South Dakota Aging of Accounts Payable refers to a financial practice that tracks and analyzes the time it takes a company's accounts payable to be settled by its clients or customers in the state of South Dakota, USA. This process helps businesses monitor their payment collection efficiency and identify any outstanding or overdue payments. The importance of South Dakota Aging of Accounts Payable lies in managing cash flow effectively, identifying potential issues with clients' payment habits, and improving customer relations. By categorizing outstanding invoices into different time frames, businesses can gain insights into their overall financial health and make informed decisions. There are typically three types of South Dakota Aging of Accounts Payable: 1. Current accounts payable: This category includes invoices that are expected to be paid within a predetermined time frame, usually 30 days. These invoices are considered within the standard payment terms and are not yet overdue. 2. Overdue accounts payable: This category comprises invoices that have surpassed the agreed-upon payment terms. Depending on the company's policies, invoices may be categorized further based on the time elapsed since the due date. For instance, "30-60 days overdue" or "more than 60 days overdue." 3. Bad debts or uncollectible accounts: This type of accounts payable refers to invoices that are considered highly unlikely or impossible to be collected. These could result from bankrupt clients, businesses that have permanently closed, or disputes that have led to write-offs. Implementing South Dakota Aging of Accounts Payable can offer several benefits to businesses. By monitoring payment trends, companies can proactively address potential payment issues, negotiate more favorable terms with vendors, and improve overall cash flow management. This financial technique also aids in preparing accurate financial statements, such as the balance sheet and income statement. In conclusion, South Dakota Aging of Accounts Payable is a crucial practice for businesses operating in South Dakota, as it helps them monitor and manage their payment collection process effectively. By categorizing outstanding invoices into current, overdue, and bad debts, businesses can gain insights into their financial health and take appropriate actions to optimize their cash flow.

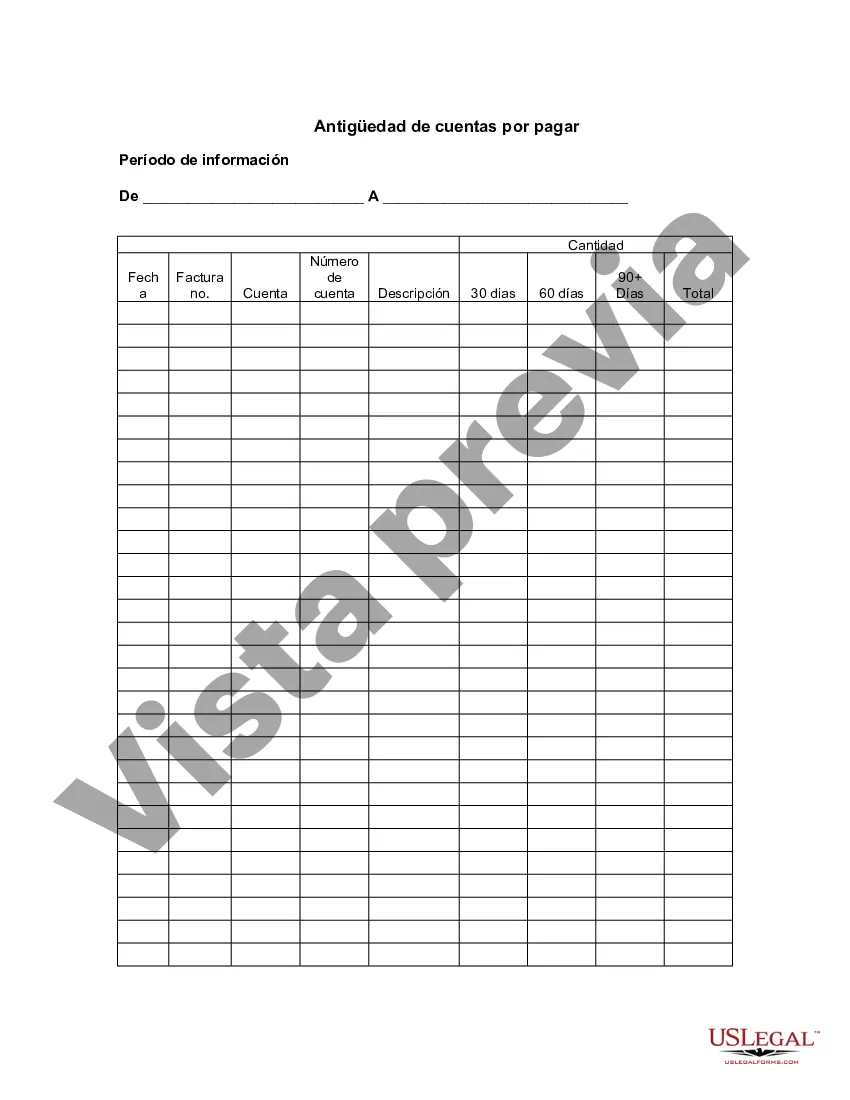

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.South Dakota Antigüedad de cuentas por pagar - Aging of Accounts Payable

Description

How to fill out South Dakota Antigüedad De Cuentas Por Pagar?

It is possible to commit time on the web attempting to find the authorized document template that suits the federal and state demands you want. US Legal Forms provides 1000s of authorized forms which can be reviewed by specialists. You can easily down load or print the South Dakota Aging of Accounts Payable from our service.

If you have a US Legal Forms profile, you may log in and then click the Obtain option. Following that, you may full, edit, print, or sign the South Dakota Aging of Accounts Payable. Every authorized document template you get is your own property permanently. To have yet another version of the bought form, visit the My Forms tab and then click the corresponding option.

Should you use the US Legal Forms internet site initially, keep to the basic instructions beneath:

- Initial, be sure that you have chosen the proper document template to the state/town of your choice. Browse the form description to make sure you have picked the proper form. If offered, utilize the Review option to check from the document template too.

- If you wish to discover yet another edition of the form, utilize the Research field to discover the template that meets your needs and demands.

- Upon having discovered the template you want, click Buy now to move forward.

- Find the costs prepare you want, type your accreditations, and sign up for an account on US Legal Forms.

- Total the transaction. You can use your bank card or PayPal profile to fund the authorized form.

- Find the structure of the document and down load it to your product.

- Make modifications to your document if necessary. It is possible to full, edit and sign and print South Dakota Aging of Accounts Payable.

Obtain and print 1000s of document web templates utilizing the US Legal Forms Internet site, that offers the largest assortment of authorized forms. Use professional and express-particular web templates to handle your organization or specific needs.