South Dakota Checklist — Key Record Keeping: A Comprehensive Guide for Efficient Record Management Overview: The South Dakota Checklist — Key Record Keeping serves as a valuable resource for individuals, businesses, and organizations operating within the state. It outlines the essential record-keeping practices required to ensure compliance with legal, financial, and administrative regulations. By implementing this checklist, you can establish a systematic approach to organizing, storing, and maintaining records, which not only facilitates easy access to information but also fulfills necessary legal obligations. Types of South Dakota Checklist — Key Record Keeping: 1. Business Record Keeping: For businesses, maintaining accurate records is crucial for managing operations, complying with tax regulations, and making informed decisions. This category covers key documents such as financial statements, tax records, employee records, contracts, licenses, permits, and vendor information. 2. Personal Record Keeping: Individuals residing in South Dakota must also keep important personal records in order. Examples include identification documents, birth certificates, Social Security cards, vehicle titles, insurance policies, financial statements, and property records, among others. It is important to have these documents readily accessible and securely stored, ensuring their protection and avoiding any complications in the future. 3. Tax Record Keeping: The South Dakota Department of Revenue mandates proper maintenance of tax records by individuals and businesses. This includes income tax returns, receipts, invoices, expense documentation, payroll records, and any other financial records relevant to tax filing. Adhering to this checklist ensures not only compliance but also facilitates smooth tax filing processes and minimizes the potential for audits or penalties. 4. Employment Record Keeping: Both employers and employees in South Dakota are legally obligated to maintain specific employment records. These records encompass employee contracts, payroll records, personnel files, time cards, and work schedules. Maintaining accurate and up-to-date employment records is essential for employee management, wage and hour compliance, performance evaluations, and legal protection. 5. Healthcare Record Keeping: In the healthcare industry, healthcare providers are required to maintain detailed patient records, including medical history, treatment plans, laboratory reports, and billing information. Adequate record-keeping not only meets legal requirements but also ensures effective patient care, improves communication between healthcare professionals, and supports accurate medical billing processes. Key Record-Keeping Recommendations: — Implement a systematic record-keeping system: Categorize and organize records based on their type and importance. Utilize electronic document management systems or physical filing systems to ensure easy retrieval and limited errors or losses. — Set retention periods: Understand the legal requirements for record retention and disposal to avoid unnecessary clutter and potential legal repercussions. — Regularly update records: Keep records current by regularly reviewing and updating information, purging outdated or irrelevant documents, and ensuring all necessary additions or amendments are promptly made. — Maintain backups and secure storage: Utilize secure cloud storage, external hard drives, or offsite storage facilities to ensure the protection of records from physical damage, theft, or loss. — Train staff or personnel: Provide adequate training to individuals responsible for record-keeping to ensure they understand the requirements, best practices, and potential consequences of poor record management. By following the South Dakota Checklist — Key Record Keeping, individuals, businesses, and organizations can maintain order, efficiency, and compliance in their record-keeping practices.

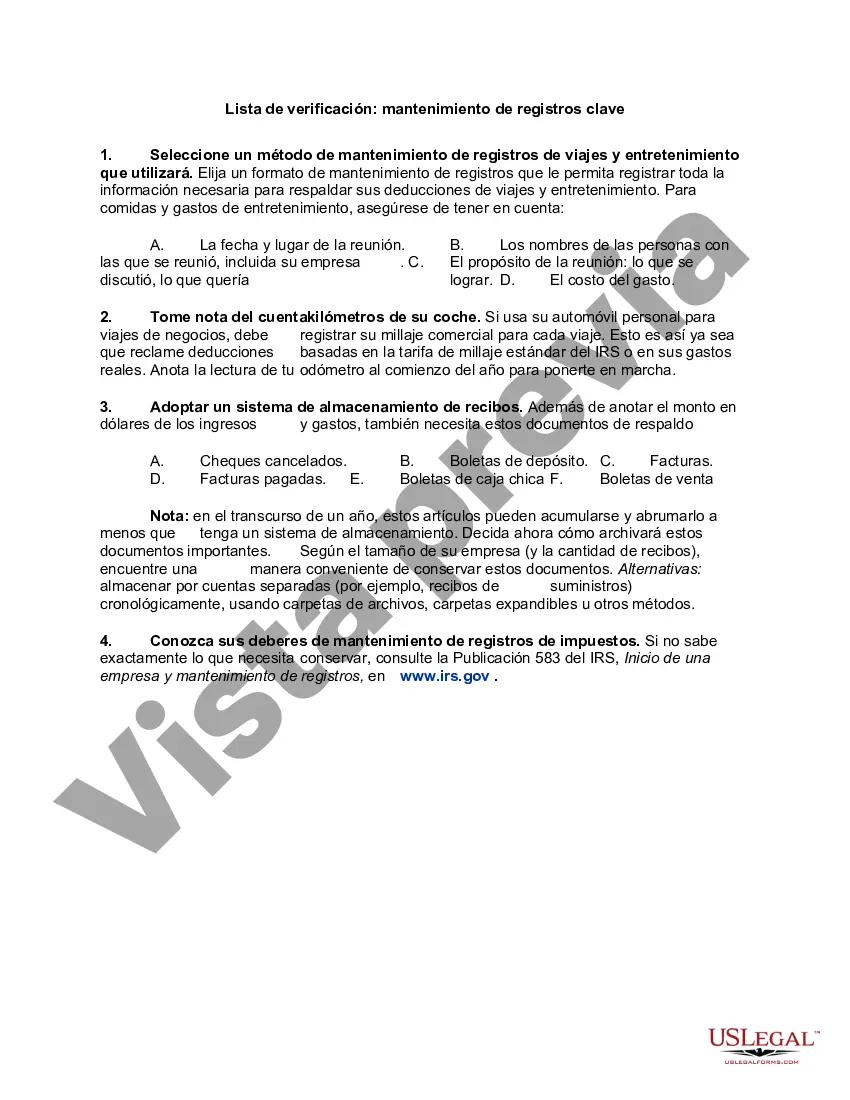

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.South Dakota Lista de verificación: mantenimiento de registros clave - Checklist - Key Record Keeping

Description

How to fill out South Dakota Lista De Verificación: Mantenimiento De Registros Clave?

If you wish to comprehensive, down load, or print legal record web templates, use US Legal Forms, the greatest variety of legal varieties, which can be found online. Take advantage of the site`s simple and convenient search to find the paperwork you need. Different web templates for enterprise and specific functions are categorized by groups and states, or keywords and phrases. Use US Legal Forms to find the South Dakota Checklist - Key Record Keeping with a handful of mouse clicks.

In case you are already a US Legal Forms customer, log in to your accounts and then click the Down load button to find the South Dakota Checklist - Key Record Keeping. Also you can gain access to varieties you previously acquired inside the My Forms tab of your respective accounts.

Should you use US Legal Forms the first time, follow the instructions listed below:

- Step 1. Make sure you have chosen the shape for the proper metropolis/region.

- Step 2. Take advantage of the Review method to check out the form`s content. Never forget to read through the explanation.

- Step 3. In case you are not happy with the form, take advantage of the Lookup discipline towards the top of the screen to get other types in the legal form template.

- Step 4. Once you have identified the shape you need, go through the Get now button. Select the costs strategy you prefer and add your references to register for an accounts.

- Step 5. Approach the transaction. You may use your charge card or PayPal accounts to complete the transaction.

- Step 6. Pick the formatting in the legal form and down load it on your gadget.

- Step 7. Comprehensive, modify and print or signal the South Dakota Checklist - Key Record Keeping.

Each legal record template you purchase is your own property permanently. You may have acces to every single form you acquired inside your acccount. Go through the My Forms portion and select a form to print or down load once again.

Contend and down load, and print the South Dakota Checklist - Key Record Keeping with US Legal Forms. There are thousands of professional and express-certain varieties you may use to your enterprise or specific demands.