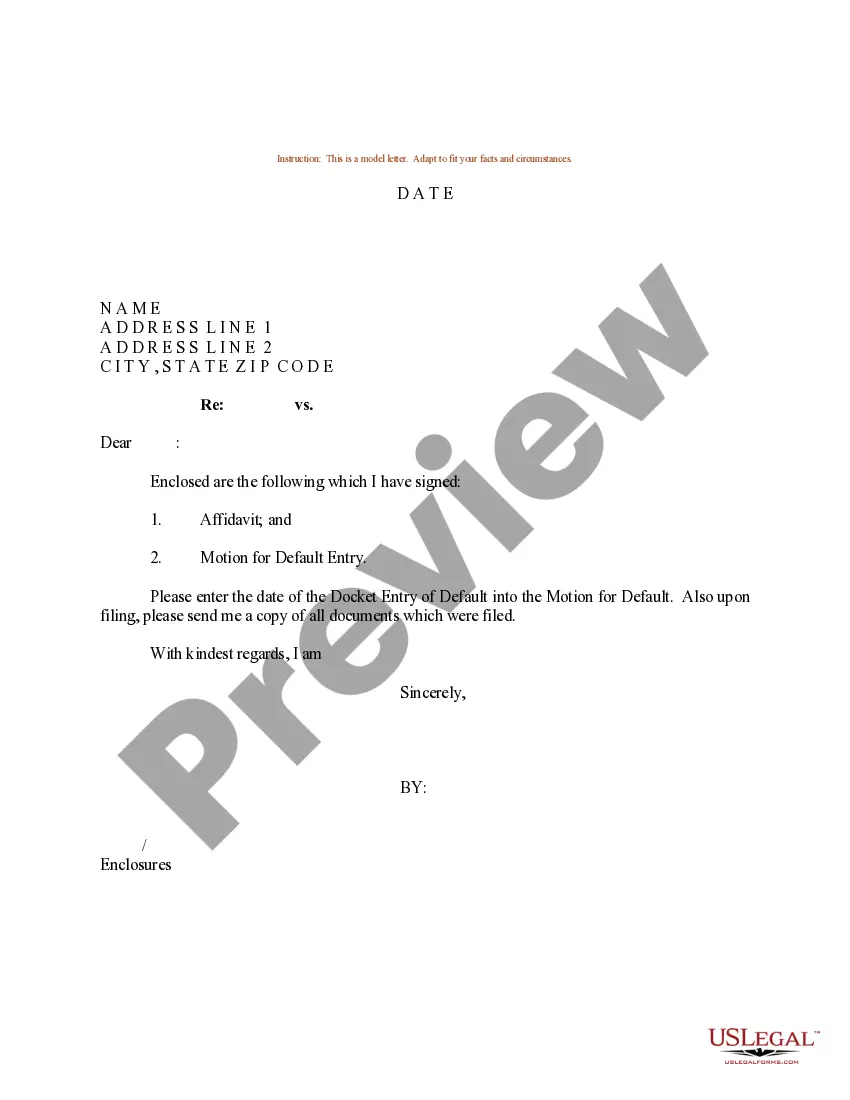

Subject: South Dakota Sample Letter for Default Entry — Comprehensive Guide Dear [Recipient's Name], I hope this letter finds you well. I am writing to provide you with a detailed description of the South Dakota Sample Letter for Default Entry, which aims to assist individuals facing default entry situations. This comprehensive guide will cover key aspects related to defaults, offering a clearer understanding and steps to address them effectively. South Dakota Default Entry Overview: A default entry occurs when an individual fails to fulfill their financial obligations, potentially leading to adverse consequences such as negative credit scores, collection efforts, or legal actions. Understanding the implications and appropriate actions to take is crucial for managing default entries responsibly. Types of Default Entries in South Dakota: 1. Loan Default: Refers to the failure to repay borrowed funds, including personal loans, mortgages, or auto loans. 2. Credit Card Default: Occurs when credit card payments are not made on time or in full, leading to default. 3. Utility Bill Default: Pertains to overdue payments for essential services like electricity, water, or gas bills. 4. Tax Default: Relates to unpaid state or federal taxes, resulting in penalties, interests, or potential legal actions. 5. Student Loan Default: Involves the non-payment or consistent delinquency of student loans, prompting collection efforts. Detailed Description of South Dakota Sample Letter for Default Entry: The South Dakota Sample Letter for Default Entry is a legally recognized document designed to help individuals address and rectify default entries on their credit reports. This letter template provides a structured format, ensuring clarity and effectiveness in communication. Key components of this sample letter include: 1. Personal Information: Start the letter by providing your full name, current address, phone number, and email address. This information will help create a line of communication with the recipient. 2. Creditor Information: Clearly state the name, address, and contact details of the creditor or collection agency involved in the default entry. This ensures they know the specific situation you are addressing. 3. Explanation of the Default: Briefly explain the circumstances that led to the default, ensuring transparency and honesty. Mention any hardships or extenuating circumstances that contributed to the situation. 4. Request for Validation: Politely request the creditor to validate the default entry by providing any necessary documentation or proof of the debt. This is essential to ensure accuracy and legitimacy. 5. Offer for Resolution: Suggest a suitable resolution to the default situation, such as a repayment plan, negotiation of settlement amount, or any other applicable arrangement to resolve the debt. 6. Request for Removal: If the creditor agrees to the proposed resolution, politely ask them to remove the default entry from your credit report upon successful completion. This is essential for restoring your creditworthiness. Conclusion: By utilizing the South Dakota Sample Letter for Default Entry, individuals can communicate effectively with creditors or collection agencies, address default entries, and work towards resolving their financial obligations. Always consult legal professionals for personalized advice based on your specific situation. Please feel free to reach out if you require any further information or assistance relating to default entries or any other financial matters. Sincerely, [Your Name]

South Dakota Sample Letter for Default Entry

Description

How to fill out South Dakota Sample Letter For Default Entry?

US Legal Forms - one of the largest libraries of authorized varieties in the USA - delivers a wide array of authorized file themes you are able to obtain or produce. Using the internet site, you will get a large number of varieties for company and individual functions, sorted by types, suggests, or search phrases.You will discover the latest types of varieties just like the South Dakota Sample Letter for Default Entry within minutes.

If you have a subscription, log in and obtain South Dakota Sample Letter for Default Entry from the US Legal Forms local library. The Download option will appear on every single kind you view. You have accessibility to all earlier delivered electronically varieties inside the My Forms tab of the profile.

If you want to use US Legal Forms for the first time, listed below are easy instructions to help you get started off:

- Make sure you have selected the best kind for your area/state. Click the Review option to check the form`s content material. Look at the kind explanation to actually have selected the appropriate kind.

- In the event the kind does not satisfy your demands, use the Lookup area at the top of the monitor to get the the one that does.

- If you are content with the shape, confirm your option by simply clicking the Get now option. Then, choose the prices plan you want and supply your credentials to sign up for the profile.

- Process the purchase. Utilize your bank card or PayPal profile to complete the purchase.

- Find the format and obtain the shape on your system.

- Make modifications. Fill up, modify and produce and signal the delivered electronically South Dakota Sample Letter for Default Entry.

Every single template you included in your account lacks an expiry particular date and is your own forever. So, in order to obtain or produce yet another duplicate, just go to the My Forms area and click on the kind you need.

Get access to the South Dakota Sample Letter for Default Entry with US Legal Forms, the most extensive local library of authorized file themes. Use a large number of skilled and condition-specific themes that meet your business or individual requirements and demands.