South Dakota Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is an official document issued by the state of South Dakota to individuals who meet specific criteria for exemption from reporting the sale or exchange of their principal residence for tax purposes. This certification allows qualifying taxpayers to claim exemption from information reporting requirements and potentially exclude any capital gains from the sale or exchange of their primary home from their taxable income. The South Dakota Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is primarily designed to provide relief to homeowners who otherwise would have been required to report the transaction details of their principal residence to the state tax authorities. By obtaining this certification, eligible homeowners can save time and effort in fulfilling reporting obligations and potentially enjoy tax savings. To qualify for the South Dakota Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption, individuals must meet certain conditions. These criteria vary depending on the specific types of exemptions available. Some different types of exemptions include: 1. Homestead Exemption: This exemption applies to homeowners who have claimed a homestead and have utilized it as their primary residence for a certain period of time, usually one to two years. Eligible individuals must meet residency requirements and have owned the property for at least a specific duration before the sale or exchange. 2. Age-Based Exemption: South Dakota offers exemptions based on the age of the property owner. Seniors aged 65 or older may be eligible for a reduced requirement in terms of the duration of residency and ownership. 3. Disability Exemption: Individuals with qualifying disabilities may be entitled to specific exemptions. The criteria for this exemption generally includes having a certified disability and meeting certain ownership and residency requirements. 4. Low-Income Exemption: South Dakota provides exemptions for low-income homeowners who meet specific income thresholds. These thresholds may vary depending on factors such as family size and location. 5. Veterans Exemption: Veterans who have served in the military may be eligible for exemptions tailored to their service, such as reduced ownership duration or residency requirements. It is important for homeowners who meet any of these exemption categories to carefully review the South Dakota Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption application requirements and gather the necessary supporting documentation to demonstrate eligibility. This may include proof of residence, current tax returns, property ownership records, and any applicable medical or military documentation. By obtaining this certification, eligible homeowners can ensure compliance with South Dakota tax laws and potentially enjoy the benefits of reduced tax burdens or exclusions on capital gains from the sale or exchange of their principal residence.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.South Dakota Certificación de No Informar sobre Venta o Permuta de Vivienda Principal - Exención de Impuestos - Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

How to fill out South Dakota Certificación De No Informar Sobre Venta O Permuta De Vivienda Principal - Exención De Impuestos?

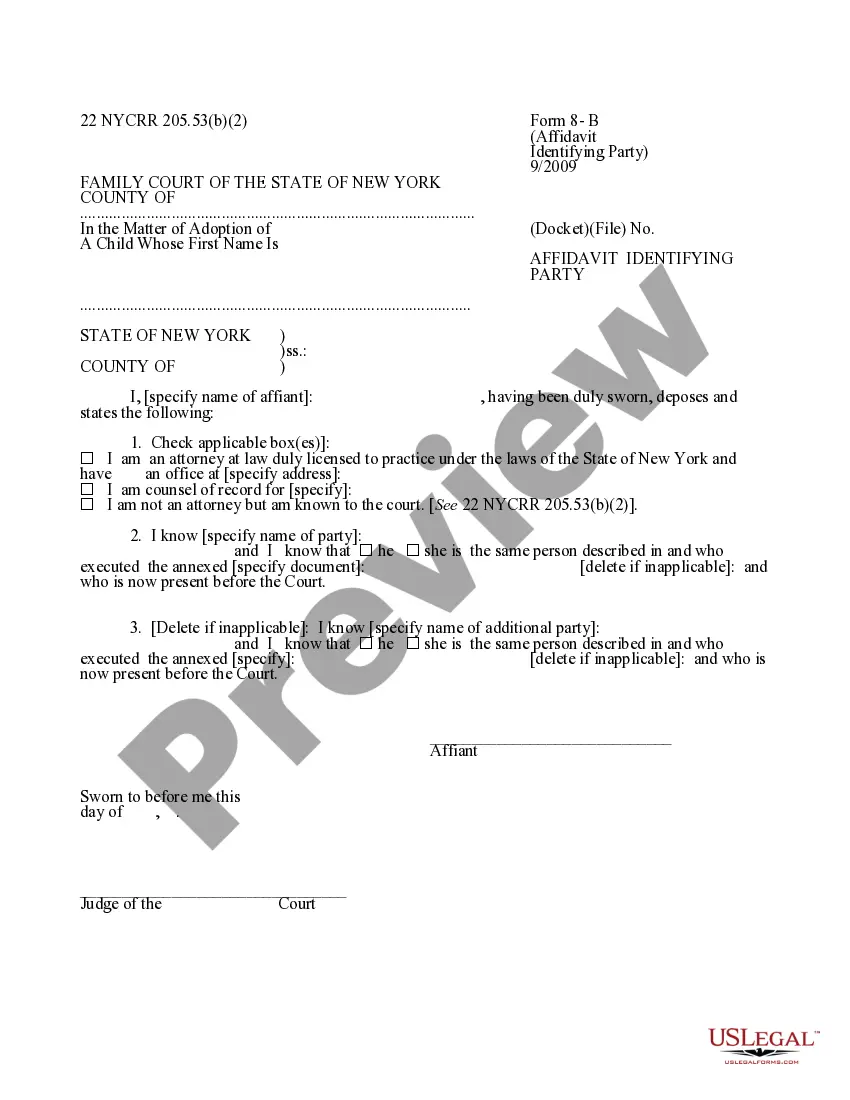

Finding the right legal papers web template might be a battle. Needless to say, there are a lot of themes available online, but how would you obtain the legal type you require? Utilize the US Legal Forms site. The service delivers 1000s of themes, including the South Dakota Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, which you can use for enterprise and private needs. Every one of the varieties are inspected by experts and fulfill federal and state requirements.

In case you are currently registered, log in in your accounts and then click the Obtain option to have the South Dakota Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption. Make use of accounts to appear with the legal varieties you have purchased formerly. Go to the My Forms tab of your own accounts and acquire an additional duplicate of the papers you require.

In case you are a new consumer of US Legal Forms, listed here are simple directions that you can adhere to:

- First, be sure you have selected the right type for your area/area. You are able to examine the shape making use of the Review option and study the shape outline to guarantee this is the best for you.

- In case the type will not fulfill your preferences, use the Seach discipline to discover the proper type.

- Once you are sure that the shape is acceptable, click the Acquire now option to have the type.

- Select the pricing plan you want and enter in the required info. Build your accounts and pay for your order making use of your PayPal accounts or bank card.

- Choose the submit format and down load the legal papers web template in your gadget.

- Comprehensive, revise and print out and indication the obtained South Dakota Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption.

US Legal Forms is the most significant library of legal varieties that you can discover different papers themes. Utilize the company to down load professionally-created paperwork that adhere to express requirements.