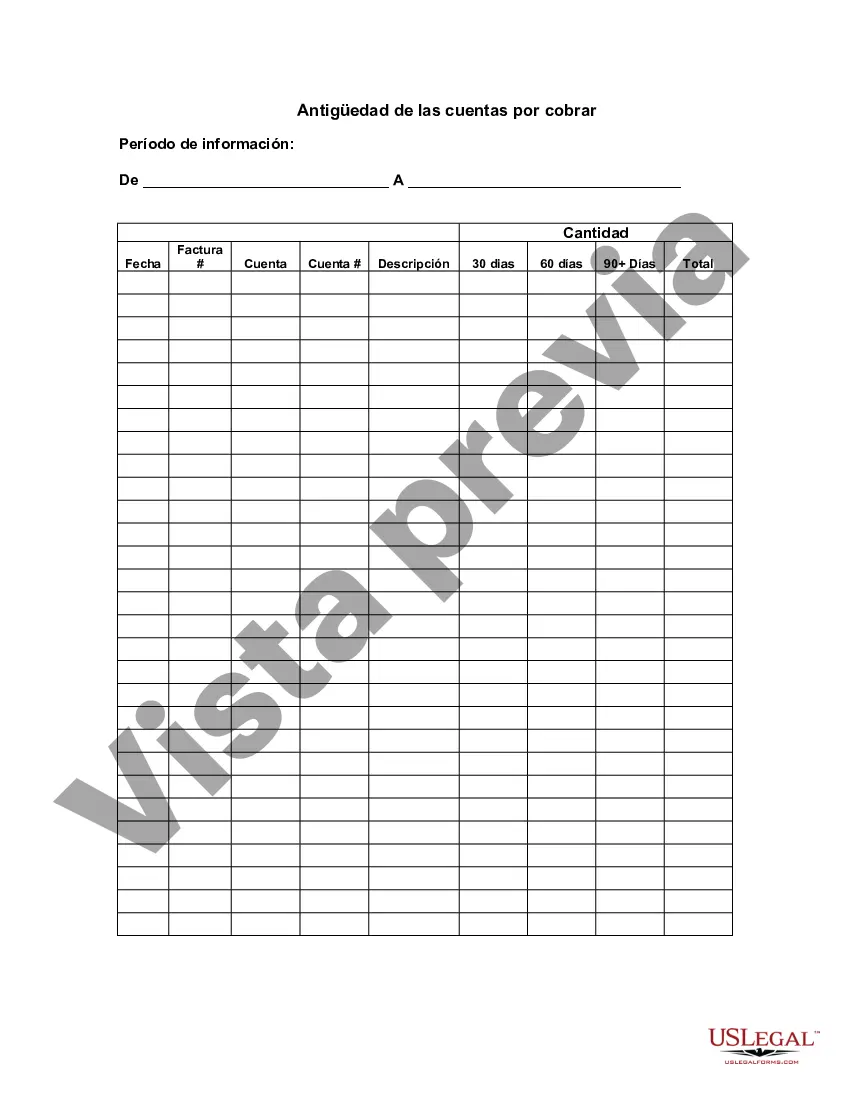

South Dakota Aging of Accounts Receivable is a financial analysis method used by businesses to monitor and manage their outstanding invoices. It provides a detailed overview of the amounts owed to the company and categorizes them based on the number of days since the invoice was issued. The purpose of the South Dakota Aging of Accounts Receivable is to evaluate the financial health of a business by identifying potential cash flow issues, assessing the effectiveness of credit and collection policies, and identifying delinquent accounts that require immediate attention. By analyzing the aging of accounts receivable, businesses can take proactive measures to improve their cash flow and reduce the risk of bad debts. There are typically three types of South Dakota Aging of Accounts Receivable: 1. Current: This category represents all outstanding invoices that are due within the current billing cycle. These invoices are not yet past their due dates and are considered to be in good standing. 2. 30 Days: This category includes invoices that are past their due dates by 1 to 30 days. It indicates a slight delay in payment and serves as an early warning sign for potential collection issues. 3. Over 30 Days: This category consists of invoices that are past their due dates by more than 30 days. It signifies a significant delay in payment and raises concerns about potential cash flow problems or non-payment. The South Dakota Aging of Accounts Receivable allows businesses to generate reports and charts that provide a visual representation of the overall state of their outstanding invoices. These reports typically include detailed information such as customer names, invoice numbers, invoice dates, due dates, outstanding amounts, and aging categories. By reviewing this data, businesses can prioritize their collection efforts, identify customers with consistent late payments, and make informed decisions regarding credit restrictions or potential legal action. The South Dakota Aging of Accounts Receivable is a crucial tool for businesses across industries, providing them with quantifiable data to help them understand their financial standing and make educated decisions. It aids in managing cash flow, improving collections processes, and reducing potential financial risks associated with outstanding invoices.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.South Dakota Antigüedad de las cuentas por cobrar - Aging of Accounts Receivable

Description

How to fill out South Dakota Antigüedad De Las Cuentas Por Cobrar?

US Legal Forms - one of several largest libraries of lawful types in the States - delivers a wide range of lawful papers themes it is possible to obtain or print. While using site, you will get a large number of types for organization and personal functions, categorized by categories, suggests, or keywords.You can get the most recent models of types like the South Dakota Aging of Accounts Receivable in seconds.

If you have a membership, log in and obtain South Dakota Aging of Accounts Receivable through the US Legal Forms collection. The Down load key will appear on each develop you perspective. You have access to all in the past acquired types in the My Forms tab of your own account.

If you wish to use US Legal Forms initially, listed below are basic instructions to get you started off:

- Be sure to have picked out the proper develop to your town/area. Click the Review key to analyze the form`s content. See the develop outline to actually have chosen the appropriate develop.

- When the develop does not satisfy your specifications, use the Research industry at the top of the monitor to obtain the the one that does.

- When you are pleased with the form, verify your option by clicking on the Get now key. Then, choose the costs plan you prefer and supply your references to register to have an account.

- Approach the financial transaction. Utilize your Visa or Mastercard or PayPal account to finish the financial transaction.

- Select the structure and obtain the form on your device.

- Make adjustments. Fill out, revise and print and sign the acquired South Dakota Aging of Accounts Receivable.

Each and every format you added to your bank account does not have an expiry day and is also your own eternally. So, if you want to obtain or print yet another backup, just check out the My Forms section and then click on the develop you need.

Gain access to the South Dakota Aging of Accounts Receivable with US Legal Forms, one of the most extensive collection of lawful papers themes. Use a large number of professional and status-particular themes that fulfill your company or personal requires and specifications.

Form popularity

FAQ

An accounts receivable aging report is a record that shows the unpaid invoice balances along with the duration for which they've been outstanding. This report helps businesses identify invoices that are open and allows them to keep on top of slow paying clients.

Simply by subtracting the birth date from the current date. This conventional age formula can also be used in Excel. The first part of the formula (TODAY()-B2) returns the difference between the current date and date of birth is days, and then you divide that number by 365 to get the numbers of years.

How to create an accounts receivable aging reportStep 1: Review open invoices.Step 2: Categorize open invoices according to the aging schedule.Step 3: List the names of customers whose accounts are past due.Step 4: Organize customers based on the number of days outstanding and the total amount due.

Accounts receivable are reported as a line item on the balance sheet. Supplementary reports, such as the accounts receivable aging report, provide further detail. Balance sheet: Accounts receivable are a line item in a balance sheet.

How to create an accounts receivable aging reportStep 1: Review open invoices.Step 2: Categorize open invoices according to the aging schedule.Step 3: List the names of customers whose accounts are past due.Step 4: Organize customers based on the number of days outstanding and the total amount due.10-May-2021

The AR Aging report uses the oldest date (February 1) as the invoice date to calculate the aging of the invoice. Use the AR Ledger report to help you identify all of the work breakdown structure levels of an invoice that you must change when you modify a posted invoice's invoice and/or due date.

Aging of Accounts Receivables = (Average Accounts Receivables 360 Days)/Credit SalesAging of Accounts Receivables = ($ 4, 50,000.00360 days)/$ 9, 00,000.00.Aging of Accounts Receivables = 90 Days.

To prepare an accounts receivable aging report, you need to have the customer's name, outstanding balance amount, and aging schedules.

To prepare the report, list the customer's name, the outstanding balance and the time since it has become overdue. The accounts are classified in categories rather than a specific time listed since becoming overdue.

More info

Credits Assets Market Research CDS Corporate Debt Equity Market Research Data Credit Risk Management Social Credit Aging Report Importance Create Products Autonomous Receivables Autonomous Treasury Autonomous Accounting Order Cash Credit EPP Cash Deductions Collections Credit Risk Management Soft Credits Assets Market Research CDS Corporate Debt Equity Market Research Data Credit Risk Management Social Credit Aging Report Importance Create Products Autonomous Receivables Autonomous Treasury Autonomous Accounting Order Cash Credit EPP Cash Deductions Collections Credit Risk Management Soft Credits Assets Market Research CDS Corporate Debt Equity Market Research Data Credit Risk Management Social Credit Aging Report Importance Create Products Autonomous Receivables Autonomous Treasury Autonomous Accounting Order Cash Credit EPP Cash Deductions Collections Credit Risk Management Soft Credits Assets Market Research CDS Corporate Debt Equity Market Research Data Credit Risk Management