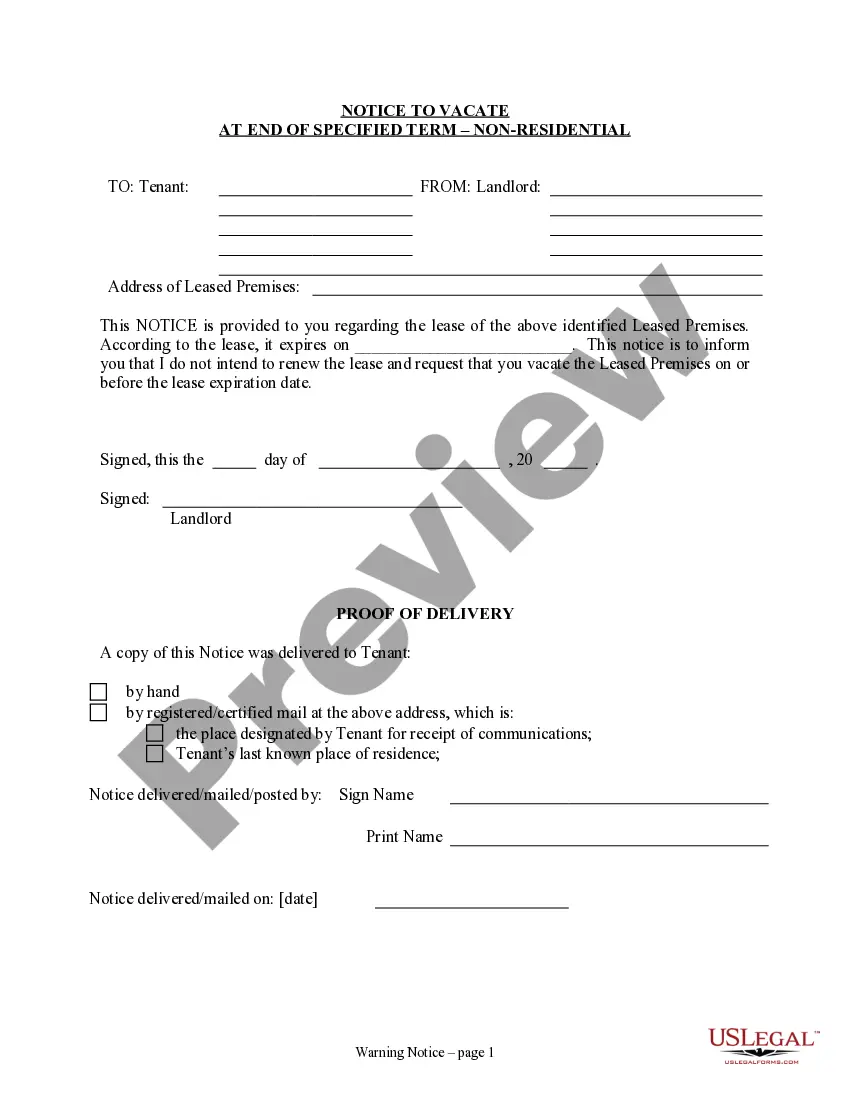

In South Dakota, a bill of sale is not a strict requirement for the sale of a car, but it is highly recommended. A bill of sale provides proof of the transaction and protects both the buyer and the seller. Additionally, including a South Dakota Promissory Note in Connection with Sale of Motor Vehicle can further clarify the payment terms and safeguard your interests in the transaction.

Yes, promissory notes generally hold up in court, provided they meet the legal requirements of a contract. A South Dakota Promissory Note in Connection with Sale of Motor Vehicle is enforceable as long as both parties agree to the terms and it is documented appropriately. In case of default, a clear promissory note can serve as substantial proof if you need to pursue legal action. It's advisable to create this document carefully, and platforms like uslegalforms provide resources to help with proper drafting.

When a promissory note is sold, ownership is transferred through endorsement, where the original holder signs the back of the note. In the case of a South Dakota Promissory Note in Connection with Sale of Motor Vehicle, the seller must clearly indicate the transaction and provide any necessary documentation to the buyer. This transfer solidifies the buyer's responsibility to fulfill payment obligations, while also providing the seller a reliable avenue for collection. Using a proper format ensures that all legal requirements are satisfied.

In South Dakota, promissory notes are generally not subject to registration; however, some specific circumstances may require documentation. For a South Dakota Promissory Note in Connection with Sale of Motor Vehicle, it is essential to ensure that all parties have clear written evidence of the transaction. Although registration might not be necessary, filing may provide added security and enforceability in certain situations. This ensures that both the buyer and the seller can refer back to the agreement if disputes arise.

Filling out a title in South Dakota involves a few important steps. Begin by signing the title in the seller's section, then write the purchaser's name and address. Make sure to note the vehicle's odometer reading correctly. If there is financing involved, the South Dakota Promissory Note in Connection with Sale of Motor Vehicle will help outline the payment process.

When selling a car in South Dakota, start by locating the vehicle title. Next, complete the seller's section by providing your name and signature, followed by the buyer’s details. It's important to include the odometer reading as well. Don’t forget to complete a South Dakota Promissory Note in Connection with Sale of Motor Vehicle for any financing arrangements.

To sell a vehicle privately in South Dakota, start by determining your car's value based on similar listings. Gather all required documents, including the South Dakota Promissory Note in Connection with Sale of Motor Vehicle, to facilitate a smooth transaction. Promote your vehicle through appropriate channels to attract buyers. Again, using uslegalforms can simplify the process by providing the necessary templates and guidance for your sale.

Selling a car privately in South Dakota involves several steps. First, you should prepare your vehicle by cleaning it and gathering relevant documents, including the South Dakota Promissory Note in Connection with Sale of Motor Vehicle. Use online platforms and local ads to reach potential buyers effectively. Ensure to negotiate clearly, finalize the sale with proper documentation, and make sure everything is legally sound through resources like uslegalforms.