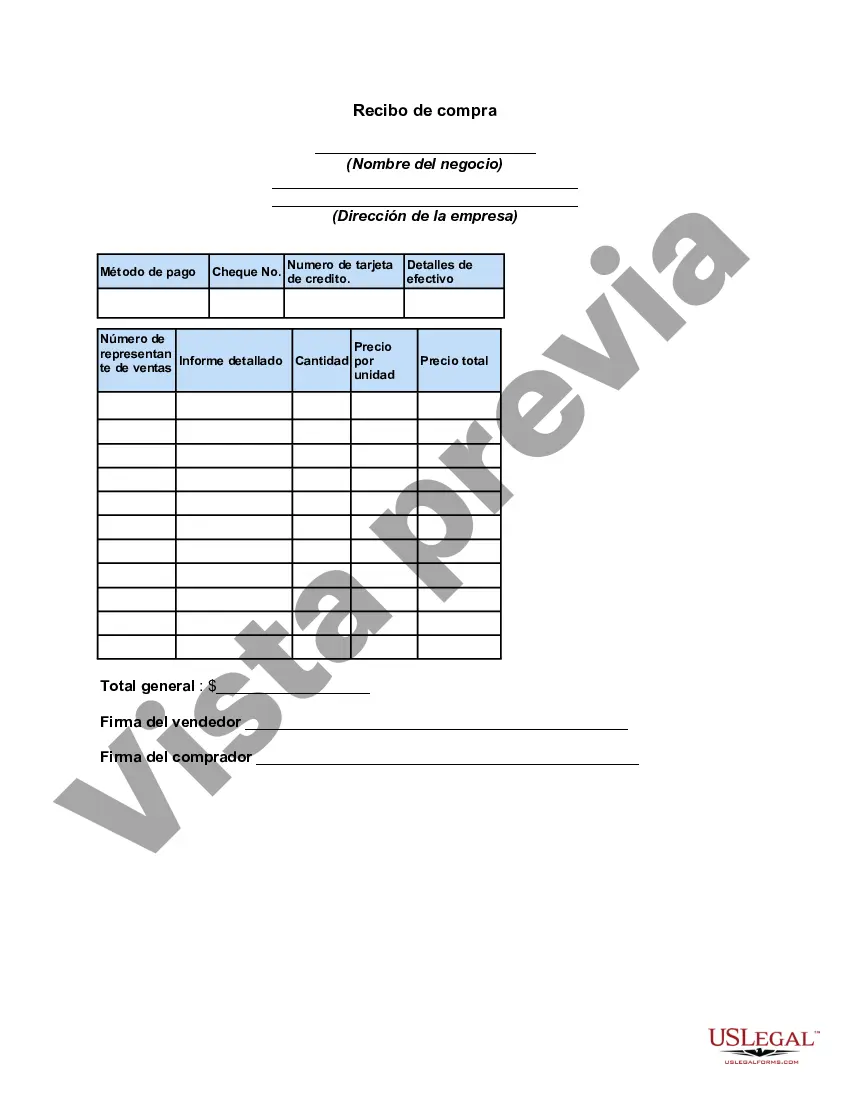

South Dakota Sales Receipt refers to a document that serves as proof of a transaction between a seller and a buyer in the state of South Dakota. It contains important details about the purchase, including the items or services purchased, their quantities, prices, and any applicable taxes. Additionally, it includes information about the seller, such as their name, contact details, and possibly their business registration number. The purpose of a South Dakota Sales Receipt is to provide evidence of the transaction and serves as a reference for both the buyer and seller. It helps in maintaining accurate records for accounting, tax compliance, and warranty purposes. Moreover, it allows the buyer to retain a copy of the receipt for personal reference, potential returns or exchanges, and filing claims with insurance providers, if necessary. In South Dakota, there are several types of sales receipts that can be issued, depending on the nature of the transaction. These may include: 1. Retail Sales Receipt: This is the most common type of sales receipt, issued by retail businesses to customers for the purchase of goods. It lists the items bought, their prices, any applicable sales tax, and the total amount paid. 2. Service Sales Receipt: Service providers, such as contractors, consultants, or repair technicians, issue service sales receipts to their clients. These receipts document the services provided, the duration or quantity of service rendered, the hourly or flat rate charges, any additional fees, and the total payable amount. 3. Online Sales Receipt: With the rise of e-commerce, online sales receipts have become increasingly popular. These receipts are generated electronically and forwarded to the buyer's email address after an online purchase. They contain similar information to retail sales receipts, including the purchased items, prices, taxes, and payment details. 4. Wholesale Sales Receipt: Wholesale businesses, which typically sell to other businesses rather than individual customers, issue wholesale sales receipts. These receipts include details of the purchased goods, quantities, prices, any applicable taxes, as well as the buyer's business information and often the seller's terms and conditions. It is essential for both the seller and buyer to retain copies of South Dakota Sales Receipts for a reasonable period, typically for at least several years. These receipts can be used as proof of purchase, for warranty claims, tax audits, or even in legal disputes. Additionally, businesses can utilize electronic sales receipt systems or point-of-sale software to simplify the process of generating and managing receipts efficiently.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.South Dakota Recibo de compra - Sales Receipt

Description

How to fill out South Dakota Recibo De Compra?

Discovering the right lawful papers web template might be a have difficulties. Obviously, there are plenty of themes accessible on the Internet, but how do you get the lawful type you will need? Make use of the US Legal Forms web site. The support offers a large number of themes, including the South Dakota Sales Receipt, that you can use for enterprise and personal demands. All the varieties are examined by professionals and satisfy federal and state needs.

If you are currently listed, log in in your account and click the Obtain button to obtain the South Dakota Sales Receipt. Use your account to check with the lawful varieties you have purchased earlier. Check out the My Forms tab of your own account and have another duplicate from the papers you will need.

If you are a whole new customer of US Legal Forms, allow me to share basic recommendations for you to stick to:

- Initial, be sure you have chosen the correct type to your city/county. You are able to look over the form making use of the Review button and study the form description to make sure it will be the right one for you.

- In the event the type fails to satisfy your preferences, utilize the Seach industry to discover the proper type.

- Once you are certain that the form would work, select the Purchase now button to obtain the type.

- Select the costs strategy you would like and enter the needed information. Build your account and purchase the transaction utilizing your PayPal account or charge card.

- Choose the submit formatting and obtain the lawful papers web template in your gadget.

- Complete, revise and print and indication the obtained South Dakota Sales Receipt.

US Legal Forms is the most significant library of lawful varieties that you can discover different papers themes. Make use of the service to obtain professionally-created paperwork that stick to status needs.