South Dakota General Journal is a crucial component of the state's accounting and financial reporting system. It serves as a comprehensive record of all financial transactions within the public sector, capturing both revenue and expenditure information. This detailed description will provide insights into what South Dakota General Journal is, its purpose, and its various types. The primary purpose of the South Dakota General Journal is to accurately document and track financial transactions made by state government entities, agencies, and departments. It ensures transparency, accountability, and compliance with financial regulations and standards. The journal records all financial activities, including income, expenses, transfers, and adjustments. The South Dakota General Journal incorporates a standardized and systematic approach to financial reporting. It follows the Generally Accepted Accounting Principles (GAAP) and Government Accounting Standards Board (GAS) guidelines. This ensures consistency, comparability, and reliability of financial information across different government entities within the state. There are several types of South Dakota General Journals, each serving a specific purpose: 1. Revenue Journal: This type of general journal records all incoming financial transactions, such as taxes, fees, grants, and other sources of revenue. It provides a detailed account of the sources of income for the state. 2. Expenditure Journal: This journal focuses on documenting and categorizing all expenses incurred by the government entities. It includes salaries, utilities, supplies, contracts, and other expenditures. This allows for effective budget management and tracking of expenditure trends. 3. Transfer Journal: Transfers between different accounts or funds are recorded in this journal. It ensures that all movement of funds is accurately documented, enabling better financial analysis and decision-making. 4. Adjusting Journal: This type of journal records any financial adjustments made to correct errors or reflect changes in previously recorded transactions. It ensures that the financial statements are accurately represented and compliant with accounting standards. In summary, the South Dakota General Journal is an essential tool for financial management and reporting within the state's public sector. It encompasses various types of journals, such as Revenue, Expenditure, Transfer, and Adjusting Journals, to effectively capture and document all financial transactions. Using these journals helps maintain financial transparency, accountability, and compliance across South Dakota's governmental entities.

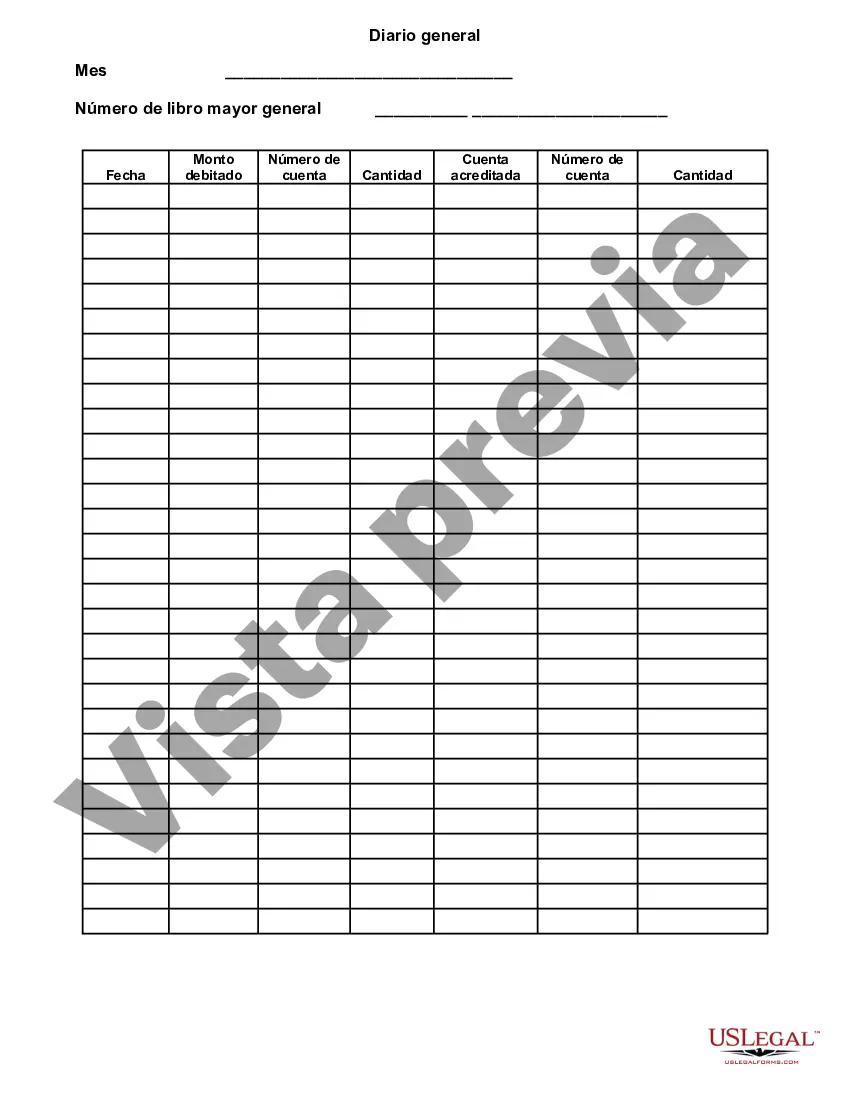

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.South Dakota Diario general - General Journal

Description

How to fill out South Dakota Diario General?

If you need to full, acquire, or printing authorized document web templates, use US Legal Forms, the most important collection of authorized types, that can be found on-line. Utilize the site`s simple and handy lookup to get the documents you require. Different web templates for enterprise and specific functions are categorized by types and says, or search phrases. Use US Legal Forms to get the South Dakota General Journal in just a couple of clicks.

Should you be previously a US Legal Forms customer, log in to your bank account and click on the Down load key to get the South Dakota General Journal. Also you can gain access to types you previously downloaded inside the My Forms tab of your bank account.

If you are using US Legal Forms initially, refer to the instructions listed below:

- Step 1. Make sure you have selected the shape to the correct city/country.

- Step 2. Use the Preview method to check out the form`s articles. Do not overlook to read the information.

- Step 3. Should you be not happy using the type, use the Research field at the top of the monitor to discover other types of the authorized type web template.

- Step 4. After you have found the shape you require, click the Buy now key. Opt for the pricing program you choose and put your accreditations to sign up for an bank account.

- Step 5. Method the financial transaction. You can use your bank card or PayPal bank account to finish the financial transaction.

- Step 6. Select the format of the authorized type and acquire it on your product.

- Step 7. Full, revise and printing or indication the South Dakota General Journal.

Every authorized document web template you acquire is your own permanently. You have acces to every single type you downloaded inside your acccount. Select the My Forms portion and decide on a type to printing or acquire once again.

Be competitive and acquire, and printing the South Dakota General Journal with US Legal Forms. There are many specialist and state-particular types you can use for your enterprise or specific needs.